Z2O - Undercollateralized Lending

Key Takeaways

- Given the decentralization and transparency benefits of blockchains, many have pointed to DeFi as crypto’s ‘killer use case.’ Sobering up from the highs of the bull market of ‘21, however, DeFi advocates are now left wondering: ‘How much of the original vision did the space end up building?’ Zero-to-One (Z2O) is a research series on the verticals we deem imperative to onboard the next wave of DeFi users.

- The first part of the series dives deep into undercollateralized lending, an elusive product in the on-chain world. We examine current undercollateralized protocols (Maple Finance, TrueFi, and Clearpool), how they bridge the ‘trust gap,’ and the design tradeoffs they incur in the process.

- On-chain loans are predominantly overcollateralized because of the ‘trust gap.’ Unlike conventional lending, lenders in generalized liquidity pools have no reason (or parameters) to ‘trust’ pseudonymous borrowers. This first iteration of digital lenders capitalized on data analytics to automate the due diligence process, while P2P lending encompasses the second iteration by offering smaller loan sizes. In our view, DeFi has the opportunity to be the next iteration of P2P lending.

- But in order for it to do so, DeFi needs to overcome the following challenges. Firstly, overcollateralized lending does not imply a real need for credit. Secondly, value flows are entirely denominated in digital assets, from collateral lent to loans borrowed and assets purchased. Lastly, the borrowing process should feel seamless compared to current models.

- Apart from current implementations, crypto-native credit scores and leveraged trading / farming protocols are other promising models that solve for undercollateralized lending. While on-chain credit scores sound promising, pseudonymity makes loan recourse difficult. A partial solution is using zero-knowledge technology to tie real-world identities on the blockchain pseudonymously. Although leveraged trading and farming constitutes undercollateralized lending, they amplify circularity within crypto.

Zero-to-One (Z2O) Series

Given the decentralization and transparency benefits of blockchains, many have pointed to DeFi as crypto’s ‘killer use case.’ After all, finance today is built along opaque and slower traditional finance rails ripe for disruption by distributed ledger technology. Sobering up from the highs of the bull market of ‘21, however, DeFi advocates are now left wondering: ‘How much of the original vision did the space end up building?’

Zero-to-One (Z2O) is a research series on the verticals we deem imperative to onboard the next wave of DeFi users. While overcollateralized lending constituted half of DeFi’s $300b in TVL last year, it has fallen dearly short of its initial promise – providing the unbanked with permissionless access to financial services. The first part of the series dives deep into undercollateralized lending, an elusive product in the on-chain world. We examine current undercollateralized products, how they bridge the ‘trust gap,’ and the design tradeoffs they incur in the process.

Introduction to Undercollateralized Lending

Borrowers who take undercollateralized loans pledge assets whose value is lower than the loan amount. On the other hand, uncollateralized loans are loans with no collateral pledged. In either case, borrowers want access to money they do not have. Undercollateralized loans typically take one of two forms, lines of credit or outright loans.

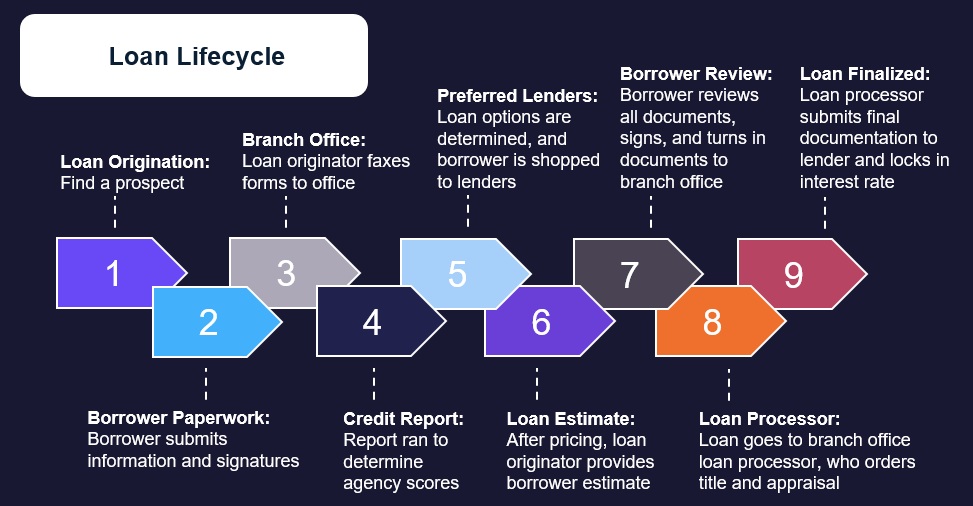

Both types of loans are typically offered by traditional financial institutions, which would assess the borrower’s creditworthiness. This process involves evaluating a person’s credit history or, in the case of a business, whether the operations have reliable cash flows to mitigate the risk of default on the counterparty’s capital. It is a slow process end-to-end, as the underwriter needs time to conduct diligence on each borrower.

By many measures, there is an insatiable demand for undercollateralized debt. As of Aug ‘22, U.S. consumer loans at commercial banks reached $1.79 trillion, while credit card debt in the U.S reached $887 billion this year. TransUnion personal loan balances grew to $192 billion through the first half of 2022, nearly doubling from ~$100m in 2016.

With the rise of digitization came a demand for less friction throughout the loan process. As traditional finance institutions were slow to embrace technology, many competitors including digital-only neobanks and online lenders emerged. In lieu of applying for a loan at a bank branch that would take weeks to approve, borrowers turned to these startups offering faster turnarounds.

This first iteration of these digitized lenders capitalized on data analytics to automate the due diligence process. By regressing the default rates against data available to them, these lenders adopted a broad-brush approach to categorizing borrower profiles and disbursing loans. Popular models include the aggregator/partnership model, where platforms evaluate risk and pass default risk to clients, in this case, partner banks providing capital. Some independent platforms are also both responsible for evaluating risk and putting company balance sheet capital at risk of default.

In addition to providing a more seamless experience, digital lenders offer competitive interest rates to potential customers relative to incumbent banks. Rates can range from 6.99% for excellent credit to 30% for bad credit. The faster turnarounds and better rates led to Fintechs’ increased market share in the personal loan market from ~5% in 2013 to 39% in 2019.

The opportunity is much more significant in enterprise lending. There is a lack of data availability on businesses and consumers outside the developed world, making risk evaluation much more cumbersome. The World Bank estimates that 40% of micro to medium-sized businesses worldwide have unmet financing needs, totaling $5.2 trillion in potential unmet financing.

Figure: Personal Loan Rates Comparison Table

Figure: Business Loan Rates Comparison Table

If the first iteration of digital lending increased access to the supply side of capital, peer-to-peer (P2P) lending encompasses the second iteration by offering smaller loan sizes. For the first time, retail lenders could directly provide their own capital and choose their counterparties based on advertised use of funds. The P2P market reached a value of $83.79 billion in 2021 and is projected to grow at a 26.7% CAGR, reaching $705.8b by 2030.

In our view, DeFi has the opportunity to be the next iteration of P2P lending. But in order for it to do so, DeFi needs to overcome the challenges laid below and innovate to the same scale that digital lending did to conventional lending. Paying crypto natives for usage will not suffice – DeFi needs to leverage transparency offered by blockchains to develop superior data models. Most importantly, interacting with DeFi dApps needs to be as seamless as current alternatives.

The Challenges of On-Chain Lending

The total TVL of on-chain lending is shy of $15b and consists almost entirely of overcollateralized leverage. Overcollateralized lending typically involves borrowers locking up collateral (usually in the form of another cryptocurrency) in a smart contract to borrow against it. Lending platforms then rely on third-party liquidators to sell the collateral if the market value of the tokens pledged falls below an established collateralization ratio, allowing creditors to recoup the loan’s value.

On-chain loans are predominantly overcollateralized because of the ‘trust gap.’ Unlike conventional lending, lenders in generalized liquidity pools have no reason (or parameters) to ‘trust’ pseudonymous borrowers. By requiring borrowers to pledge assets valued higher than their loans, overcollateralized lending effectively leverages the asset-loan delta to plug the gap.

On the other hand, traditional lending bridges this gap by introducing various points of centralization in the loan lifecycle. Centralized credit rating agencies provide third-party opinions for underwriters to assess risk. In the event of a default, creditors employ debt collectors to recoup the loan’s value.

Retrospectively, overcollateralized lending made the most sense as a proof-of-concept for DeFi. Due to the trustless nature of smart contracts and the pseudonymity of wallets, protocols cannot ascertain whether a particular lender is credit-worthy. Instead, bluechip DeFi lending protocols leaned into these principles, treating each debtor as the same and building the infrastructure (oracles, liquidation engines, safety modules) to provide an overcollateralized lending pilot product.

While this first iteration of on-chain lending has led to initial adoption, it has also manifested problems that have led the vertical astray from ‘democratizing access to finance.’ Firstly, overcollateralized lending does not imply a real need for credit. To echo Decentralized Leverage, Baby:

“Why would you need a loan of $500 if you have $1,000 to collateralize the loan?”

Users of lending platforms today are thus financial speculators looking to access leverage by collateralizing their existing positions, effectively ‘longing their longs.’ Alternatively, they are inefficient hedgers, unable to achieve perfect delta neutrality due to the over-collateralization requirement.

Secondly, value flows are entirely denominated in digital assets, from collateral lent to loans borrowed and assets purchased. This denomination magnifies circularity in the space, drawing criticism that DeFi is mere ‘hypothecation upon rehypothecation.’

Circularity in crypto lending is challenging to break because tokens today do not infer representation of real-world financial assets or their respective ownership (yet). Borrowers may pledge their real-world assets to obtain financing on-chain, but foreclosure proceedings are challenging given the lack of enforceability. This leaves on-chain assets as the only eligible asset type to back on-chain loans.

In the proceeding sections, we peruse crypto projects striving to bridge the aforementioned trust gap in undercollateralized loans and outline the tradeoffs they incur.

1. Maple Finance

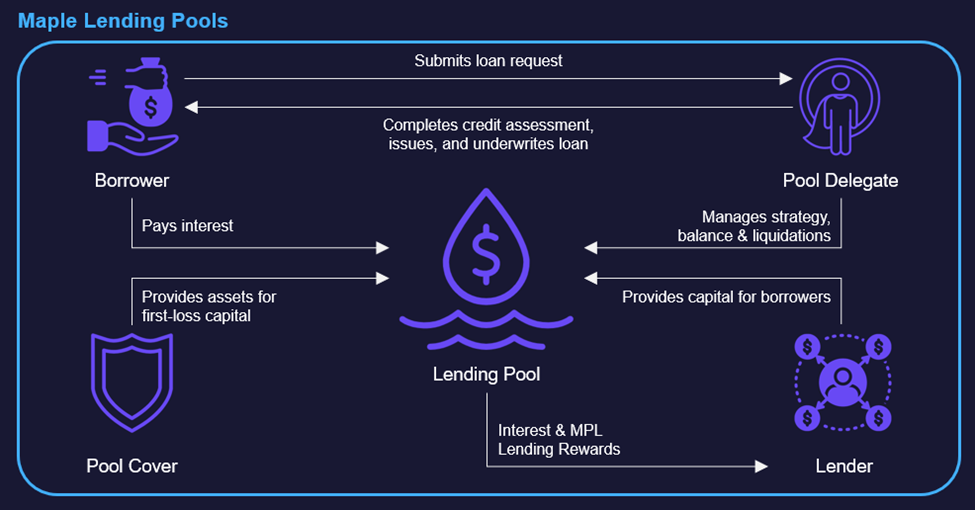

Maple Finance is an institutional credit market built on Ethereum and Solana. The protocol went live on Ethereum in May ‘21 and Solana in Apr ‘22, issuing $2.05b in undercollateralized loans across both networks. According to co-founder Sidney Powell, Maple aims to become the “Shopify” of lending. Rather than issue loans with the treasury’s capital, Maple provides the infrastructure to connect creditworthy borrowers to lenders seeking risk-adjusted yields.

Maple does this by employing a ’Pool Delegate’ for each Lending Pool. Pool Delegates are responsible for negotiating loan terms (interest, duration, and collateral ratio) with borrowers, performing due diligence, and liquidating collateral in the event of a default. In return, Pool Delegates earn an origination (‘Establishment Fees’) fee and a portion of the interest earned (‘Ongoing Fees’). Pool Delegates can also determine whether liquidity provision and Pool Cover for a specific Lending Pool is open or restricted to a list of predetermined addresses.

In the Maple ecosystem, lenders effectively delegate the risk assessment to third-party Pool Delegates. This process is not dissimilar to private debt funds, where Limited Partners defer the underwriting process to General Partners. Doing so centralizes power around fund provision and disbursements, especially given Pool Delegates are manually approved by the Maple Finance team. By many measures, Maple’s product is not reinventing the wheel – unsecured tranched lending has been around for decades.

On the demand side, potential institutional borrowers must pass a KYC/AML process to access various Lending Pools offered by Pool Delegates. To create a new loan, borrowers submit a loan request, which gets circulated among Pool Delegates. Should a Pool Delegate underwrite the loan post-due diligence, the funds will be made available for drawdown by the borrower. So far, borrowers have included the likes of Alameda Research, LedgerPrime, and Wintermute.

To mitigate risk in the event of a default, Pool Delegates contribute to a ‘Pool Cover,’ aligning their interests with lenders. Pool Cover liquidity providers deposit a 50/50 combination of Maple tokens (MPL) and USDC into a Balancer liquidity pool. The LP position will be liquidated first in a default, protecting lenders in the event of default.

If borrowers miss a payment, they have a five-day grace period to make the payment before their collateral is liquidated by the Pool Delegate (if applicable) and repaid to the Lending Pool. All Borrowers enter a Master Loan Agreement during onboarding which enables legal enforcement.

While lenders can claim earned interest at any time, they must wait for their withdrawal timer before removing their principal. The withdrawal request triggers a 10-day cooldown period, after which lenders have a 48-hour window to withdraw funds. Should lenders fail to withdraw during the window, they will need to reinitiate another request subject to the same 10-day wait.

Two out of seven Lending Pools are also permissioned, compromising on the permissionless nature of DeFi. Other parts of the loan lifecycle also appear clunky, from loan applications (and negotiations) to Master Loan Agreement enforcement and principal withdrawals. To illustrate, Babel Finance lenders took a hit despite having sufficient Pool Cover due to a faulty principal withdrawal design and 33% capped withdrawals from the Pool Cover.

Having said that, the primary benefit of offering undercollateralized on-chain is transparency – liquidity providers to Lending Pools and Pool Covers can observe to whom funds are lent. Given the leverage unwinding of May ‘22, it is impressive that Maple reported a mere $10m default from Babel Finance out of $2b loans originated. Perhaps this transparency and Pool Delegates’ prudence in place of collateral contributed to Maple’s lower default rates.

2. TrueFi

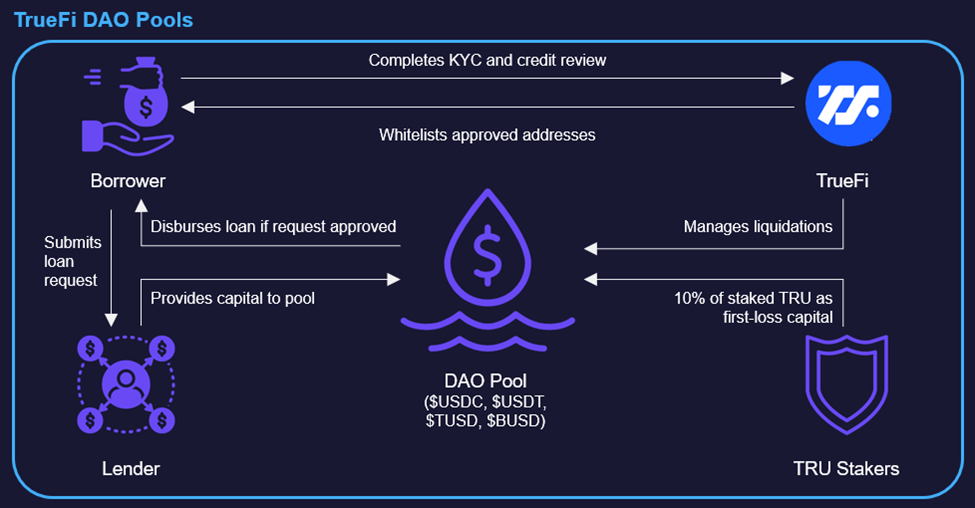

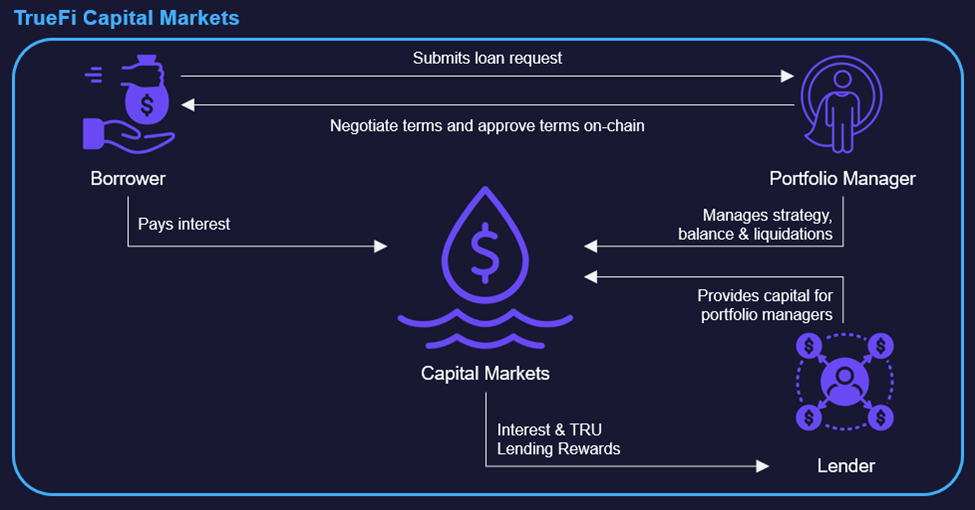

TrueFi is an open-source unsecured lending protocol for institutional borrowers. Since launching in late 2020 as the first uncollateralized lending market on Ethereum, nearly $1.7b in loans have originated on the platform. While TrueFi started by lending to crypto-native borrowers (DAO Pools), it now offers fund management tooling for portfolio managers allocating capital to real-world opportunities (Capital Markets).

DAO Pools are managed by protocol stakers ($stkTRU), who approve loan requests submitted by institutions that have undergone KYC/AML checks. Liquidity is pooled permissionlessly and loans are disbursed from generalized pools of stablecoins (USDC, USDT, TUSD, and BUSD). After lending to a pool, a lender receives LP tokens representing their proportional stake that can be tradeable on secondary markets.

While Archblock (formerly TrustToken) previously managed DAO Pools, the team ceded underwriting responsibilities to TrueFi DAO in an effort of progressive decentralization. The significance of this decentralization process cannot be understated. Before decentralizing, Archblock had to sign off on credit evaluations and compliance checks on all potential borrowers. This initial credit review was a possible single point of failure because lenders had to place faith in Archblock’s competency as a credit evaluator. Nevertheless, requiring protocol stakers to vote on each DAO Pool loan requires active governance participation that eludes even top protocols.

On the other hand, the Capital Markets product is managed by ‘Portfolio Managers’ (akin to Maple’s Pool Delegates), who negotiate terms with each institutional borrower. Portfolio Managers also have discretion over lenders, compliance screenings, and the execution of lending agreements with borrowers. Archblock is one of seven portfolio managers of the protocol who compete for liquidity.

Although Portfolio Managers need to be approved via TrueFi governance, they do not need to pledge assets or assume credit risk when creating a portfolio. This misaligns incentives between the lender and Portfolio Managers/borrowers, especially when the Portfolio Manager and borrowers are related entities (as is the case for three out of the six active Capital Markets pools).

In the event of default in DAO Pools, up to 10% of the staked TRU tokens in the staking pool will be slashed to repay lenders. TrueFi’s Secure Asset Fund for Users (SAFU), which Archblock initially funded, will fund amounts above the 10% slashed. Finally, if this does not cover total losses, the bad debt is reflected in the lending pool’s LP token price, realizing losses for lenders in the pool. The Archblock team also pursues traditional legal recourses to minimize losses.

TrueFi recently experienced its first default from South Korean blockchain investment firm Blockwater Technologies, which failed to pay back a $3.4m loan. The default occurred even after Archblock negotiated an extension when the original loan matured on August 5th, 2022. The incident highlights how integral Archblocks’s underwriting process is to TrueFi lender pools, and how default protection allotted in bull markets may be underestimated for defaults in bear markets.

But this is not the first time TrueFi has been in a precarious position. Crypto market maker Wintermute lost $160 million in a hack while it was the largest single borrower on TrueFi, with $92 million in debt to the platform. Wintermute made good on their loan after TrueFi said its “credit teams had multiple constructive discussions” with Wintermute. Separately, TrueFi also warned of Invictus Capital’s potential inability to repay a $1 million loan after filing for voluntary liquidation earlier this year.

3. Clearpool

Similar to TrueFi, Clearpool is a decentralized marketplace for unsecured institutional capital. The platform launched in Apr ‘22 and is live on Ethereum and Polygon, originating more than 300m in loans across both networks. Currently, all lending pools are denominated in USDC.

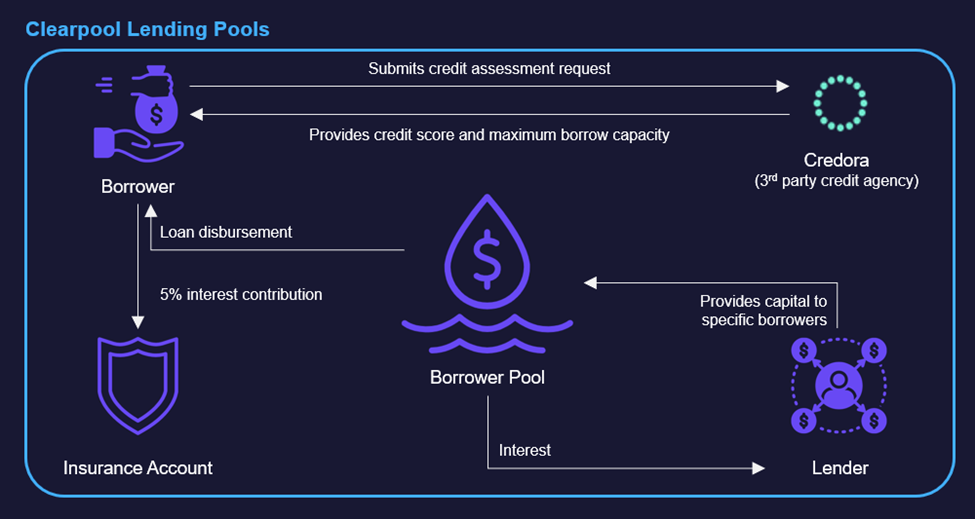

Institutions interested in accessing credit first request to be whitelisted and are subject to an initial assessment by the core team. Those approved then go through KYC/AML, agree to Clearpool’s enforceable legal agreements, and undergo a credit risk assessment by third-party credit scoring platform Credora. This results in the issuance of a credit rating and a maximum capacity per borrower.

While Maple’s pools are organized by Pool Delegates and TrueFi’s by Portfolio Manager or asset type, Clearpool sorts its pools by the borrower. Informed by the outsourced credit scoring above, the underwriting responsibility thus falls on lenders instead of third-party Pool Delegates or Portfolio Managers.

Before launching a pool, borrowers must stake a minimum amount of CPOOL, which acts as a ‘borrower fee.’ Borrowers can also request for lenders to undergo KYC checks, thus creating a permissioned pool with a fixed duration, interest rate, and CPOOL reward structure. Lenders interested in permissioned pools must request access before undergoing the required KYC and AML checks.

In permissionless pools, however, lenders do not need to be whitelisted before being able to lend on the platform. After providing liquidity, lenders receive cpTokens, which are LP tokens that represent the lender’s stake and accrue interest. Although lenders can withdraw liquidity at any time, they are still subject to available liquidity in the pool.

Specifically, pools reach a ‘High-Util’ state once utilization[1] rates breach 95%. In this state, borrowers cannot draw down additional liquidity from the pool. Lenders may still provide and withdraw liquidity during High-Util. However, withdrawals for lenders will also be halted should the utilization rate reach 99%. Borrowers have a 5-day grace period to return utilization below 95%, the failure of which will result in the pool entering the Default state.

Aside from intertwining utilization rates, interest rates, and pool sizes, this design choice implies that interest rates on Clearpool are not underwritten. Instead, they follow a curve and depend on the pool’s utilization rate at any given time. Pools with high utilization rates will have less available liquidity but pay higher interest rates than pools with low utilization rates, ceteris paribus. Pool sizes are also dynamic, with no cap on how much liquidity lenders can provide.

In the event of default, participants (apart from borrowers) can bid for the pool’s cpTokens in a week-long auction. Minimum auction bids must be higher than the insurance account, funded by 5% of the pool’s interest accrued and from which lenders can make claims. Relative to Maple Finance’ c.7% coverage on its lending pools, Clearpool’s insurance accounts are on average less than 0.5% of their pool sizes, exposing principal lenders to the majority of credit risk.

If the bid is rejected, each cpToken holder can redeem their cpTokens for their proportionate share of the pool’s insurance account and maintain their rights to pursue the defaulted borrower legally. If the bid is accepted, each cpToken holder will be able to redeem their cpTokens for their proportionate share of the winning bid amount but relinquish their rights to pursue the defaulted borrower to the winning bidder. The winning bidder will receive an NFT containing the legal rights to the pool’s debt and the exclusive legal right to pursue the defaulted borrower.

Other Promising Models

Although the protocols above dominate the conversation (and liquidity) around undercollateralized lending, several innovative alternatives have surfaced recently to bridge the ‘trust gap.’

One such model is crypto-native credit scores, as offered by LedgerScore and Credora. These protocols leverage on-chain activity ranging from historical loan repayments, trading activity, and governance participation to develop on-chain identities and credit scores. The transparency and liveness of on-chain activity can afford more dynamic models than the status quo. Although on-chain credit scores sound promising superficially, its implementation may be more challenging than initially imagined.

Firstly, on-chain identities are pseudonymous. This pseudonymity makes loan recourse difficult, as borrowers can easily spin up a new wallet should they default on another. Moreover, unlike Web 2, there is no inherent social graph for Web 3. Instead, there is a financial one since we can establish financial flows between accounts. Yet financial repercussions are irrelevant in lending without collateral. This is why credit score implementations thus far have been weighted towards institutions that perform KYC and bear the social repercussions in the event of defaults.

A partial solution is using zero-knowledge technology to tie real-world identities on the blockchain pseudonymously. Unlike financial capital, this social identity should not be transferable. Vitalik describes the implementation of this as ‘soulbound tokens,’ where an NFTs representing a user’s identity is permanently tied to a single wallet address. Platforms that succeed in making customers comfortable enough to do so will capture significant market share in retail undercollateralized lending.

Another model that offers undercollateralized lending, perhaps in disguise, is leveraged trading and farming protocols. Similar to centralized exchanges, protocols such as GMX, gTrade, Gearbox, Sentiment offer retail investors more liquidity than their collateral.

While this technically constitutes undercollateralized lending, these protocols limit the use of funds to whitelisted protocols and for specific use cases (trading). This prevents borrowers from misappropriating borrowed funds, but amplifies circularity within crypto. Until ownership of real-world assets can be conveyed on-chain through legal precedents, this circularity problem will persist.

Bottom Line

By all metrics, the demand for online lending is massive. The first wave of digital lenders captured market share by creating a superior lending experience to what was available. Yet the question remains – is DeFi positioned to be the next iteration of digital lending?

In our view, the jury is still out from our initial dive into existing undercollateralized lending protocols. The current leaders of this sub-vertical are effectively platform businesses catering to institutions that have brought proven models on-chain, including their bulky administrative processes. While there has been progress on decentralizing the underwriting process, any model which relies on a data model, and a partner to assess risk, must trust that partner is competent enough to preserve lenders’ capital.

On the transparency front, posting first-order lending activity on-chain will help to a certain extent. However, current implementations have no way to enforce funds specificity apart from good faith – funds are disbursed to borrowers’ accounts and are free to be used in ways outside of the original intent. For example, Orthogonal Trading’s USDC loan to Babel Finance was on-chain and intended for ‘market-neutral’ strategies, yet the Pool Delegate had no control or visibility into whether lent funds were used in Babel’s own strategies or lent to other debtors like 3AC.

For DeFi to gain a foothold in the competitive digital lending ecosystem, we believe it has to innovate on a few pieces first:

- On-chain identity/reputation – A protocol that figures out how to incentivize building credit history on-chain, or conversely can verify real-world credit history on-chain, will win market share in retail and institutional lending.

- Crypto Circularity – To truly capture growth opportunities in lending, protocols need to add value to businesses and consumers outside of crypto.

- Operational Friction – Getting approval from multiple entities and DAOs disincentivizes borrowers from engaging with DeFi and pushes them to traditional lenders where they typically only deal with one party. The borrowing process should feel seamless compared to current models.

Special thanks to Henry Contreras for his help in writing this piece.

[1] Utilization rates are calculated as the Amount Drawn Down / Pool Size.