Infrastructure and Gaming Lead the Way

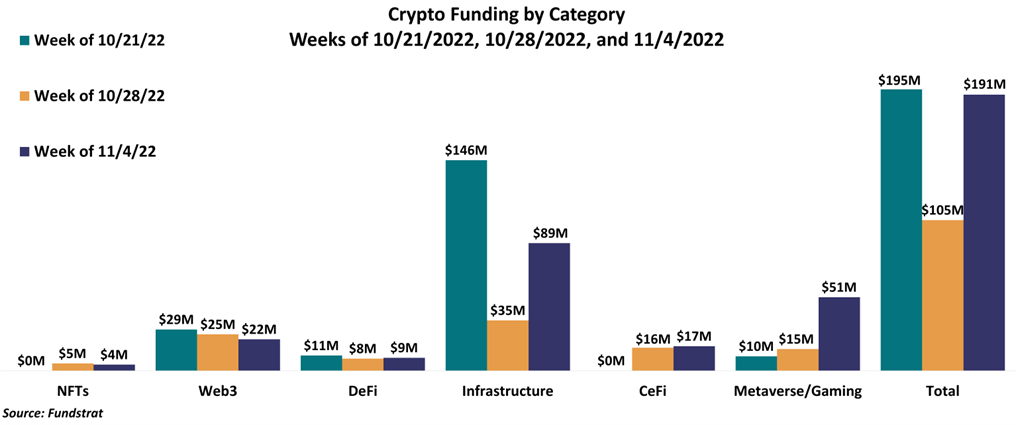

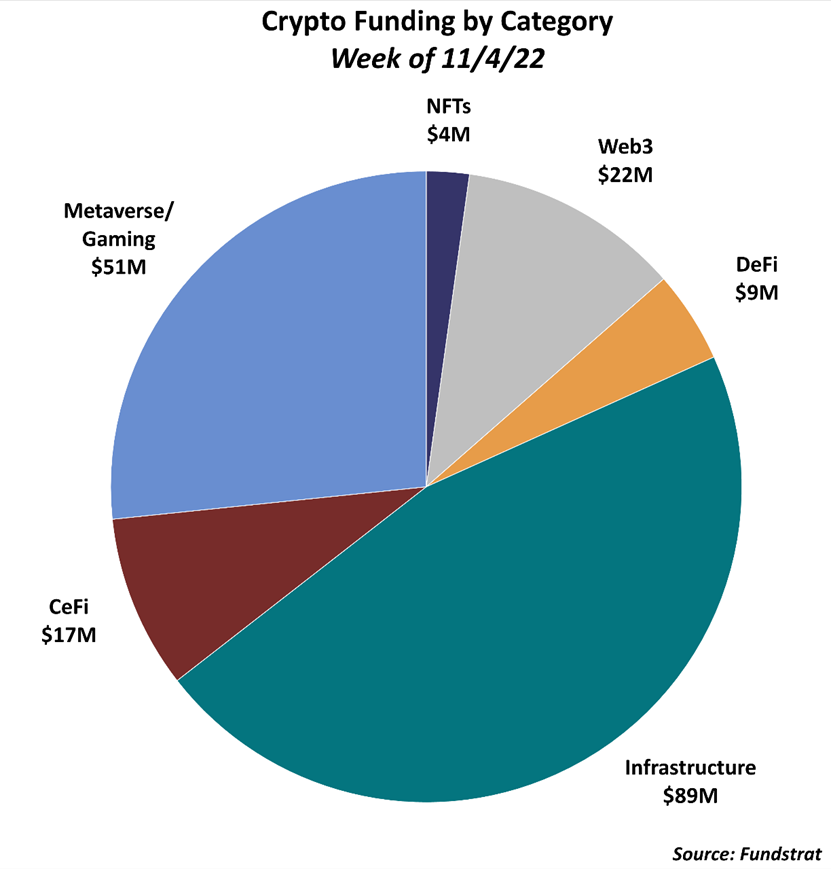

This week, funding increased to $191 million from a measly $105 million last week. The bulk of fundraising came from the infrastructure and gaming sectors. Infrastructure has been the strongest category for most of the year, but gaming saw a notable increase, rising to $51 million from $15 million last week. Other categories, such as NFTs, Web3, DeFi, and CeFi have been consistent with the amounts raised over the previous few weeks. A large part of the gaming funding came from Wemade’s $46 million deal which had participation from Shinhan Asset Management, Kiwoom Securities, and Microsoft Corporation. Wemade is a blockchain gaming and finance company whose goal is to “transform everyday games with blockchain technology and establish its WEMIX token as a key currency in the gaming industry.”

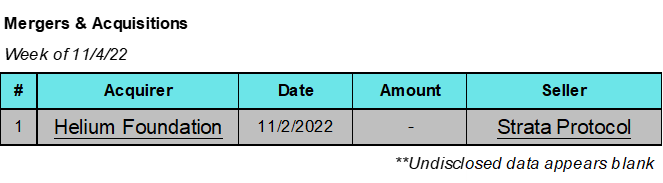

There was one acquisition this week in which Helium Foundation, the company behind the Helium Blockchain, acquired Strata Protocol and its engineering team. They will assist with Helium’s network migration to Solana.

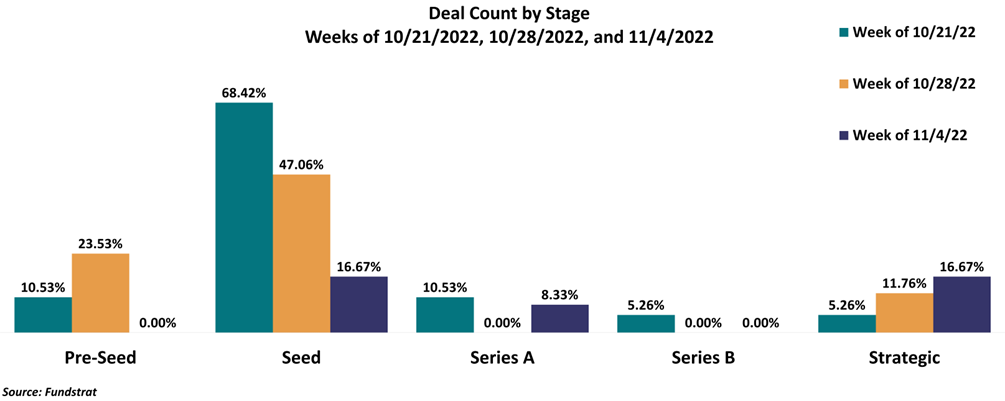

Seed and Strategic rounds each accounted for approximately 17% of the deals this week. Series A deals made up another 8%, while the rest failed to disclose the stage or type of fundraising.

Deal of the Week:

WalletConnect, the Web3 communications protocol company, announced they raised $12.5 million in an ecosystem round, with participation from Shopify, Coinbase Ventures, ConsenSys, Circle Ventures, Polygon, Uniswap Labs Ventures, Union Square Ventures, 1kx, HashKey, Foresight Ventures, and others. WalletConnect establishes end-to-end encrypted connections between a wallet and an app, enabling wallet users to securely interact and transact with the app. The funds will be used to scale the company, accelerate its product pipeline, and contribute to strategic partnerships to create the WalletConnect Network, “a decentralized communications network.” This follows WalletConnect’s $11 million Series A round in March this year, co-led by Union Square Ventures and 1kx.

Why is This Deal of the Week?

Over 210 consumer and institutional wallets have integrated WalletConnect, including leading wallet providers MetaMask and Fireblocks, in addition to web2 and web3 companies such as Uniswap, Opensea, Twitter, Stripe, and Plaid. Walletconnect’s communication APIs have increased “interoperability in the fragmented web3 space”, says Pedro Gomes, co-founder, and CEO of WalletConnect.

One of the significant barriers to the adoption of web3 applications is the fragmented user experience. Currently, users have separate wallets for each chain they interact with and have to navigate to a different website whenever they want to connect to a new application. The front-end sites and even protocol-level contracts frequently get hacked, leading to users losing funds or valuable NFT holdings. Compared to apps on mobile devices, televisions, or personal computers, web3 has more friction and risk for users. WalletConnect is building products to create the seamless user experience needed for web3’s next leg of adoption. These include secured connections to hundreds of apps, single-click multichain transactions, one-click log-ins, chat, and push notifications. WalletConnect is laying the groundwork infrastructure that will be a crucial catalyst to increasing adoption to users that are not crypto native.

Selected Deals

Braavos is an infrastructure-based crypto wallet platform aiming to simplify self custody of digital assets for its users. One of the ways the platform plans to accomplish this is through a transaction explainer, which will help novice traders review and comprehend their transactions.

The company has secured $10M in funding through its seed round led by Pantera Capital. In addition, the funding round also included investor participation from Brevan Howard Digital, Crypto.com, Road Capital, Starkware, and others. Braavos is available for use on web browsers, Android, and iOS devices.

Centrifuge is a DeFi-based platform aiming to create a decentralized credit ecosystem. The platform plans to accomplish this by allowing its users to finance real-world assets such as invoices and mortgages on the blockchain. The company has secured $4M in funding through a strategic round with investor participation from Coinbase Ventures, L1 Digital, Scytale, and BlockTower Capital.

NiftyApes is an NFT-based platform aiming to provide its users with the ability to borrow funds by using their NFT collections as collateral. The company has secured $4.2M in funding through its seed round, co-led by FinTech Collective and Variant. In addition, the funding round also included investor participation from Coinbase Ventures, Polygon, Robot Ventures, FlamingoDAO, and others. NiftyApes intends to use the capital raised to grow its workforce.

ZoidPay is an infrastructure-based platform aiming to become the largest provider of Web3 architecture globally. It plans to accomplish this by launching a line of software development tools and application programming interfaces (APIs) for its users. The company has secured $75M in funding from GEM Digital Limited. ZoidPay intends to use the capital raised for developing new architecture, facilitating acquisitions, and launching an application.

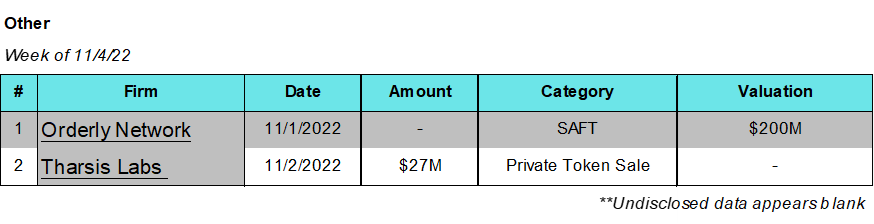

Orderly Network is an infrastructure-based platform with a focus on decentralized trading. The platform provides its users with the ability to build DeFi applications. The company raised an undisclosed amount in funding through a simple agreement for future tokens (SAFT) at a $200M valuation with participation from Laser Digital, the crypto venture arm of Nomura. This funding round adds to the $20M in funding it received through its seed round in June 2022, which included investor participation from Sequoia Capital China, Dragonfly Capital, Alameda Research, and others. Orderly Network intends to use the capital raised to grow its workforce.