Private Market Remains Hot

November Recap

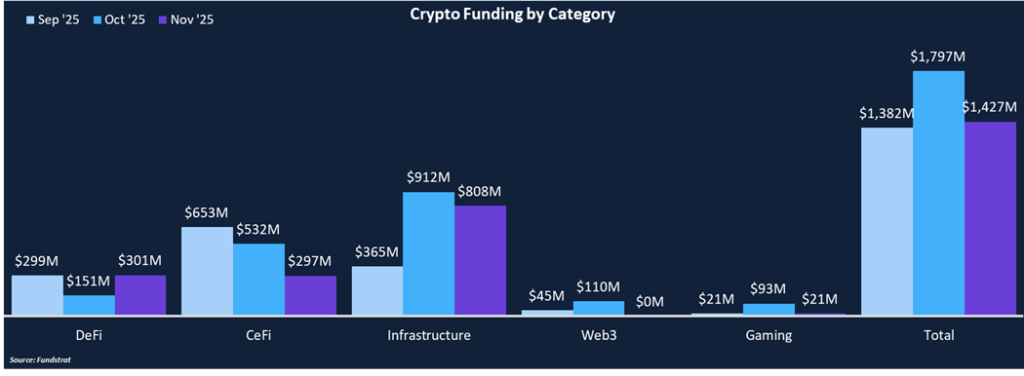

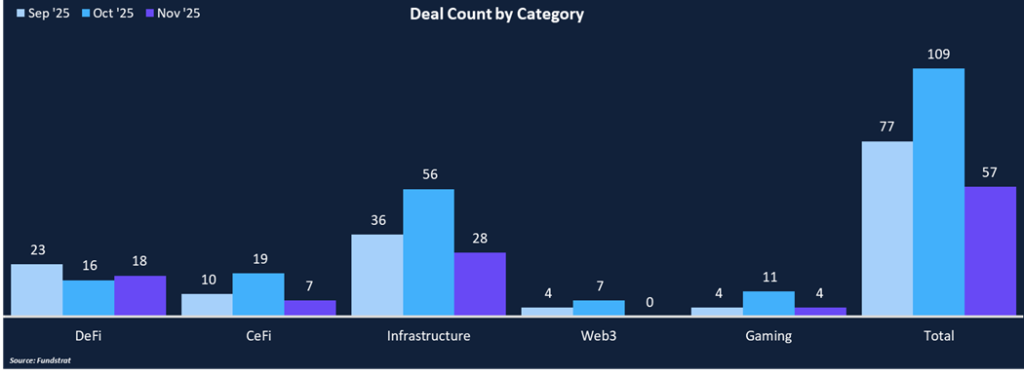

Despite liquid token prices suffering steep drawdowns over the past two months, the private market has remained extremely strong. There was a total of $1.4 billion in funding across 57 deals in November. This was the third consecutive month with more than $1 billion in funding, marking the longest monthly streak since Q1 2023. In addition to funding totals increasing, there has been a notable rise in valuations. November saw multiple companies raise at multi-billion-dollar valuations, including Revolut at $75 billion, Ripple Labs at $40 billion, Kraken at $20 billion, and Lighter (DotM) at $1.5 billion.

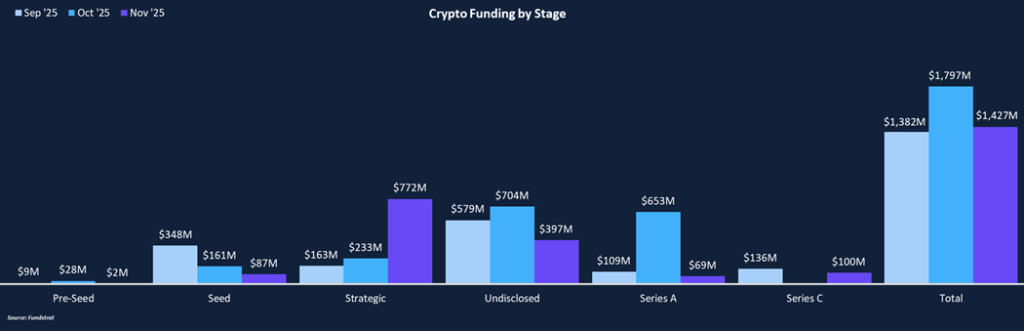

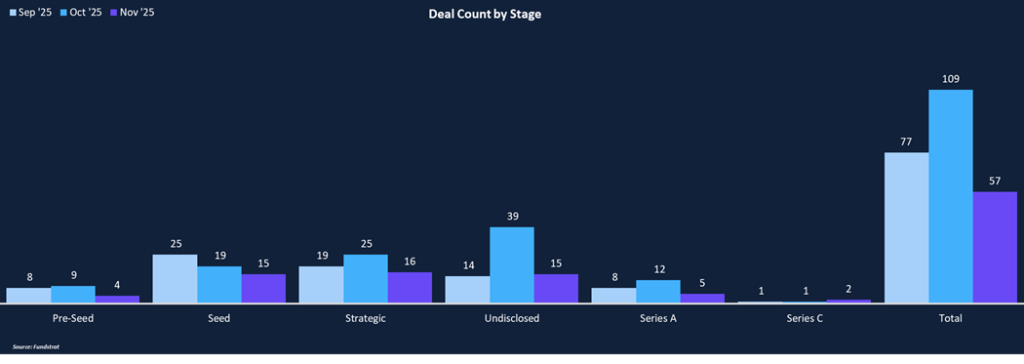

Funding was concentrated in Infrastructure companies, which comprised 57% of total funding and 49% of total deal count. The majority of the remainder was allocated to CeFi and DeFi companies, which both accumulated approximately $300 million in funding. There was a number of large Strategic rounds throughout November, which was the leading deal stage from both a funding and count perspective, totaling $772 million across 16 deals. While Series C rounds are still relatively rare in crypto, November was also the third consecutive month in which companies raised later-stage funds. There have been eight Series C rounds in 2025 compared to just two in 2024.

Funding by Category

Funding by Stage

Deal of the Month

Lighter, a zk-rollup and perp DEX, raised $68 Million in an undisclosed round from Ribbit Capital, Founders fund, Haun Ventures, and Robinhood Markets. The fresh funding will be used to develop new derivative products across asset classes, expand across chains, and fund its institutional product offering. The funding round values Lighter at $1.5 billion ahead of its TGE, which is expected sometime this month.

Why is This Deal of the Month?

Perp DEXs have been a popular topic over the past few months, with activity increasing across the sector and new names competing for market share. Lighter has been a major winner in the sector throughout 2025. Lighter is an application-specific zk-rollup optimized for Ethereum L2 trading. It’s currently capable of processing thousands of order operations per second, maintaining only a few milliseconds of latency for traders and enabling high-frequency trading. Lighter’s highly optimized infrastructure has enabled them to eliminate exchange and transaction fees for users, thereby enhancing the trading experience compared to their competitors. As an “app-chain,” Lighter moves order book computation off Ethereum and leverages ZK snarks and other optimized data structures while maintaining Ethereum’s base layer security and decentralization. Users can trade perps on crypto, equities, and commodities all on the same exchange. They have recently added spot trading, with support for Ethereum initially, and more assets to follow.

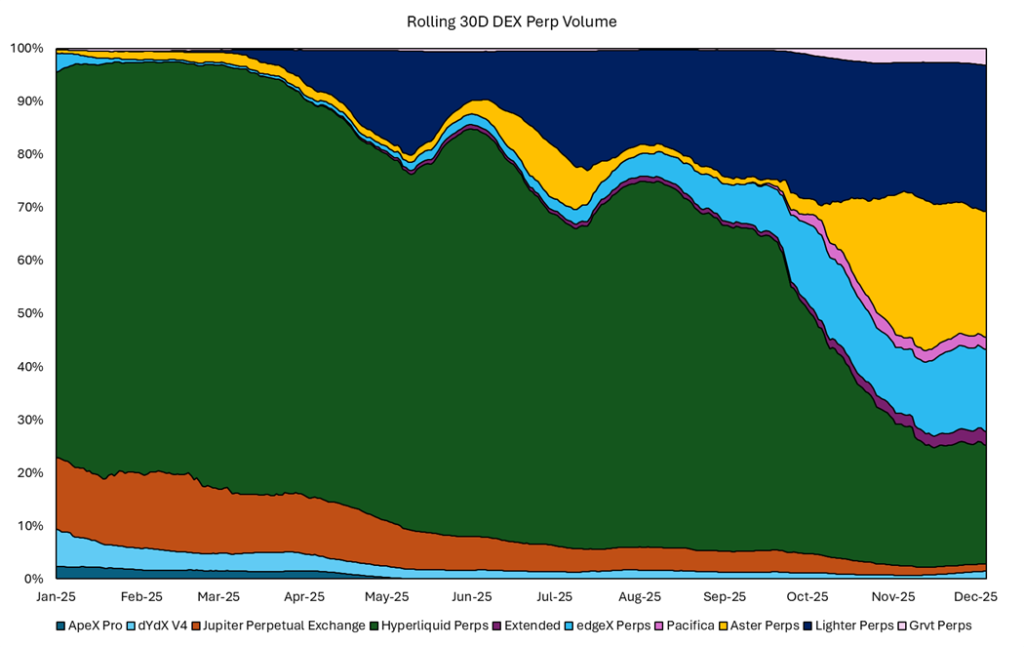

The improvement of zero-fee trading, support for multiple asset classes, being Ethereum-native, and users preparing for a Lighter TGE have helped Lighter gain perps market share throughout 2025. Lighter has taken the top spot in 30D perp volume, with more than $290 billion traded. Its market share has grown steadily throughout 2025, eating into Hyperliquid’s lead along with Aster and EdgeX. It’ll be interesting to monitor whether there is a drop-off in Lighter’s volume following the airdrop to determine whether it has been driven by mercenary capital or whether their zero-fee model is truly disrupting the sector.

Selected Deals

Numerai, an AI hedge fund, raised $30 million in a Series C round from leading university endowment funds, Union Square Ventures, Shine Capital, and Paul Tudor Jones. The Series C round values the company at $500 million. The funding round comes on the heels of two other recent achievements: securing up to $500 million in capacity from JP Morgan and recently purchasing 1 million worth of NMR on the open market. Numerai hosts a “Tournament,” which is essentially a data science competition where users can submit their machine learning models predicting stock market moves. Numerai provides high-quality data for users to train their models, ensuring consistent and accurate training sets. Numerai then tracks model prediction performance over the next month and allows users to stake NMR on their model for the chance to earn performance fees. Similarly, users can leverage their own data sets for stock or crypto signals and compete against other users. Numerai’s AUM has grown from $60 million to $550 million in the past three years. In 2024, their Meta Model (stocks) delivered a net return of 25.5% with a single down month. With new equity capital and JP Morgan’s financing line, Numerai is well-positioned to grow the fund to over $1 billion in AUM.

Lava, a Bitcoin lending and borrowing app, raised $200 million in an undisclosed round from Anthony Pompliano and Eric Jackson. Previous investors include Founders Fund, Susquehanna, and Khosla Ventures. Lava allows users to instantly borrow dollars against their Bitcoin holdings at fixed rates. There is no loan underwriting or documentation needed, and users can borrow without restrictions. Borrowed dollars can be instantly withdrawn to bank accounts, and users can customize loan terms and repayment plans. Beyond borrowing, users can purchase Bitcoin with zero fees, access 5% yield on dollars, and earn 5% cashback (in BTC) via the Lava Card. No assets on the Lava platform are rehypothecated or lent out. Lava also boasts institutional-grade security, featuring multi-party approvals, biometric security, withdrawal safeguards, and the elimination of single points of failure.

Commonware, a blockchain software company, raised $25 million in a strategic round led by Tempo, the Stripe and Paradigm-incubated L1. This is Tempo’s first venture investment, involving the development team adopting the Commonware Library and becoming a core contributor to its ongoing development. Commonware is building what they call an anti-framework, which is a blockchain development solution that doesn’t designate specific layers or security assumptions. Its libraries can be used to build any type of blockchain framework, with everything being fully modular and interoperable. Commonware doesn’t believe blockchains are a one-size-fits-all solution, and the ability to customize and specialize for unique use cases is essential to providing the next wave of adoption. Tempo falls into this category as it is focused on building a payments-specific blockchain that has unique needs compared to a general-purpose chain. The funding will be used to accelerate Commonware’s development and expansion of its solution library.