Long Thesis - Aave

Key Takeaways

- Aave is the largest DeFi lending market by TVL (~$8b) and the fifth largest dApp overall. They announced that they are launching native stablecoin GHO in July 2022. We believe GHO possesses a few features that will catalyze the re-pricing of Aave.

- In terms of timing, the thesis accrues some tailwinds from the recent stablecoin saga stemming from Silicon Valley Bank’s bankruptcy, which affected USDC and USDC-adjacent stablecoins. Aave offers an alternative through its "full-reserve" model, providing over-collateralized crypto loans that mitigate credit and run risk.

- The key difference between GHO and other stablecoins is that Aave does not have to incentivize liquidity for GHO since it can only be minted on its platform. All interest payments accrued by GHO minters will accrue directly to the Aave DAO treasury, as opposed to a spread (borrow less supply rates) for other assets.

- Due to v3 integrations, GHO will feature cross-chain functionality, managed risk parameters, and reduced need for initial liquidity against other stablecoins. GHO will also leverage a discount strategy to maintain its peg to $1.

- To estimate the impact of GHO on Aave's revenue and valuation, we assume that it will capture 30% market share of all stablecoin borrows on the platform, in addition to a 7% average GHO borrow rate. These assumptions imply ~33m in additional interest revenue (~3x LTM uplift) and a $469m market cap. Based on current competitors, we view our projections as conservative, best illustrated by the adjusted FDV/earnings.

- Our in-house market technician Mark Newton then provides color on near-term price dynamics, highlighting key levels at $64.50, $53.50, and $80.

- In terms of risks, Aave faces liquidity risks as it has to incentivize liquidity between GHO and other stablecoins despite having emitted most of its tokens. Moreover, Curve Finance, TapiocaDAO and Yama Finance are competing protocols that are launching innovative stablecoin models.

Introduction

Founded by Stani Kuchelov, Aave (formerly LEND) is the largest DeFi lending market by TVL (~$8b across v2 and v3) and the fifth largest dApp overall. The protocol is currently live across five networks and 11 markets, hosting more than 30 assets across its platform. In July ‘22, Aave announced that they are launching their native stablecoin, GHO, in the near future. Apart from allowing users to mint against yield-bearing assets, we believe that GHO possesses a few features that will catalyze the re-pricing of Aave.

Market Tailwinds

Centralized Stablecoin Risks

In terms of timing, the thesis accrues some tailwinds from the recent stablecoin saga stemming from Silicon Valley Bank’s bankruptcy, where USDC and USDC-adjacent stablecoins lost their pegs because their reserve deposits were in the startup-focused bank. The irony is not lost on us that just under a year ago, USDT was the stablecoin in the spotlight after $7b in withdrawals raised concerns on its backing. Such is crypto.

Given the custodial nature (and risk) of fiat-collateralized stablecoins, we believe there is a market for an asset overcollateralized stablecoin and expand below on the competitive advantages GHO possesses to be a market leader within the vertical.

Aave vs. SVB

Recent turbulence in the banking industry has underscored the inherent risks of depositing funds at traditional banks. Aave offers an alternative through its “full-reserve” model, providing over-collateralized crypto loans that mitigate credit and run risk. Unlike Aave’s decentralized, peer-to-peer lending via smart contracts, banks such as Silicon Valley Bank (SVB) operate on a fractional reserve model—lending out a portion of deposits while retaining some as reserves. Though SVB enables money creation, it is susceptible to bank runs when withdrawals surpass reserves. While SVB is regulated and FDIC-insured, Aave’s decentralized approach entails risks, including smart contract vulnerabilities and regulatory uncertainty.

While we don’t advocate abandoning conventional banking, options for custodying funds beyond the $250,000 FDIC limit are limited and entail counterparty risk. Mitigation strategies include diversifying funds across multiple banks, using money market funds, or purchasing treasuries—each with associated risks. The current scrutiny of fractional reserve banking’s limitations may serve as a catalyst for the growth of decentralized platforms like Aave.

GHO Mechanics

GHO will be a decentralized stablecoin that is fully backed by collateral supplied to the Aave protocol. Similar to other Aave assets, borrowers can mint GHO by supplying assets into V3 as collateral, while continuing to earn interest on their underlying assets. Correspondingly, when a borrower repays their borrowed position (or is liquidated), GHO is returned to the Aave pool and burned.

This is the key difference between GHO and other stablecoins – Aave does not have to incentivize liquidity for GHO, since it can only be minted on its platform. Moreover, because of this feature, all the interest payments accrued by minters of GHO will go directly to the Aave DAO treasury .[1] This is in contrast to other assets, where protocols take a portion of the spread (borrow less supply rates).

GHO is hence overcollateralized by the collateral supplied to Aave and relies on ‘Facilitators’ to help facilitate arbitrage, provide instant liquidity, and liquidate users by minting and burning GHO tokens. Each facilitator is approved by governance, with Aave and Flashminter being the first facilitators.

Moreover, the fact that GHO is native to Aave negates the need for the borrowed asset to be supplied beforehand. For example, if a user deposits USDC and would like to borrow LINK, another user must have supplied LINK for the user to later borrow it. Conversely, a user can borrow GHO as long as they supply collateral and maintain healthy collateral ratios on Aave.

GHO’s native design on Aave also implies that borrowers undertake short positions on GHO when they borrow it against their collateral to swap to another asset. This significantly reduces user risk for GHO, since borrowers will profit when GHO de-pegs to the downside. While we are not calling for a dramatic de-pegging event, it is a nifty feature that lowers user risk.

Liquidations on GHO also happen similarly to other assets listed on the protocol. Liquidators repay up to 50% of the outstanding borrowed amount on behalf of the borrower. In return, they can buy the collateral at a discount and keep the difference (liquidation penalty) as a bonus.

V3 Integrations

Due to the following integrations, GHO will also feature cross-chain functionality, managed risk parameters, and reduced need for initial liquidity against other stablecoins.

- Portals: Portals will allow users to mint GHO on Ethereum, supply GHO to receive aGHO, then withdraw aGHO on any Aave-supported chain. This will eliminate the need to bridge funds and allow GHO to scale with already integrated chains

- Isolation Mode: Isolation Mode will allow new assets to be listed with a specific debt ceiling, reducing the complexity and risk for cross-collateralized liquidations during the rollout

- Efficiency Mode: E-mode will enable users to supply other correlated stablecoins to Aave to borrow GHO at a higher LTV, increasing the capital efficiency and reducing liquidity needs with another stablecoin at launch

Aave Discount Strategy Mechanism

Although interest income does not directly accrue to Aave holders, the protocol incentivizes users to contribute to the Safety Staking module (stkAAVE holders) by allowing them to borrow GHO at a discounted rate. The thinking here is that borrowers should be indifferent between borrowing at the normal rate and borrowing at the discounted rate after purchasing and staking Aave tokens.

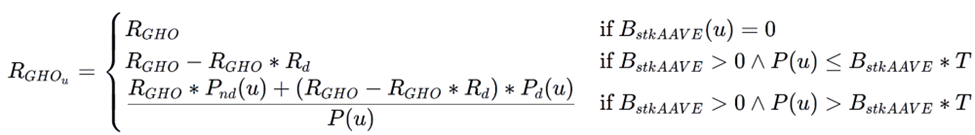

Followingly, Aave governance will have control over parameters such as the GHO interest rate, the maximum GHO to be minted/burned at a discount, and the liquidation penalty to incentivize facilitators to maintain price at $1. Discount rates are effective for a certain period and follow the following formula:

- BstkAAVE (u) = stkAave balance of user u

- RGHO = Borrow rate for GHO (without discount)

- T = Maximum amount of GHO generated at discount per stkAAVE held

- Rd = Global discount rate users will receive per GHO token

- P(u) = Principal borrowed by user u, in GHO

- Pd(u) = Part of the principal at discount

- Pnd(u) = Part of principal that is not discounted = P(u) – Pd(u)

Interest Rate Model

Apart from the Discount Strategy Mechanism, Aave leverages an algorithmic Interest Rate Model to maintain the peg to $1. If GHO de-pegs to the downside, interest rates are increased to incentivize returning GHO and decrease supply. Should GHO de-peg to the upside, however, interest rates are reduced to incentivize borrowing (minting).

While the algorithmic interest rate model can strike fear in a demographic of readers post-Luna, the reality is much less grim and risky for Aave in our view. Despite this algorithmic mechanic, GHO is fully backed by supply positions on Aave at all times – borrowers of GHO will need to supply collateral worth more than their GHO debt.

By fixing the price of GHO at $1, users and arbitrageurs can always borrow, repay, and liquidate GHO at parity. If GHO is above peg, users can mint 1 GHO for only $1 worth of debt and sell it on the open market, pocketing the spread above peg. Conversely, when GHO is trading below its peg, users can buy GHO below $1 to repay their debt and claim $1 worth of collateral.

Valuation

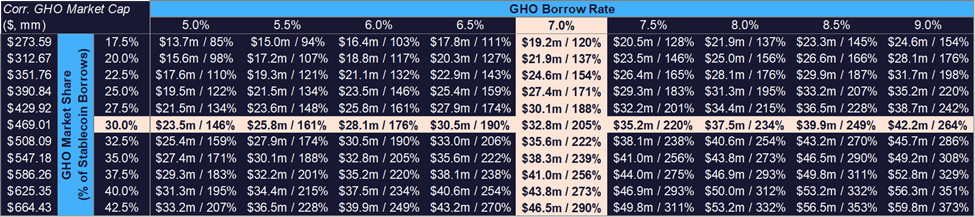

To estimate the impact of GHO on Aave’s revenues and valuation, we rely on the following inputs and make several assumptions. First, we apply Aave v2’s[2] LTV metrics (45%) to its $5.5b in TVL to estimate the total borrows across the platform, before applying v2’s stablecoin borrow market share (60%) to arrive at total stablecoin borrows ($1.5b).

Of the $1.5b total stablecoin borrows, our base case assumes that GHO can capture 30% market share at steady state given their competitive advantage of reduced cost of capital. We further assume that GHO has an average 7% borrow rate (normalized across bull and bear cycles). These assumptions imply ~$33m in additional interest revenue for a total of $49m, or a ~3x uplift from Aave’s LTM Revenue of $16m. This interest revenue is mostly profit since the protocol will incentivize borrowers to stake Aave for discounted rates instead of emitting more Aave tokens as incentives.

Figure: GHO Interest Income and Revenue Uplift Sensitized Against GHO Borrow Rate and Native Stablecoin Market Share

We view the assumptions to arrive at a $469m market cap as somewhat conservative. This is because GHO’s lower cost of capital, low switching costs for existing Aave users, and synthetic short characteristics should translate to significant market share on Aave in our view, especially since users’ debts will be ‘forgiven’ if GHO de-pegs to the downside. GHO’s 7% borrow rate is also a simple average of 20%, 2%, 2%, and 4% average borrow rates in a bull-bear cycle.

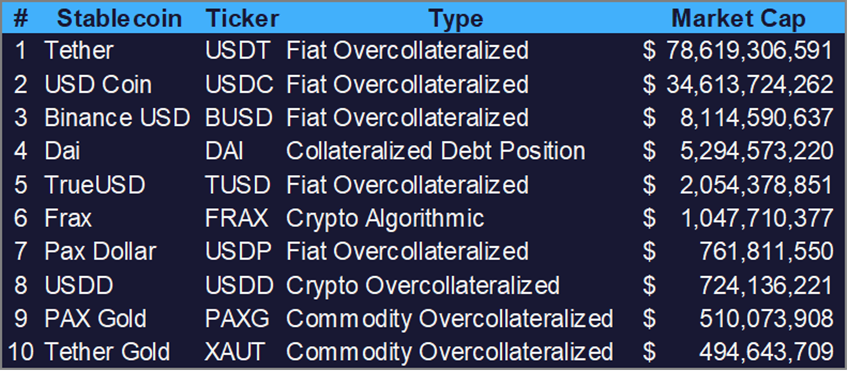

Even with these assumptions, the $486m projected market cap pales in comparison to the top 10 stablecoins today. Of these, DAI ($5.3b market cap) is the only one leveraging the Collateralized Debt Position (CDP) model and can be minted using four types of assets. Conversely, Aave allows GHO to be minted against most of the collateral supplied to the lending platform.

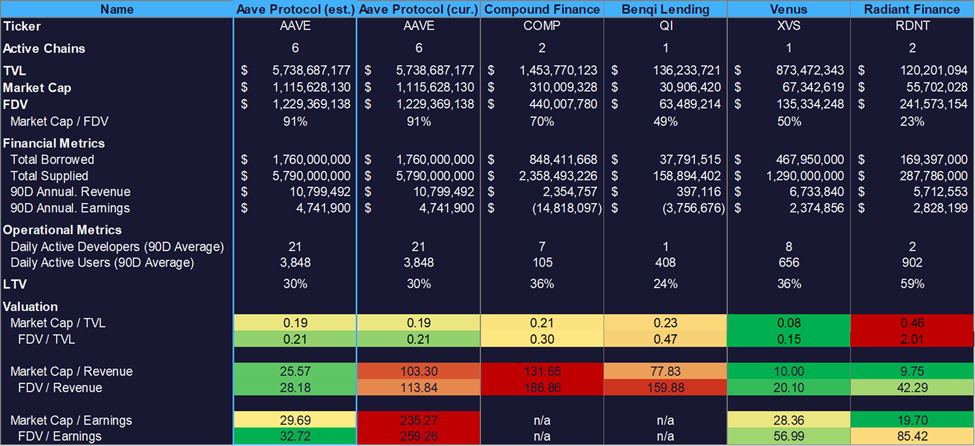

We derived Aave’s comp set primarily based on size and model. Venus and Benqi are forks of Compound, with the former built on BNB Smart Chain and the latter on Avalanche. Radiant is a fork of Aave with additional ve-tokenomics[3] and uses LayerZero’s technology to offer cross-chain borrowing.

While not apparent from current transaction metrics, Aave is valued cheap relative to its competitors in our view. It is worth noting that Aave has the highest market cap / FDV ratio of its comp set, implying that most of its tokens are emitted already. Despite not having much Aave left as incentives, the protocol still retains most of its liquidity relative to competitors, speaking to its lindy effect in lending.

On a Market Cap / TVL basis, Aave only trails behind Venus, commanding 0.20 of market cap per unit of liquidity on its platform. Using Market Cap / Revenue, Aave’s current valuation is on par with Compound, both of which command a premium due to their positions as the incumbents.

After adjusting for GHO’s revenue uplift of $33m as illustrated above, Aave is underpriced on both market cap and FDV. Venus and Radiant have lower market cap multiples, but this is because of their low market cap / FDV ratios – both projects have not emitted a majority of their tokens.

Hence, perhaps the most telling metric is FDV / Earnings. Of the comp set, Compound and Benqi are loss-making after accounting for token incentives, rendering the metric not applicable. Again, Venus and Radiant may appear undervalued on a circulating market cap basis, but this is because most of their tokens have not been emitted yet.

Technical Analysis

For the following section, we have consulted our in-house market technician Mark Newton to provide color on near-term price dynamics.

AAVE has largely trended in neutral range-bound consolidation following its bottom last June after a 90%+ decline from May 2021. Momentum indicators like RSI and MACD both show momentum having relatively strengthened given the trend shift from bearish to more neutral more than six months ago. In the near term, AAVE movement has nearly directly coincided with that of other risk assets, having bottomed in late December and peaked in the first week of February 2023.

Short-term trends from February remain bearish yet are approaching levels thought to be an attractive risk/reward towards helping a bottom form which could jump-start an intermediate-term rally. At present, the two important areas of support to concentrate on lie near $64.50, and below that would result in another challenge of this intermediate-term area of triangle support, which intersects near $53.50.

Conversely, any move back above $80 would be quite constructive technically, and should drive AAVE up to $90 in my view which is the larger “line in the sand.” Until there’s evidence of this range being broken in either direction, the short-term trend is not compelling towards thinking a low has definitely been put in place. However, AAVE looks increasingly like an attractive risk/reward to consider owning on weakness, barring any move back down under December 2022 lows. Momentum has improved overall, and volume has been supportive of rallies, having expanded meaningfully back in January of this year. For most investors who might be price sensitive, surpassing $80 should be the first technical catalyst that can allow for additional gains.

Risks

The GHO stablecoin has been audited extensively and is currently deployed on Ethereum’s Goerli Testnet. All updates with regards to interest rates and risk parameters will be public and must be agreed to in advance by Aave Governance prior to execution.

Liquidity Risks

Although the minting of GHO makes a lot of sense given its strategic position, how Aave incentivizes the liquidity between GHO and other stablecoins remains a concern. In other words, borrowers of GHO will need liquidity between GHO and other assets since they are likely borrowing GHO to swap to other assets instead of holding GHO itself.

Aave has a 14.3m circulating supply out of a 16m max, implying a ~90% Market Cap / Fully Diluted Value ratio. Unlike launches on new networks (with new ecosystem fund tokens), this means that the Aave treasury does not have a multitude of tokens left to incentivize liquidity between GHO and other stablecoins after it launches. As such, the cost incurred to do so becomes the primary cost of capital for the stablecoin, partially subsidized by E-mode described above.

Competitor Risks

While Aave announced plans to launch GHO last July, they have not been the only DeFi protocol to do so. In November, Curve released the whitepaper for crvUSD, a decentralized stablecoin overcollateralized by Curve LP tokens that utilize a Lending-Liquidating AMM Algorithm (LLAMMA) to offer smoother liquidations.

After a hiatus in stablecoin projects, Tapioca DAO and Yama Finance are also coming up with innovative models. However, users will incur significant switching costs relative to the fourth most forked protocol in DeFi.

Bottom Line

Given the custodial risk of fiat-collateralized stablecoins, we believe there is a market for an native protocol overcollateralized stablecoin and believe GHO possesses the competitive advantages to be the market leader. From our projections, GHO will cause a ~3x uplift in Aave’s LTM revenue, implying a $469m market cap based on 30% stablecoin market share on Aave and 7% average GHO borrow rate.

[1] While value accrual to the DAO treasury is separate from the AAVE token, this distinction has historically been less clear for an emerging asset class like crypto. Another perspective is that the DAO treasury will pay out Aave’s core contributors who will build value accrual channels back to the AAVE token.

[2] We apply v2’s metrics to Aave’s total TVL as v2 is still the dominant product of all and is most indicative of the demand for leverage across Aave’s products.

[3] Ve-tokenomics refer to ‘vote-escrowed’ tokenomics popularized by Curve Finance, where users lock their CRV tokens in exchange for the right to vote on which liquidity pools receive CRV emissions.