Venture Funding Rebounds

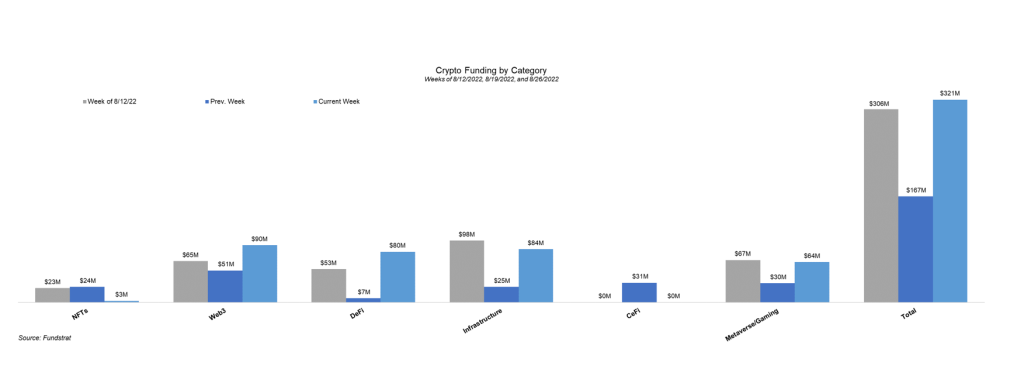

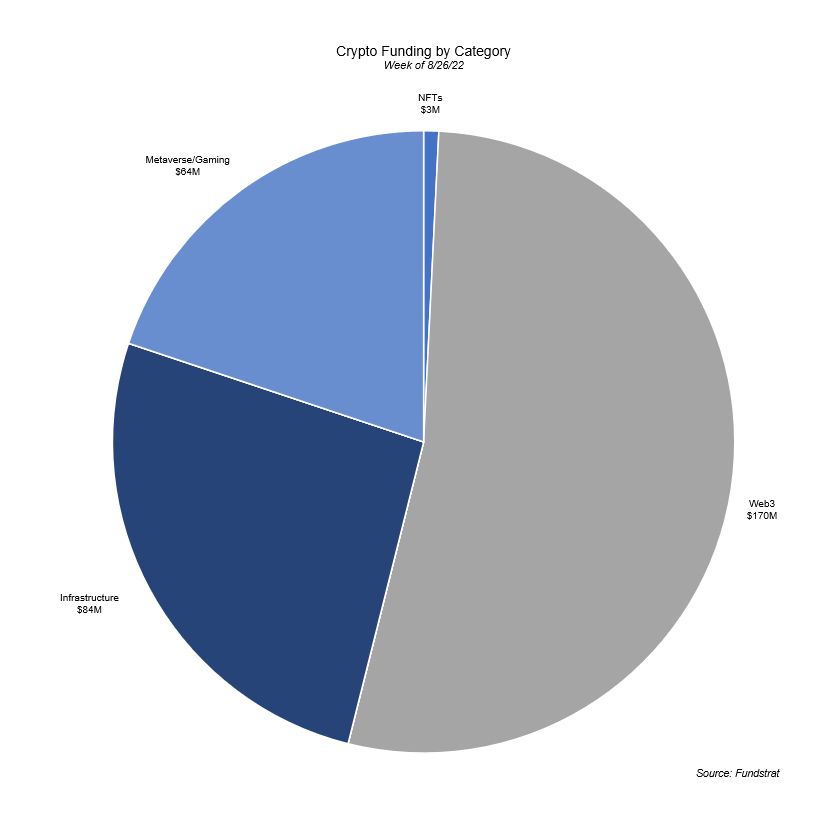

Venture funding had its highest funded week of the month, with funding nearly doubling from $167M to $321M. Web 3 led the way, accounting for over half of all funding at $170M. There were seven Web 3 deals, the largest of which was an $80M investment in Orange DAO, a Decentralized Autonomous Organization that is made up of over 1,000 Y Combinator alums and operates like a decentralized venture fund. The DAO’s mission is to “support past, present, and aspiring Y Combinator founders who are building the future of the crypto ecosystem.” Infrastructure and Metaverse/Gaming bounced back from low funding last week, receiving $84M and $64M, respectively. While funding as a whole was strong, Defi, NFTs, and CeFi lagged. DeFi and Cefi received no funding this week and NFTs only received $3M.

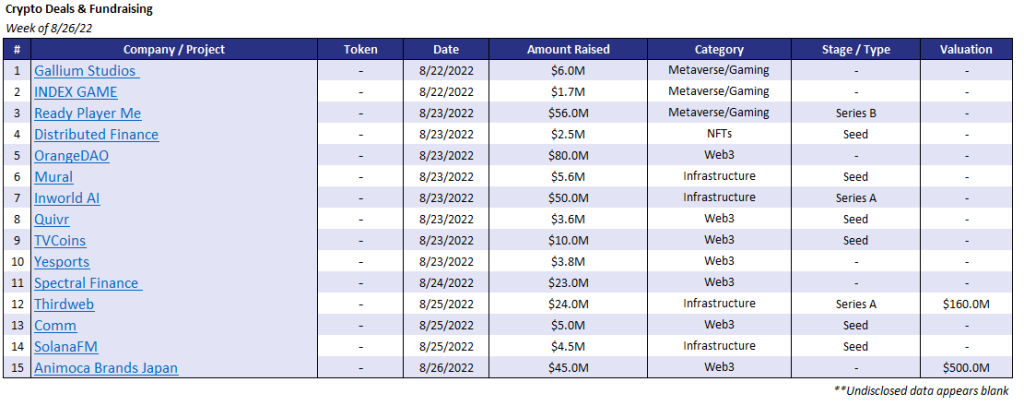

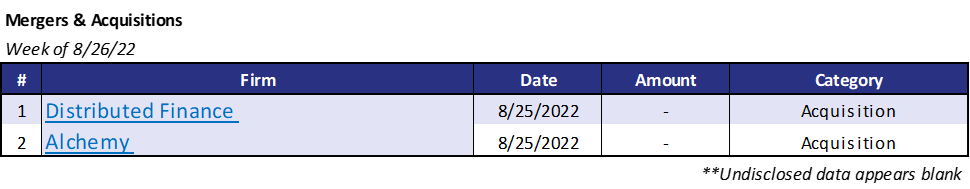

There were two acquisitions this week. Distributed Finance acquired Algorand NFT marketplace Rand Gallery. The second acquisition was $10 billion crypto developer platform, Alchemy, acquiring Chainshot, an Ethereum coding boot camp. Alchemy has seen a meteoric rise in the past year, with the number of teams building on its platform increasing 10x.

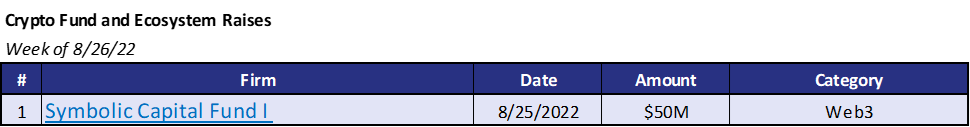

Symbolic Capital raised $50M for its first fund, which plans to invest in Web 3 projects. Symbolic Capital was founded by Polygon’s founder Sandeep Nailwal and ex-Borderless Capital’s and Cere co-founder Kenzi Wang.

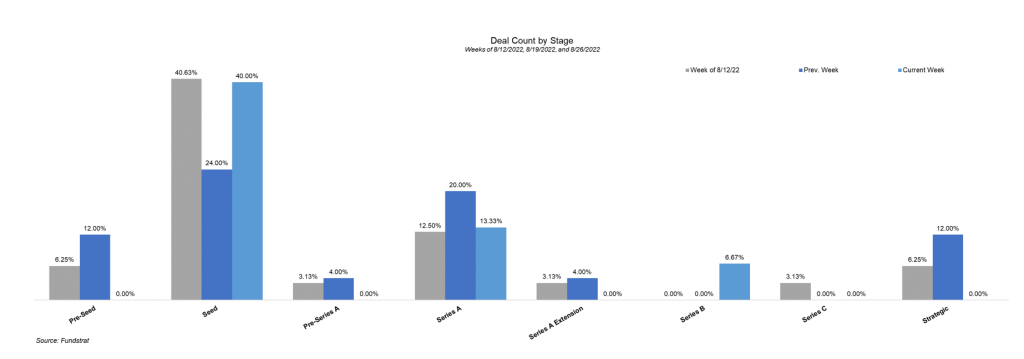

Funding was concentrated in the early stages this week. 40% of financing was Seed Round and 15% was Pre-Seed.

Deal of The Week:

Ready Player Me, a metaverse company focused on creating cross-platform avatars for the open metaverse, has raised $56 million in a Series-B round led by a16z. Other prominent names such as Justin Kan (co-founder of Twitch) and David Baszucki (co-founder of Roblox) are also involved in the fund-raise. Ready Player Me wants to enable the interoperability of the metaverse allowing users to carry their digital identity and assets with them through various digital worlds.

Why Is This Deal of The Week?

The metaverse is one of the hottest sectors of crypto thus far in 2022. Metaverse and Web 3 projects have accounted for just under 50% of all private crypto deals throughout the first half of the year. Investors see the potential in the sector, with many equating future adoption trends to that of internet companies over the past two decades. Beijing announced a two-year plan for metaverse innovation and development in China earlier this week. The program mandates that companies start building metaverse infrastructure and integrate metaverse technology into traditional business sectors.

By focusing on interoperability, Ready Player Me can succeed in the metaverse even if all its partners do not. To date, Ready Player Me has over 3,000 different partners spanning multiple industries. Ready Player Me is offering its partners a plug-and-play solution for 3D avatars allowing developers to focus on actual metaverse experiences without spending significant development time on complex avatars. Additionally, developers can build new revenue streams by selling skins or other digital items for Ready Player Me’s avatars. On the other hand, users can seamlessly integrate their digital identities across various metaverse experiences. The future of the metaverse very well may be cross-platform, and Ready Player Me will certainly be ready.

Selected Deals

Thirdweb is an infrastructure-based platform aiming to assist developers with building their Web3 applications. The platform is able to accomplish this by offering pre-built audited smart contracts. The company has secured $24M in funding through its Series A round at a $160M valuation. The funding round was led by Haun Ventures with additional investor participation from Coinbase (COIN 17.12% ), Shopify, Polygon, Protocol Labs, and others. Thirdweb plans to use the capital raised towards expanding its workforce and product development.

Yesports is a Web3-based platform with a concentration on esports engagement. Although the platform is already the largest within its field, it is currently working on establishing additional partnerships with esport organizations. The company secured $3.8M in funding with participation from NGC Ventures, BR Capital, and Rising Capital. Yesports plans to use the capital raised to expand its workforce.

Spectral is a Web3-based protocol that aims to provide on-chain credit scoring. The platform hopes to accomplish this by assigning users a Multi-Asset Credit Risk Oracle (MACRO) score calculated based on various transaction data components. The company has secured $23M in funding co-led by General Catalyst and Social Capital. The funding round also included additional investor participation from Jump Capital, Samsung Next, Gradient Ventures, and others. Spectral plans to use the capital raised to scale and develop its current network.

Inworld is an infrastructure-based platform aiming to provide its users with the ability to create characters powered by artificial intelligence for virtual reality-based games and the metaverse. The company has secured $50M in funding through its Series A round co-led by Section 32 and Intel Capital. The funding round also included additional investor participation from Founders Fund, Kleiner Perkins, LG Technology Ventures, and others.

Comm is a Web3-based communication and messaging company that aims to compete with the Web2 messaging platform Discord. The company’s messaging system will operate using federated keyservers and allow users to log in to the platform using their crypto wallets. The company has secured $5M in funding through its seed round led by CoinFund. The funding round also included additional investor participation from Electric Capital, Slow Ventures, LongHash Ventures, and others. Comm plans to use the capital raised to expand its workforce.