Funding Takes a Dive After FTX Collapse

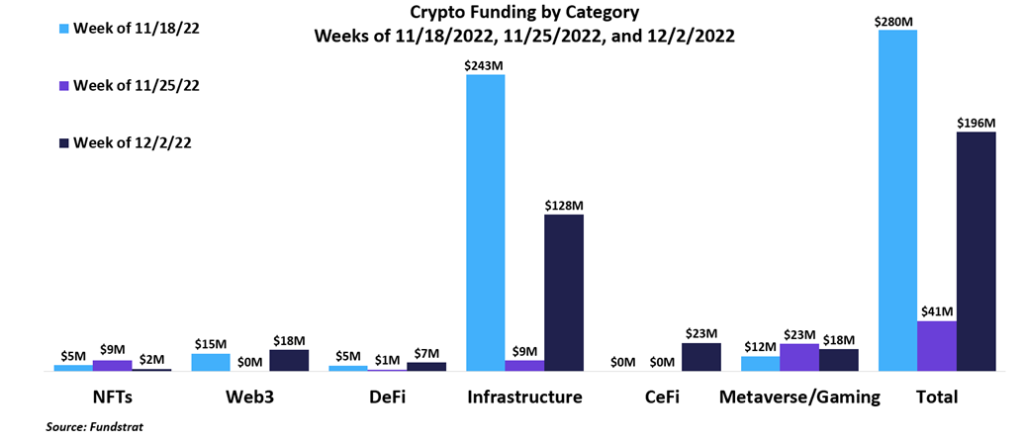

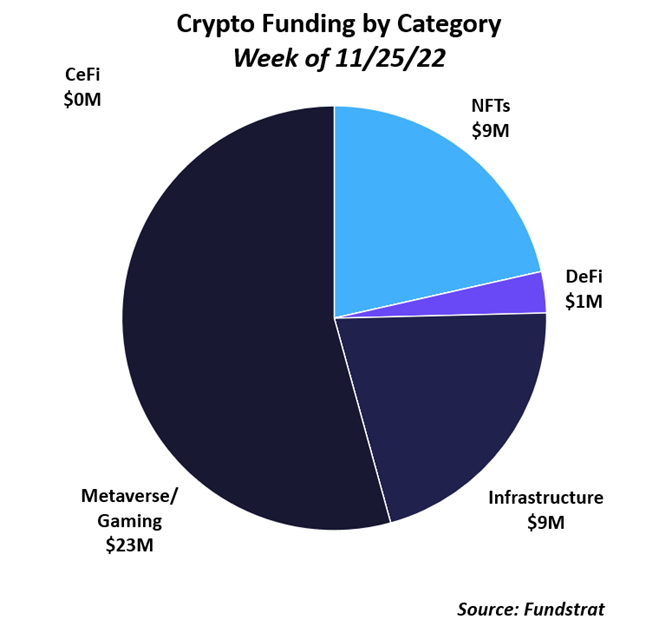

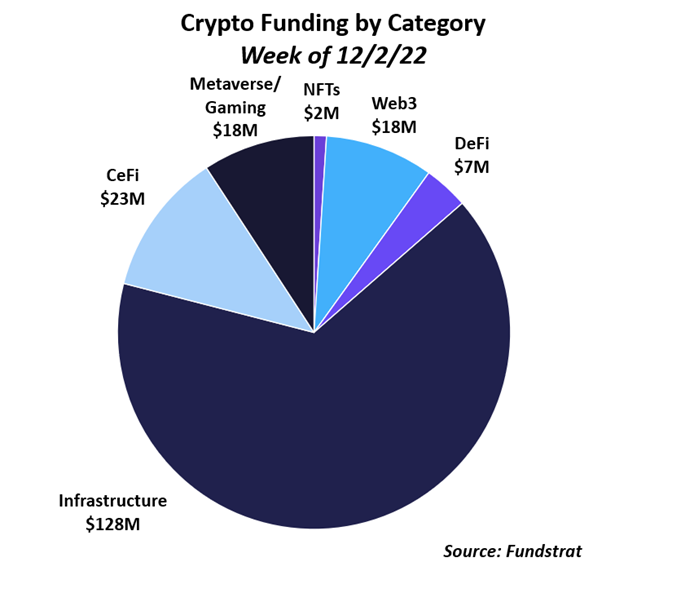

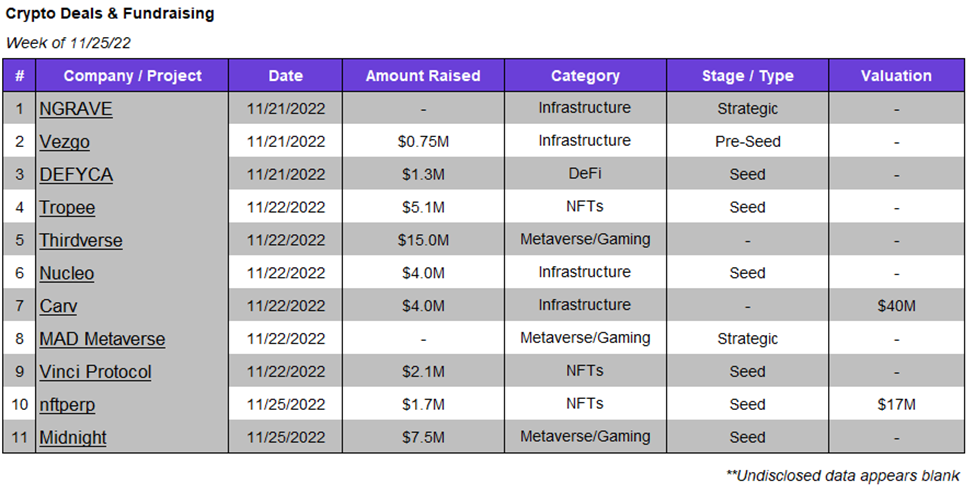

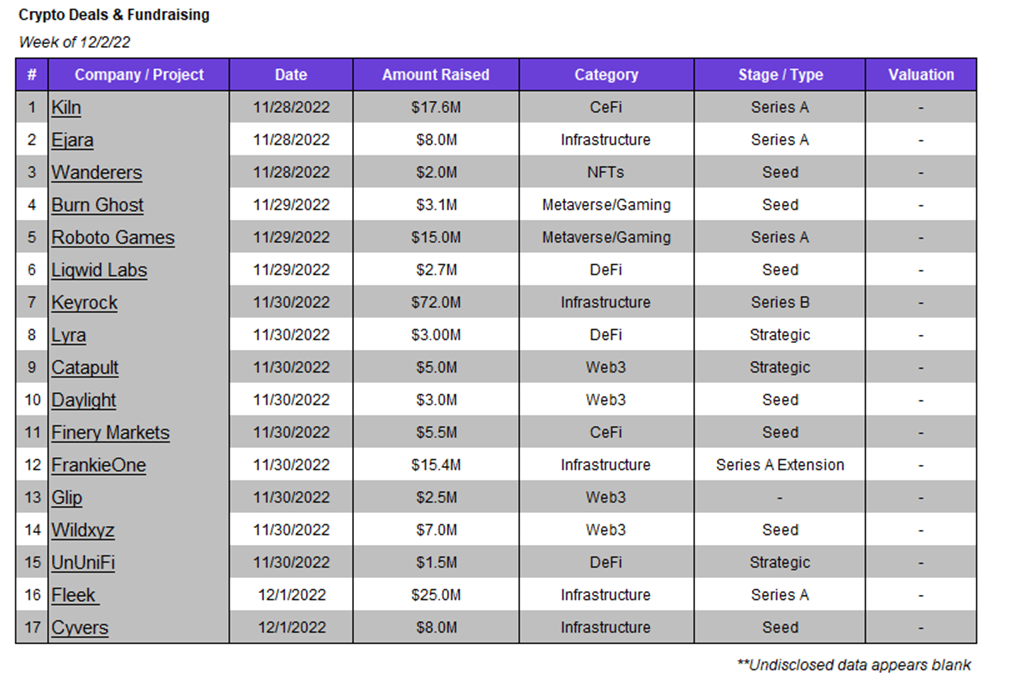

Today we are covering both this week and last week due to Thanksgiving last Thursday. Not surprisingly, funding was low last week during the holiday and amid the FTX insolvency. Funding decreased from $280M the week of 11/18 to just $41M last week. However, we’re seeing funding starting to bounce back this week – increasing from $41M to $196M. Like we’ve seen most of the year, much of this funding came from the infrastructure segment. Infrastructure accounted for five of this week’s seventeen deals and included the largest deal of the week – a Series B round for Keyrock, which we discuss later in this report.

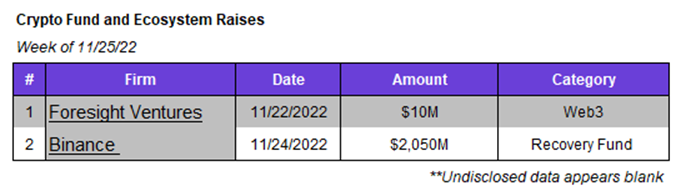

An interesting development this week was Binance announcing a recovery fund to assist distressed firms in the wake of the FTX collapse. Binance initially committed $1B in Binance USD (BUSD) towards the fund, and more recently announced an additional $1B in BUSD, bringing the total fund size to over $2B. There was an additional $50M contributed by Jump Crypto, Aptos Labs, Animoca Brands, and Polygon Ventures. Currently, over 150 companies have applied for support.

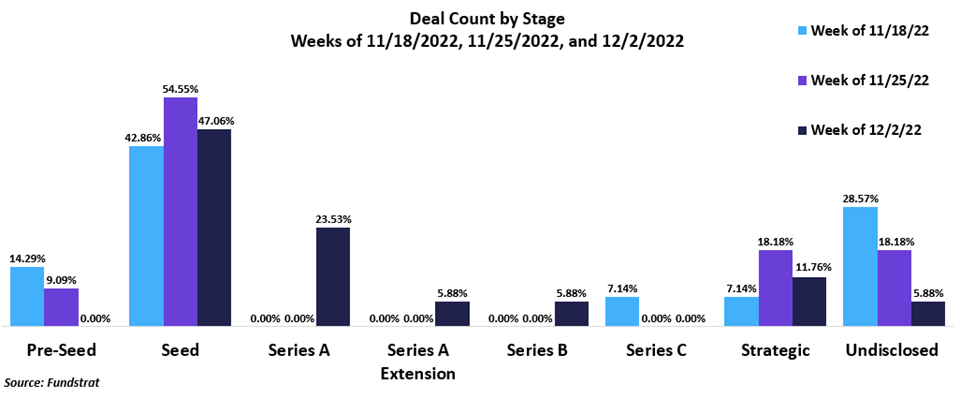

The majority of deals were Seed Round the past two weeks, although we have seen an increase in strategic deals, which accounted for roughly 18% of deals last week and 12% of deals this week.

Deal of The Week:

Keyrock, the digital asset market maker building scalable, self-adaptive technologies to support efficient markets, raised $72 million in a Series B deal with participation from Ripple, SIX Fintech Ventures, and Middlegame Ventures. Keyrock plans to use the funds to continue improving its infrastructure and scalability and pursue regulatory licenses across the United States, Europe, and Singapore. Keyrock CEO Kevin de Patoul stated that the new funding round will “dramatically accelerate our vision to provide liquidity solutions for digital assets.” After launching in 2017, Keyrock has become a liquidity partner for 85 different partners across 200 unique markets and hopes to continue its growth trajectory.

Why is this Deal of The Week?

In the past month, liquidity across crypto markets has been a hot topic as Alameda Research collapsed and Genesis Trading is seeking emergency funding. In the wake of two large market makers facing substantial issues, Keyrock is well-positioned to expand its market share globally. Keyrock actively deploys different market-making technologies across major centralized and decentralized exchanges. Due to proper risk management practices, Keyrock escaped the FTX fiasco with “non-consequential” losses with no client funds affected.

Despite the digital asset market shrinking over 50% in the last year, Keyrock has seen threefold growth in terms of its trading volume. Additionally, Keyrock has doubled the size of its workforce and plans to continue rapidly hiring while other crypto companies are cutting jobs or freezing hiring. Keyrock’s long-term approach to “gradually develop a self-adaptive trading technology that enables swift, secure, and scalable liquidity solutions to tokenized markets” is paying dividends for the company.

Selected Deals – Week of 11/25/2022

Tropee is a non-fungible token (NFT) based platform that focuses on uncomplicating the post-mint process. The platform plans to accomplish this by offering collections and projects the ability to create user experiences seamlessly. The company has secured $5.1M in funding through a round led by Tioga Capital. In addition, the funding round also included investor participation from Sebastien Borget, Gregoire le Jeune, Lorens Huculak, and Thibault Launay.

Carv is an infrastructure-based platform that provides solutions for decentralized identity (DID) in the gaming space. The company has secured $4M in funding at a $40M valuation led by Vertex. In addition, the funding round also included investor participation from Lyrik Ventures, Infinity Ventures Crypto, 7UpDAO, Lintentry Foundation, and others. Carv intends to use the capital raised for workforce expansion and further develop its infrastructure.

Thirdverse is a gaming-based platform currently developing a blockchain game based on a popular Japanese printed cartoon called Captain Tsubasa. The platform has also previously released two virtual reality-based games and has one that is currently in development. The company has secured $15M in funding through a round led by MZ Web3 Fund. In addition, the funding round also included investor participation from B Dash Ventures, Fenbushi Capital, Yield Guild Games, and OKX Ventures. Thirdverse intends to use the capital raised for workforce expansion and game development.

Nucleo is an infrastructure-based platform aiming to provide security and privacy for companies wanting to go on-chain. The company has secured $4M in funding through its seed round, co-led by Bain Capital Crypto and 6MV. In addition, the funding round also included investor participation from Olympus, Aztec Network, Espresso Systems, Aleo, and others. Nucleo intends to use the capital raised for workforce and product expansion.

Selected Deals – Week of 12/2/2022

Kiln is a centralized finance (CeFi) based platform aiming to provide institutional and retail clients with staking services for Ethereum (ETH -2.23% ). The company has secured $17.6M in funding through its Series A round led by Illuminate Financial. In addition, the funding round also included investor participation from Kraken Ventures, ConsenSys, Leadblock Partners, Sparkle Ventures, and others. Kiln intends to use the capital raised to expand its service offerings and infrastructure.

Fleek is an infrastructure-based platform aiming to improve content delivery networks (CDN). The platform plans to accomplish this through the launch of Fleek Network, which plans to offer similar capabilities and services of a traditional CDN like Amazon Web Services while also incorporating decentralization. The company has secured $25M in funding through its Series A round led by Polychain Capital. In addition, the funding round also included investor participation from Protocol Labs, North Island Ventures, Coinbase Ventures, and Digital Currency Group. Fleek intends to use the capital raised to fast-track the development of its network, which is expected to launch in Q2 2023.

Roboto Games is a gaming studio aiming to produce engaging synchronous multiplayer titles that incorporate Web3 elements in-game. In 2020, the studio released its first title, Last Mage Standing. The mobile-platform-based game offers player versus environment (PvE) and player versus player (PvP) modes. The company has secured $15M in funding through its Series A round led by Andreessen Horowitz. In addition, the funding round also included investor participation from Animoca Brands, Makers Fund, Harrison Metal Capital, Gumi Cryptos Capital, and others. Roboto Games intends to use the capital raised for workforce expansion and developing its second gaming title, codenamed Foragers & Fighters.

CyVers is an infrastructure-based platform that provides security solutions for Web3 firms. The platform can successfully detect threats by applying geometric machine learning and its domain expertise. The company has secured $8M in funding through its seed round led by Elron Ventures. In addition, the funding round also included investor participation from Differential Ventures, HDI, and Crescendo Venture Partners.

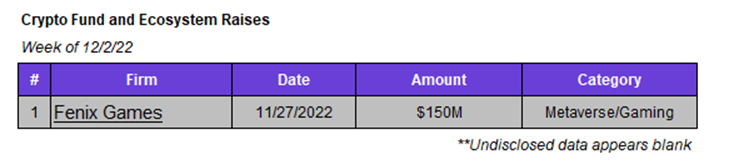

Fenix Games is a Web3 gaming publisher aiming to capitalize on the growth of traditional game developers interested in expanding into the blockchain gaming market. In addition, the publisher views itself as a venture capital fund that focuses on identifying successful games. The company has secured $150M in funding in a round that included investor participation from Cypher Capital and Phoenix Group. Fenix Games intends to use the capital raised to acquire, distribute, and invest in additional gaming titles.