ARK Raises New Crypto Fund and VCs Target Infrastructure

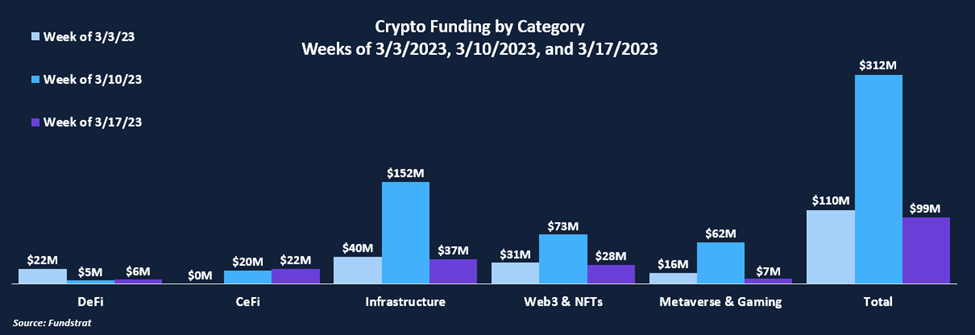

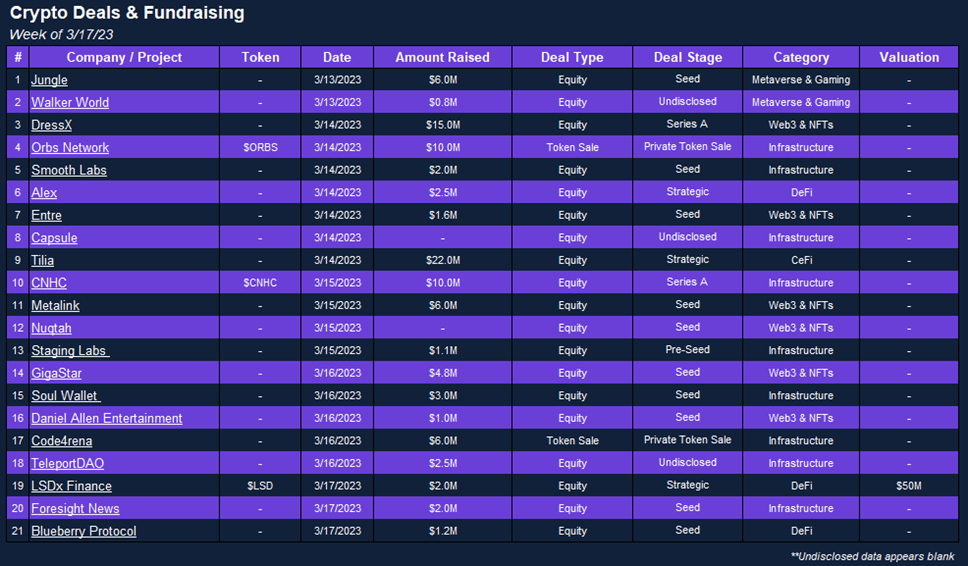

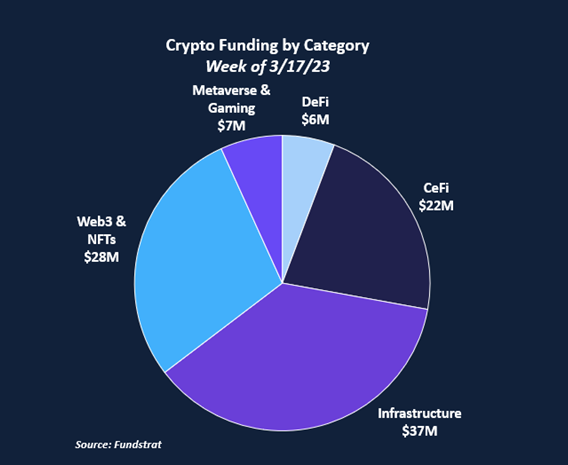

Funding dropped this week from $312M to just $99M. As we’ve seen all month, funding remains primarily concentrated in Infrastructure and Web3, which raised $37M and $28M, respectively. Infrastructure accounted for 9 of this week’s 21 deals, and Web3 & NFTs accounted for 6. DeFi remains a laggard this week, receiving just $6M of funding

One major crypto fund was raised this week –Cathie Wood’s ARK’s Crypto Revolutions Fund, which raised over $16M. The fund is split between a fund based in the U.S., which raised ~$7.2M from nine investors, and a fund based in the Cayman Islands, which raised ~$9M from one investor. This raise comes just after the ARK Innovation ETF received a whopping $397M of inflows last Friday, its largest influx since April 2021.

Most deals this week were done in the early stages, with 53% in seed or pre-seed rounds.

Selected Deals

Jungle is a Web3-based gaming studio aiming to acquire undervalued intellectual property. This allows the studio to bypass the development process for gaming titles, which can expedite releases by up to three years. The company has secured $6M in funding through its seed round, co-led by Framework Ventures and Bitkraft Ventures. The funding round included investor participation from Delphi Digital, Stateless Ventures, 32-Bit Ventures, Monoceros, and others. Jungle intends to use the capital raised for product distribution, marketing, and workforce expansion.

Tilia is a CeFi-based company aiming to become an all-in-one payment solution for Web3, NFT, metaverse, and gaming platforms. The company has raised $22M in funding through a strategic round, co-led by J.P. Morgan and Dunamu & Partners. Tilia intends to use the capital raised to expand its operations further.

DressX is a Web3 & NFT-based platform with a focus on digital fashion. Augmented reality allows the platform’s users to wear their digital clothing through the DressX application and as skins in metaverse-based games. The platform also launched its own NFT marketplace in March 2022. The company has secured $15M in funding through its Series A round led by Greenfield. The funding round included investor participation from Warner Music Group, Slow Ventures, Red DAO, and The Artemis Fund. DressX intends to use the capital raised for further augmented and virtual reality integration in its social and metaverse platforms.

Smooth Labs is an infrastructure-based platform focusing on parallel transaction execution. This type of execution increases transaction speeds by allowing multiple transactions to be processed simultaneously. The company has secured $2M in funding through its seed round led by NGC Ventures. The funding round included investor participation from ArkStream Capital, Token Metrics, and Cogitent Ventures. In addition, Smooth Labs intends to expand its workforce and plans on launching a testnet in Q3 2023.

Metalink is a Web3 & NFT-based company focusing on creating an NFT portfolio management and social platform. Its recently launched application allows NFT owners to track their portfolio’s performance and interact with each other. The company has secured $6M in funding through its seed round. The funding round included investor participation from Dapper Labs, Gemini, Baller Ventures, Human Ventures, and others.

Deal of The Week:

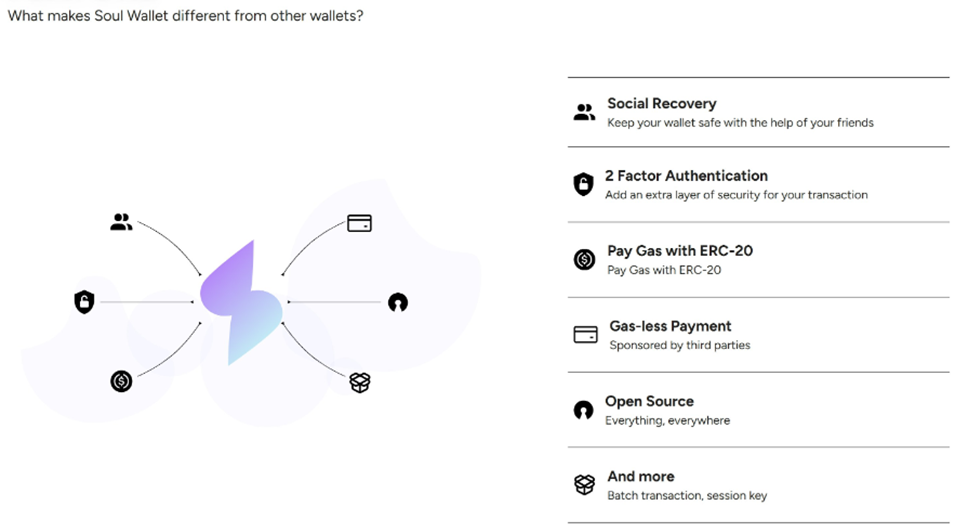

Soul Wallet, a Web3 software company building a next-generation password recovery-enabled wallet, announced a $3m raise from their “Ethereum Community” seed round, with participation from Struck Crypto, Alchemy, and several well-known influencers and angel investors in the crypto industry. Soul Wallet plans to leverage the ERC-4337 standard to enable seedless smart contract wallets with social recovery through plug-in extensions and mobile applications. The funds will be used for development, internal testing, and audits for the wallet’s launch in Q3 or Q4 of this year.

Why is this the Deal of The Week?

Popular wallet solutions like Metamask require users to create a 16-word recovery phrase. User funds are irrecoverable without this 16-word phrase, placing an enormous burden on any user who wants to have complete control over their digital assets not to lose the phrase. Alternatively, users can store funds on third-party wallets with a better user experience, but there is a lack of transparency on what that third party does with users’ funds. Blow-ups like FTX and Celsius demonstrated that third parties could deceive their users and take unnecessary risks with user funds without their consent.

Soul Wallet founder Jianjan Zeng, a former product manager at TikTok’s parent company ByteDance, claims that comparing existing solutions to wallets that use the ERC-4337 standard is similar to “comparing Nokia to iPhones.” Through ERC-4337, Ethereum plans to enhance wallets with smart contract capabilities. Known as “account abstraction,” this would allow programmers to execute smart contracts directly in wallets instead of relying on the base blockchain. These capabilities enable social recovery tools, reduce reliance on seed phrases, and allow additional user-friendly features, such as paying gas with non-base layer currencies. With a shout-out from Ethereum founder Vitalik Buterin himself, Soul Wallet’s innovations with account abstraction could bring the next level of user experience for digital assets to market.