VC Capital Continues to Flow to Alt-L1's

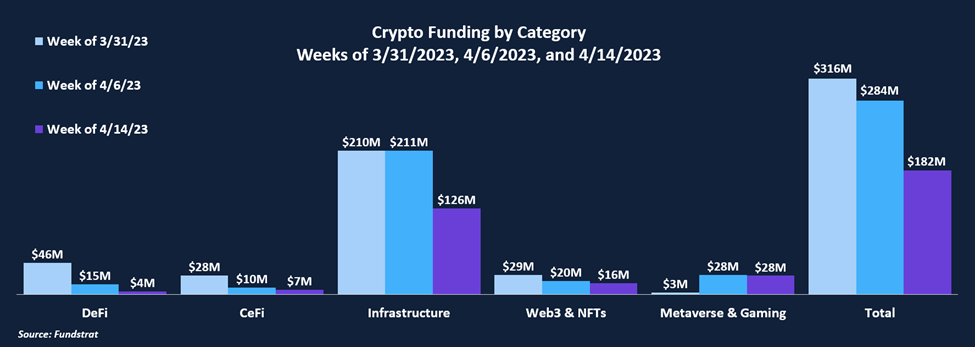

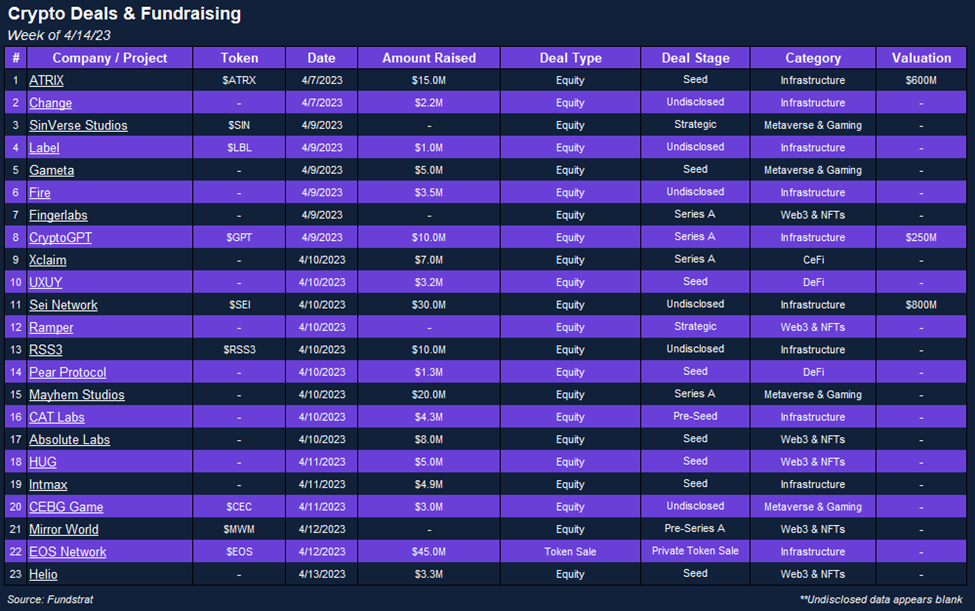

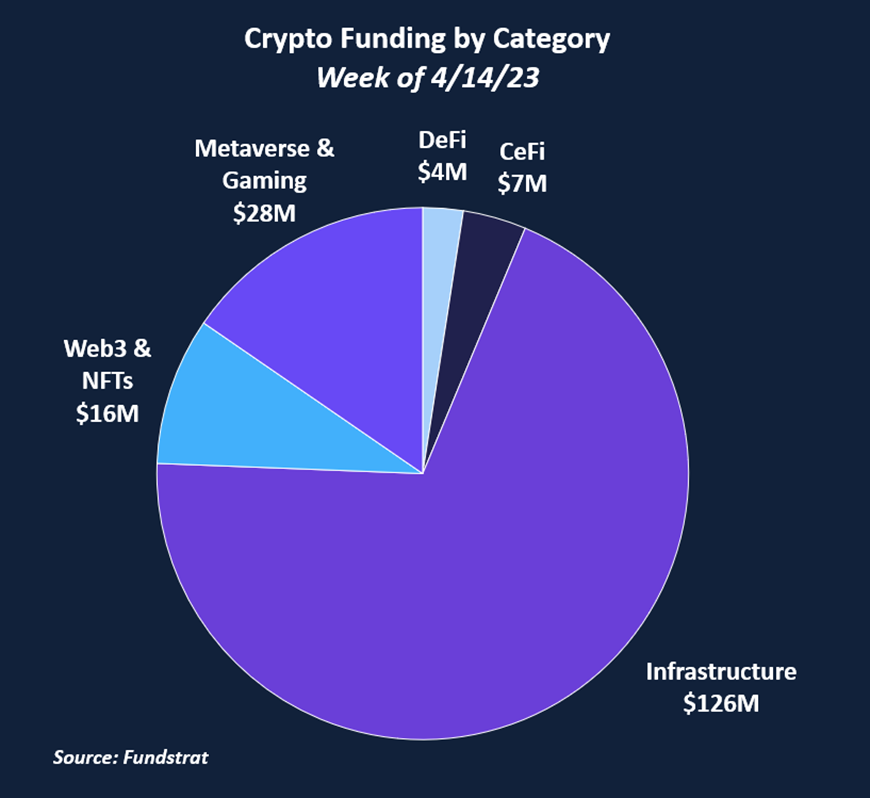

Funding slid lower this week from $284M to $182M. Continuing the trend of the last three weeks, infrastructure deals comprised the bulk of funding, with 9 deals amounting to $126M or 69% of total funding. Most of this infrastructure funding came in the form of Alt Layer-1 investments in Sei and EOS. The financial verticals had a lackluster week – DeFi and CeFi received just $4M and $7M of financing, while Web3 and NFTS and Metaverse and Gaming fared slightly better, raising $16M and $28M, respectively.

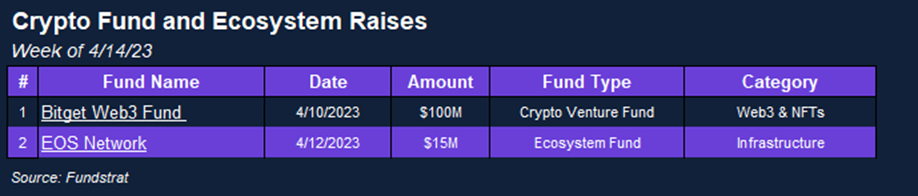

There were two crypto funds raised this week. Bitget, a crypto trading platform, raised $100 million to invest in Asia-based Web3 startup projects. The EOS Network raised $60M in a partnership with DWF Labs, which includes a $45M EOS token purchase agreement and a $15M pledge for EOS-based projects.

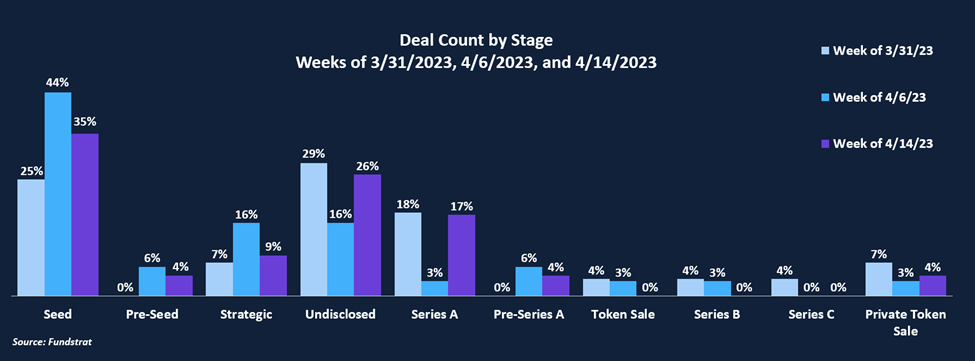

Most deals this week were Seed Round—35% were Seed and 4% were Pre-Seed. While not comprising a large percentage of total deals, we’ve seen more consistent Token Sales in the past few weeks, with around ~7% of deals each week being Token Sales or Private Token Sales.

Deal of the Week

Sei Labs, the development company creating Sei Network, a trading-focused layer-1 network, raised $30 million via two strategic rounds with participation from Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric Capital Partners, and others. The Sei blockchain uses unique chain-level optimizations to enable DEXs and trading apps to offer elite trading experiences with modern performance and scalability. The latest fundraising round puts Sei Labs’ valuation at $800 million. The funding will be used to accelerate Sei Labs’ growth, including a deeper push into the Asia-Pacific region.

Why is this Deal of the Week?

A pain point for decentralized trading platforms is that current layer-1 one blockchains do not have the transaction throughput or transaction finality speeds to enable things like high-frequency trading. Sei Labs hopes to alleviate this pain point with what they claim is the fastest layer-1 network, boasting 500-millisecond transaction finality and capabilities to handle 20,000 orders per second. The Sei Network hopes to provide the next wave of blockchain scalability without sacrificing security or stability. Sei’s public testnet went live in mid-March and has already accumulated over 4 million unique users and has over 120 teams deploying dApps ahead of its mainnet launch. A $30 million fundraise during a time when companies are struggling to raise large amounts is indicative of the network’s promise and the fundraise should help them expand into the Asian market with notable strategic partners behind them.

Selected Deals

EOS Network (EOS 1.23% ) is an infrastructure-based open-source layer-1 blockchain platform. The company aims to create a decentralized future that provides developers with the necessary tools to release decentralized applications and build blockchain games. The platform has secured $45M in funding through a private token sale led by DWF Labs. In addition, EOS Network received a $15M pledge from DWF Labs to support applications and projects built on the network.

Absolute Labs is a Web3 & NFT-based platform aiming to help companies acquire and retain customers. The platform plans to accomplish this through its Wallet Relationship Management (WRM) product. The company has secured $8M in funding through its seed round. The funding round included investor participation from MoonPay, Alpha Praetorian Capital, Punja Global Ventures, Samsung Next, and others. Absolute Labs intends to use the capital raised to increase the platform’s public exposure and expand its operations.

Mayhem Studios is the mobile gaming division of Mobile Premier League (MPL). The studio aims to build engaging and immersive gaming titles. It released its first title, Underworld Gang Wars, a battle royale-based game, in May 2022. The platform has secured $20M in funding through its Series A round led by Sequoia Capital India. The funding round included investor participation from Truecaller, Steadview Capital, Bing Gordon, and others. Mayhem Studios intends to use the capital raised for new game development.

CAT Labs is an infrastructure-based platform focusing on digital asset recovery and developing cybersecurity tools. The company has secured $4.3M in funding through its pre-seed round. T the funding round included investor participation from Brevan Howard Digital, RW3 Ventures, Castle Island Ventures, and others. CAT Labs intends to use the capital raised to increase the platform’s public exposure and expand its operations.

Xclaim is a CeFi-based platform that allows its users to trade bankruptcy claims efficiently. The platform accomplishes this by utilizing automation and open-market trading. The company has secured $7M in funding through its Series A round led by Josh Jones. Xclaim intends to use the capital raised to grow its product and service offerings.