Funding Pulls Back Once Again

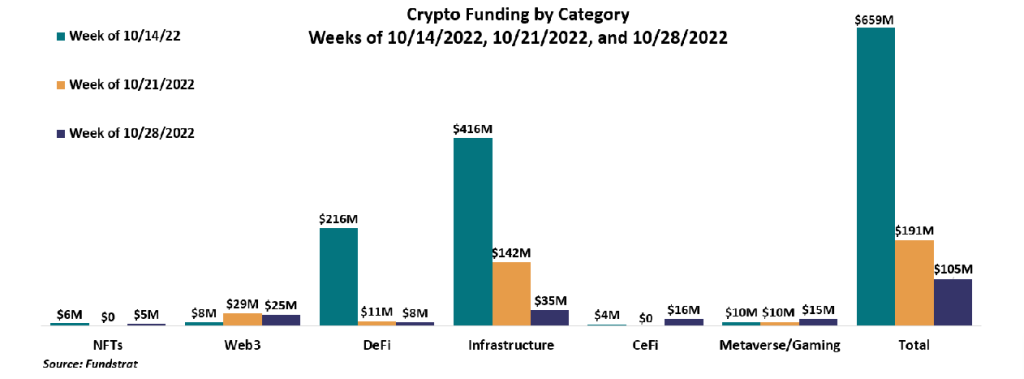

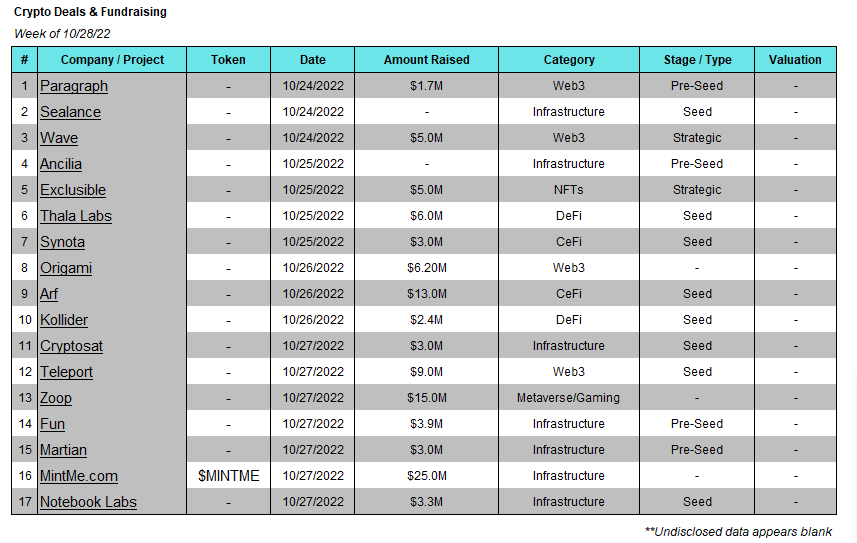

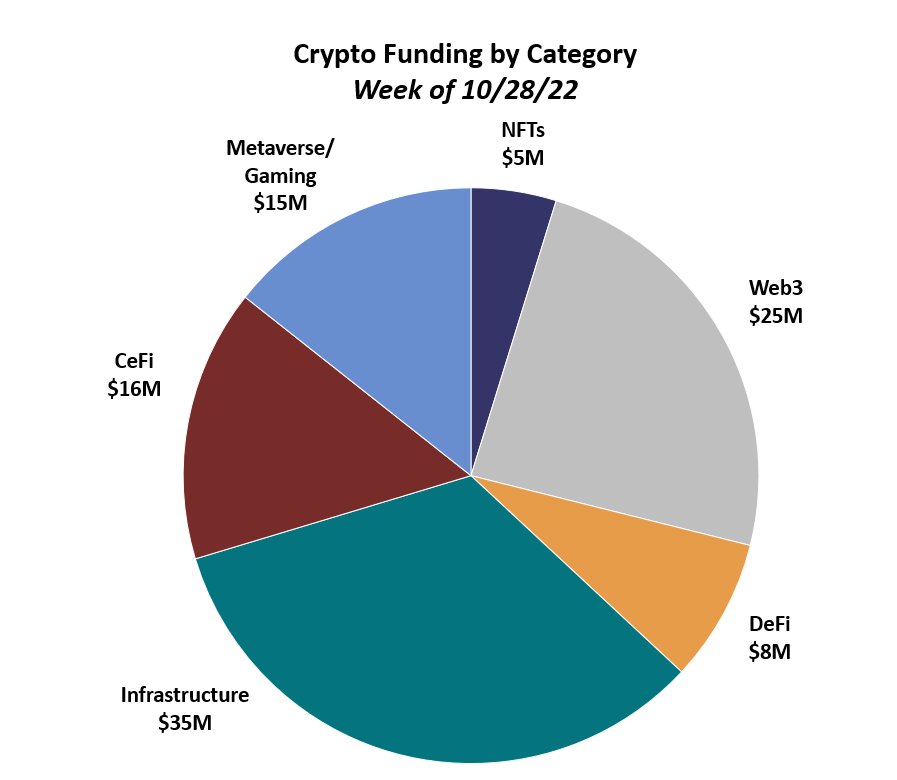

Funding this week fell once again, dropping from $191M to just $105M. Surprisingly, the bulk of this decline came from the infrastructure segment, which has generally been strong this year. Infrastructure funding fell from $142M to $35M, but still saw a fair number of deals, with seven of this week’s 17 deals being infrastructure-related. It’s important to note that the financing amount for two of the infrastructure deals this week (Sealance and Ancilia) wasn’t released, so the infrastructure funding amount is showing lower than it was. Other segments remained low in comparison, with almost all being flat from last week. CeFi, which has had meager funding ever since the insolvency of Celsius, saw the largest uptick in funding this week – increasing from zero last week to $16M this week. This was mainly due to a $13M raise for Arf, a VQF-regulated global settlement banking platform using Web3 technology.

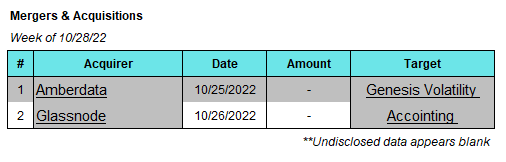

There were two acquisitions this week. Crypto market intelligence provider, Glassnode, acquired crypto tax accounting platform, Accointing, and Amberdata, a crypto data provider, acquired Genesis Volatility, a crypto options and derivatives analytics firm.

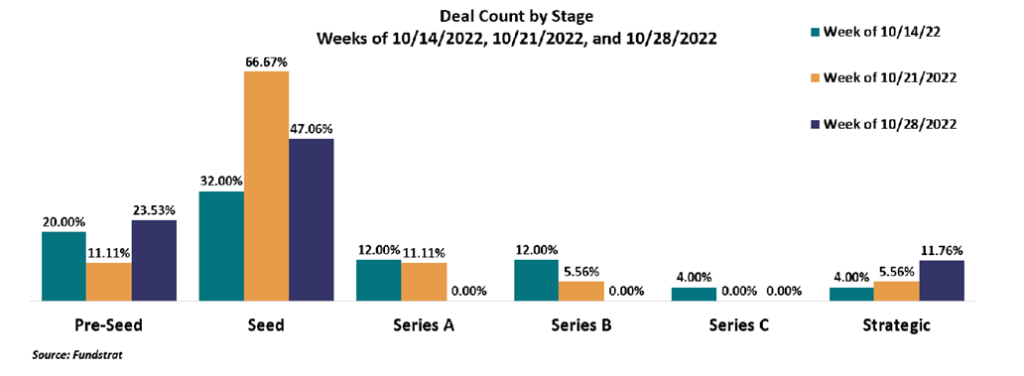

The bulk of deals was done in the early stages, with Pre-Seed and Seed deals accounting for 70.6% of all deals.

Deal of The Week:

Paragraph, a Web3-focused publishing platform building tools for content creators, closed a $1.7 million pre-seed funding round led by Lemniscap. Other investors include Binance Labs, FTX Ventures, Seed Club Ventures, and Global Coin Research. Paragraph wants to disrupt the traditional media industry and build the most accessible and comprehensive publishing platform. Paragraph will offer creators a cleaner and more intuitive publishing experience, allowing them to own, distribute, and monetize their content. The funding will be used to expedite Paragraph’s product development, user acquisition and recruitment pipeline, as well as emphasize the growth of its engineering team.

Why is this Deal of The Week?

Media consumption has continued to grow as the “creator economy” has grown with the proliferation of various social media platforms such as TikTok, Instagram, Twitter, Twitch, and many others. Crypto is not isolated from the creator economy, as users push out tons of content on platforms such as Substack, Medium, Mirror, or any of the various crypto newsletters hitting email inboxes. Paragraph wants to revolutionize the industry with its platform and change the experience for both creators and consumers.

With Paragraph, content creators can post their media which will be stored on the Arweave permaweb, where it will be permanent and immutable. Readers can subscribe with their emails in a traditional fashion or connect their wallets directly. Airdrops can be pushed directly to subscribers who have their wallets linked, token paywalls can be added to posts, or subscription fees can be distributed to token holders. Paragraph has the potential to disrupt the traditional media industry with its innovative product suite and large addressable market.

Selected Deals

Teleport is a Web3-based application developed by Decentralized Engineering Corporation (DEC). The application aims to provide a decentralized alternative to ride-share services such as Uber and Lyft through the use of TRIP, its ride-share protocol built on Solana. The company has secured $9M in funding through its seed round, co-led by Road Capital and Foundation Capital. In addition, the funding round included investor participation from Common Metal, 305 Ventures, 6th Man Ventures, Thursday Ventures, and others. Decentralized Engineering Corporation intends to use the capital raised for the launch and growth of Teleport.

Martian is an infrastructure-based crypto wallet platform created for the Aptos ecosystem aiming to manage its user’s assets effectively. The platform plans to accomplish this by being receptive to user feedback and building a strong community. The company has secured $3M in funding through its pre-seed round led by Race Capital. In addition, the funding round included investor participation from Jump Capital, FTX Ventures, Aptos, and Superscrypt. Martian intends to use the capital raised to fast-track product development and for workforce expansion.

Notebook Labs is a Web3-based platform aiming to fast-track mainstream decentralized finance (DeFi) adoption. The platform plans to accomplish this through its protocol allowing crypto users to be securely identified. The company has secured $3.3M in funding through its seed round led by Bain Capital Crypto. In addition, the funding round included investor participation from Abstract Ventures, Y Combinator, Soma Capital, Pioneer Fund, and others. Notebook Labs intends to use the capital raised for workforce expansion and infrastructure growth.

Synota is a centralized finance (CeFi) based platform aiming to allow users to pay their energy bills via Bitcoin’s Lightning Network through its software. The company has secured $3M in funding through its seed round led by ego death capital. In addition, the funding round included investor participation from Hivemind VC, Bitcoiner Ventures, Recursive Capital, Trammell Venture Partners, and others. Synota intends to use the capital raised for the commercialization of its software.

Origami is a Web3-based platform aiming to simplify and assist users throughout the launching of a decentralized autonomous organization (DAO). The company has secured $6.2M in funding from a round led by Bloomberg Beta. In addition, the funding round included investor participation from Orange DAO, betaworks, VC3 DAO, Protocol Labs, and others. Origami intends to use the capital raised for software, platform, and infrastructure development.