VCs Bet Big on Interoperability

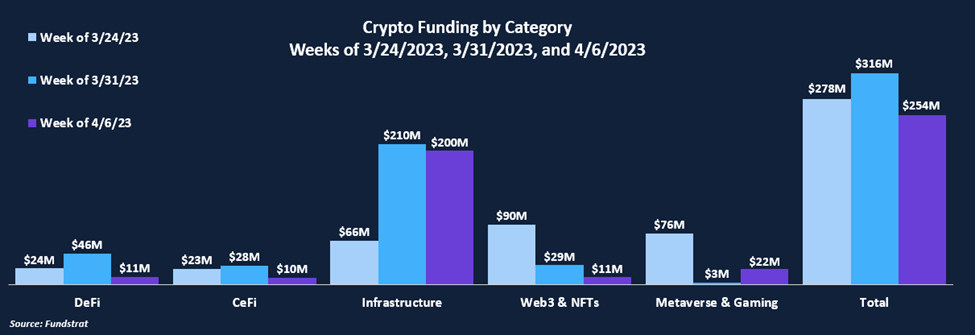

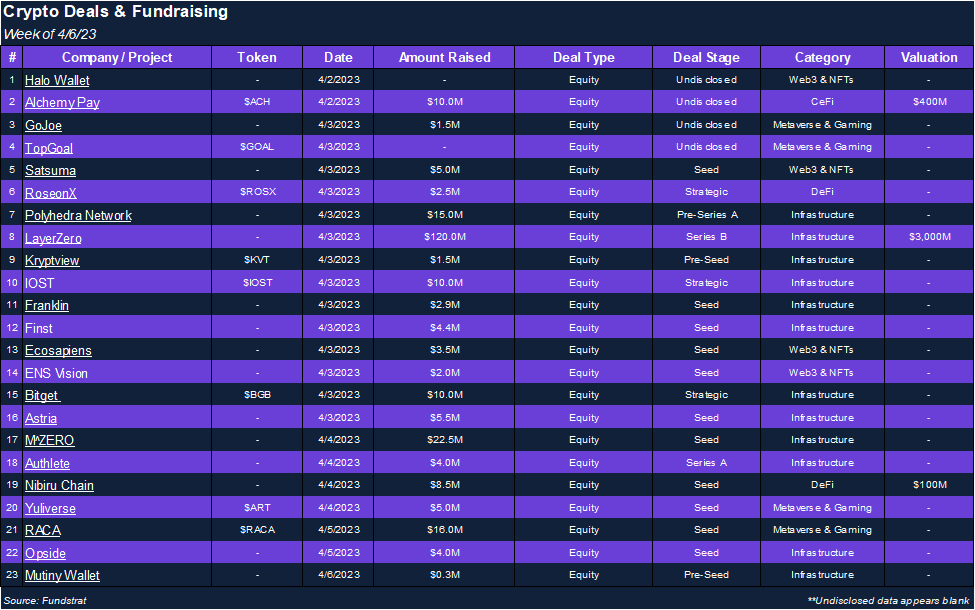

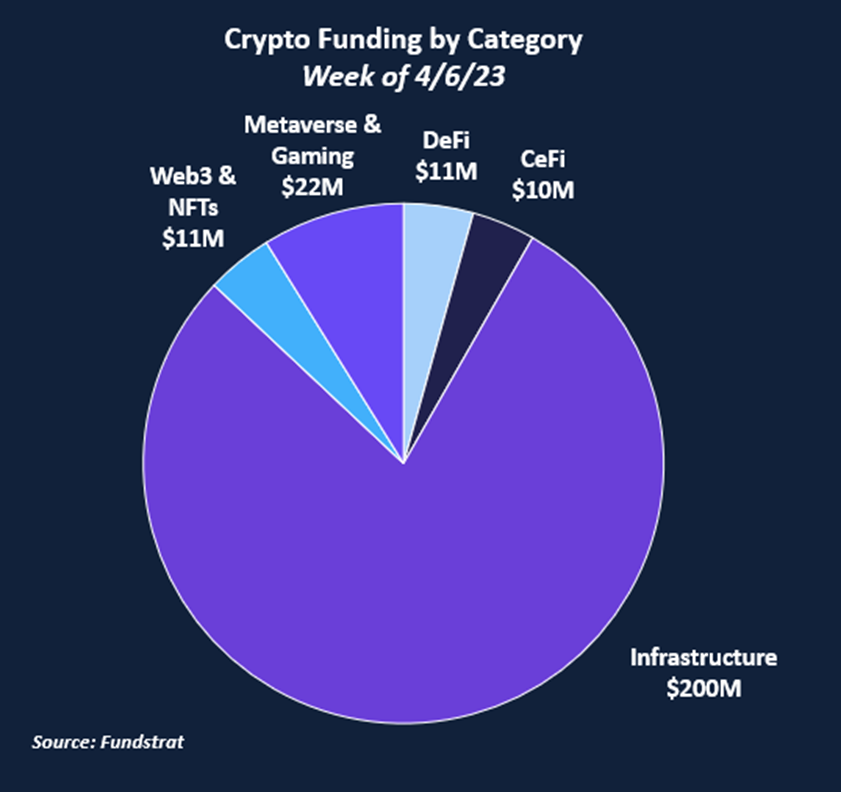

Funding declined slightly this week, from $316M to $254M, with infrastructure making up the majority of funding for the second week in a row at $200M, nearly 80% of total funding. Infrastructure also had one of the biggest deals of the year – LayerZero Labs, an interoperability protocol that raised $120M in a Series B round. We discuss this deal in more depth later in this report. Other segments lagged behind, with each other category accounting for less than $25M.

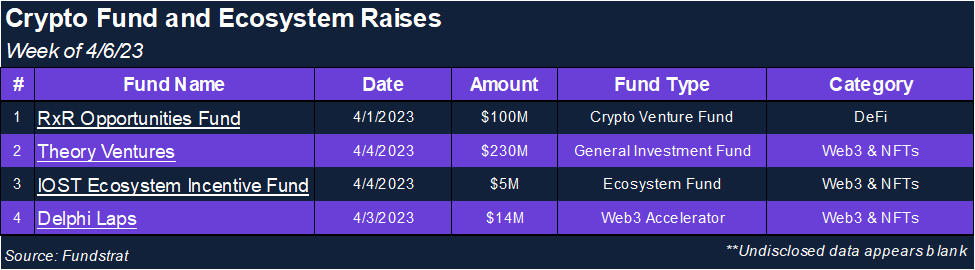

There were three crypto funds raised this week. The RxR Opportunities Fund raised $100M to invest in liquid tokens. This fund is a strategic venture between VC firm, Re7 Capital and crypto infrastructure firm, Republic Crypto. Theory Ventures raised $230M to invest in web3, data, and machine learning startups and Delphi Labs raised $14M for a web3 accelerator that will invest $200,000 in each team accepted into the 4-6 month program.

The Deal of the Week

This week’s Deal of the Week is LayerZero Labs, the team behind the blockchain interoperability protocol, LayerZero. LayerZero Labs raised $120M in Series B funding in a round that included a16z Crypto, Sequoia Capital, and Circle Ventures, among others. This round puts LayerZero Labs at a whopping $3 billion valuation. The team has stated that the raise was for “purely strategic alignment” and that they don’t urgently need the money. They plan to use the funds to expand into the APAC region and push into the gaming sector.

Why is this the Deal of the Week?

Blockchain bridges are essential because they help to overcome one of the significant limitations of blockchain technology: the lack of interconnectivity between different networks. Without blockchain bridges, users would be limited to only using dApps and digital assets on a single blockchain, severely limiting the potential of blockchain technology. LayerZero is an interoperability protocol that uses a novel mechanism to make it easier for different blockchain networks to communicate with each other. By using LayerZero, multiple chains can easily connect through a single interface and code, making it more convenient to use multi-chain dApps. The increased interoperability can significantly improve various applications, including swaps, liquidity mining, lending, borrowing, and others. Since LayerZero’s launch last year, it has seen massive usage. It currently has over $7 billion of total value locked and volume of over $6 billion. DeFi protocols such as Uniswap have also integrated LayerZero for cross-chain transactions. LayerZero Labs plans to put a lot of its recent funding towards integrating with gaming protocols to the same extent they have with DeFi protocols. According to LayerZero co-founder and CEO, Bryan Pellegrino, “Our job is to build the primitive that allows developers to create the best systems they can, whether its games, DeFi applications or something else.”

Selected Deals

Franklin is an infrastructure-based platform aiming to scale modern payroll systems. The platform plans to accomplish this by providing a tool that allows companies to pay their workforce via cryptocurrency. The company has secured $2.9M in funding through its seed round, co-led by CMT Digital and Gumi Cryptos Capital. In addition, the funding round included investor participation from Sfermion, Arca, Portage, and Synergis Capital. Franklin intends to use the capital raised to expand its product offerings.

Bitget is an infrastructure-based platform that provides its users with access to a crypto derivatives exchange. The company has secured $10M in funding through a strategic round from Dragonfly Capital. In addition to using the capital raised to grow its global and launchpad initiatives, Bitget plans to expand its yield generation and spot trading product offerings on its exchange.

Satsuma is a Web3 & NFT-based platform that assists developers through its data indexing software. In order to accomplish this, the platform utilizes open-source technology and custom APIs based on its client’s individual needs. The company has secured $5M in funding through its seed round, co-led by Archetype and Initialized Capital. The funding round included investor participation from Y Combinator, OpenSea, South Park Commons, and Homebrew.

M^ZERO is an infrastructure-based platform aiming to connect decentralized applications with assets in the global financial system. The company has secured $22.5M in funding through its seed round led by Pantera Capital. The funding round included investor participation from ParaFi Capital, Distributed Capital, Standard Crypto, and others. M^ZERO intends to use the capital raised for product development and building additional decentralized infrastructure.

Nibiru Chain is a DeFi-based platform aiming to provide a user-friendly experience similarly seen on centralized exchanges. The platform plans to accomplish this by implementing automated smart contract applications. The company has secured $8.5M in funding through its seed round at a $100M valuation. The round was co-led by Original Capital, Republic Capital, NGC Ventures, and Tribe Capital. The funding round also included investor participation from CapitalX, HashKey Capital, TokenMetrics, and others. Nibiru Chain intends to use the capital raised for workforce expansion and product development.