Degen Edition - STFX

Key Takeaways

- While we emphasized the importance of tokenomics in the last issue, multiple projects with weak tokenomics have performed well in the past. Specifically, we believe that STFX is a high-probability, narrative-based opportunity project that stands to benefit from multiple tailwinds.

- The protocol pioneered a concept called Single Trade Vaults (STV) that are short-duration, non-custodial, and actively managed vaults that only execute one trade. If the only validated use case for crypto right now is speculation, then protocols like STFX that socialize the strongest use case in the space will stand to benefit from this narrative tailwind. Furthermore, STFX routes their trades through GMX, one of the most prominent decentralized perpetual futures protocols.

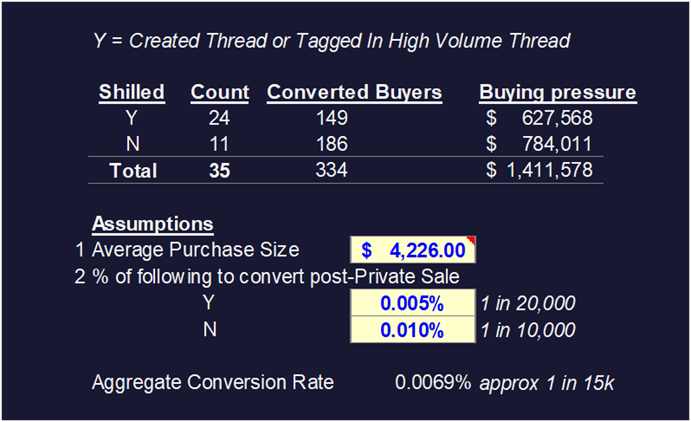

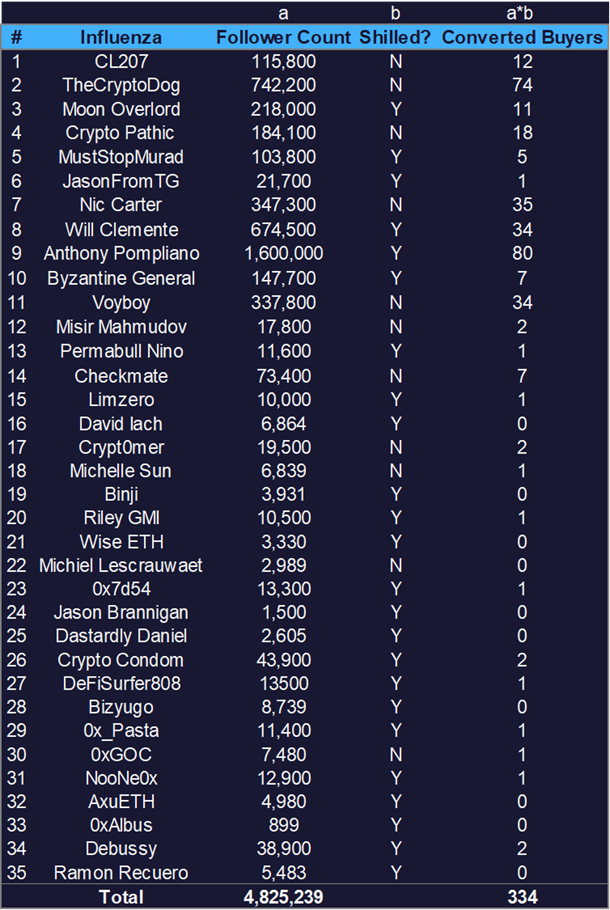

- If following your favorite influencers’ trades is the main use case of this protocol, then inspecting which of them have participated in STFX’s seed round would constitute proper due diligence. We extrapolate $1.4m buying demand from the 4.8m followers of 35 influencers and 10 VC funds using some back-of-napkin estimations.

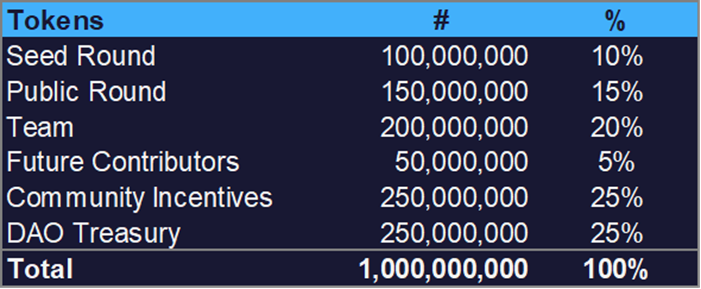

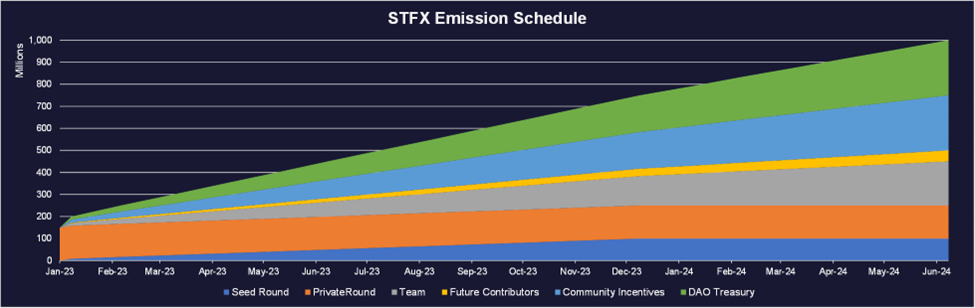

- The tokenomics (supply side) of the protocol paints a bleaker picture - further highlighting this opportunity as a trade than an investment. The first date of unlocks will occur one week after the token launch date, leaving a one-week period to take capital at risk off before letting profits ride.

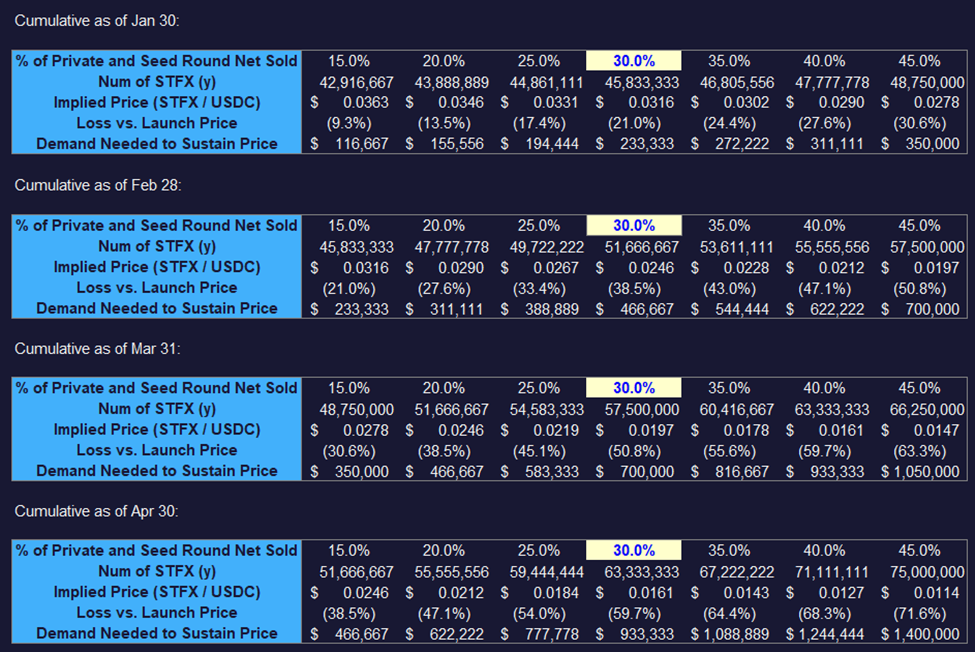

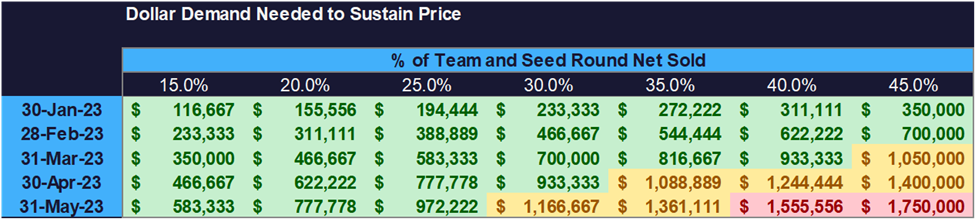

- With $1.6m in liquidity, we then estimate downside risk across different proportions of team and seed round investors selling across different unlock periods. Coupled with our buying demand approximations above of ~$1.4m, we observe that price can remain steady until the end of April even if 45% of team and seed round vested tokens are sold.

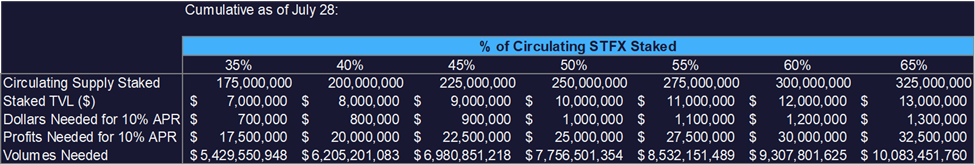

- We then examine the 'real yield' narrative purported by the protocol. While it is trending now, the profits and volumes required to offer a relatively competitive 10% APR is relatively large given the current structure. This further supports the case for STFX being a good trade rather than a good investment.

Figure: GMX Blueberry Club Member and STFX Pepe Attracting Retail Liquidity to the Slaughterhouse Under the Guise of Education

In our last issue of DeFi Digest (On Tokenomics), we acknowledged that multiple projects with weak tokenomics have performed well in the past. This points towards the prevalence of narratives driving price action, even nine years after Bitcoin was birthed. Instead of lamenting on this or waiting until fundamentals become consistently relevant (read: after crypto ceases to be a nascent asset class), market participants can recognize high-probability, narrative-based opportunities even in the bear markets.

Specifically, we believe that STFX is a project that stands to benefit from narrative tailwinds. Admittedly, this opportunity is more ‘degen’ than others we have written about in the past, given that it is currently holding its public sale and does not have a live token yet. This is also the first time we have written about a public sale.

Introduction

STFX, Single Trade Finance Exchange, is a protocol for short-term asset management. The protocol pioneered a concept called Single Trade Vaults (STV) which are short-duration, non-custodial, and actively managed vaults that only execute one trade.

STV managers fill in a series of parameters (i.e. Asset, Direction, Leverage, Planned Entry, Planned Target etc.). After that, they either wait until the vault is filled or conclude fundraising early to deploy capital. Because of this lag, it is important to note that ‘Planned Entry’ and ‘Planned Target’ prices are neither binding nor limit orders – managers have the discretion to execute trades manually.

Narratives

In our Crypto Concepts: Social Tokens piece, we posit that Social Finance opens a new investment medium for those looking for an easily accessible direct link to creators and communities. If the only validated use case for crypto right now is speculation, then protocols like STFX that socialize the strongest use case in the space should stand to benefit from this narrative tailwind. In other words, instead of manually copy-trading their favorite influencers on Twitter, retail traders can now directly do so in a self-custodial manner.

STFX routes their trades through GMX, one of the most prominent decentralized perpetual futures protocols we wrote about two issues ago. The GMX team publicly signaled their support for STFX by executing an OTC treasury swap between both protocols, swapping $100k worth of esGMX (GMX vesting for one year) for 3.3m tokens at a $30m FDV. Because of this partnership, STFX is well-positioned to adopt the cult-like following of GMX Blueberry Club Members. On the flip side, however, STFX is currently limited to GMX’s liquidity until they integrate with other DEXs.

If following your favorite influencers’ trades is the main use case of this protocol, then inspecting which influencers have participated in STFX’s seed round would constitute proper due diligence.

On the public sale page, STFX lists 35 influencers and 10 VC funds participating in the seed round. These influencers have a total of 4.8m followers who can potentially become investors in the trading vaults they create.

Figure: List of Influencers Listed on STFX Sale Page

More importantly, these followers can serve as a proxy for buying demand of the STFX public token. To that end, we parsed through each influencer’s Twitter account to see if they have created or been tagged in a high-volume thread on STFX, marking ‘Y’ for those who have and ‘N’ for those who haven’t.

For ‘Y’ (those who have), we assume that they have partially converted their followers to buyers in the ongoing public sale and further assume 0.005% (1 in 20k) of their followers will be converted to buyers after the token launches. For ‘N (those who haven’t), we assume that they will market the protocol at some point, and assume 0.01% (1 in 10k) of their followers will be buyers post-public sale. The aggregate result is that we estimate 334 followers (~1 in 15k) will be converted to buyers, which is not too aggressive. If we apply the average public sale investment of $4,226, this translates to ~$1.4m of buying demand.

At the risk of stating the obvious, the methodology utilized here is a tad ‘finger-in-the-air,’ but then again this is the degen edition of DeFi Digest, so bear with us.

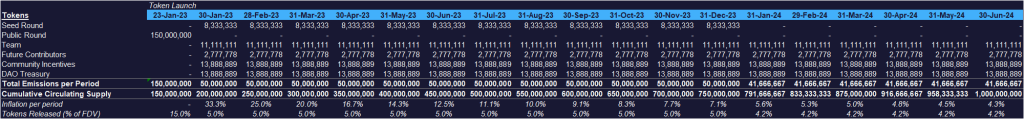

Tokenomics

In terms of tokenomics, the token breakdowns and emissions point towards a bleaker picture, which further supports the thesis that this opportunity is more of a trade than an investment.

To start off, 85% of the tokens are controlled by investors. Seed round investors (35 influencers + 10 VCs) constitute 10% of tokens at a $20m FDV and are subject to a 12-month linear vesting period. Public round investors can still invest at the time of writing at a $40m FDV and do not have lockups or vesting periods. Team, future contributors, community incentives and the DAO Treasury (75% of tokens) are subjected to a linear vesting period of 18 months. In other words, the initial market cap of the protocol will be $6m and will be composed of public round tokens only.

While emissions and token composition/control are less than ideal for outsiders by most measures, the first date of unlocks have been confirmed to be 1/30/2023. This leaves one week from the token launch date of 1/23/2023 for the first wave of insider tokens to unlock. As such, we speculate that the majority of influencers will market the protocol heavily during this period leading up to their token unlocks. This potentially sets up a one-week period to take capital at risk off the table before letting profits ride.

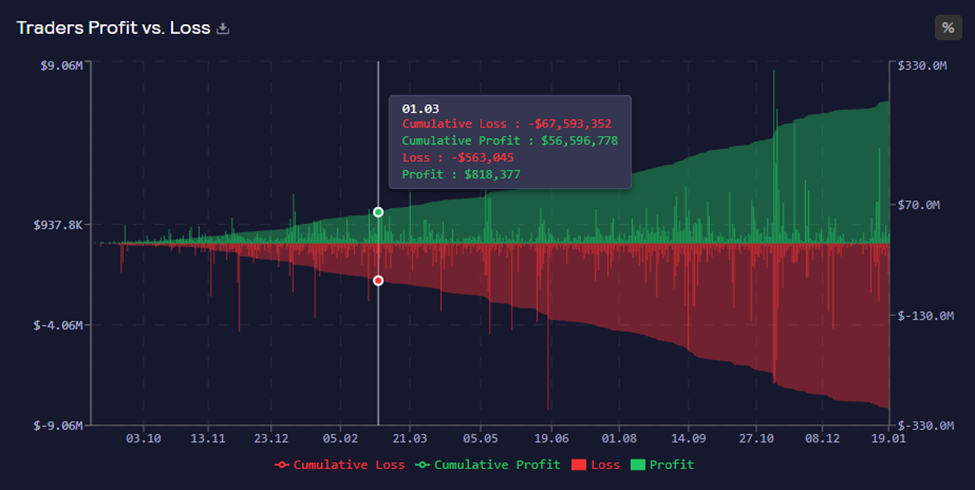

Downside Risk

Furthermore, the team has stated that they will add $1.6m in liquidity should the public sale fills, which is looking like a certainty at this point ($5.4m out of $6m raised in 4 days, with 3 days to go). This allows us to approximate the downside risks of this trade.

While liquidity will be added to Uniswap v3 and will be paired against ETH, we once again run back-of-napkin math using Uniswap v2 and USDC (since v3 is unpredictable without existing liquidity ranges and ETH-based liquidity pools will depend on ETH price).

As the $1.6m in initial liquidity will be launched at an implied price of $0.04, we can assume that the selling pressure in the markets will be primarily from the existing team and seed round investors who are up 2x from their seed round price. Again, this is a big assumption since bots / highly impatient traders frequently list their freshly minted NFTs at below-floor prices.

As such, we estimate the buying demand needed to sustain public round prices against different percentages of the team and seed round investors who decide to sell across the different unlock periods. Coupled with our buying demand approximations above of ~$1.4m, we can conclude that price could remain steady until the end of April even if 45% of team and seed round vested tokens are sold.

Figure: Buying Demand Needed to Sustain Price If Private and Seed Round Investors Sell Across Different Time Horizons

Figure: Dollar Demand Needed to Sustain Public Sale Price ($0.04) Sensitized Against % of Team and Seed Round Tokens Sold and Different Unlock Periods

Bonus: Real Yield Narrative

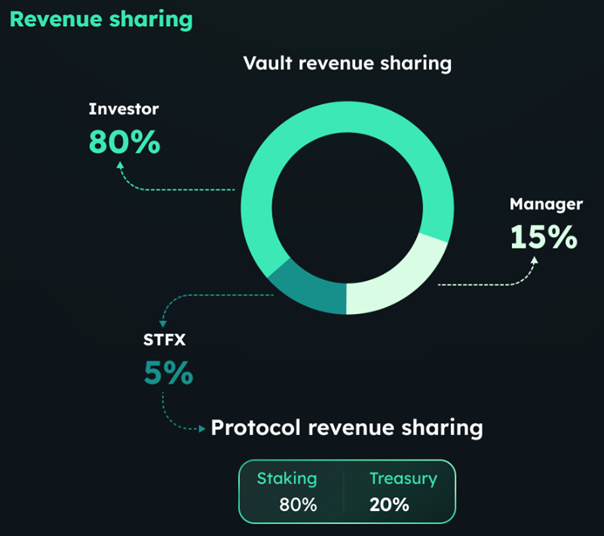

Due to the current prevalence of the ‘real yield’ narrative, STFX has also stated intentions of launching single-sided staking to distribute a portion of vault profits with the STFX token. The breakdown is comparable to the 2/20 rule in traditional finance – 80% of profits will be distributed to investors, 15% will be distributed to managers, 1% to the DAO treasury, and 4% to stakers.

While the narrative is indeed appealing, the profits and volumes required to offer a relatively competitive 10% APR are relatively large. Assuming that single-sided staking launches 6 months after the token launch (end of July), prices remain stable ($0.04) and 50% of circulating supply then is staked, the profits needed for a 10% APR are $25m.

Should the volume-to-profit ratio track that of GMX (310x), the volumes required for 10% APR are ~$7.5b. This is indeed aggressive, since this is ~40% of GMX’s trading volumes at the 6-month mark and STFX needs to route its trades through the DEX.

Having said that, the ‘real yield’ narrative is currently a trending one. Although STFX is unlikely to build a compelling offering given the current structure, we believe the narrative itself is strong enough to cultivate demand.

Bottom Line

STFX has numerous narratives serving as tailwinds for the protocol, including social finance, self-custodial vaults, and routing through popular DEX GMX. Moreover, the roster of influencers who participated in the seed round will likely promote the project on Twitter after the public sale concludes. However, the lack of a lockup for seed investors and massive volumes needed for a competitive staking yield will weigh down on token price in the medium term. As such, readers should treat this opportunity as a trade instead of an investment.