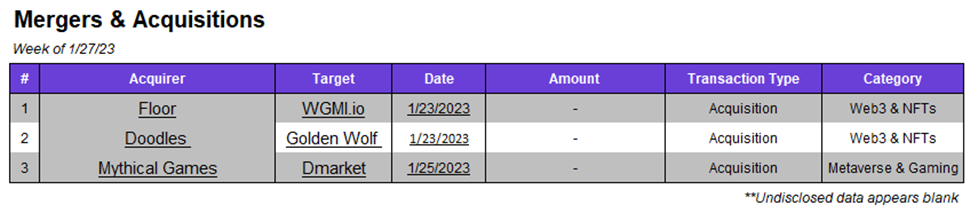

Mining Funding Comes Back from the Dead

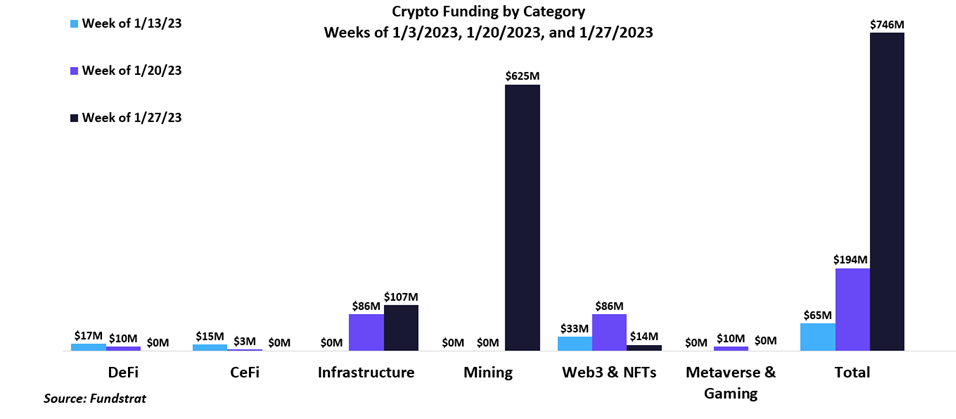

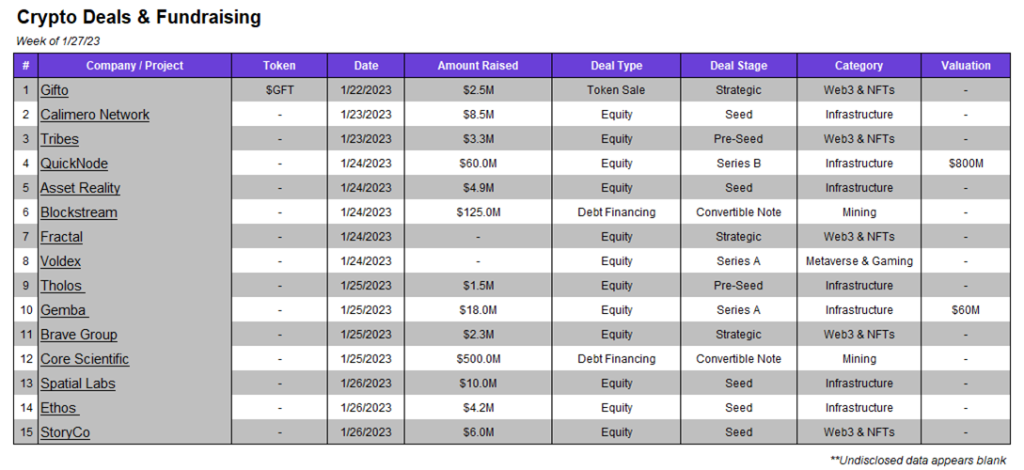

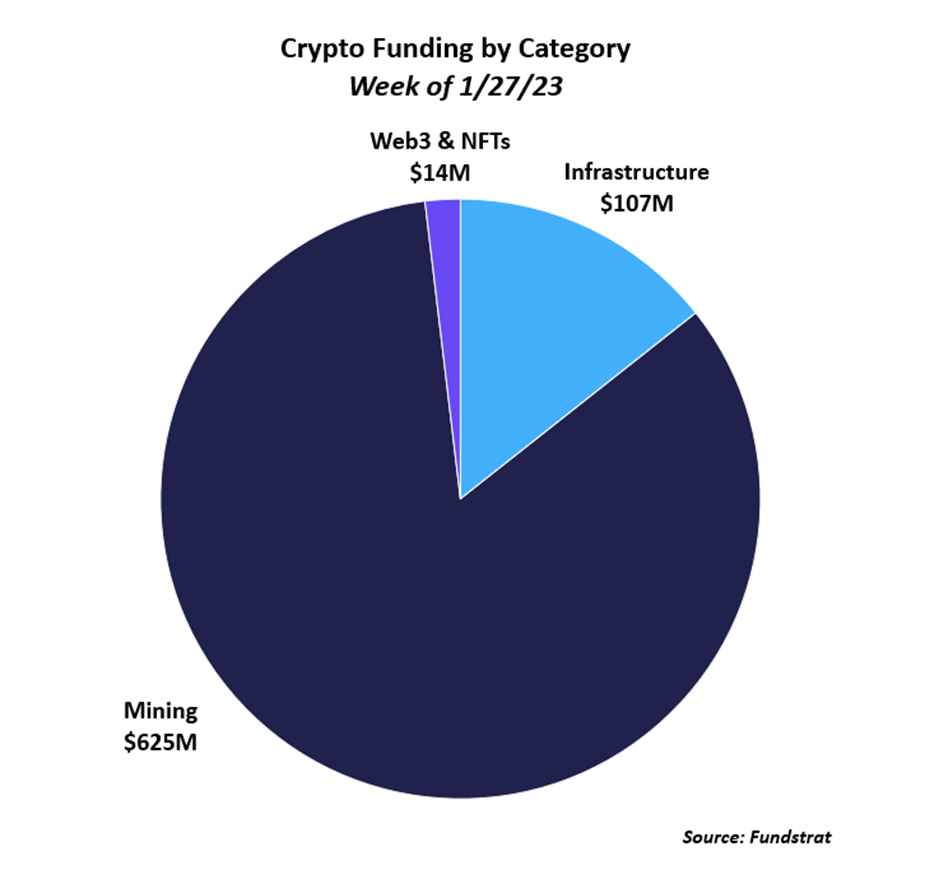

For the first time in over a year, we’ve seen mining dominate crypto funding, comprising $625M of this week’s $746M of funding. There were two mining deals, Core Scientific and Blockstream, which received $500M and $125M, respectively. This heavy funding in mining caused total funding this week to skyrocket from last week, increasing nearly 4x from $194M to $746M (one of the most funded weeks in months). Aside from mining, infrastructure also had a strong week, increasing to $107M in funding from $86M last week. There were seven infrastructure deals, the largest of which was Quicknode, which we describe in more detail below. Aside from mining and infrastructure, the rest of the segments had a relatively slow week. DeFi, CeFi, and Metaverse & Gaming received no funding. Web3 & NFTs received $14M, made up of five smaller deals.

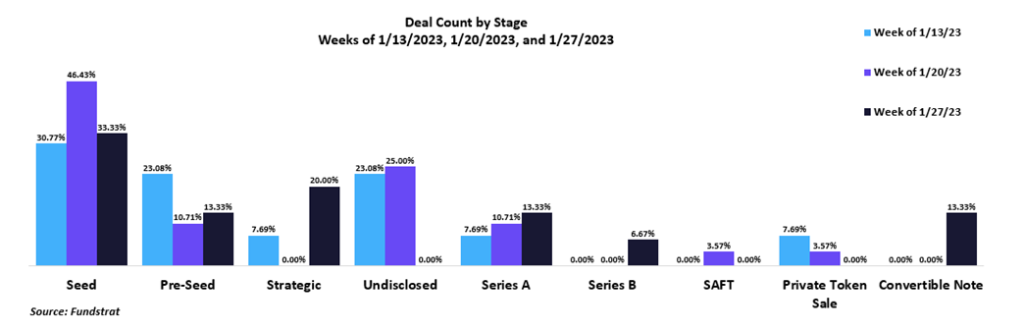

Deals remain concentrated in the early stages – 33.3% were Seed Round and 13.3% were Pre-Seed.

Deal of the Week:

Quicknode, a blockchain development platform, raised $60 million in a Series B funding round led by 10T Holdings. The fundraising round valued Quicknode at $800 million, and the deal had other participation from Tiger Global, 776, QED, and others. The capital is earmarked for helping Quicknode expand globally, continue hiring, and build out its technology stack. Quicknode had previously raised $35 million in a Series A round led by Tiger Global a little over a year ago.

Why is this the Deal of the Week?

Quicknode offers Web3 builders different tools such as elastic APIs, powerful analytics, and knowledge base articles to give developers competitive advantages. Quicknode currently provides tools for over 16 blockchains and 33 networks that help improve speed, reliability, and security for developers. Some highlights of their tools include their Core API, which can handle blockchain forks, upgrades, and network interruptions for an app, or their NFT API, which makes it easier for apps to find NFTs and their metadata.

Quicknode is fetching a large valuation in part due to its ability to book record revenues in Q3 and Q4 of 2022, which was one of the most challenging times in the industry. Revenues rose by over 300% as Web2 giants and Web3 native companies continued to dive into the space. Quicknode continues to see demand from companies trying to integrate blockchain into their products, with over 200 billion API requests a month. CEO Alex Nabutovsky said the company’s long-term vision is simple, “We want to get to the point where any company that wants to build or interact with blockchain will use us.” Quicknode seems well on its way to achieving that vision and could become the “AWS or Azure of blockchain.”

Selected Deals

Spatial Labs is an infrastructure-based platform aiming to support the metaverse. The platform plans to accomplish this through its LNQ One Chip. Like a QR code, the microchip provides users access to in-person and online experiences once connected to a phone. The company has secured $10M in funding through its seed round led by Blockchain Capital. In addition, the funding round included investor participation from Marcy Venture Partners. Spatial Labs intends to use the capital raised to scale and develop its product along with expanding into new industries. In 2023, the company also plans to release a new product that will uncomplicate the deployment and development process for augmented reality (AR) experiences.

Core Scientific is a US-based digital asset mining company that focuses on mining bitcoin ($BTC). In an effort to repay debt holders, Core Scientific has secured $500M in funding through the form of secured convertible notes. The largest investor in the debt financing deal was Ibex Investors, which lent $100M. Other investors in this funding round include Apollo Capital, BlackRock, Kensico Capital, and others.

Tholos is an infrastructure-based platform aiming to develop institutional-grade treasury management and digital asset custody solutions. The company has secured $1.5M in funding through its pre-seed round, co-led by Lattice Capital, North Island Ventures, Dispersion Capital, and Chainforest. The funding round also included investor participation from Reverie, 369 Capital, and others.

StoryCo is a Web3 & NFT-based platform aiming to create a new generation of storytelling using blockchain. The platform plans to accomplish this by allowing fans and creators to develop content collaboratively. Also, StoryCo integrates NFTs by allowing the tokens to play a role within the story. The company has secured $6M in funding through its seed round, co-led by Patron and Collab+Currency. In addition, the funding round also included investor participation from Sfermion, Blockchange Ventures, GMoney, and others.

Ethos is an infrastructure-based platform aiming to provide its users with access to digital assets and integration of decentralized applications on the Sui blockchain. The company has secured $4.2M in funding through its seed round, co-led by gumi Cryptos Capital and Boldstart Ventures. In addition, the funding round included investor participation from Builder Capital, Tribe Capital, Mysten Labs, and others. Ethos intends to use the capital raised for product development and workforce expansion.