Big Week for Beras

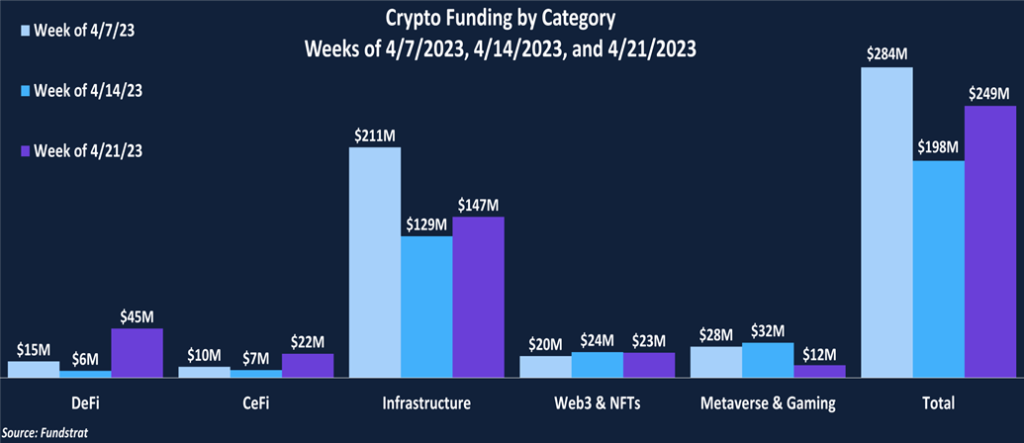

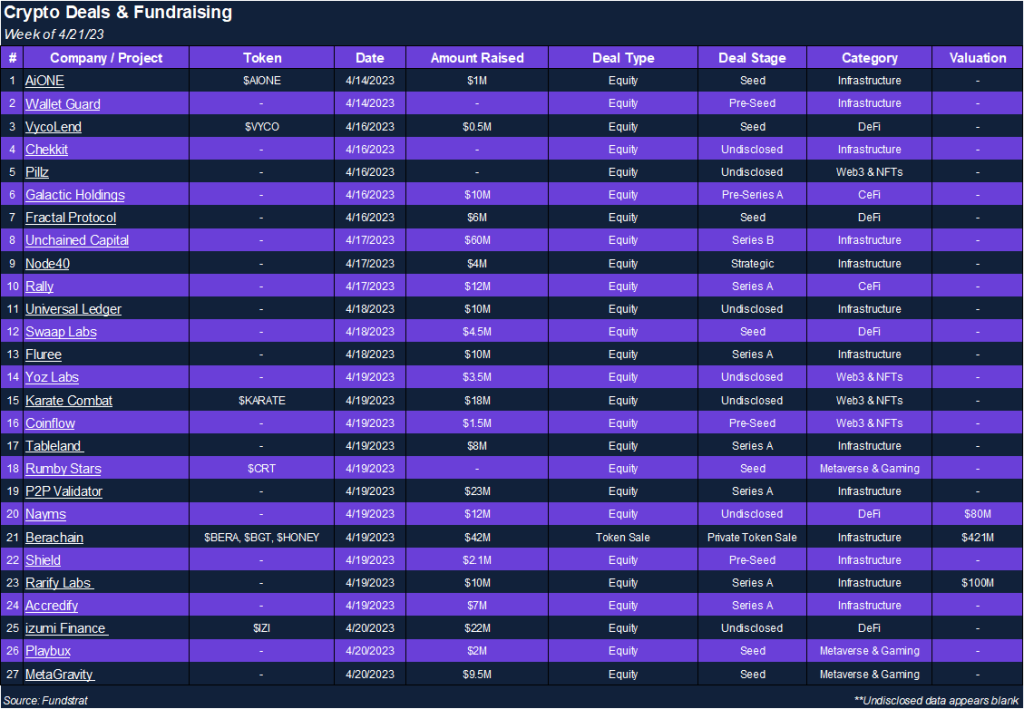

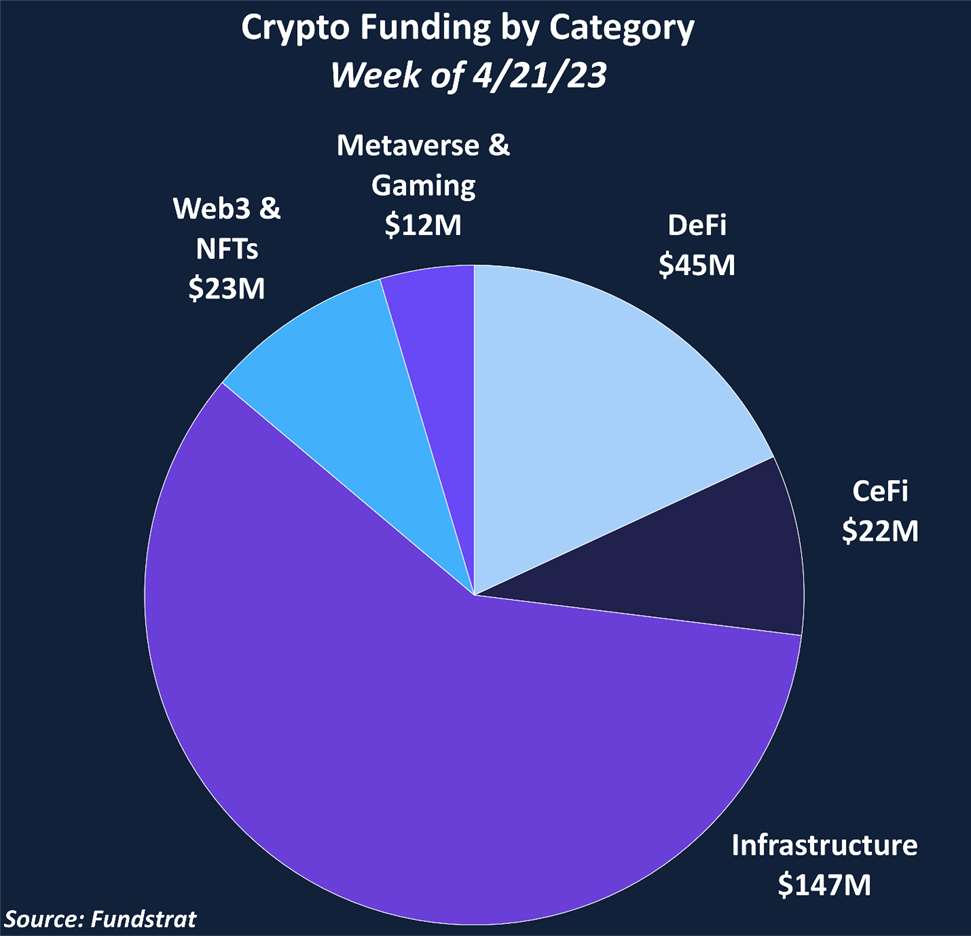

Total funding for this week rose approximately 25% from $198 million to $249 million, with the large majority coming from the Infrastructure and DeFi verticals. One of the larger DeFi deals was Nayms’ $12 million round valuing the company at $80 million. Nayms is building a fully-regulated on-chain insurance platform to bring efficient and transparent features to a largely off-chain market. The funding will be used to expand Nayms’ global team and accelerate the growth of its products.

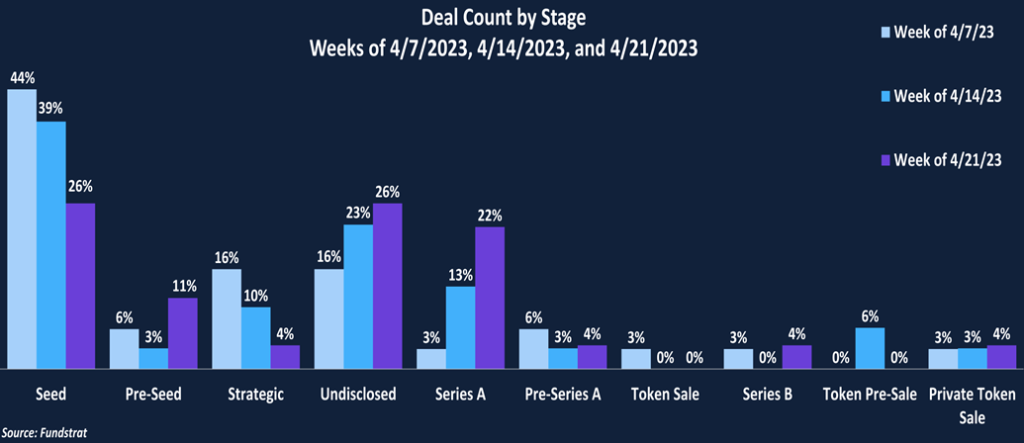

Seed and Series A deals were the most common this week, representing 26% and 22% of the deal count. The average deal size was $11 million, a significant increase compared to last week’s $8 million.

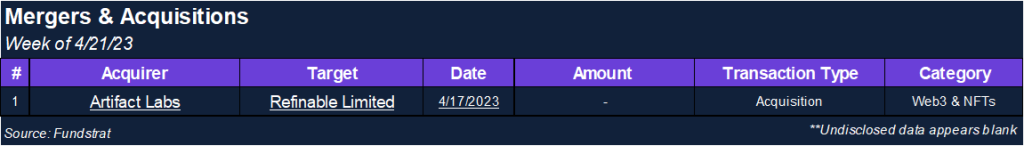

There was one private token sale and one M&A transaction this week. Berachain (deal of the week) completed a $42 million private token sale, while Artifact Labs acquired the source code of Refinable, an NFT launchpad, and marketplace. The acquisition should help Artifact Labs rapidly accelerate its product roadmap and offer users exciting NFT & Metaverse experiences.

Deal of The Week

Berachain, a layer-1 EVM-compatible blockchain built on Cosmos, has raised $42m in a Series A round led by Polychain Capital, with participation from GoldenTree Asset Management, Tribe Capital, Hack VC, and others. The raise values the DeFi focused layer-1 at $420.69 million through a simple agreement for future tokens (SAFT) sale. Berachain aims to allow users to simultaneously stake and utilize assets in DeFi protocols, two mutually exclusive activities on existing blockchains. Through its “proof of liquidity,” the team hopes to create an incentive structure to align security and liquidity, creating stickiness for mercenary capital that rotates throughout DeFi.

Why is this the Deal of The Week?

This year has seen continued momentum from new layer-1 blockchains, with raises from Sei Labs, Dymension, and VRRB Labs. Despite the highly crowded and competitive nature of layer-1s, investors are betting there is still room for more winners after layer-1s were some of the best-performing investments of the last bull cycle. Berachain stands out as creating something truly novel rather than incremental improvements on scalability that were common among emerging competitors to Ethereum in the previous few years.

The project will allow users to both stake tokens and provide liquidity to DeFi protocols concurrently. Launched by pseudonymous co-founders in 2021, the team began raising funding last November. Co-founder Smokey the Bera described the project’s value, “if you had ether and all of that ETH was being used to secure the Ethereum network and was also being able to be used within DeFi protocols such as Uniswap and MakerDAO. That’s a powerful unlock.” Berachain is currently in devnet, with plans to release an incentivized testnet in the next few weeks and mainnet planned for later this year. Incentivized testnets are often used by projects to attract users to their blockchain while products are under development. Testnet participants are sometimes rewarded through airdrops once mainnet launches, as was the case with Aptos, Optimism. Investors backing this round will get native bera tokens once mainnet launches.

Selected Deals

Yoz Labs is a Web3 & NFT-based platform aiming to enhance the user experience within decentralized applications. The platform utilizes scalable messaging rails that allow developers to send notifications to their users. The company has secured $3.5M in funding through a round led by Electric Capital. In addition, the funding round also included investor participation from Coinbase Ventures, North Island Ventures, Collab+Currency, Form Capital, and others.

Accredify is an infrastructure-based platform that verifies documents against forgery and fraud. The platform accomplishes this by requiring users to create an identity on the blockchain during its onboarding process. The company has secured $7M in funding through its Series A round, co-led by SIG Venture Capital and iGlobe Partners. In addition, the funding round also included investor participation from Qualgro and Pavilion Capital. Accredify intends to use the capital raised for product and geographical expansion.

Unchained Capital is an infrastructure-based platform that provides its clients with bitcoin trading, lending, and custody services. The company has secured $30M in funding through its initial close led by Valor Equity Partners in an ongoing $60M Series B round. In addition, the funding round also includes investor participation from Trammell Venture Partners, Highland Capital Partners, NYDIG, and Ecliptic Capital. Unchained Capital intends to use the capital raised for product and workforce expansion.

Swaap Labs is a DeFi-based automated market-making (AMM) protocol aiming to provide its users with profitable and passive strategies that address impermanent losses. The company has secured $4.5M in funding through its seed round led by Signature Ventures. In addition, the funding round also included investor participation from Kima Ventures, New Form Capital, C2 Ventures, and others.

Shield is an infrastructure-based platform aiming to detect and prevent crypto-related scams. The platform plans to accomplish this through its threat detection software which leverages machine learning and AI. The company has secured $2.1M in funding through its pre-seed round, which included investor participation from Wagmi Ventures, MH Ventures, Coinswitch, Bessemer Ventures DAO, and others.