Degen Edition 3 - Conic Finance

Key Takeaways

- While the vote-escrowed model proved itself last cycle, maximizing yield on a token on Curve became a feat edging out smaller and passively managed portfolios due to high gas fees and the emergence of newer gauge pools. Via ‘Omnipools’ (OP), Conic Finance represents a platform to maximize single-asset yield exposure on Curve and Convex.

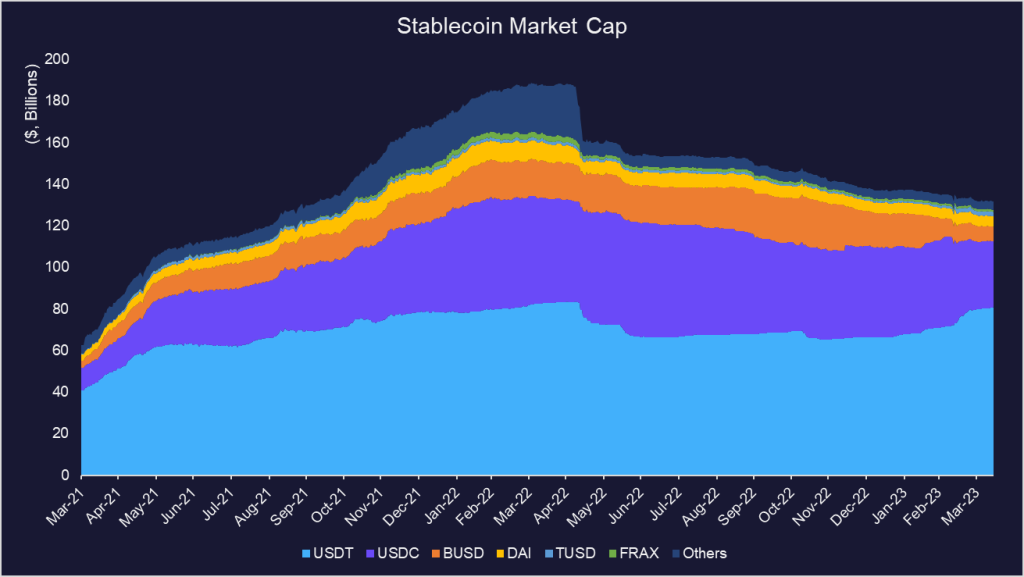

- While the total stablecoin market cap has declined steadily since Apr ‘22, Conic Finance’s TVL has grown 215% purely in stablecoins since its launch. This is despite the fact that Convex’s TVL has dropped 14% in the same period, perhaps demonstrating early signs of product-market fit.

- From a protocol’s perspective, Conic is a partner protocol that can quickly bootstrap liquidity for its own token. Similar to how protocols accumulated veCRV that birthed the term ‘Curve Wars,’ Conic’s innovative approach could kick off another flywheel that attracts allocation from protocol treasuries to bootstrap liquidity for their own token.

- The most important catalyst underpinning the Conic Finance thesis is the impending launch of crvUSD. While crvUSD needs to be redeployed due to a bug, we view this retracement as a short-term opportunity to accumulate CNC.

- From a technical perspective, we view the $3 - $4 range as attractive given the accumulation phase CNC underwent in Q4 ’22. From a fundamentals perspective, we compare Conic to Curve and Balancer, which are protocols that deploy ve-tokenomics to control primary emissions.

- ~78% of CNC tokens have been vested today (4.3m / 5.6m), indicating minimal future inflation that will dilute current token holders. In the spirit of Conic being a public good, the team also does not have tokens allocated to them.

- The primary risks to the Conic thesis include limited token utility (no shared revenues), continually growing liquidity on the platform, and risks pertaining to single-sided liquidity provision in two-sided liquidity pools.

Figure: Pepes Wearing Cones to Celebrate New Curve Ecosystem Protocol

Investment Thesis

Out of the numerous tokenomic designs that emerged (and failed) last cycle, the vote-escrowed model proved objectively most ‘feasible’, as evidenced by Curve’s dominant position in TVL amongst DEXs. Control over a protocol’s gauge emissions made sense to many, assigning real value to governance tokens. The second-order expectations that liquidity would follow did as well. However, maximizing yield on a token on Curve became a feat edging out smaller and passively managed portfolios due to high gas fees and the emergence of newer gauge pools.

In other words, deciding on which Curve pool to allocate liquidity to is not trivial, as liquidity gauge inflation weights on Curve change weekly, and the number of Curve pools constantly increases, especially since the introduction of factory pools. Conic solves for people who want attractive yields on their stablecoins but do not want to move funds around liquidity pools (LPs).

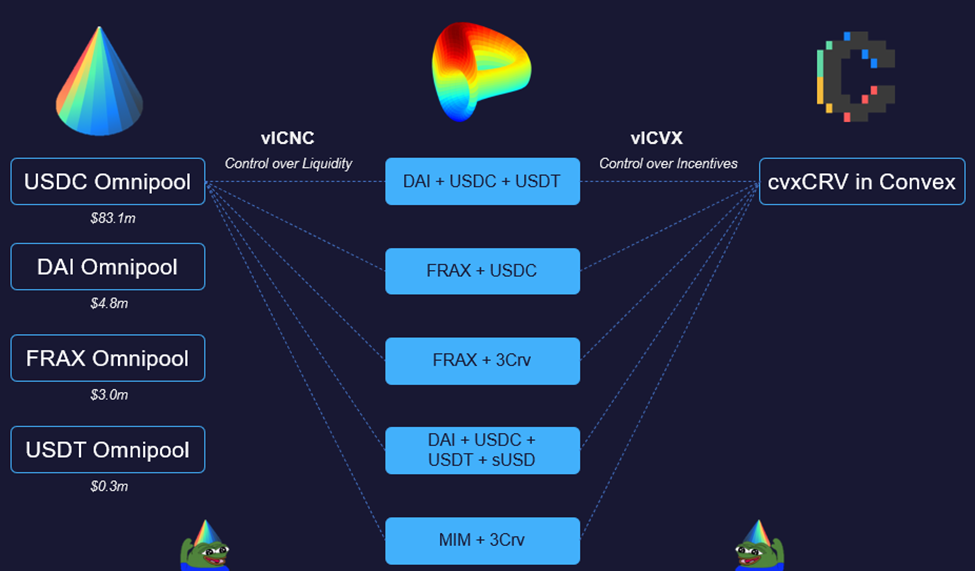

Via ‘Omnipools’ (OP), Conic Finance represents a platform to maximize single-asset yield exposure on Curve and Convex. Today, users can deposit assets to earn competitive stablecoin yields that originate from a set of whitelisted Curve pools. In other words, liquidity providers of an OP get exposure to multiple Curve pools via a single LP token.

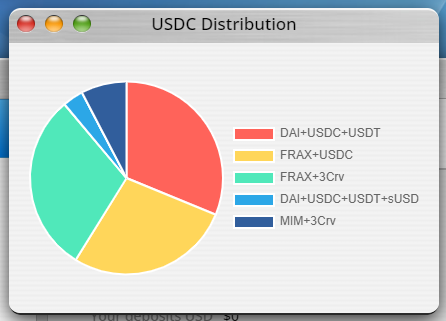

Users can choose to lock their CNC for vlCNC for up to 8 months. Every two weeks, vlCNC holders determine each OP’s allocation to different Curve pools in a Liquidity Allocation Vote (LAV), rebalancing Curve pools in line with target weights.

Figure: USDC Omnipool Distribution on Curve

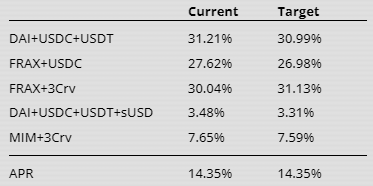

Launched in March of this year, Conic Finance has attracted non-trivial TVL due to its strong value proposition to users. To illustrate, the total stablecoin market cap has declined steadily since Apr ‘22, signaling waning investor interest in the crypto space.

Conversely, Conic Finance’s TVL has grown 215% purely in stablecoins since its launch. This is despite the fact that Convex’s TVL has dropped 14% in the same period, perhaps demonstrating early signs of product-market fit. The team has further indicated that they plan to include non-stablecoin OP in the future, expanding the TAM of the protocol.

Figure: Stablecoin Market Cap Over Time

Figure: Conic Finance vs. Convex Finance TVL

From a protocol’s perspective, Conic is a partner protocol that can quickly bootstrap liquidity for its own token. Instead of accumulating and locking CRV to direct future CRV emissions and hoping for liquidity to follow suit, protocols can do the same with CNC 3.45% and directly control the liquidity deposited on Conic to pair it with their own token.

This is a notable difference from Curve as protocols can have first-order control over liquidity via Conic instead of second-order control over emissions via Curve. Similar to how protocols such as Frax Finance and Yearn Finance accumulated veCRV that birthed the term ‘Curve Wars’ during DeFi Summer, Conic’s innovative approach could kick off another flywheel that attracts allocation from protocol treasuries to bootstrap liquidity for their own token.

Figure: Conic Mechanics in Curve Ecosystem

Upcoming Catalysts

Perhaps the most important catalyst underpinning the Conic Finance thesis is the impending launch of crvUSD. It makes intuitive sense for Curve (and other stablecoin projects with pools on Curve) to vie for vlCNC control, especially given Curve’s proven ve-model. For Curve’s new crvUSD to be collateralized by a wide asset pool, it needs enough liquidity for liquidations to mitigate price manipulation risk.

Despite the hype surrounding crvUSD, its May 4th launch included a bug that required redeployment on Ethereum, triggering a retracement across most Curve ecosystem tokens. While other projects would patch the bug via upgradeable proxies, the Curve team needed to redeploy crvUSD’s smart contracts given its focus on immutability. Having said that, we view the retracement as a short-term opportunity to accumulate CNC before crvUSD’s successful deployment.

Valuation, Liquidity & Entry Suggestions

CNC’s liquidity is currently sitting at ~$5.5m, representing ~28% of its circulating market cap. Curve v2 can accommodate clips of $100k CNC for 1.3% slippage. From a technical perspective, we view the $3 – $4 range as attractive given the accumulation phase CNC underwent in Q4 ’22. This coincides with Mark’s analysis on the token about a month ago, in which he expressed the need for stabilization at or around the $4 level.

Figure: CNC Entry Zone

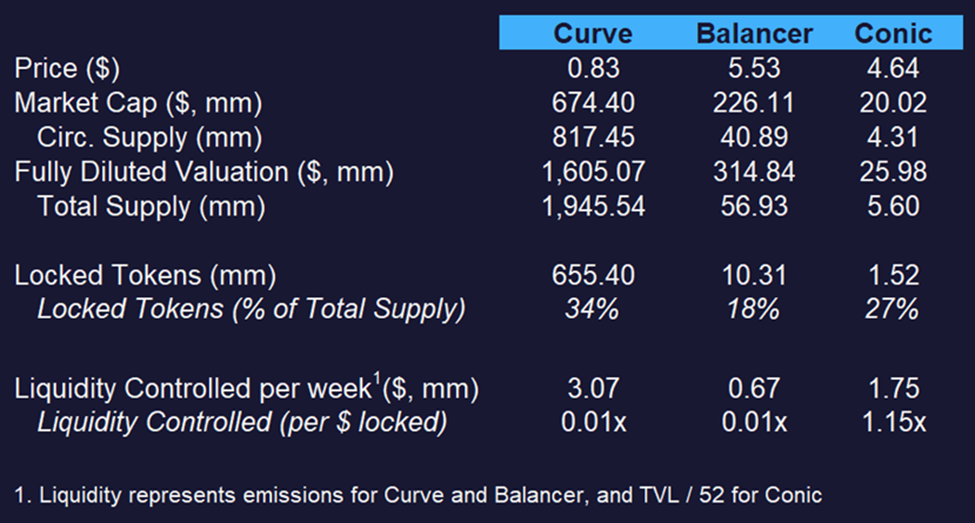

From a fundamentals perspective, we compare Conic to Curve and Balancer, which are protocols that deploy ve-tokenomics to control primary emissions. For this reason, we omit Convex and Aura (secondary emissions) as comps, although they are very much relevant in the Curve ecosystem.

Figure: Conic Finance Comp Set

Specifically, we compare liquidity controlled by the respective locked governance tokens. As alluded to above, Curve and Balancer’s control over liquidity is represented by their biweekly emissions, while Conic’s control over liquidity is represented by the TVL deposited on its platform. We divide Curve and Balancer’s emissions by two and Conic’s TVL by 52 weeks in attempt to make the best apples-to-apples comparison.

As such, Conic is reasonably undervalued (1.15x) relative to Curve and Balancer, which control ~0.01x of emissions per week per dollar of their respective locked governance tokens. While we are certainly not calling for a 100x based on this metric alone, Conic’s current $20m market cap and $26m FDV provides much room for growth, especially given that the most popular Curve derivative Convex trades at $344m market cap and $447m FDV.

Tokenomics, Supply Schedule, Unlocks

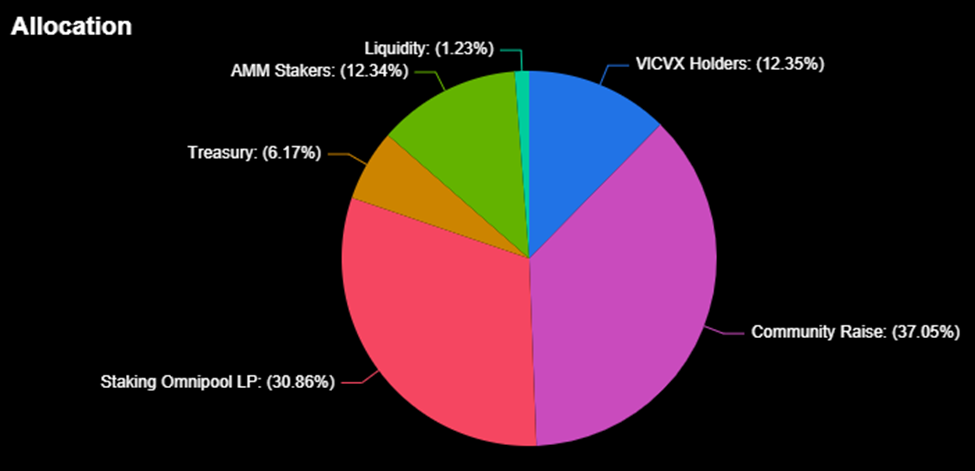

Figure: CNC Token Allocation

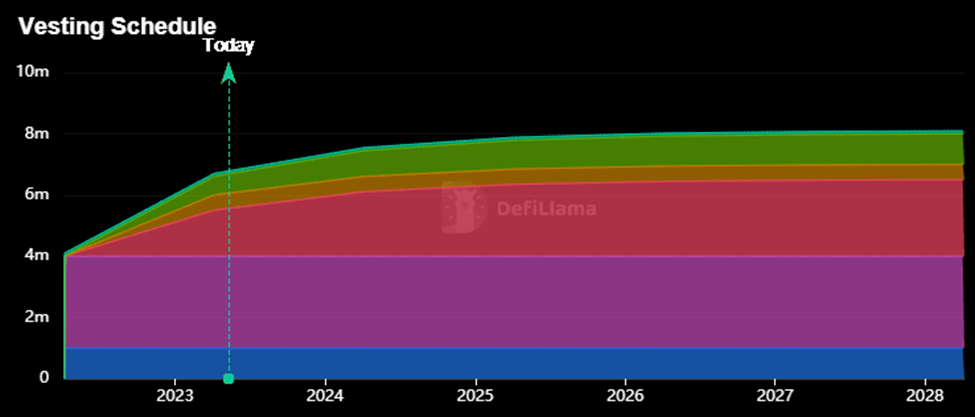

Figure: CNC Token Emission Schedule

Although Conic’s platform went live in March, the Conic team airdropped 1m (10% of maximum supply) tokens to vlCVX holders as homage for building atop their protocol. Furthermore, the team held a community raise for 3m tokens (30% of maximum supply). While this amounted to 40% of tokens circulating at launch, only 400k tokens were claimed from the airdrop, with the balance clawed back to the treasury.

~78% of CNC tokens have been vested today (4.3m / 5.6m), indicating minimal future inflation that will dilute current token holders. In the spirit of Conic being a public good, the team also does not have tokens allocated to them.

Risks

While Conic’s mechanics make sense, the CNC token today can only be locked to vote on which Curve pools liquidity is directed to. This represents limited utility to the CNC token. However, developers have hinted at the possibility of charging platform fees for Curve and Convex earnings via Omnipools to accrue to vlCNC holders.

Moreover, the thesis hinges upon Conic Finance being able to attract liquidity onto its own platform for stakeholders to acquire and lock CNC to direct said liquidity. As such, Conic currently offers the 9th highest USDC yield (per DefiLlama) despite having one of the highest TVL of pools >$1m.

Moreover, while single-sided liquidity provision is challenging when it comes to managing slippage, gas costs, and flash loan attack risks, Conic employs a combination of oracles, LP token pricing mechanisms, and rebalancing incentives to ensure that liquidity shifts are performed in a secure manner.

Bottom Line

While DeFi has not been in the spotlight in the depths of the bear market, we believe Conic represents a high-beta project that can pop off should the meta return to DeFi. Apart from the launch of crvUSD, we believe that Conic possesses the necessary ingredients to become a lego brick in the Curve ecosystem, namely a community-centric token allocation, the impending launch of non-stablecoin Omnipools, and a novel liquidity incentivization mechanism.