Digital Identities for BNB

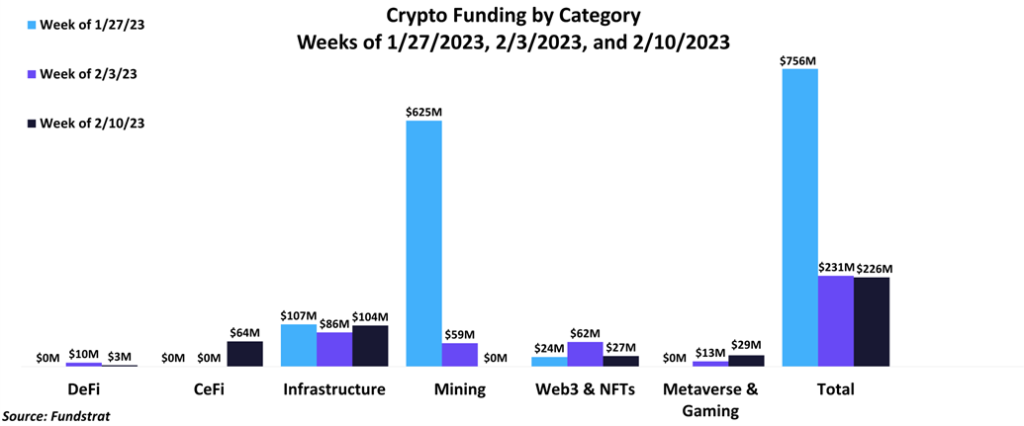

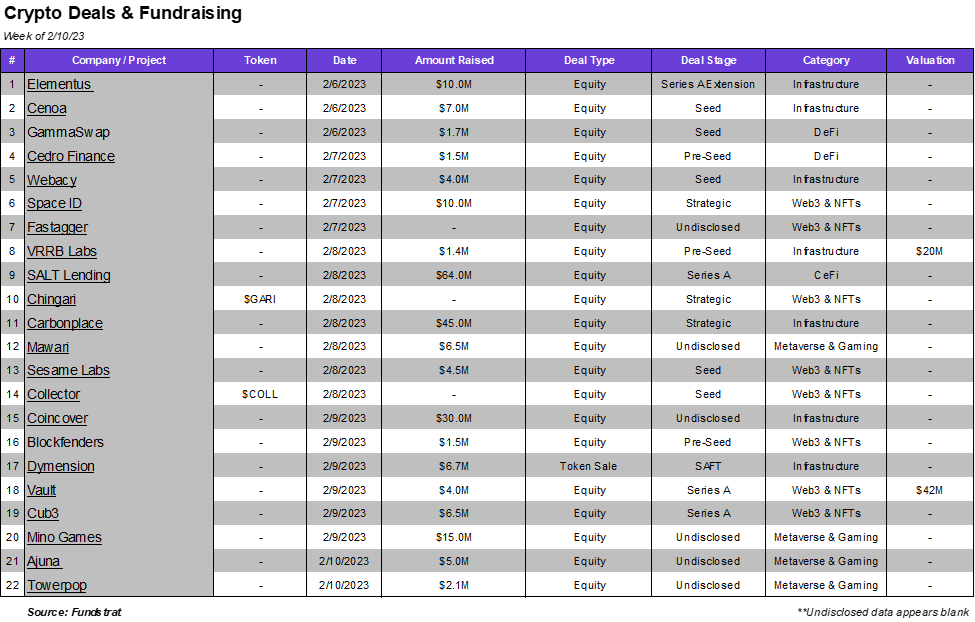

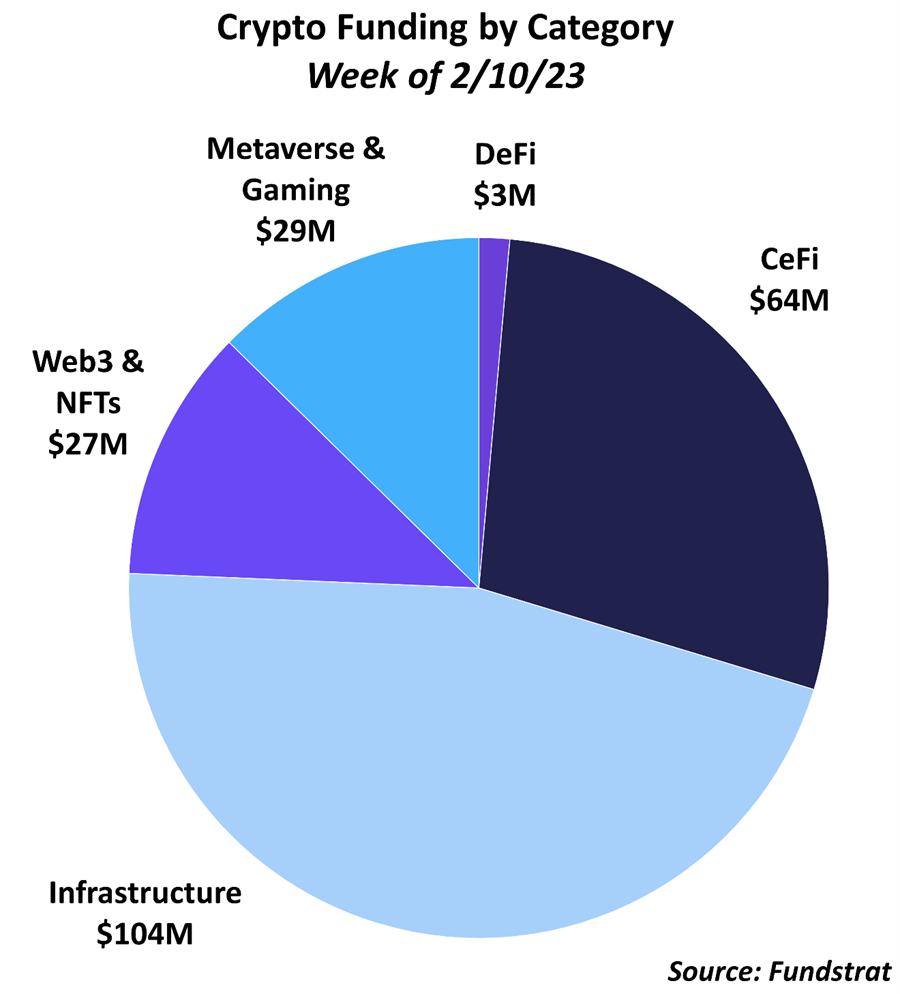

This week’s funding totals were on par with last week, declining slightly from $231 million to $226 million. Funding amounts were concentrated in the Infrastructure and CeFi verticals, raising $104 million and $64 million, respectively. SALT Lending closed a $64 million Series A deal, representing the largest deal this week and comprising the entire amount of CeFi capital raised. SALT Lending is a crypto lending platform that paused its business following the collapse of FTX. They raised capital in order to cancel out debts owed to customers, with any remaining funds to be used for new products and growth strategies.

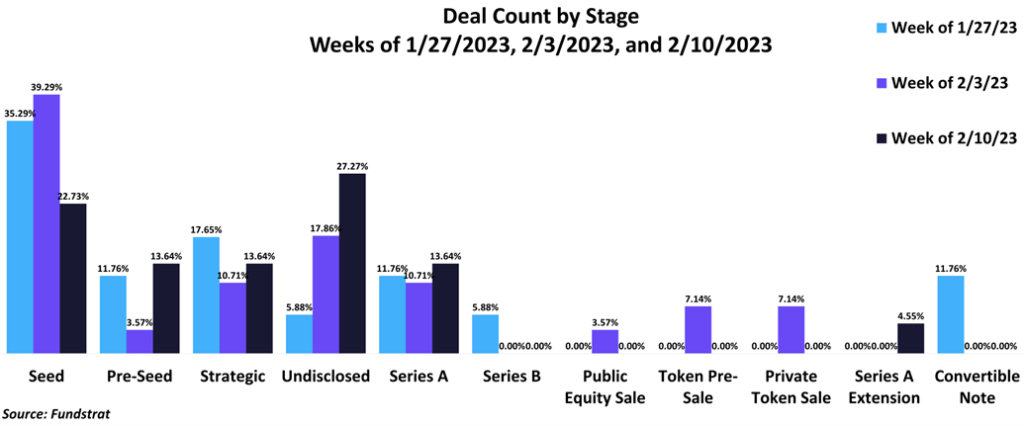

Seed rounds were the most common disclosed deal stage this week but only comprised 7.6% of the total funding amount, whereas Series A rounds were tied for the least common stage but represented 33% of total fundraising. Dymension, a modular blockchain network leveraging Cosmos and Celestia technologies, completed a $6.7 million SAFT offering, representing the only SAFT deal this week.

Deal Of The Week

SPACE ID, a universal name service and decentralized identity provider, has raised a $10m strategic round led by Polychain Capital and dao5, with participation from other industry leaders, including BscScan and Trust Wallet. Space ID launched a .bnb public domain registration in September 2022, and to date has generated 370k registrations and 170k unique name holders. Last month they announced their 2.0 upgrade, with ambitions to build an infrastructure to create a one-stop blockchain domain and identity platform for all Web3. They aim to accommodate the complete life cycle of Web3 domain management, including registration, trading, and management. Their offering includes a Web3 name SDK and API platform for developers across chains and a multi-chain name service that enables the creation of a portable Web3 identity for users.

Why Is This Deal of the Week

The Ethereum Name Service, which allows users to create a human-readable address for ETH native wallets, has become one of the top NFT ecosystems. In terms of protocol earnings (revenue net of token incentives), ENS -1.57% is one of the top-grossing protocols with $78.4m in all-time earnings. This ranks 3rd for all-time fees on Ethereum, falling behind industry giants OpenSea ($912.1m) and MakerDAO ($146.9m). While ENS has established provenance and solidified itself as the standard domain service on Ethereum, there has yet to be another domain service to develop this type of relevancy on other chains. The ability to link a cross-chain domain and identity, which would port with a user regardless of the chain they transact on, does not currently exist on the market. While many protocols can use the same Metamask address to send and receive transactions, in some cases, users must go through cumbersome linking processes to connect their addresses on different blockchains. SPACE ID recently acquired ARB ID, which is working towards standardizing a domain service on Arbitrum. If SPACE ID successfully creates its ‘Universal naming service,’ it would present a tremendous market opportunity and enhance crypto adoption through more intuitive user experiences.

Selected Deals

Coincover is an infrastructure-based platform with a focus on digital asset protection. The platform is able to protect institutions through insurance-backed guarantees. The company has secured $30M in funding through a round led by Foundation Capital. Additional investor participation in the funding round was undisclosed. Coincover intends to use the capital raised for product updates, partnerships, and workforce expansion.

Cub3 is a Web3-based platform focusing on helping its clients improve engagement with their customers. The platform accomplishes this by creating loyalty programs that reward users with tokens. The company has secured $6.5M in funding through its Series A round, co-led by Fabric Ventures and Bitkraft. In addition, the funding round included investor participation from Geometry Labs, CMT Digital, and Red Beard Ventures. Cub3 intends to use the capital raised towards developing and launching its Proof of Behavior protocol.

VRRB Labs is a Layer 1 blockchain platform aiming to improve the developer experience. The company plans to accomplish this through its language-agnostic platform, allowing developers to build and run applications more efficiently. The platform has secured $1.4M in funding through its pre-seed round at a $20M valuation. In addition, the funding round included investor participation from Big Brain Holdings, Taureon, and Jump Crypto.

Vault is a Web3-based platform that focuses on the music industry. The platform allows artists to turn their music into collectibles available for purchase by their fans. The company has secured $4M in funding through its Series A round at a $42M valuation. In addition, the funding round was led by Placeholder VC with investor participation from Bullpen Capital, Alleycorp, and Everblue Management. Vault intends to use the capital raised to scale its protocol.

Ajuna is a gaming-based platform that offers users access to game development engines. These engines lower traditional gaming developers’ barriers to entering the Web3 gaming space. The company has secured $5M in funding through a round led by CMCC Global. Ajuna intends to use the capital raised to develop more game engines and support projects that launch on its network.