Canto: The Experimental Layer 1

Key Takeaways

- 2022 saw how inorganic the growth most VC-backed Layer 1s actually was, inflated by ecosystem funds and incessant marketing. Bluechip DeFi protocols are also integrating more product verticals in their suites to maintain their edge, best illustrated by Frax Finance. Moreover, application-specific chains are gaining momentum over general smart contract networks due to their customizability.

- Forked from Evmos, Canto is a Layer 1 chain that is the culmination of the trends above. It strives to deliver on the these ideologies via the Free Public Infrastructure (FPI) model, incorporating its own native DEX (Canto DEX), Lending Market (Canto Lending Market), and Unit of Account (NOTE).

- The Canto DEX is a Solidly fork that can be interfaced by DEX Aggregator Slightshot Finance. Since there is no value extraction, the DEX relies on liquidity mining rewards instead of fees to attract liquidity, which can be problematic given Canto's terminally decaying inflation. The Canto Lending Market is a Compound v2 fork that issues the majority of Canto emissions through the provision of LP assets on the supply side. Similar to Aave's upcoming GHO stablecoin, NOTE is overcollateralized by the assets supplied to the CLM and maintains its peg through an algorithmic interest rate.

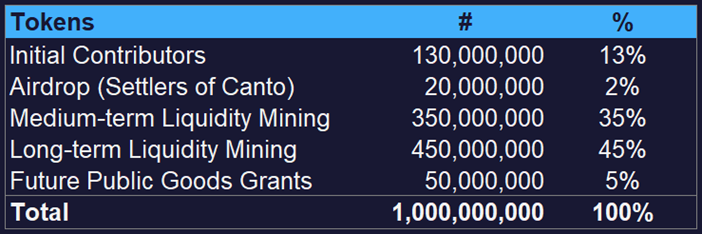

- Canto launched with a 15% circulating supply to initial contributors and and early settlers via an airdrop. The remaining 85% will be distributed through medium and long-term liqudity mining programs and future public goods grants, all of which are governed by tokenholders. As such, CANTO's tokenomics are futile to project.

- While Canto has some lofty ambitions, its implementation has experienced certain hurdles with respects to user experience, value extraction, and ownership concentration. Nevertheless, it has attracted a wave of users, capital, and developers to its chain to build upon its ethos of providing Free Public Goods on a blockchain.

Figure: Pepe Exploring the Canto Ecosystem & Its NFTs

Introduction & Context

2021 saw the rise of numerous VC-backed Layer 1s, the most prominent of which includes Solana, Luna, and Avalanche, known to many in the fold as ‘SoLunAvax.’ Their meteoric rise was partially attributable to the large ecosystem funds deployed [1] [2] [3] and the incessant marketing by large venture capitalists and their counterparts. Fast forward to 2023, the digital asset space has come to realize how inorganic the growth of these alternate Layer 1s actually was, as illustrated by the deflated metrics on all fronts once the music stopped.

Moreover, bluechip DeFi protocols are realizing that in order to maintain their edge, they need to integrate more product verticals into their suites. To illustrate, Frax Finance started off with its partially algorithmic stablecoin FRAX, but quickly expanded its product suite with FraxLend (lending market), FraxSwap (decentralized AMM), frxETH (liquid staking derivative), FPI (inflation-resistant stablecoin), all integrated within the Frax Share (FXS) token. This move to consolidate signals a maturation across core DeFi pillars, prompting protocols to create more value accrual channels for their tokens.

Lastly, application-specific chains are gaining momentum over general smart contract networks. This is because the former offers greater customizability of network design and incentives, at the expense of forcing applications to bootstrap their own network security. dYdX v4 (also built on Cosmos SDK) is an endeavor of this, offering gas-less trading and ascribing more value to the $dYdX token.

Canto Design

Forked from Evmos, Canto is a Layer 1 chain that is the culmination of the trends above. It leverages Tendermint’s PoS consensus secured by its own validator nodes and boasts EVM functionality, focused on delivering the original ideologies of DeFi – to provide new systems that are accessible, transparent, decentralized, and free.

Specifically, Canto endeavors to become the best execution layer for original work. It accomplishes this in three ways:

- Liquidity as a Free Public Good: Zero fees for Liquidity Providers (LPs), making liquidity free for protocols, arbitrageurs, and traders

- Rent Extraction Resistant: Free public infrastructure without sovereign governance tokens or the capacity to extract rent in the future

- Minimal Viable User Capture: Where possible, Canto will leverage third-party aggregators to facilitate user acquisition for other protocols

It attempts to deliver on these ideologies via a Free Public Infrastructure (FPI) model, incorporating its own native:

- Decentralized Exchange (Canto DEX) – a zero-fee DEX for liquidity providers interfaced via Slingshot Finance (see below)

- Lending Market (CLM) – a Compound v2 fork

- Unit of Account (NOTE -23.91% ) – a fully collateralized stablecoin issued by CLM that serves as Canto’s unit of account

In the spirit of FPI, the protocol also has no official foundation, no presale, no vesting, and no venture backers. The CANTO token thus underpins governance for both the network itself and the FPI dApps baked into the network.

They launched the token in August 2022 via an airdrop, with the three DeFi pillars underpinning the smart contract layer. Where appropriate, these protocols are immutable, have no official interface, and run in perpetuity without the ability to extract rent (read: no protocol fees).

DEX

The Canto DEX is a Solidly fork that is immutable. Embracing the principle of minimum viable user capture, it can be interfaced by users via Slingshot Finance, a DEX aggregator platform. Drawing inspiration from Uniswap, Canto leverages a mixture of:

- Constant product AMM (Uni v2): x * y = k

- Full range liquidity for altcoins

- Concentrated liquidity (Uni v3): yx^3 + xy^3 = k

- Concentrated liquidity for stablecoins and Canto’s unit of account NOTE -23.91%

The liquidity from the dex originates from the liquidity mining program, which is also where most of the CANTO emissions will occur. These LP tokens can be supplied in the Canto Lending Market (more below), against which other tokens can be borrowed.

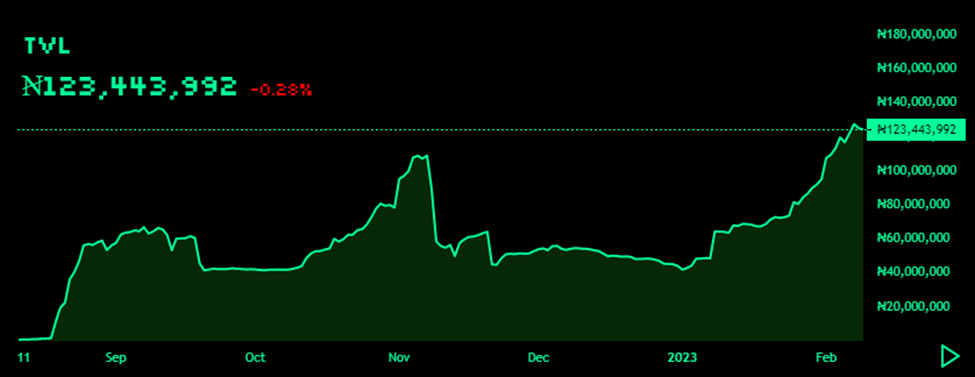

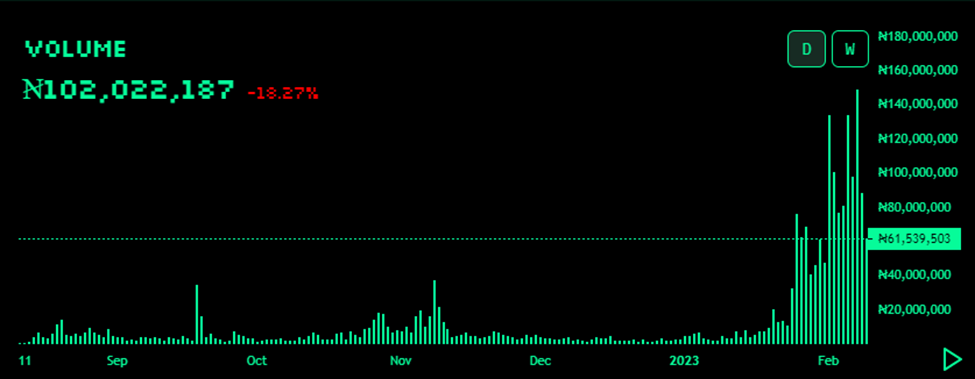

Since its launch in mid-August, the TVL and volume metrics on Canto DEX has been relatively subdued, perhaps due to unfavorable market conditions and fatigue around the Layer 1 rotations post-FTX. In the start of the new year, however, CANTO caught a bid and its native DEX has experienced increased usage on most fronts.

Figure: Canto DEX TVL

Figure: Canto DEX Volume

Since there is no value extraction (fee mechanisms), liquidity providers do not receive revenue from traders. As such, the DEX relies on liquidity mining rewards as an incentive to attract liquidity providers on the DEX. This is a significant design choice since CANTO has an exponentially decaying inflation schedule. Analogously, if Bitcoin’s decaying inflation design is unsustainable, Canto’s is even more so as it lacks the transaction fees that will one day make up for the terminally decaying inflation.

Today, other DEXes such as CantoSwap and Forteswap exist, but have so far commended minuscule TVL and volume metrics. We anticipate that as Canto emissions decay, trading volume and TVL should migrate to these competitor DEXes. The equilibrium will be swayed towards Canto DEX, however, given their contracts are baked into the layer and require less gas.

Lending Market

Canto’s Lending Market (CLM) is a Compound v2 fork that accepts LP and other tokens as collateral from users and lends out NOTE -23.91% , USDC and USDT. LP tokens are not allowed to be used as collateral but receive CANTO emissions (that converge market cap to FDV) when supplied to CLM.

Unlike the Canto DEX, however, the CLM is not free from fees – buyers pay interest to lenders to compensate them for the opportunity cost of lending out their assets. In alignment with the FPI principle, CANTO stakers possess governance power to manage protocol risk, preventing the protocol from accruing bad debt.

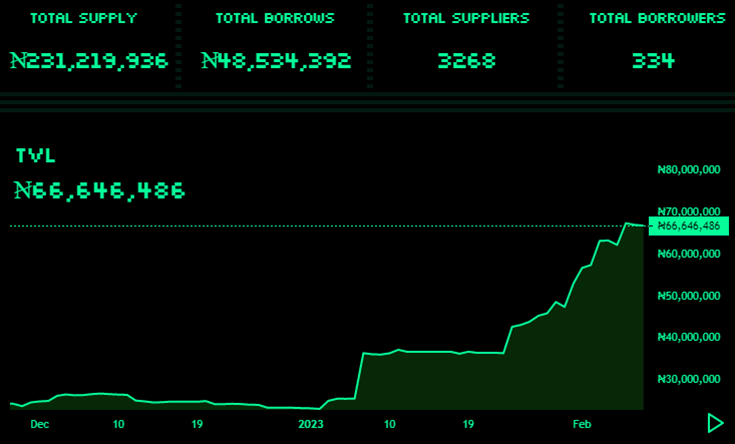

Figure: CLM Supply, Borrow and TVL Metrics

The CLM saw an increase in TVL in the new year, in line with its DEX usage. Nevertheless, much of this TVL arose from the supply side, taking advantage of the medium-term liquidity mining incentives elaborated in the tokenomics section below. The number of borrowers is a mere ~10% of suppliers, implying a 0.21x aggregate leverage ratio across the protocol. Suffice to say that the demand for leverage is still subdued, even on a nascent layer like Canto.

Unit of Account (NOTE -23.91% )

NOTE is an overcollateralized stablecoin that can only be borrowed from the CLM. The design is similar to that of Aave’s GHO stablecoin, collateralized by the assets supplied to the CLM.

NOTE maintains its peg to $1 through an algorithmic interest rate. If NOTE trades under the peg, the interest rate rises to incentivize market participants to buy NOTE on the open market for yield. Conversely, if NOTE trades above the peg, the interest rate is lowered to subsidize short-selling on the open markets.

Specifically, the algorithmic interest rate follows the following formula:

newInterestRate = max(0,(1-price(NOTE -23.91% ) * AdjusterCoefficient + priorInterestRate), where

- AdjusterCoefficient = 0.25

Moreover, the main unit of account on CANTO features:

- Overcollateralization: Since NOTE can only be borrowed overcollateralized against USDC and USDT, 1 NOTE is backed by at least $1 worth of USDC or USDT

- Capital Efficiency: Collateral backing NOTE can be lent out to other participants if the borrow rate for NOTE is less than the supply rate for USDC/USDT, incentivizing users who hold NOTE

Tokenomics

As mentioned above, CANTO is the native token of the Canto network and is used to pay for gas fees and can also be staked with validators to secure the network. At genesis, the initial total supply of CANTO is 1b tokens, of which the circulating supply is 150m (15%), composed of initial contributors and airdrop holders.

The rest of the tokens are distributed via liquidity mining emissions (80% through CLM and PoS staking) and future public good grants (5%) for circulating market cap to converge to point-in-time FDV.

The CANTO token serves a few purposes, namely:

- Securing the PoS chain via staking

- Native token for gas fees and block space

- Incentivizing Canto DEX liquidity

- Governance token CLM and NOTE parameters, as well as the general layer

Due to the FPI philosophy of not extracting rent, Canto also does not have a maximum supply. Instead, the total max supply of CANTO inflates at a constantly decaying rate. All tokens from inflation are distributed to CANTO stakers, proportionate to their stake in the network. Because emissions are governed by the DAO, the CANTO emissions schedule is variable, rendering projections futile.

Canto or Cando?

User Experience

While the ambitions of the chain are lofty, the execution has lagged relative to the excitement surrounding the smart contract network. Users who initially bridge to the chain are prompted to generate a public key, which is currently still buggy. Even if users manage to generate their public keys, they still need to bridge from the Canto-native blockchain to the Canto EVM. This is because the Canto blockchain and the Canto EVM are actually separate. Not to mention, the whole process takes 20 minutes after the Ethereum outgoing transaction is confirmed.

Even if users manage to bypass all the hurdles described above, their assets will land on the Canto EVM but they would not possess CANTO to use as gas to transact on the chain – they would need to turn to faucets to start off. As such, third-party bridge Synapse has benefitted from the poor user experience offered by the native bridge malfunction. This cross-chain bridge (and future aspiring cross-chain rollup) completes bridging transactions within five minutes whilst airdropping CANTO to first-time bridge users.

Value Extraction

Canto implements a fee-split model called Contract Secured Revenue (CSR) that splits the transaction fee paid by users between validators and contract deployers. Upon registering a contract, a transferable NFT representing the right to claim the contract’s revenue is minted. Alternatively, contract deployers can assign the contract’s revenue to an existing CSR NFT. The current split is 80/20 to the validator/contract deployer, but can be modified via governance.

CSR is a contentious topic as it is effectively an enforced royalty to contract deployers. Those who support CSR contend that it is necessary for the continued development of public goods in lieu of tokens, given that tokenization is the typical path to monetization adopted by developers on other Layer 1s. They argue that CSR solves the free-riding problem incurred in the public goods space. For example, there are currently nine versions of wrapped Ethereum deployed (the latest version deployed by MakerDAO), each funded by developers out of goodwill or who retrospectively apply for funding from the Ethereum foundation.

Conversely, opponents of CSR point to its inefficiency as it creates distorted incentives. Contract deployers can effectively build nested contracts to drive value to themselves as users interact with their contracts. The irony in this structure is it actually extracts value from users to the Canto token that accrues to the CSR NFT.

In a weird way, the network without extractive tokens has the most extractive token itself. The feeless DEX incentivizes Miner Extractable Value (MEV)[1] that drives value (through gas fees) back to the CANTO token itself instead of to applications building on top of Canto. This stifles innovation on the chain, since the canonical DEX, lending market, and stablecoin are already ‘nationalized’ on the network. In the real world, this is analogous to nationalizing healthcare, imposing a tax that is partially directed to healthcare, and expecting healthcare services to be competitive.

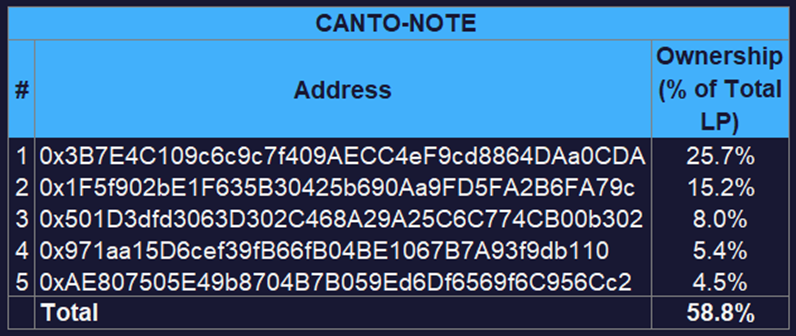

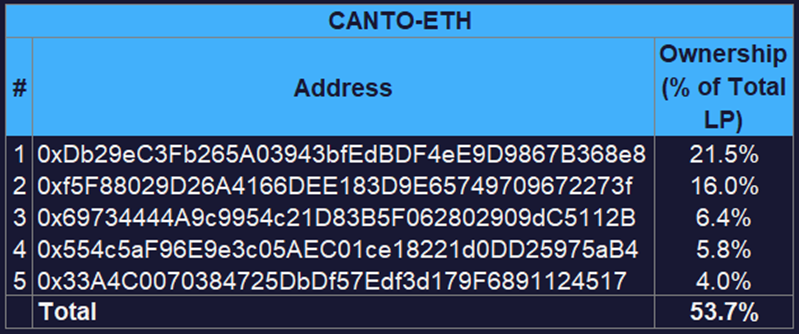

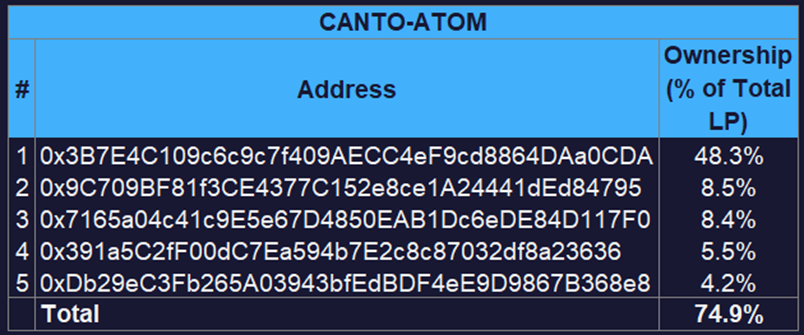

Ownership Concentration

In spite of the issues discussed above, arguably the largest problem plaguing this nascent layer is the concentrated ownership of current liquidity pool tokens, and followingly, future tokens. Because almost all token emissions come from the liquidity mining program, the current largest providers of liquidity will remain the largest holders of tokens as long as (i) no larger liquidity provider enters the pool and (ii) they keep their liquidity pool tokens staked.

In fact, if larger LPs enter the pool, the concentration problem of Canto will only get worse, not better. And even if larger players do not, the current liquidity providers will only get more concentrated as the liquidity mining program is currently paying 282% – 315% APR.

Figure: Top 5 Holder Concentration of CANTO-NOTE LP

Figure: Top 5 Holder Concentration of CANTO-ETH LP

Figure: Top 5 Holder Concentration of CANTO-ATOM LP

Bottom Line

While Canto possesses grand ambitions of becoming a network that encompasses the equitable principles of DeFi, its implementations are far from perfect once one factors in the inferior user experience, CSR, and ownership concentration. Nevertheless, it has attracted a wave of users, capital, and developers to its chain to build upon its ethos of providing Free Public Goods on a blockchain.

[1] Miner extractable value (MEV) is the maximum profit a validator/miner can make through their ability to arbitrarily include, exclude, or re-order transactions