VC Interest in DeFi Slowly Picking Up

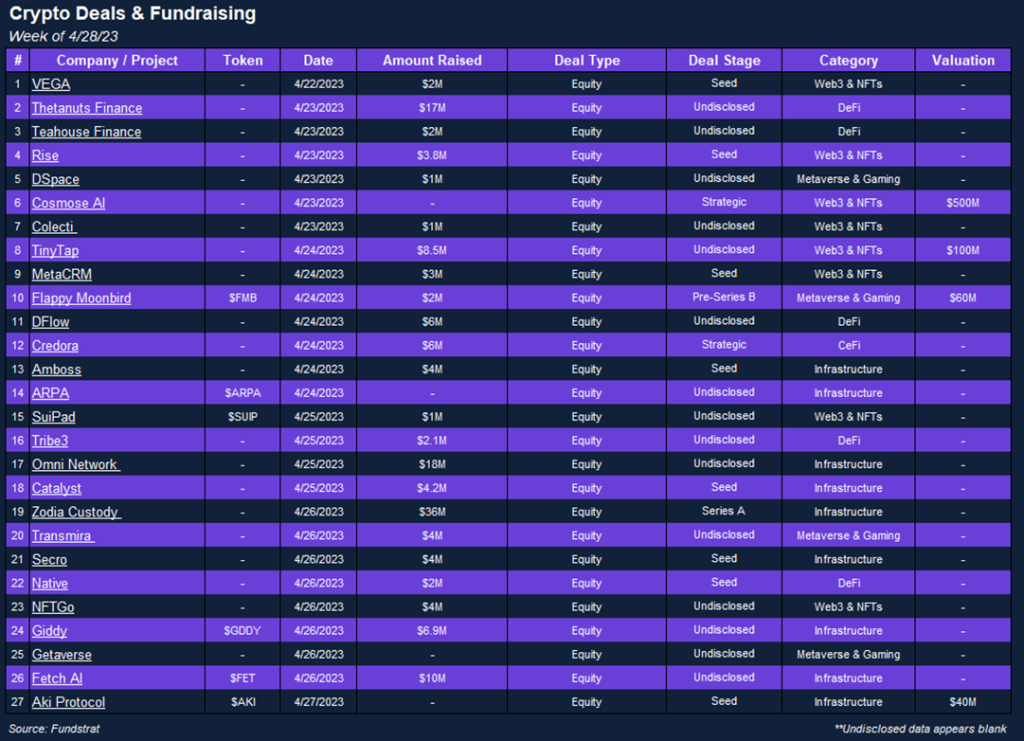

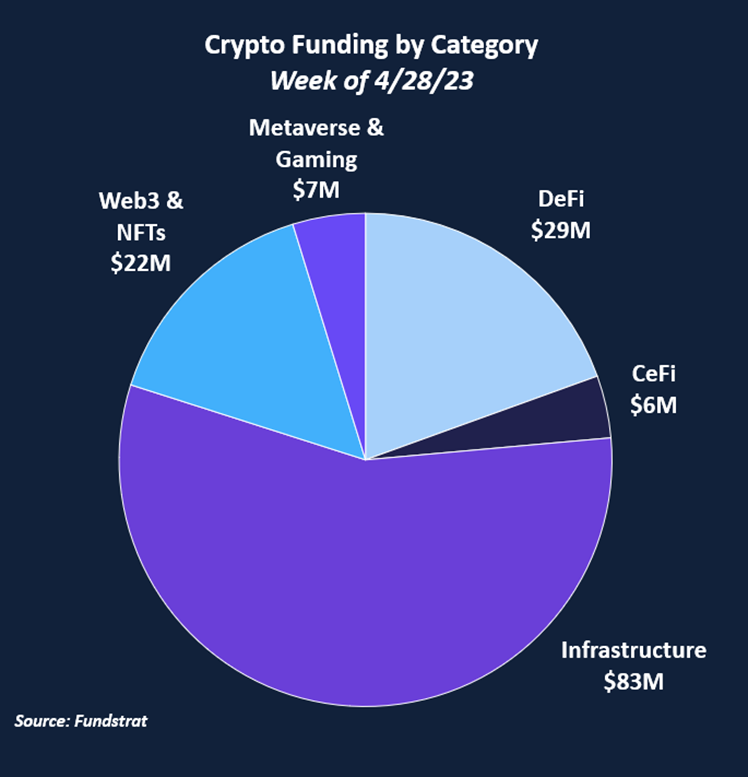

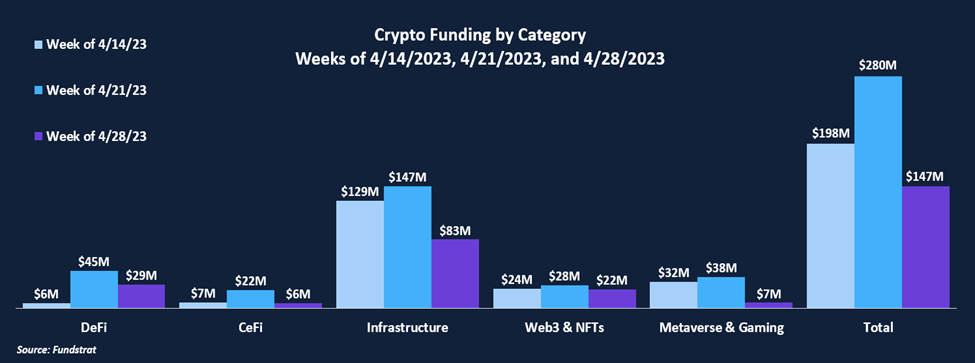

Funding declined this week from $280M last week to just $147M this week. Not surprisingly, most deals were infrastructure-related, something we’ve seen all month. DeFi, which has generally been one of the less funded verticals the last year, has slowly begun to see an uptick in funding. DeFi was the second highest funded vertical in the past two weeks, with $45M and $29M funded. This week’s largest deal, Thetanuts Finance, is in the DeFi vertical as well. Thetanuts Finance is a multi-chain structured products protocol and raised $17M in a round led by Polychain Capital, Hyperchain Capital, and Magnus Capital. Metaverse & Gaming was the next highest funded vertical at $22M while CeFi and Web3 & NFTs lagged, each receiving less than $10M in funding.

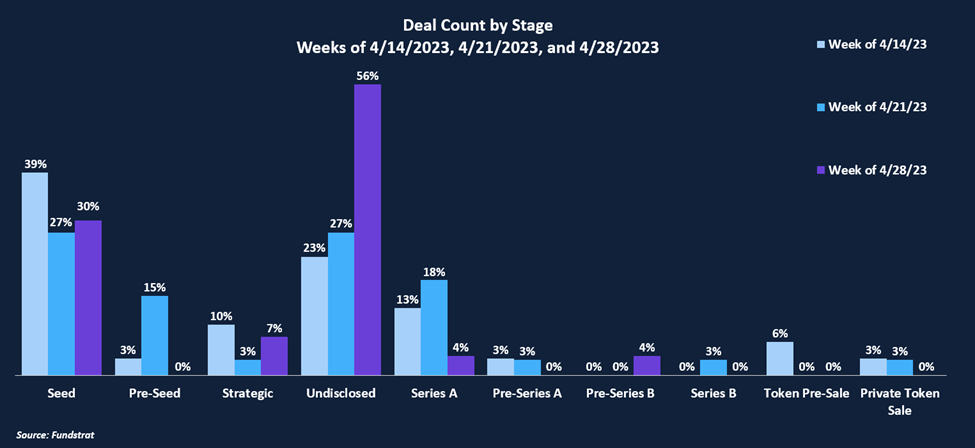

Most deals this week (56%) had their deal stage undisclosed, but of the disclosed deals, the majority were Seed Round, at 30%.

Deal of The Week

DFlow, a decentralized marketplace for order flow, announced a $5.5m funding round led by Framework Ventures, with participation from Coinbase, Circle, Cumberland, Wintermute, Spartan Group, and ZeePrime. The funding round was not disclosed, but this follows a $2 million seed round in early 2022 that Multicoin Capital and Framework Ventures co-led. DFlow is a DeFi protocol hoping to decentralize order flow in crypto by creating open and fair payment-for-order-flow markets. Through these markets, the team aims to help retail traders achieve better price execution as market-makers compete for order flow through auctions and transparent pricing. The protocol will also help wallets monetize retail flow by connecting them to market makers.

Why is this the Deal of The Week?

In the current model, crypto investors trade tokens through wallets that route to decentralized exchanges and aggregators such as Uniswap and 1inch. Users typically receive poor execution with high slippage, paying Dexes, wallets, and MEV fees. In traditional markets, brokerages usually sell retail order flow to institutional market makers who execute trades on behalf of investors. DFlow aims to expand on this model through an open payment for order flow standard, adding transparency to order execution. Nitesh Nath, founder and CEO of DFlow, says their decentralized marketplace can improve on the current model by “benefiting retail investors with the most capital efficient trading, market makers with access to valuable order flow, and wallets with new streams of reliable revenue”. DFlow will use the freshly raised funds for further development of the protocol, expansion of its market presence, and onboarding of market makers and wallets. If successful, the team can improve a fragmented and unnecessarily expensive experience, enticing more traders to transact on decentralized rails instead of exchanges.

Selected Deals

Zodia Custody is an infrastructure-based platform that provides digital asset custody solutions to institutional clients. In addition, the platform also offers settlement services, allowing for client assets traded on exchanges to be protected. The company has secured $36M in funding through its series A round, led by SBI Holdings. The funding round also included investor participation from SC Ventures. Zodia Custody intends to use the capital raised for geographical expansion and product development.

Rise is a Web3 & NFT-based platform that develops payroll and compliance-related solutions for its users. The company has secured $3.8M in funding through its seed round, co-led by Sino Global Capital and Polymorphic Capital. In addition, the funding round included investor participation from HashKey Capital, Draper Associates, Paradigm Shift Capital, and others. Rise intends to use the capital raised for workforce expansion and product development.

Giddy is an infrastructure-based platform aiming to make DeFi secure and accessible for everyone. The platform plans to accomplish this through its self-custody wallet application. The company has secured $6.9M in funding through a round that included investor participation from Clarke Capital, Peak Capital Partners, Pelion Venture Partners, and others. Giddy intends to use the capital raised for business development.

Tribe3 is a DeFi-based platform aiming to allow users to trade NFT derivatives. The exchange plans to launch in May 2023 and support a limited number of NFT collections with plans to add more. The platform has secured $2.1M in funding through a round that included investor participation from Infinity Ventures Crypto, Newman Capital, Lapin Digital, Cogitent Ventures, and others. Tribe3 intends to use the capital raised for operational expansion and product development.

Credora is a CeFi-based platform aiming to build transparent credit markets for institutions. The company has secured $6M in funding through a strategic round co-led by Coinbase Ventures and S&P Global. The funding round also included investor participation from KuCoin Ventures, CMT Digital, Wagmi Ventures, and others. Credora intends to use the capital raised for product development.