On Tokenomics

Key Takeaways

- Tokenomics represents the monetary policy of tokens that contributes to their price fluctuations. In bull markets, tokenomics constituted full theses for investment decisions. When the euphoria wears off in the bear, however, tokenomics can delay a weak project’s demise, but cannot prevent it altogether. We examine tokenomic design through the lens of emissions, demand, sinks, and liquidity below.

- If tokens are vehicles of value, token emissions are the methodology and speed at which value is transferred to holders. Projects need to decide on which TGE they plan to pursue before determining how much of initial token supply to release, balancing valuation, liquidity necessary, and control. Emissions can follow fixed or variable schedules.

- Demand drivers temporarily support prices through externalities that have shelf lives, coming in the form of investment and utility. Generally, tokens with revenue shares are considered ‘in financial demand.' Utility tokens command weaker demand relative to their financial counterparts because users only buy these tokens as needed.

- Token sinks reduce the circulating supply of tokens by burning them permanently or locking them up impermanently. The 'Curve Wars' best illustrate the impermanent locking of tokens, with derivative project Convex working around locking with its own liquidity shortfalls. On the other hand, tokens that are burnt best illustrate permanent token sinks, reducing total supply.

- Emissions not bought up by organic demand or re-invested into token sinks will inevitably be sold, weighing on the token price. Due to ease of access and the enablement of organic price discovery, altcoins are most often paired with a stablecoins or ETH. Liquidity is a facet of tokenomics that is still largely unsolved, evidenced by unprofitable LP behavior on the most popular DEX, Uniswap v3.

Tokenomics (a portmanteau for token and economics) represents the monetary policy of tokens that directly contributes to their price fluctuations. In bull markets, tokenomics were given utmost priority, sometimes constituting full theses for investment decisions. When the euphoria wears off in the bear, however, founders and market participants are left realizing that tokenomics can delay a weak project’s demise, but cannot prevent it altogether.

The reality is that regardless of tokenomic design, projects need product-market fit to survive in the medium to long term. In fact, multiple tokens with strong product-market fit (see: Compound, Aave, Lido) but weak tokenomics have performed well in the past. This outperformance can partially be attributed to narratives forming around verticals at different times, pointing to the nascency of crypto markets. Additionally, these tokens with little to no value accrual often make up for it by touting ‘governance’ features, alluding to the possibility of directing value to the token in the future.

To appreciate the good facets of tokenomics, we first need to be aligned on what tokens represent.

Put simply, tokens are vehicles to transfer value. They are integral to the clichéd Web 3.0 motto of ‘Read, Write, Own’ and equip projects with the ability to distribute value amongst its various stakeholders. When a large proportion of tokens are distributed amongst a small number of insiders, the project is considered ‘centralized’ and antithetical to the crypto ethos. Conversely, well-designed tokenomics can facilitate a healthy dApp ecosystem and incentivize desired behavior between different parties.

While tokenomics ultimately boils down to supply and demand, tokenomic design has grown far beyond Bitcoin’s original four-year halving cycles – different projects utilize tokenomics to optimize for different things. As we laid out in ‘FDV No Longer a Meme,’ markets will learn that tokenomics matter in the bearish backdrop of 2023, with buy-side demand unable to absorb structural supply.

As such, we attempt to examine tokenomic design through the lens of emissions, demand, sinks, and liquidity below. These constituents of tokenomics are seemingly disparate but are actually closely intertwined with one another.

Tokenomics Structure

Emissions

If tokens are vehicles of value, token emissions can be perceived as the methodology and speed at which value is transferred to their eventual holders. At inception, projects undertake a Token Generation Event (TGE) to distribute the initial supply. In 2017, the Initial Coin Offering (ICO) was the most popular rendition of this.

More recently, however, there have been an explosion of TGEs aside from ICOs, including Liquidity Bootstrapping, Liquidity Bonding, and Airdrops. Due to the controversy surrounding its naming, ICOs have also rebranded to Initial Exchange Offerings (IEOs), where (centralized or decentralized) exchanges facilitate the initial launch of tokens.

Airdrops and public sales have dominated the conversation around token generation events, as they constitute good marketing and are considered more equitable than private sales. The way tokens are released into the corners of crypto can have a significant impact on the project’s long-term success, as it can determine whether tokens are sold instantly or held by supporters of a project.

Besides deciding on which TGE to pursue, projects need to determine how much of the initial token supply to release, impacting valuation, liquidity necessary, and control. Initial Fully Diluted Valuation (FDV) can be defined as:

FDV = $ x / y %, where

- x = Dollar Amount Paired with Token

- y = Percent of Initial Token Supply Released

Should projects pair their token with $x in ETH or USDC and release y% of token supply, the FDV for the project shall be x / y. Launching with a low $x or high y% of tokens introduces risks of getting project tokens controlled by a single whale who can jeopardize price in the future. Conversely, launch with a high $x or low y% and risk high inflation in the form of future emissions outpacing organic demand (see: Solana ecosystem tokens).

Effectively, teams launching new tokens are faced with the dilemma of:

- Ceding control with a high y% to reduce future inflation and limit liquidity ($x) requirements to absorb future inflation

- Fundraising from external parties for a high $x to maintain control and inflation, but ceding control over liquidity

- Maintaining control with a low y% and use limited liquidity ($x), but have high inflation

Once teams decide on their TGE and determine how much liquidity to seed (more on this below), the next consideration would be inflation schedules. Early renditions of yield farms followed fixed emission schedules – a certain number of tokens are designated to specific pools, for TVL to normalize and reflect risk-adjusted APRs. While this worked well for traditional LPs, it did not foster any ‘desired behavior’ from users apart from that of profit seekers.

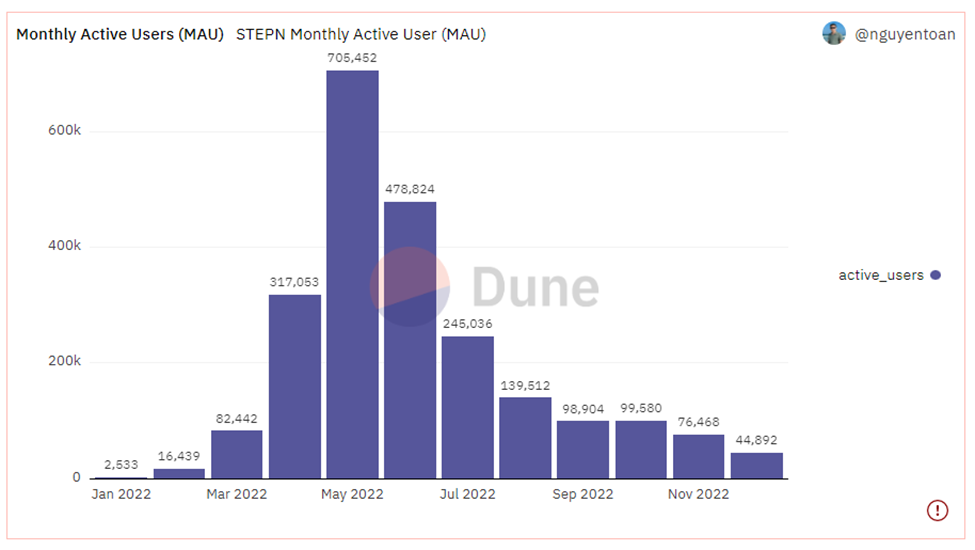

As a solution to this, GameFi projects adopted variable emission schedules, where emissions were contingent on players completing a desired action (a certain number of tokens emitted per action / NFT). Stepn, one of Solana’s most popular consumer-facing dApps, emits GST as yield for players who own their sneaker NFTs and perform the pre-requisite action (walking). Realizing high emissions is a pre-requisite to attract early adopters yet can tank price, teams typically adopt two-token models – one for ‘governance rights’ and the other for emissions.

The downside of this model is that because emissions are variable, founders lose control of the emissions curve as more participants perform the desired hurdle action. In the early days of Stepn, Find Satoshi Lab tried to curb this by limiting the number of participants via ‘invite codes.’ Despite these efforts, the founders learned that it always takes longer to build a game with organic (non-financial) demand, no matter the size of the total addressable market (in Stepn’s case, the TAM was mobile humans with a smartphone).

Figure: Stepn Monthly Active Users (MAU)

Demand

Once tokens are released into the wild, they are first absorbed by demand (read: purchases) in the market. These demand drivers temporarily support prices through externalities that have shelf lives, after which tokens are either re-invested into sinks or sold into liquidity.

Broadly speaking, demand comes in the form of investment and utility. Investors buy tokens in hopes of financial returns, while users/gamers/cultural savants buy tokens for utility. In other words, these tokens are used to gain access to exclusive gaming features or token-gated events.

Whether a specific tokenomic feature makes a token a security is beyond the scope of this piece, but generally tokens with revenue shares in the form of buybacks or distributions are considered ‘in financial demand’ and have the potential to garner organic demand. Just like other tokenomic features, it is worthy to note that cash flows should be supplemental to the thesis, not vice versa.

The first generation of projects that shared revenue with tokenholders include Sushi (xSushi – discontinued), Synthetix (discontinued), and TraderJoe (sJoe). While these projects shared revenue with holders, the manner in which they did differed. Sushi utilized the cToken model, converting fees to xSushi and increasing the Sushi:xSushi exchange rate, while Synthetix and TraderJoe utillize the aToken model, distributing rewards directly to users[1].

While earlier protocols shared a portion of revenue with stakers, newer iterations of the model have directed all protocol revenue to them. Most notably, these newer protocols include decentralized perpetual protocols that use hefty fees charged to users instead of emissions to attract liquidity providers.

Projects recognize that demand, albeit short-lived, will help curb the liquid supply of tokens that will inevitably weigh on price. To illustrate, 82% of GMX’s circulating supply is currently staked, leaving less than a fifth of the circulating supply to be traded on the open markets. This is also the reason why IMX and Apecoin launched single-sided staking programs weeks before large token unlocks.

Figure: GMX Supply and Staked %

On the other hand, utility tokens command weaker demand relative to their financial counterparts. This is because users only buy these tokens as needed, negating the need for stockpiling ahead of an event. Additionally, projects are disincentivized to let utility tokens appreciate since it merely increases the barriers to entry for new users. Some examples of utility tokens include Basic Attention Token (BAT), Chainlink (LINK -2.15% ), and Decentraland (MANA).

Technically, most Layer 1 tokens constitute ‘utility tokens,’ since they are needed as gas to execute various transactions. However, the minimum required amount is so minuscule that the utility is overshadowed by the desire to gain exposure to said Layer 1.

GameFi utility tokens are no different. Drawing from our Stepn example above, the utility token GST is emitted to users who possess the NFT and perform the desired action (walking), negating the need to buy these tokens altogether. Value accrues to shoe NFTs, while users have the option to (i) re-invest their GST into token sinks (i.e. leveling up their shoes) in hopes of higher future earnings, or (ii) to sell their tokens.

Sinks

Unlike demand, token sinks reduce the circulating supply of tokens by burning them permanently or locking them up impermanently. In DeFi, governance tokens have been the most popular candidates for this, pioneered by Curve Finance.

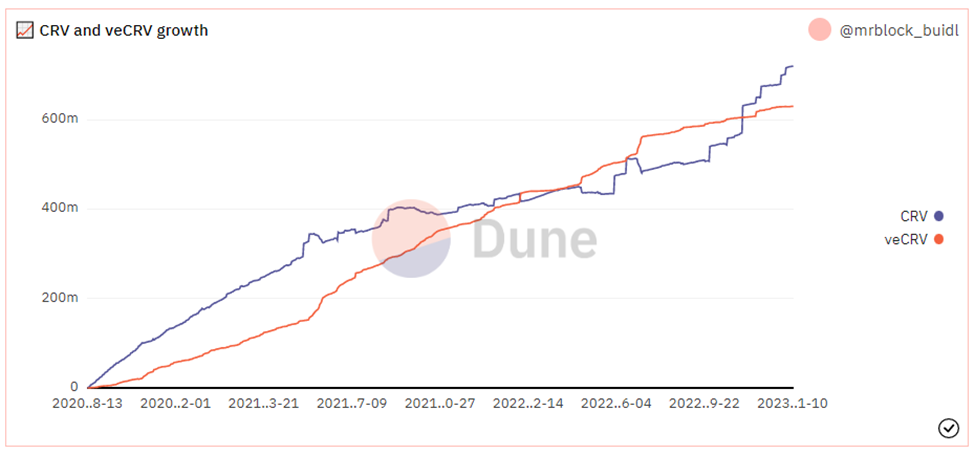

Users lock their CRV tokens for up to four years in exchange for veCRV. veCRV grants up to 2.5x higher emissions and governance rights to vote on which pools CRV tokens get emitted by epoch. Additionally, veCRV holders are entitled to 50% of trading fees on the DEX, distributed in 3pool tokens (DAI, USDC, and USDT). A user’s veCRV balance decays linearly over time, prompting users to relock CRV tokens for maximum emissions. In addition to attracting retail investors, this governance feature drew usage from projects that wanted to incentivize liquidity for their own token on Curve.

Figure: CRV and veCRV Growth

As of writing, 46% of CRV total supply is locked as veCRV. This flywheel effect was eventually termed ‘Curve Wars,’ positioning Curve as one of the most celebrated designs in the 2021 DeFi bull market. Recognizing Curve’s success, other projects have followed suit, including Dopex (veDPX), Balancer (veBAL), Frax (veFRAX), Trader Joe (veJOE), and Platypus (vePTP).

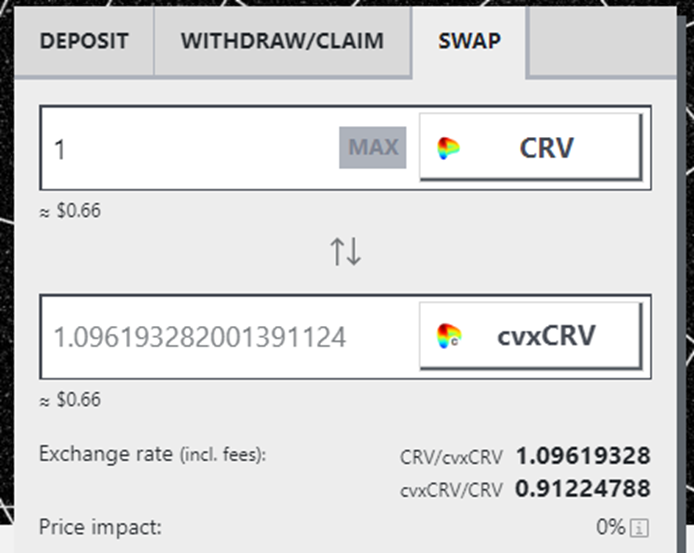

While veCRV was initially meant to be locked and non-transferrable, a derivative project called Convex created a liquid wrapped to bypass this. Essentially, users could one-way lock CRV on Convex in return for cvxCRV, a liquid wrapper of veCRV that paid out additional yield in CVX -0.46% . Like stETH, cvxCRV maintained its parity to CRV through an incentivized liquidity pool on Curve. Before long, Convex became the dominant locker of veCRV and controlled more than 40% of Curve emissions.

Figure: cvxCRV:CRV Depeg

But alas, the credit crunch of 2022 put a dent in one of the most popular models in DeFi. Because conversion of CRV to cvxCRV is one-way, stakers can only sell their CRV by swapping via the liquidity pool. When liquidity wore thin, cvxCRV depegged against CRV by ~10%, effectively erasing five months of gains based on an APR of 24.11%.

The permanent version of sinks is to burn tokens that players elect to spend in the ecosystem. Drawing from our Stepn example above, the project burns GST tokens that are reinvested (to mint or level up shoes) in the ecosystem. This effectively reduces total supply and renders the net emissions as emissions less tokens burnt.

Liquidity

Projects understand that emissions not bought up by organic demand or re-invested into token sinks will inevitably be sold, weighing on the token price.

Unless projects are well-funded and are willing to spend mid-six figures for a listing on Binance, they need to start by launching their token on-chain using a decentralized exchange. Founders need to consider two factors when listing their tokens in a decentralized liquidity pool – accessibility and correlation of the pair.

This is why altcoins are most often paired with a stablecoin or ETH 0.98% . ETH is one of the most popular (and accessible) tokens in the market, negating the need for users to first swap into other less common tokens before swapping to the new token. Stablecoins offers muted volatility in the value of a LP, hence facilitating more organic price discovery.

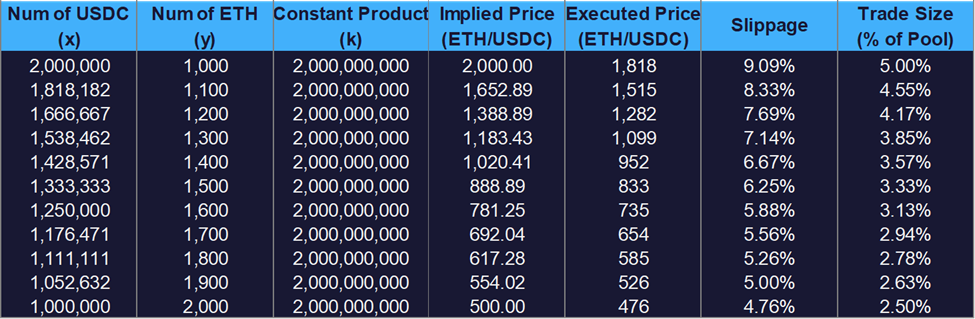

After deciding on a token pair, projects need to provide deep liquidity for their LP pools. Price slippage is approximately twice the magnitude of trade sizes as a percentage of the total liquidity pool (see table below). Hence, as a general rule of thumb, ‘healthy’ liquidity pools should be at least 10 – 20x the estimated size of largest trades to accommodate a maximum slippage of 10% – 20%.

To maintain this liquidity, protocols often need to incentivize LPs by directing token emissions to LP pools, in addition to the token fees earned by them. Doing so can get expensive retrospectively since more tokens are needed to attract liquidity when token prices are low in the early days. Effectively, yield farming emissions are programs for protocols to ‘rent’ liquidity from market participants. Once incentives dry up, protocols are at risk of losing their liquidity.

While OlympusDAO and Tokemak ventured to solve this with protocol-owned liquidity and single-sided liquidity pairing with no impermanent loss, both protocols have fallen short. The reality is that liquidity is a facet of tokenomics that is still largely unsolved, evidenced by unprofitable LP behavior on the most popular DEX, Uniswap v3.

Wen[2] Token

Now that we’ve covered the different facets of tokenomics and some example designs, we should address the proverbial catchphrase: ‘wen token?’.

While the optimal timing of token launches is highly subjective, it primarily hinges on two factors: funding needs and use case. Bootstrapped teams have higher funding needs, needing to resort to earlier token raises to fund development and liquidity. However, as we have covered in the sections above, tokens with limited functionality to garner enough demand will just be speculated upon and eventually sold in the open market.

In our view, governance decisions with minimal financial implications (i.e. voting on which oracles to use) make a weak case for issuing tokens and should be delayed until more substantial demand drivers to arise.

Short-sighted teams who perceive project launches as cash grabs are the main culprits of this. The longer the wait before launching a token, the less ownership founders will give up. Lastly, founders can also build heads down without the distraction of fluctuating token prices.

Bottom Line

While tokenomics are an ancillary factor to projects’ long-term viability, they can have profound implications to a project if not designed thoughtfully. If project founders fail to balance emissions with sufficient demand and token sinks, they risk introducing insurmountable sell pressure on the liquidity pools. Because of this, it is perhaps unsurprising that most projects trend to zero over time – they probably did not need a token to begin with.

[1] For example, a user stakes for 10% APR in two separate protocols, one using an aToken model while the other uses a cToken model. After a year, the user redeems the cToken for the Token at a 1.1x conversion ratio. Conversely, users can claim tokens amounting to 10% of their aToken holdings at the end of the period.

[2] Wen is crypto lingo for ‘when.’ Wen token, hence, is a common catchphrase used by degens to inquire or pressure project teams to release tokens for them to speculate.