Funding Skyrockets on the Back of Infrastructure

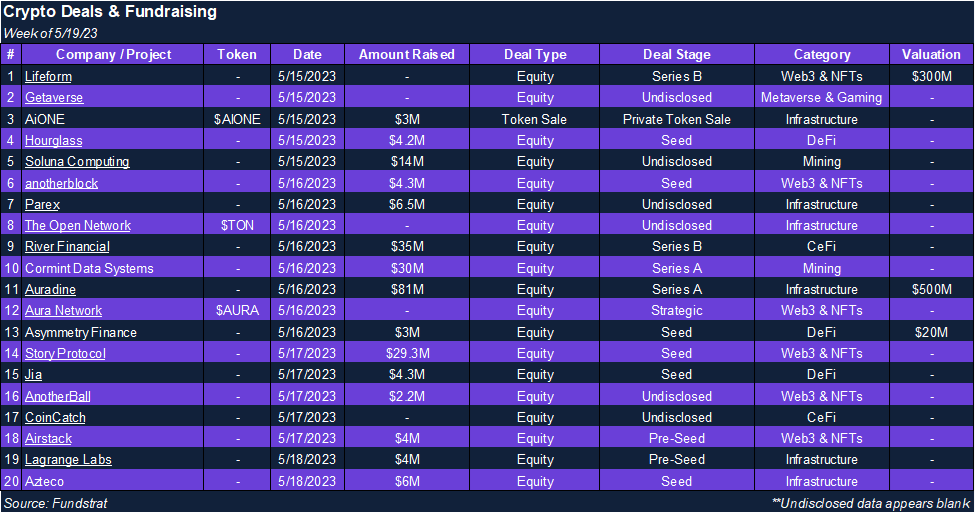

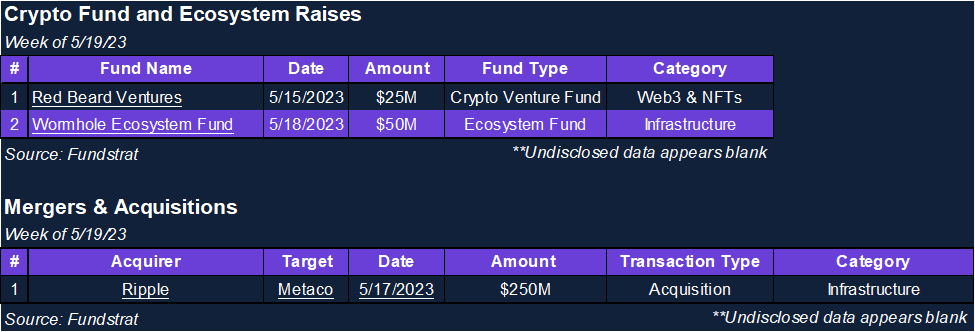

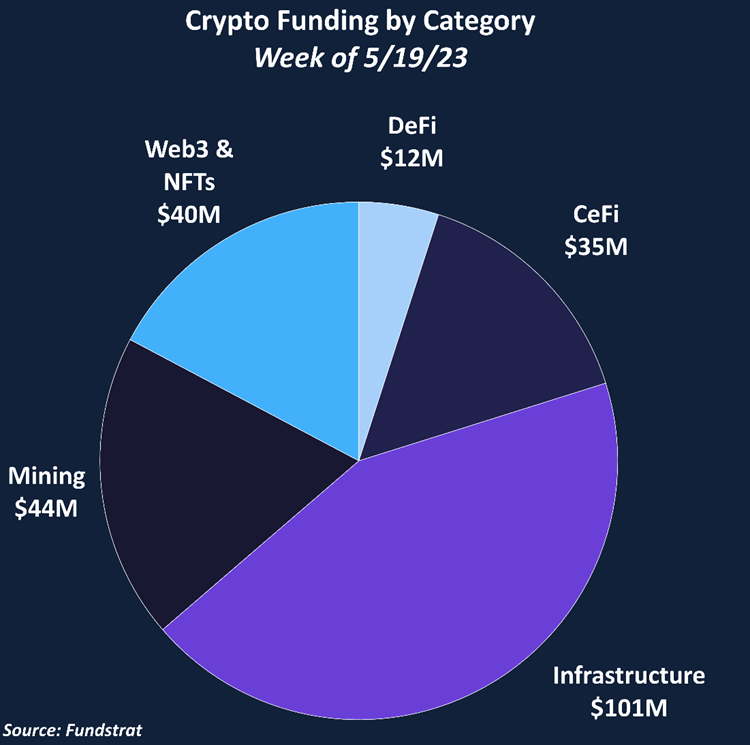

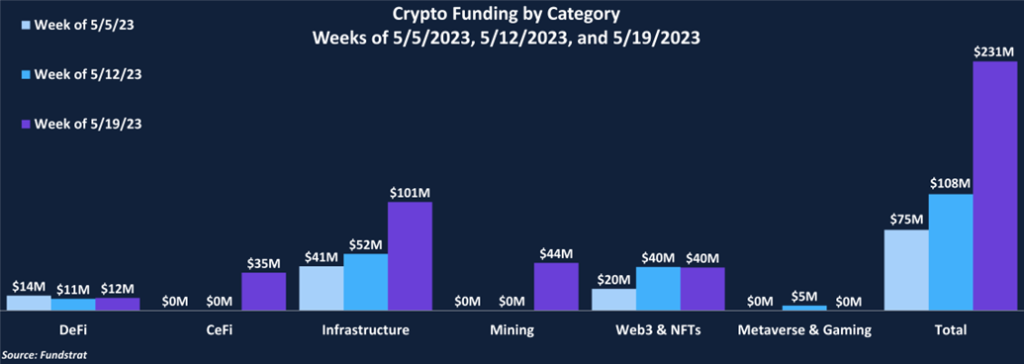

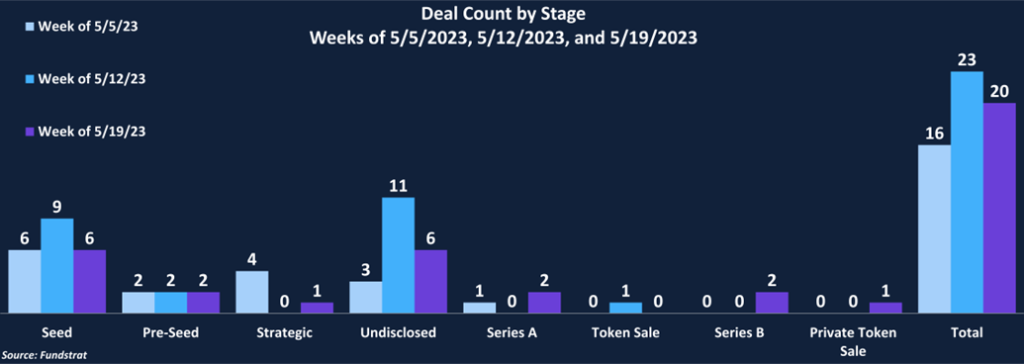

Crypto funding sharply increased this week, rising 114% from $108 million to $231 million. Infrastructure was the breadwinner, representing 44% of the total funding amount. The largest deal was an $81 million Series A deal completed by Auradine, valuing the company at $500 million. Despite the notable rise in total funding, deal counts dropped from 23 to 20, while the average deal size rose to $15.4 million.

Series A and Series B deals comprised 63% of total funding but only represented 20% of deal counts. Seed rounds remained the most popular type of deal, making up 30% of the count and 22% of funding. There was one M&A transaction this week. Ripple acquired Swiss digital custodian firm Metaco for $250 million. The acquisition will expand Ripple’s product suite and enable future issuance, custodial, and settlement services for tokenized assets while growing the company’s presence outside the U.S.

Deal of the Week

The Deal of the Week is Hourglass, a crypto startup that raised $4.2M in a seed round led by Electric Capital with participation from Coinbase Ventures and Circle, among others. Hourglass is the first marketplace that allows users to trade Time-Bound Tokens (TBTs), a concept that tokenizes a user’s staked or locked assets. TBTs essentially act as “receipts” for the user’s assets that they have committed to a crypto protocol. Through TBTs, users can gain liquidity of their locked assets by selling the rights of the time duration in a secondary market. Hourglass’s launch partners include Lido, Frax, and Convex, but the protocol aims to expand this concept throughout the whole crypto ecosystem.

Why is this the Deal of the Week?

It’s increasingly common in crypto and DeFi, in particular, to allow users to stake or lock their assets for yield. While this can provide users with a higher return and incentivize long-term usage of the protocol, the lack of instant liquidity can be a disadvantage in a volatile and constantly changing market. Hourglass looks to provide users with a solution by giving them liquidity for these locked assets in exchange for a discount that is based on the duration of the locked asset. For example, a user could pay a ~2% discount on Hourglass to receive instant liquidity for ETH that is locked on Frax for 3 months. The 3-month-till unlock frxETH would be turned into a receipt in the form of a Time Bound Token. Technically, TBTs are semi-fungible tokens based on the ERC1155s token standard. The tokens are issued by “Hourglass custodian smart contracts” and are semi-fungible tokens. Although the smart contracts are called “custodian”, the TBTs are non-custodial, meaning that the Hourglass team will have no control over the assets that are deposited. The Hourglass launch comes during Lido’s V2 deployment and will tokenize Lido’s withdrawal queue, allowing users to trade their place in line and gain liquidity for their staked ether ($stETH).

Selected Deals

Cormint is a mining-based company aiming to mine Bitcoin at a low cost in conjunction with supporting a renewable power grid. The firm has secured $30M in funding through its series A round, co-led by Nav Sooch and Jamie McAvity. The funding round also included participation from Alessandro Piovaccari and others. Cormint intends to increase its self-mining capacity at its mining facility in Fort Stockton, TX, by Q4 2024.

Auradine is a California-based company aiming to construct the next generation of web infrastructure. The firm plans to accomplish this by developing cloud solutions, hardware, and software. The company has secured $81M in funding through its series A round at a $500M valuation, co-led by Mayfield and Celesta Capital. In addition, the funding round included investor participation from Marathon Digital Holdings, Stanford University, DCVC, and Cota Capital. Auradine intends to use the capital raised to expand the firm’s reach and operations.

River Financial is a CeFi-based company aiming to provide its users with Bitcoin trading, custody, and mining-related services. Additionally, the firm offers a Bitcoin wallet that is capable of supporting Lightning Network and on-chain transactions. The company has secured $35M in funding through its series B round led by Kingsway Capital, with other participation from Valor Equity Partners, Alarko Ventures, Esas Ventures, Peter Thiel, and others. River Financial intends to use a portion of the capital raised to develop its B2B River Lightning segment further.

Story Protocol is a Web3 & NFT-based platform aiming to change how narrative universes are formed. The company has secured $29.3M in funding through its seed round led by A16z Crypto. The funding round also included investor participation from Two Small Ventures, Berggruen Holdings, Hashed, Samsung Next Fund, and others. Story Protocol intends to use the capital raised to fast-track infrastructure development.

Jia is a DeFi-based platform aiming to provide an affordable financing alternative for small business owners in emerging markets. The company has secured $4.3M in funding through its seed round led by TCG Crypto. Other investor participation includes Hashed Emergent, Global Coin Research, BlockTower Capital, Saison Capital, and others. Jia intends to use the capital raised for geographical expansion.