Apes Crashing Ethereum to Raise Money

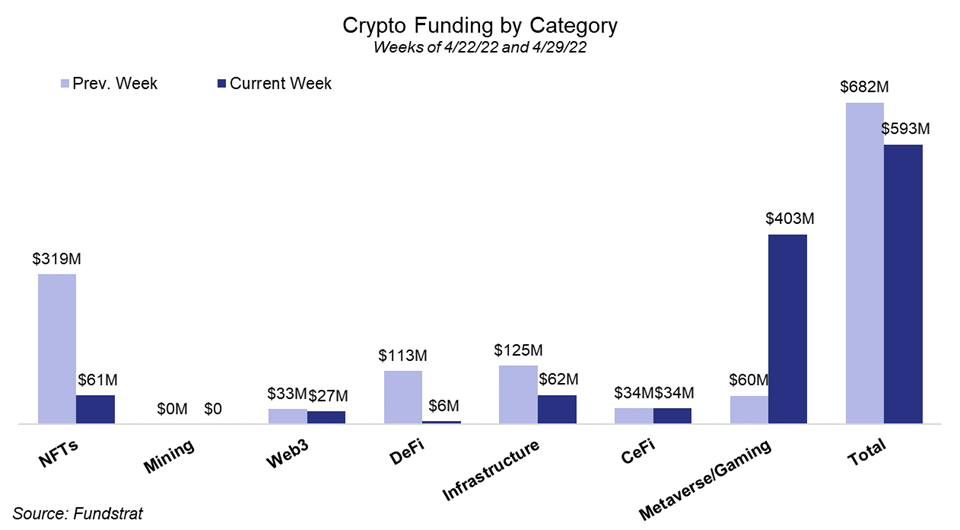

In another busy week of capital raising, the switch flipped from NFTs to Metaverse and Gaming projects, though most of the funding came from Yuga Lab’s public virtual land sale. Metaverse/Gaming projects raised $403 million, over two thirds of the total pot this week. The rest of the funds were pretty evenly spread between Infrastructure ($62 million), NFTs ($61 million), CeFi ($34 million), Web3 ($27 million), and lastly, in a major drop from last week, DeFi ($6 million).

Three more funds launched this week with a combined $535 million ready to deploy. One is an ecosystem fund for Nym Mixnet, and two general funds that will be focused on later-stage projects that have proven sustainability and strong value adds. Argo Blockchain was the sole mining company that secured a loan this week with a $70.6 million financing agreement with NYDIG.

Deal of The Week

Yuga Labs (APE) is the company that created the Bored Ape Yacht Club, the most popular NFT collection by market cap. The group raised $320 million in a public metaverse land sale that infamously crashed the Ethereum network over the weekend. The sale was for 55,000 plots in the Otherside metaverse, each selling for a flat price of 305 APE, or around $5,800 at the time of the sale.

Why Is This a Big Deal?

Yuga Labs has been both extremely active and massively dominant in the NFT space practically since its inception. The company has grown to a massive $4 billion valuation after its first fundraising in March of this year, after acquiring CryptoPunks, Meebits, and Larva Labs. This was done in conjunction with the announcement to create Otherside, an MMORPG metaverse project that Yuga hopes to make interoperable with any NFT collection in order to fully integrate NFT ownership into a gamified metaverse. Otherside is one step closer to completion after this most recent fundraising round in exchange for an initial land allocation in the world, and the funds will be locked for a year as a means of creating a deflationary supply pressure on the ApeCoin market. In an NFT market that has seen sales volume drop by over 90% from its September 2021 high, Yuga Labs has been able to consistently draw widespread support and interest from its fans and investors. Raising $770 million over the course of 2 months in a bear market is ample evidence of the value that Yuga Labs has been able to grow out of its active community engagement and development. (Bored Ape metaverse frenzy raises millions, crashes Ethereum)

Deals & Fundraising

- Bitcoin.com (VERSE), a centralized crypto exchange and media outlet, raised $33.6 million from a private token sale that included Digital Strategies, KuCoin Ventures, Blockchain.com, and Redwood City Ventures, among many others.

- Kinetix is an AI-based 3D animator where users take videos of themselves to convert into 3D animated avatar NFTs for use in metaverse worlds and games. The company closed an $11 million seed round led by Adam Ghobarah with participation from Sandbox, ZEPETO, Entrepreneur First, and Sparkle Ventures, among many individual investors.

- Decrypt, a major crypto media company, raised $10 million in a Series A to value the company at $50 million. Participants in the round included Hack VC, Hashkey Capital, and Protocol Labs, among many others. The funding round was initiated as a result of Decrypt spinning off from its parent company, ConsenSys Mesh, which had incubated Decrypt to bring it to launch back in 2018.

- Amberdata, an on-chain digital asset data provider, raised $30 million in a Series B that valued the company at $330 million. Knollwood Investment Advisory led the round that also saw participation from Susquehanna International Group, Nasdaq Ventures, Chicago Trading Company, and Coinbase Ventures, among many others.

- Zora is an NFT marketplace-making platform that provides tools for creators to build and launch their own personal NFT marketplaces and collections for apps, games, fashion, etc. The company raised $50 million in a funding round that valued Zora at $600 million. The round was led by Haun Ventures with participation from Coinbase Ventures and Kindred Ventures.

Please see below for the full list of deals

Crypto Deals & Fundraising

| # | Company / Project | Amount (MM) | Category | Stage / Type | Valuation (MM) |

| 1 | InfiniGods | $9 | Metaverse/Gaming | Seed | |

| 2 | Bitcoin.com | $34 | CeFi | Token Sale | |

| 3 | Particle Network | $2 | Infrastructure | Pre-Seed | |

| 4 | Zora | $50 | NFTs | $600 | |

| 5 | Cometh | $10 | Metaverse/Gaming | Seed | |

| 6 | LootRush | $12 | Metaverse/Gaming | Seed | |

| 7 | Untamed Planet | $24 | Metaverse/Gaming | Series A | |

| 8 | Monoverse | $3 | Metaverse/Gaming | Seed | |

| 9 | Masa | $4 | DeFi | Pre-Seed | |

| 10 | Amberdata | $30 | Infrastructure | Series B | $330 |

| 11 | Kinetix | $11 | Metaverse/Gaming | Seed | |

| 12 | Bundlr Network | $5 | Infrastructure | Seed | |

| 13 | Covalent | $25 | Infrastructure | ||

| 14 | The Football Club | $3 | NFTs | Seed | |

| 15 | Stakes | $5 | NFTs | Seed | |

| 16 | Americana | $7 | Web3 | Seed | |

| 17 | Syndicate | $6 | Web3 | ||

| 18 | Decrypt | $10 | Web3 | Seed | $50 |

| 19 | Cheq | $2 | Web3 | Pre-Seed | |

| 20 | Forte | $9 | Metaverse/Gaming | ||

| 21 | Lighthouse | Infrastructure | |||

| 22 | MetaPang | Metaverse/Gaming | Pre-Seed | ||

| 23 | Yuga Labs | $320 | Metaverse/Gaming | Public Land Sale | |

| 24 | Revise | $4 | NFTs | Seed | |

| 25 | Rivermen | $5 | Metaverse/Gaming | ||

| 26 | MYSO Finance | $2 | DeFi | Seed | |

| 27 | CrowdPad | $3 | Web3 | Seed | |

| 28 | SeeDAO | Web3 | Series A | $30 |

Crypto Funds and Ecosystem Raises

| Firm | Amount (MM) | Category |

|---|---|---|

| Pangea Fund Management | $85 | General |

| Nym Technologies | $300 | Ecosystem Fund |

| Archetype | $150 | General |

Crypto Capital Markets

| Firm | Amount (MM) | Category |

| Argo Blockchain | $70.6 | Mining |