Digital Assets Weekly: June 23rd

Market Analysis

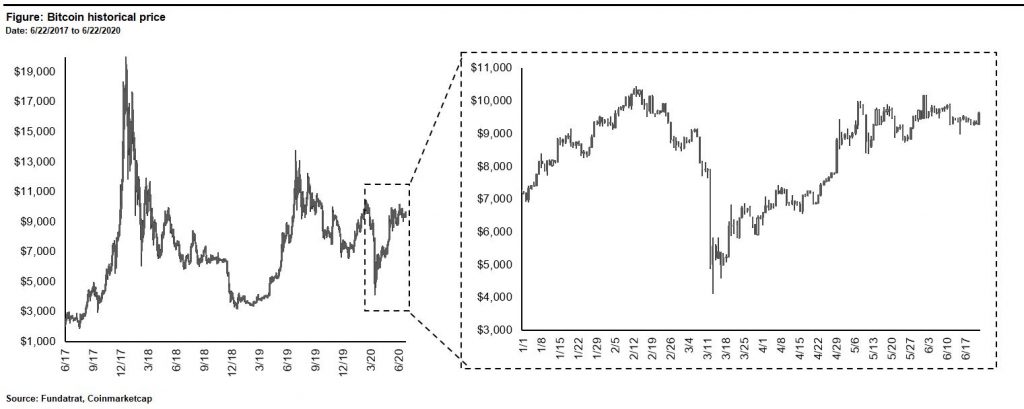

Closing at $9,304 on Tuesday evening, Bitcoin remains firmly within its $9,000 – $10,000 trading range that has persisted since the May halving. Heading into the back half of the week, all eyes are on the options market as an estimated $930M worth of bitcoin options, accounting for about 70% of total open interest are set to expire on June 26th.

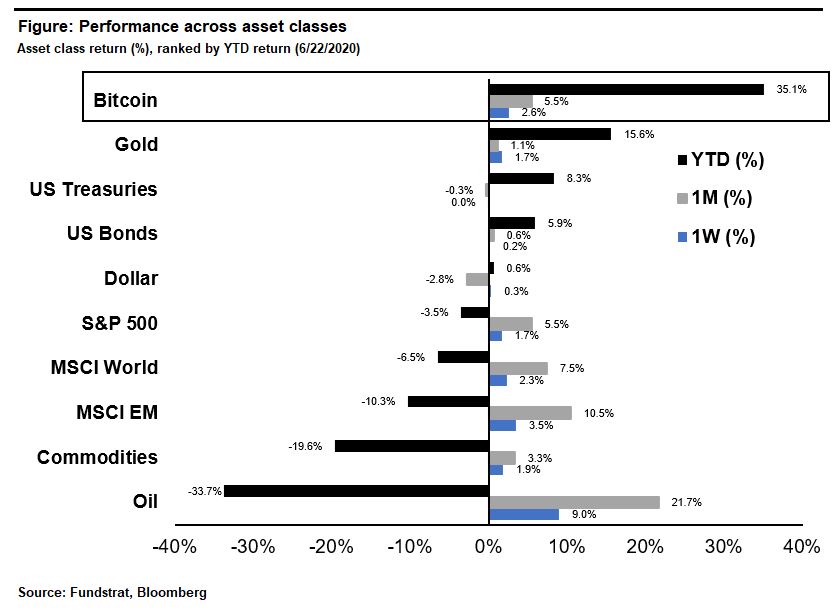

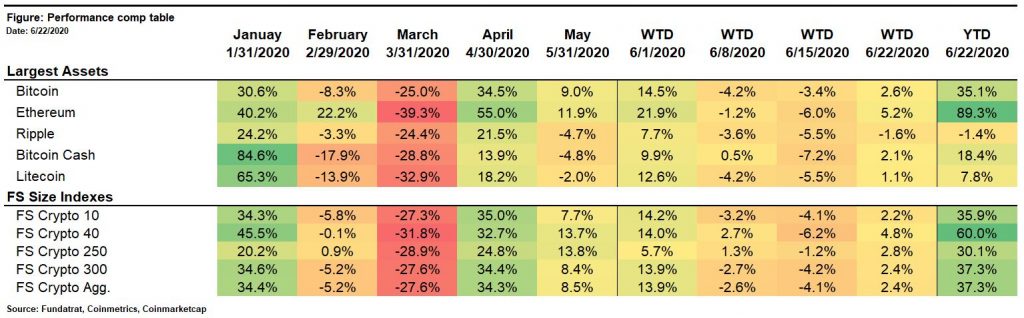

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

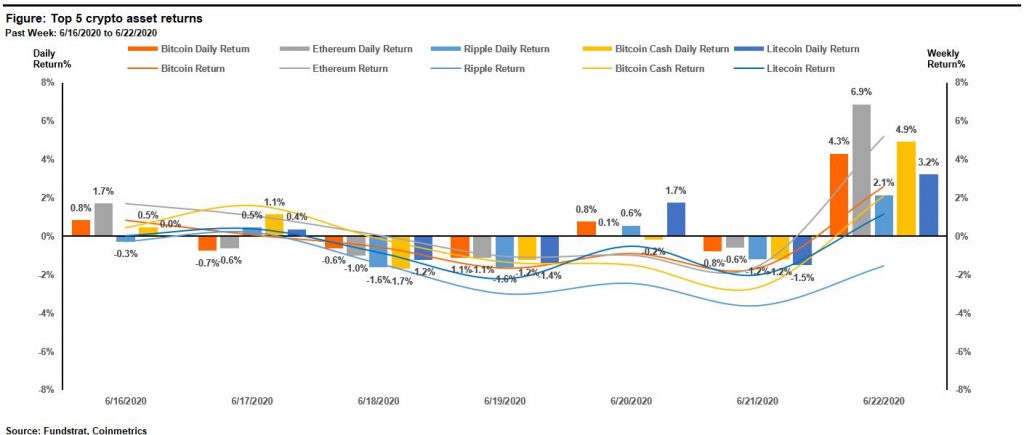

Ethereum led all major crypto assets over the past week by ~3% and finished the week up 5.2%.

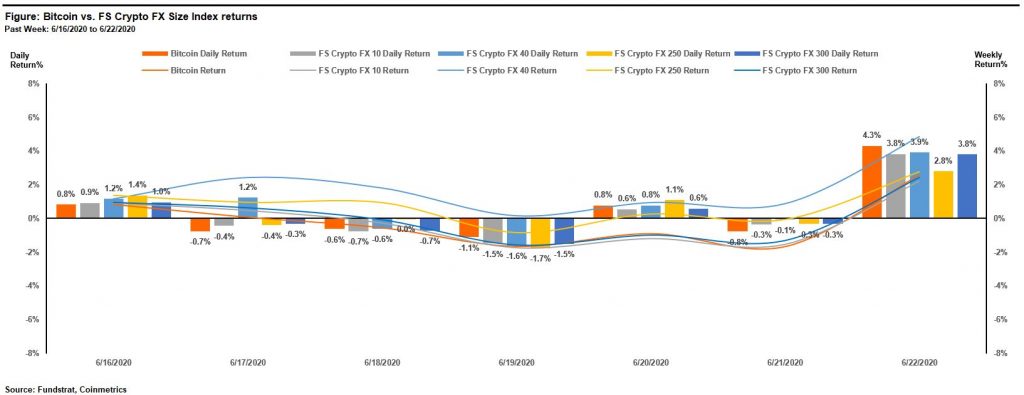

FS Crypto FX 40 was the best performing index last week, finishing the week up 4.8% and outperforming all other indices by ~2%. Major contributors to this outperformance were Chainlink (+14%), Cypto.com Coin (+12.2%) and Ontology (+18.9%).

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

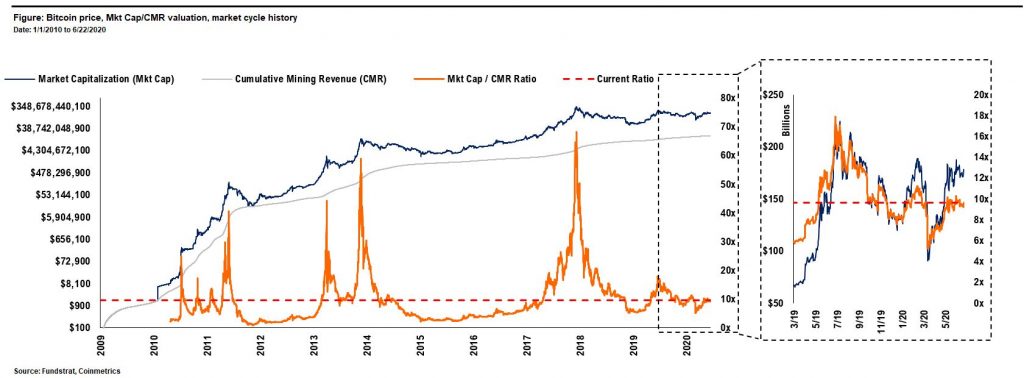

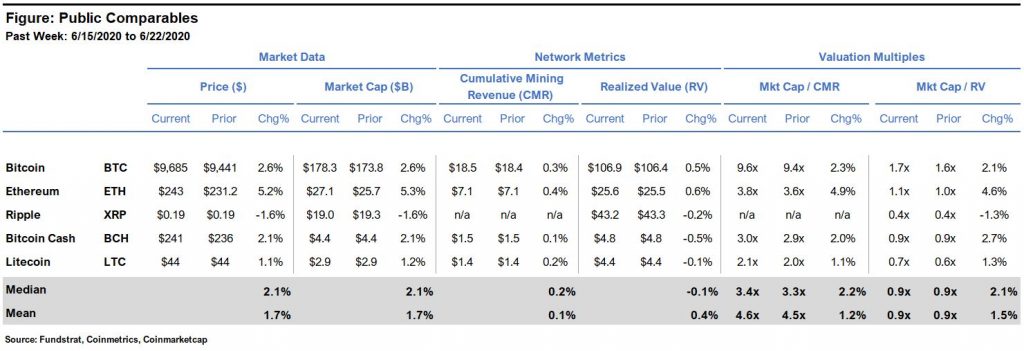

Bitcoin’s P/CMR valuation stood at 9.6x as of 6/22 vs 9.4x as of last week. This value remains slightly below the levels from Mar-19 through present.

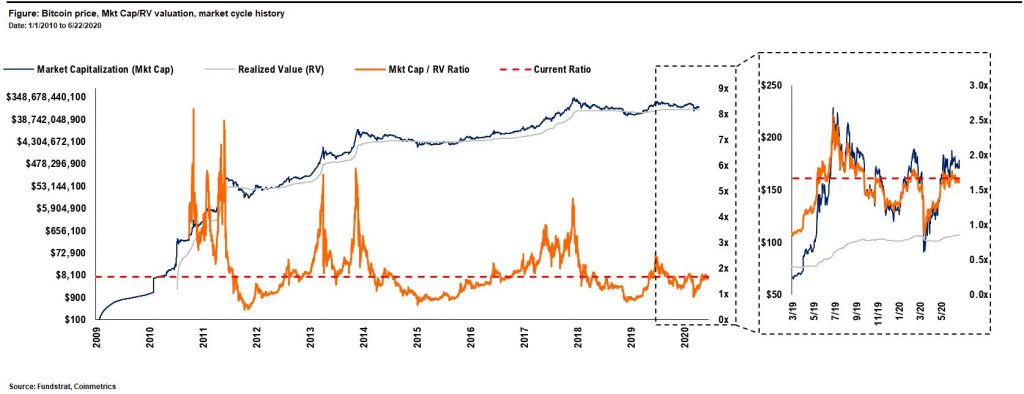

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.7x as of 6/22 vs 1.6x last week.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

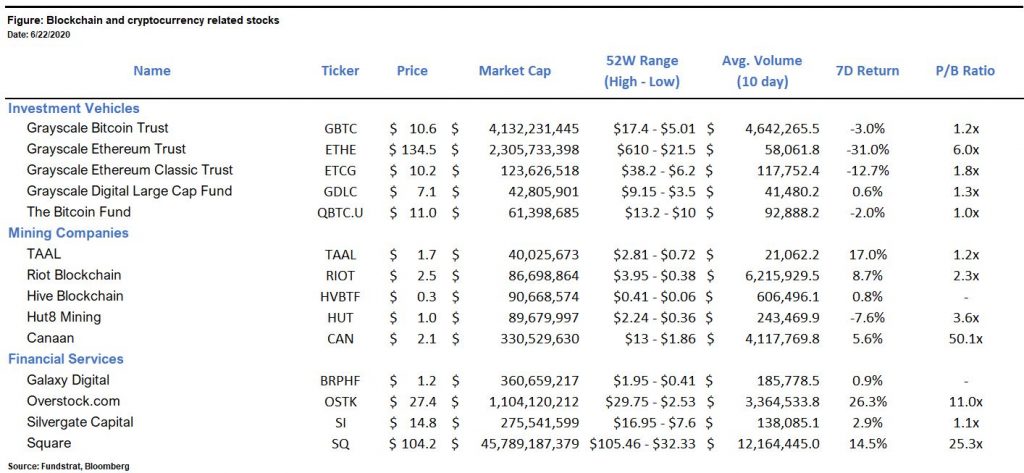

Blockchain & Crypto Stocks

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Grayscale Ethereum Trust (OTCX: ETHE): Shares of Grayscale’s Ethereum Trust (ETHE) were down 31% over the last 7 days as the asset’s premium to NAV dropped from ~800% as of last Tuesday to ~500% on Tuesday 6/22 and has further fallen to about ~415% at present. Ethereum (ETH) was up 5.2% over the week.

Portfolio Strategy

Investment Themes

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

| Source: Fundstrat |

Winners & Losers

Winner: PayPal? – According to industry sources provided by CoinDesk, PayPal and Venmo are adding support for direct exchange of cryptocurrencies with built-in wallet functionality on their platforms. While the news has yet to be confirmed by the Company, the addition of support for crypto by PayPal would be a massive development and could bring crypto to the company’s 325M+ active users.

Loser: Wirecard – Following a slew of accounting fraud allegations, Wirecard, a German based crypto debit card provider confirmed that ~$2.1B of its reported cash balances are missing. While the company is blaming the misstatement on cash balances provided by a third party, CEO Markus Braun was arrested on Monday night on suspicion of fraud. Shares of the company’s stock fell as much as 63% on Thursday after news of the missing billions broke out.

Financing & M&A Activity

SYNQ – The Thailand based parent company of OMG Network (formerly Omisego) — a layer-2 Ethereum scaling solution raised $80 million in Series C funding. The round was led by SCB10X, the venture arm of Thailand’s Siam Commercial Bank and Mirai Creation Fund II of Japanese asset manager SPARX Group. With the fresh capital in place, Thailand-based SYNQA plans to strengthen its payment platform, Omise, to help Asian merchants go cashless in a world post-COVID-19. Participating investors in the round include Toyota Financial Services Corporation, Sumitomo Mitsui Banking Corporation, among others.

River Financial – The San Francisco based bitcoin brokerage company raised $5.7M in a seed round with participation from Polychain Capital, Slow Ventures, Castle Island Ventures, and others. River Financial’s services are available in 15 states, and Co-Founder Alex Leishman expects to be in 40 states by the end of the year, with a goal to enter New York in early 2021.

Sparrow – The Singapore based options trading platform raised $3.5M in a Series A lead by HDR Group, the parent company of BitMEX and had participation from Singum Capital, Du Capital and Finlab EOS VC.

Unum ID – The San Francisco based digital identity company announced a $2M Seed round led by Draper Associates with participation from TappanHill Ventures, Wedbush Ventures, Hard Yaka, and several angel investors. The Seed round comes on top of backing the company received from Samsung NEXT and EOS VC earlier this year.

Opyn – Opyn, an Ethereum-based options issuance platform, has raised a $2.16 million funding round led by Dragonfly Capital. The financing drew support from 1kx, A. Capital, Version One Ventures, Uncorrelated Ventures, Balaji Srinivasan, Robert Leshner and others.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 5

- Robert Sluymer: Crypto Technical Analysis: BTC remains range bound as select Alts showing signs of bottoming

- David Grider: Digital Assets Weekly: June 16th 2020