Web3 & Gaming Attracting Investors’ Interest

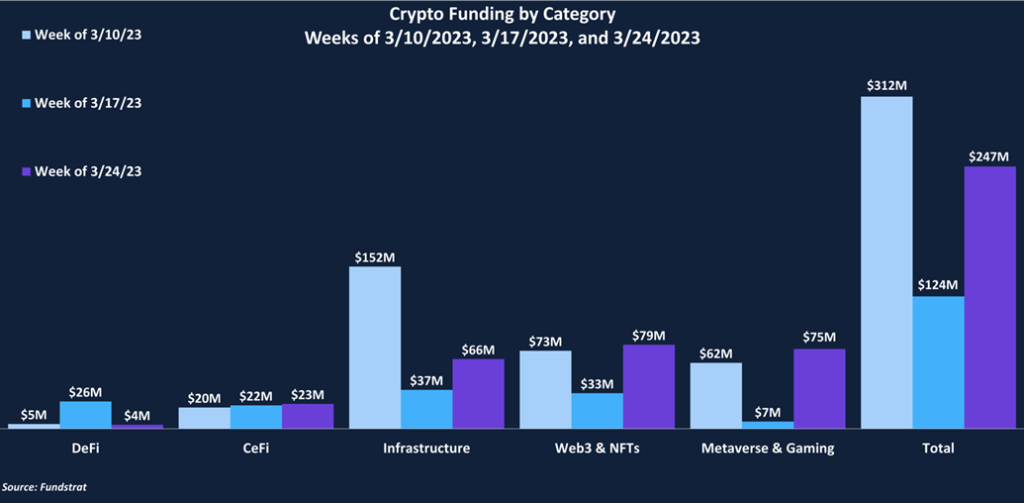

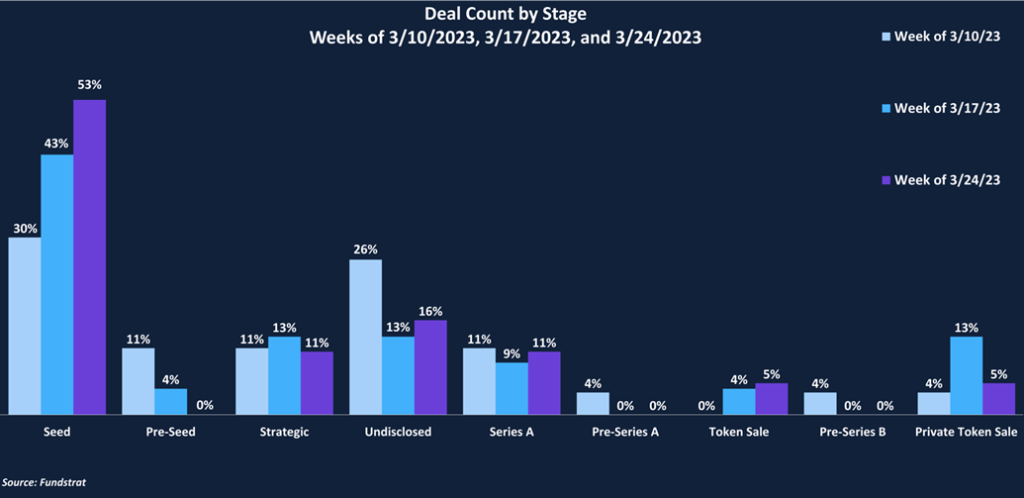

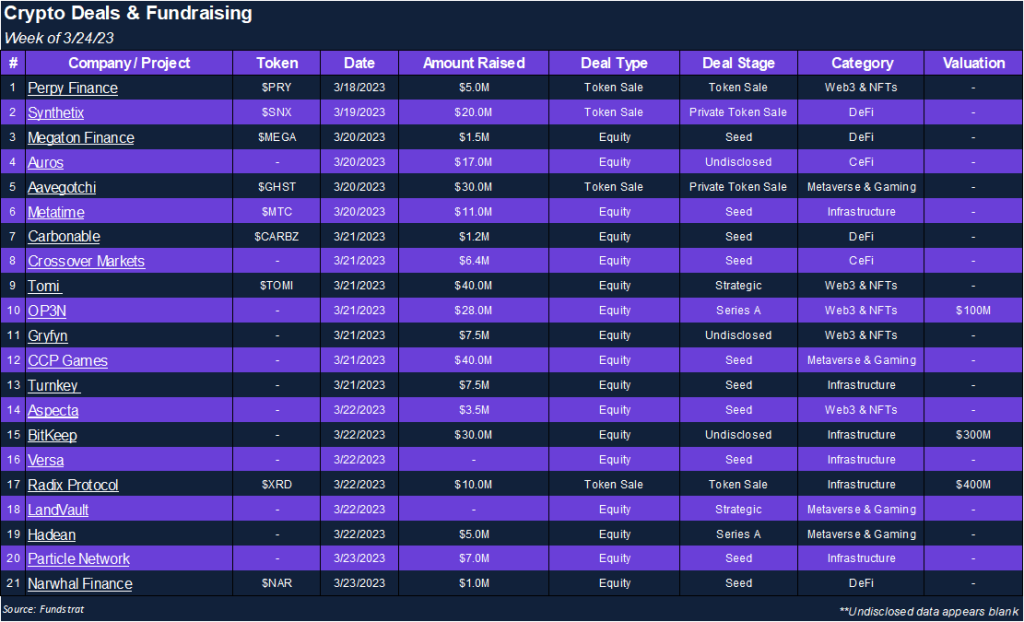

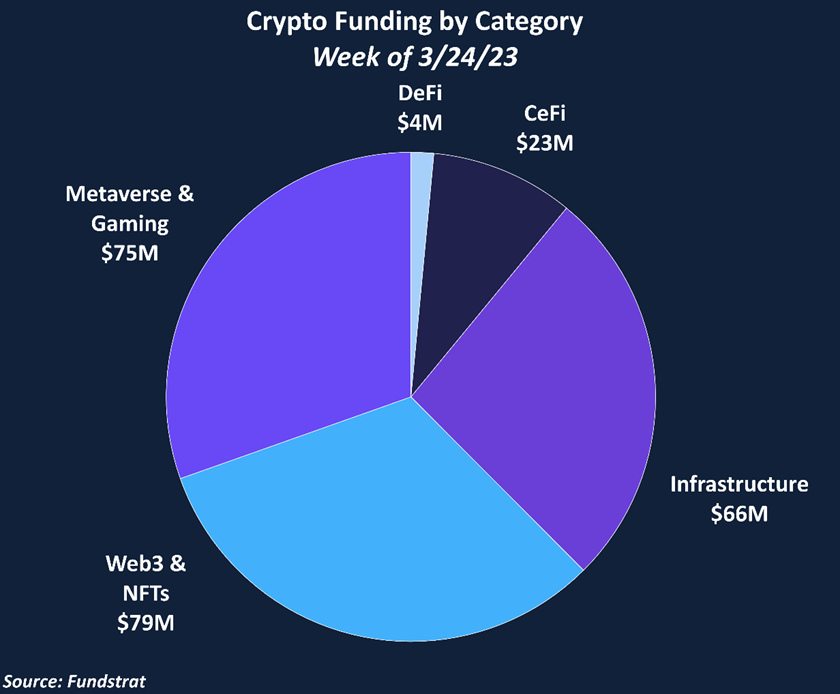

Total funding rose from $124 million last week to $247 million this week, with nearly two-thirds represented relatively evenly between Web3 & NFTs and Metaverse & Gaming. 53% of the deals this week were seed rounds, comprising 32% of the total funding. One of the larger deals this week comes from OP3N, a Web3 AI-powered platform described by its CEO as, “a Web3 version of WhatsApp meets Amazon.” OP3N allows influencers to interact with fans via NFT-gated experiences while providing accessible wallet infrastructure for end users. The $28 million Series A deal was led by Animoca Brands and included investment from other notable names such as Dragonfly Capital and Galaxy Digital.

Two token sales were completed this week (one private and one public) by Radix and Aavegotchi. Radix completed the private sale, raising $10 million solely from one of its previous investors, DWF Labs. The new fundraising round values the layer-1 network at $400 million. The public token sale comes from Aavegotchi, a popular metaverse game, raising $30 million without participation from venture capital or private investment firms.

Deal of the Week

This week’s Deal of the Week is CCP Games, which raised $40M in a seed round led by a16z with participation from Makers Fund, BITKRAFT Ventures, and Hashed, among others. CCP Games was founded in 1977 and is a video game developer specializing in building virtual worlds. CCP is best known for developing EVE Online, a community-driven spaceship MMORPG, which allows players to play for free and choose their path from countless options. EVE has a total player count of nearly 10 million and a daily player count of ~273k, according to MMO Populations. CCP Games will use this financing round to develop a new MMO (Massively Multiplayer Online) game within the EVE Universe utilizing blockchain technology.

Why’s this Deal of the Week?

Crypto gaming is a vertical with huge potential. It can allow players to have secure ownership and trading of in-game assets, offer unique rewards and incentives, have decentralized governance, and more. Despite this potential, crypto gaming is still in its very early stages. Most crypto games released today are relatively nascent compared to traditional AAA gaming titles and generally less funded and with less experienced teams. This makes a deal like CCP Games interesting – an existing video game developer with decades of experience has the capital to leverage their skills and innovate within crypto. Andreessen Horowitz general partner Jonathan Lai said, “CCP Games is a pioneer in virtual worlds and digital economies with 25 years of experience creating living sandboxes with unparalleled depth. They’re a veteran team, and we believe in their ambitious vision to deliver incredible player experiences at the intersection of best-in-class game design and blockchain technology.” We are interested to see how CCP Games and other talented gaming studios integrate blockchain in their games in the future.

Selected Deals

BitKeep is an infrastructure-based platform that provides users access to a decentralized multichain Web3 wallet, NFT marketplace, and DApp store. The company has secured $30M in funding at a $300M valuation from Bitget. In comparison, the platform received $15M in funding at a $100M valuation through its Series A round in May 2022. Having made undisclosed investments in BitKeep during 2021 and 2022, the new round of funding now gives Bitget a controlling stake in the platform.

Crossover Markets is a CeFi-based platform offering institutional clients efficient execution services. With one of the quickest crypto trading engines in the industry, the platform can execute trades at a significantly faster rate in comparison to mainstream crypto exchanges. The company has secured $6.35M in funding through its seed round. The funding round also included investor participation from Laser Digital, Two Sigma, Wintermute Ventures, and Flow Traders.

Particle Network is an infrastructure-based platform aiming to build tools that assist Web3 developers. The company has secured $7M in funding through its seed round led by ABCDE. The funding round included investor participation from Animoca Brands, GSR Ventures, Longhash Ventures, and others. Particle Network intends to use the capital raised for workforce expansion and advancing its security-based products.

OP3N is a Web3 & NFT-based platform aiming to ease the onboarding process of Web2 to Web3 by incorporating blockchain technology into Web2-like interfaces. The platform has secured $28M in funding through its Series A round at a $100M valuation. The funding round was led by Animoca Brands with investor participation from Republic Crypto, Dragonfly Capital, Galaxy Digital, SuperScrypt, and others. OP3N intends to use the capital raised for workforce expansion and product development.

Radix Protocol (XRD) is an infrastructure-based Layer 1 blockchain network focusing on DeFi. The platform aims to provide developers with a more straightforward way of creating smart contracts through its programming language. The company has secured $10M in funding through a private token sale at a $400M valuation led by DWF Labs. Radix intends to launch its main-net in Q2 2023.