NFT Derivatives Trading is Here

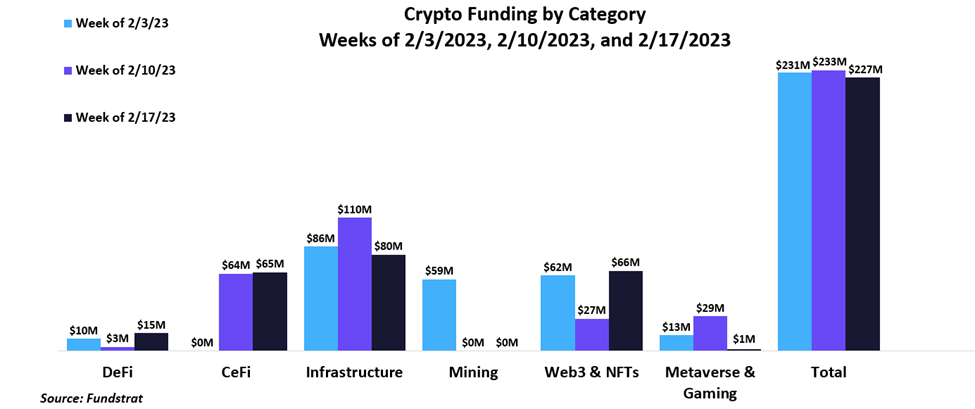

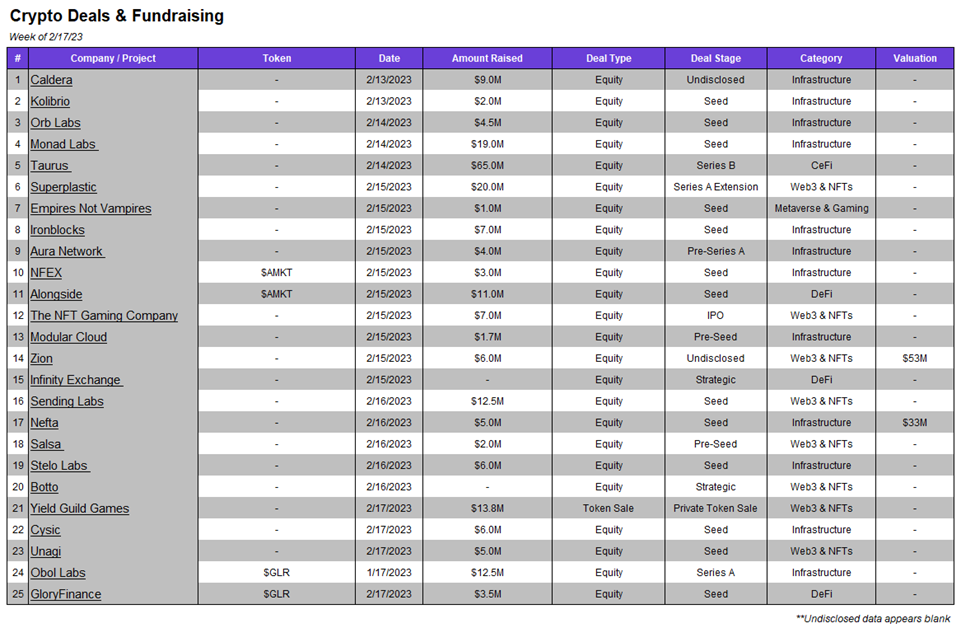

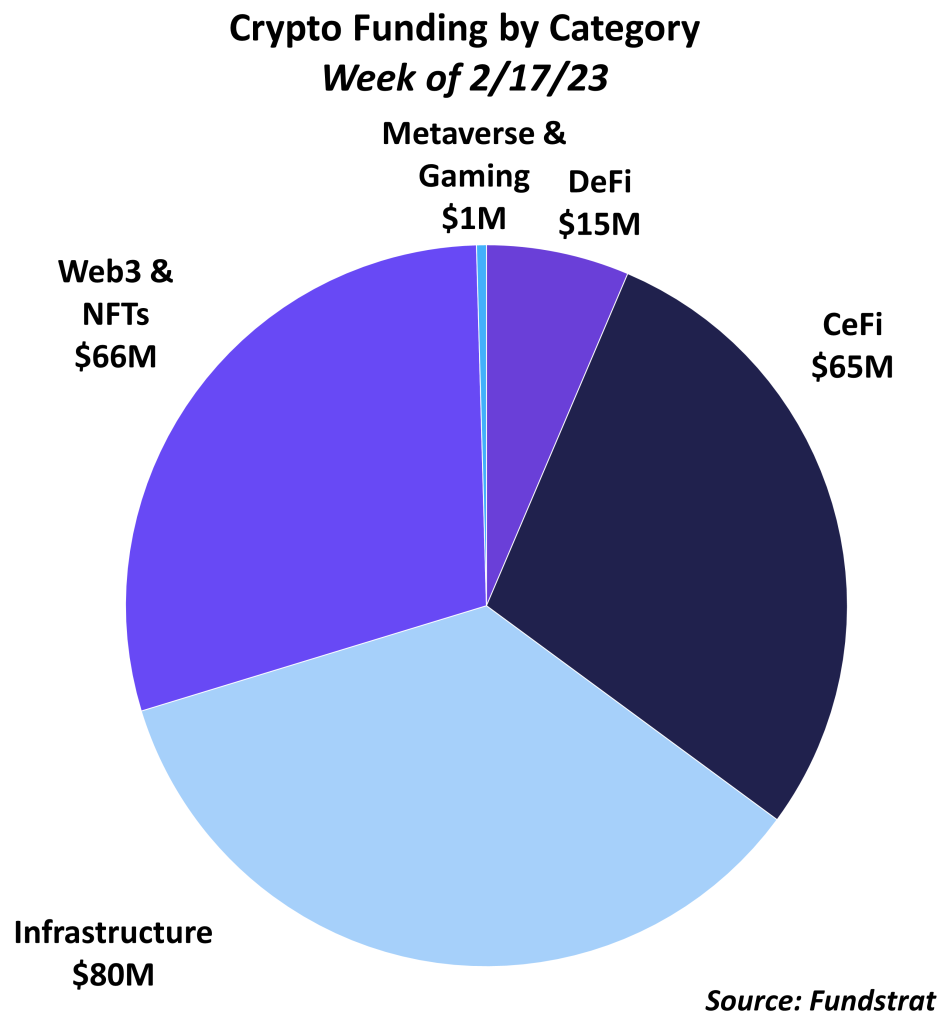

Funding has remained consistent the past few weeks at about ~$230M per week. Infrastructure made up the bulk of the deals this week, with $80M in funding and 12 total deals. Infrastructure funding was led by Monad Labs, which raised $19M from Dragonfly Capital. Monad Labs is the team supporting the Monad blockchain, a blockchain looking to optimize execution and process 10,000 transactions per second. CeFi and Web3 & NFTS also received considerable funding, at $65M and $66M, respectively. The week’s largest deal, Taurus, is in the CeFi vertical and received $65M in funding in a Series B round led by Credit Suisse. Taurus aims to be the go-to digital asset platform for banks worldwide.

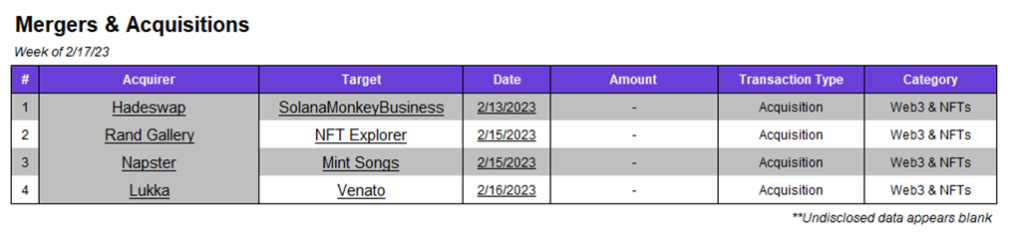

Interestingly, there were four acquisitions in the Web3 & NFTs vertical. This included hadeswap acquiring the popular Solana NFT collection, Solana Monkey Business, and Napster acquiring Web3 music startup Mint Songs. After a strong start to 2023, mining funding has cooled off, not receiving any funding in the past two weeks. DeFi and Metaverse and Gaming funding also lagged, at $15M and $1M.

Deal of the Week

NFEX, a decentralized derivatives exchange that plans to offer perpetual swaps trading for blue chip NFTs, has raised a $3m seed round led by ABCDE Capital, with participation from Amber Group and Firestone Ventures. NFEX aims to build a derivative market for NFTs, enhancing liquidity in the marketplace. Their DEX will offer the preferred instrument for trading in crypto, perpetual swaps, on blue chip NFTs and other crypto assets. This will enable traders to leverage long/short on positions for future price direction on NFT collections, without requiring the user to buy the NFT. Traditional NFT marketplaces only offer spot exposure, with most blue-chip NFTs pricing out average traders as their values can exceed thousands of dollars. NFEX has just launched their invitation-only Beta this past week, with open applications to participate in their upcoming Alpha testing.

Why Is This the Deal of the Week?

The crypto market has an insatiable appetite for trading perpetuals, with top perp dexes GMX and dYdX generating nearly $500m in combined fees since launching. NFTs have also found strong adoption, with close to $25bn in organic trading volume for both 2021 and 2022, according to DappRadar. With the aim to combine two of the biggest products among blockchain users into one platform, NFEX has the potential to gain a first mover advantage in a market which has yet to be cracked. The issue with NFT derivatives, and NFT price discovery in general, is that most collections are thinly traded and thus have poor liquidity. While most collectors assume their NFTs are worth at least the ‘floor’ (cheapest spot sell) price of what their collection trades at, this is rarely the case. NFTs typically see highly volatile swings when their floor price begins to fall, as sellers rush to undercut each other by listing their NFT at a lower price than the floor, leading to a downward spiral in price. The floor prices of many collections are also frequently manipulated by whales that have large holdings of a certain collection. This is one of the reasons NFT derivatives have yet to find traction, as no product has been able to deal with the price manipulation that may lead to abuse of their derivatives contracts. By starting with liquid blue-chip collections that have higher liquidity, NFEX could become the go-to marketplace for NFT derivatives should they execute on launching a product that can overcome floor manipulation.

Selected Deals

Caldera is an infrastructure-based platform that allows its users to launch and operate layer-two blockchain rollups. The company has secured $9M in funding co-led by Sequoia Capital and Dragonfly. In addition, the funding round included investor participation from 1kx, Neo, Ethereal Ventures, and others. Caldera intends to use the capital raised for workforce expansion, product development, and partnerships.

Orb Labs is an infrastructure-based blockchain interoperability platform. The platform is planning to launch a cross-chain messaging protocol named Earlybird. The protocol aims to be cheaper and more secure in comparison to existing alternatives. The company has secured $4.5M in funding through its seed round led by Bain Capital Crypto. In addition, the funding round included investor participation from Newman Capital, 6th Man Ventures, Shima Capital, Modular Capital, and others. Orb Labs intends to use the capital raised for workforce expansion, product development, and security audits.

Obol Labs is an infrastructure-based platform aiming to make proof-of-stake (PoS) blockchains more secure. The company has secured $12.5M in funding through its Series A round, co-led by Pantera Capital and Archetype. In addition, the funding round included investor participation from IEX, Placeholder, Nascent, BlockTower, and others.

Taurus is a digital asset infrastructure provider for financial institutions. The company has secured $65M in funding through its Series B round led by Credit Suisse. In addition, the funding round included investor participation from Investis, Pictet Group, Arab Bank Switzerland, and Deutsche Bank. Taurus intends to use the capital raised for compliance requirements, geographical expansion, and hiring.

Nefta is an infrastructure-based platform focusing on the entertainment and gaming industries. It plans on developing tools for its users to enter and expand within Web3. The company secured $5M in funding through its seed round at a $32.5M valuation. Play Ventures led the funding round, which also included investor participation from Polygon Ventures, Picus Capital, Sfermion, and SevenX Ventures. Nefta intends to use the capital raised for workforce expansion.