Decentralized Leverage, Baby

Debt. Arguably one of the most controversial financial terms in modern history. Embroiled in the conversations of 45 million student debt holders, 55% of Americans who carry a month-to-month credit card balance, and the mortgage holders that account for 70% of all American debt. Use too much and risk defaulting, use too little and miss out on opportunities due to temporary illiquidity. Even nation-states use debt to boost productivity – global debt rose 28% to $226 trillion in 2020, constituting 256% of global GDP.

Historically, borrowing from conventional banking institutions has come with restrictions such as having a good credit score and sufficient collateral to convince them that a given debtor is credit-worthy. Decentralized lending and borrowing remove this barrier, effectively allowing anyone to collateralize their digital assets to obtain loans without the need for a bank account or a credit check.

For the risk-averse, lending assets on these platforms can also generate additional yield driven by borrowing demand. Relative to yield farming covered in the previous issue, this source of yield is superior as it is derived from organic demand instead of token inflation.

The Mechanics

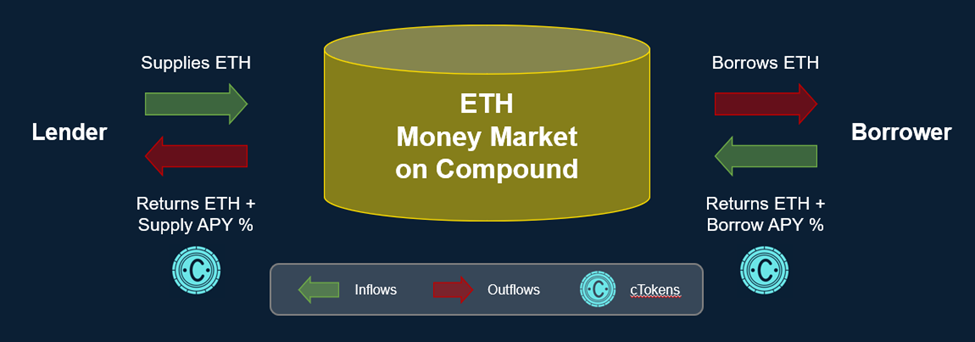

To illustrate fund flow mechanics in a decentralized money market, we examine Compound, one of the oldest and most-forked money market dApps[1] to date. Suppliers supply assets such as ETH to the pool and earn interest, while borrowers take a loan from the pool and pay interest on their positions. Essentially, Compound bridges the gap between those who want to earn yield on idle assets and others who wish to borrow funds to invest or create value.

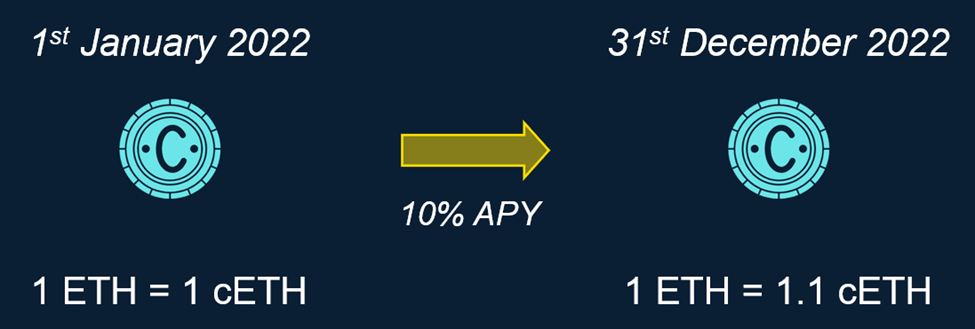

Compound algorithmically derives interest rates based on the supply and demand of the asset in the pools, earning the spread between the lending and borrowing APY[2]. Users receive “cTokens” when they deposit collateral to be lent out, representing their proportionate share of the money market pool. Upon withdrawal, the token:cToken conversion rate will appreciate by the proportional APY for however long the deposit was made.

By leveraging these algorithmic interest rates and redemption mechanisms, Compound allows for easier access to loans by all without the need for loan term negotiations, thereby creating more efficient money markets.

It’s All Fun and Games Until You’re Liquidated

As the old adage goes, “With great leverage comes great responsibility”.

Similar to their counterparts in TradFi, creditors in DeFi need certainty that debtors will make good on their loans. For every loan taken out, projects measure the health of those positions via a collateral ratio, outlined below:

Collateral Ratio = Value of Collateral / Value of Loan

Once the collateral ratio of the position dips below the minimum collateral ratio required for the given asset pool, the position gets liquidated. Liquidation is when collateral gets sold to repay the loan, ensuring that depositors or lenders are protected against default risk. It is analogous to asset foreclosures in the real world, where creditors seize debtors’ assets when they believe debtors can no longer afford to make good on their loans.

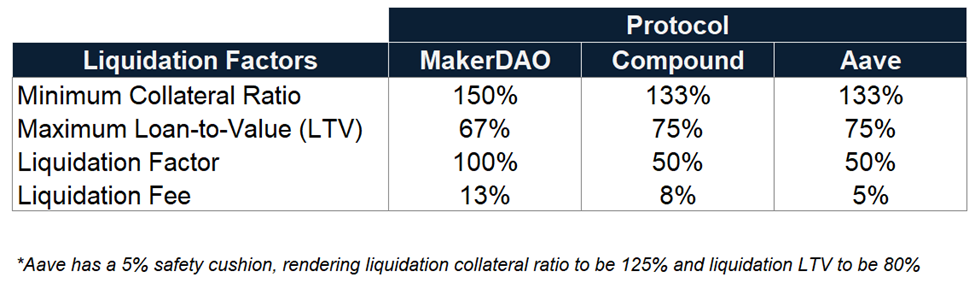

Riskier asset pools have higher minimum collateral ratios and vice versa. Most projects often have liquidation fees (typically 5 – 10%) that they use to incentivize bots to perform liquidations. These bots liquidate different levels of borrowers’ collateral depending on the liquidation factor, often voted through governance by token holders.

Figure: Liquidation Statistics for ETH Collateral Across Different Money Markets

Overcollateralized Loans

Due to the lack of centralized authorities to lend credence to debtors, only overcollateralized borrowing has found traction in the DeFi space so far. Coupled with the fact that most DeFi leverage is only used within DeFi, many have criticized projects in the DeFi space to be mere hypothecation upon rehypothecation, with only financial engineering as the end goal. In other words:

“Why would you need a loan if you have funds to collateralize the loan?”

Unfortunately, until DeFi projects can start to offer undercollateralized loans or the bridge between DeFi and real-world assets become more apparent, these critics have a point.

Some projects have begun to tackle these issues, however, with some degree of success. Third-party risk assessors have been popular amongst venture capitalists, with Maple Finance and Goldfinch raising meaningful rounds in 2021. Others such as LedgerScore and Wing Finance have turned to crypto-native credit score as a solution. Meanwhile Centrifuge and RealT are introducing loans partially collateralized by real world assets.

Collateralized Debt Positions (CDP) Stablecoins – MakerDao

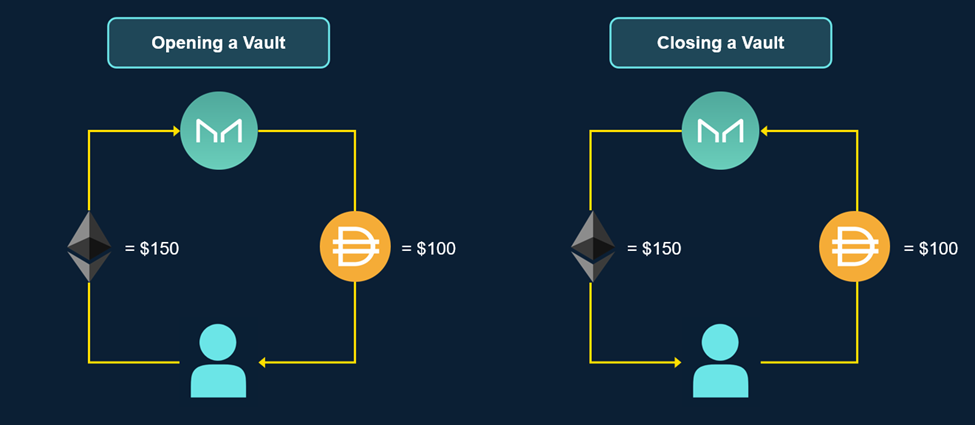

While overcollateralized borrowing markets have their shortcomings, they have also given rise to novel innovations in DeFi, one of which being Collateralized Debt Positions (CDP) stablecoins first implemented by MakerDAO. By locking in collateral in MakerDAO’s ‘vaults,’ users can mint the DAI stablecoin.

DAI is not backed 1:1 by USD or USD equivalents on a centralized balance sheet such as Tether’s USDT or Circle’s USDC. Instead, it relies on the collateral staked and liquidation mechanism to ensure that each DAI is backed by at least c.150% of other digital assets. Similar to other lending markets, when the collateral ratio of debt positions dip below 150%, collateral is liquidated to payback the DAI loan, ensuring that the aggregate DAI supply is overcollateralized.

Use Cases

Apart from CDP stablecoins, the advent of decentralized borrowing and lending markets serve distinct needs from various market participants. For those who have conviction in the future price of their digital asset portfolio but need cash flow to spend on real-world assets, these money markets present a viable source for this liquidity. Instead of selling their assets, users can borrow conservatively against them, eventually paying them off with fewer assets when prices appreciate.

Without DeFi in early 2017 for example, a Bitcoin hodler[3] would have had to part ways with 100 BTC for a $100,000 down payment for a house (assuming $1,000/BTC). If a borrowing market such as Compound had existed instead, the hodler could have collateralized 200 BTC to borrow 100,000 USDC (200% collateral ratio), paying a net interest of 1.51% APY[4]. By late 2017 when Bitcoin price hits $15,000, he would make good on his debt with only 6 BTC, keeping the remainder as profit.

Moreover, borrowing against your cryptocurrency does not trigger a taxable event. While there is no clear guidance on DeFi crypto lending taxes yet, collateralizing one’s assets in conventional markets to borrow does not constitute earning income or making a capital gain.

Most importantly, decentralized money markets allow market participants to hedge their portfolios or take short positions. To illustrate, one can deposit $75,000 of BTC and $50,000 of DAI as collateral. He then borrows $75,000 worth of BTC (167% collateral ratio) to sell for DAI, earning him a portfolio delta-neutral position without triggering a taxable event.

For the bears, the process is similar. They can deposit $125,000 worth of DAI as collateral, borrowing 1.5 BTC worth $75,000 (assuming $50,000/BTC) to sell for DAI. Once the market unwinds and the price of BTC falls to $40,000, bears only need to use $60,000 in DAI to repay the 1.5 BTC borrowed, netting the $15,000 as profit.

Last but not least, borrowing markets enable degen risk-taking activity. In reflexive bull markets, market participants can significantly magnify returns using leverage. Collateralizing long positions, they can then use proceeds to place further bids, with the strategy dubbed ‘longing your longs’ in the space.

Bottom Line

When used responsibly, decentralized borrowing and lending markets are financial tools that can help investors better navigate the different market cycles in crypto. While the current state of money markets may seem like mere wrappers of hypothecation with no actual use case, developments on the side of undercollateralized loans and connection to real-world assets will abate this.

[1] dApp refers to decentralized application.

[2] APY refers to Annual Percentage Yield, the real rate of return earned on an investment after taking into account the effect of compounding interest.

[3] HODL is a term derived from a misspelling of “hold,” in the context of buying and holding Bitcoin and other cryptocurrencies. It’s also commonly come to stand for “hold on for dear life” among crypto investors.

[4] APY figures sourced from Compound as of 3/4/22.