Digital Assets Weekly: June 16th 2020

Market Analysis

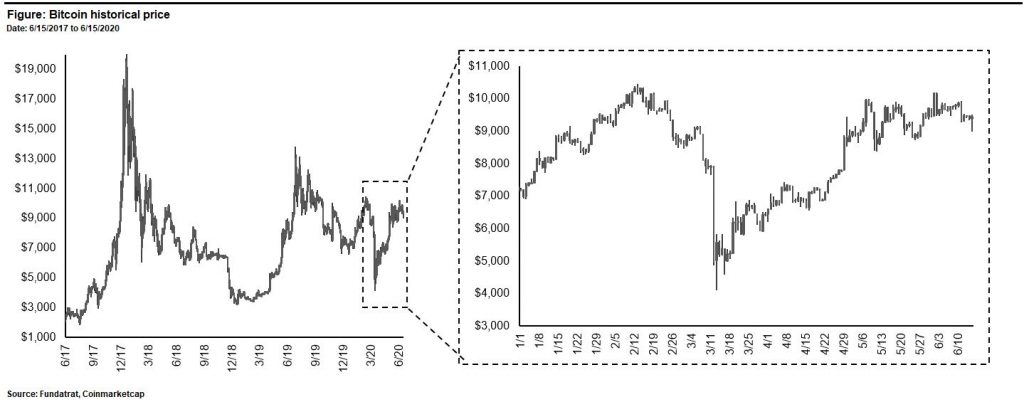

Following a brief dip below $9,000 on Monday, Bitcoin rallied in line with other major markets to close the day at $9,450.

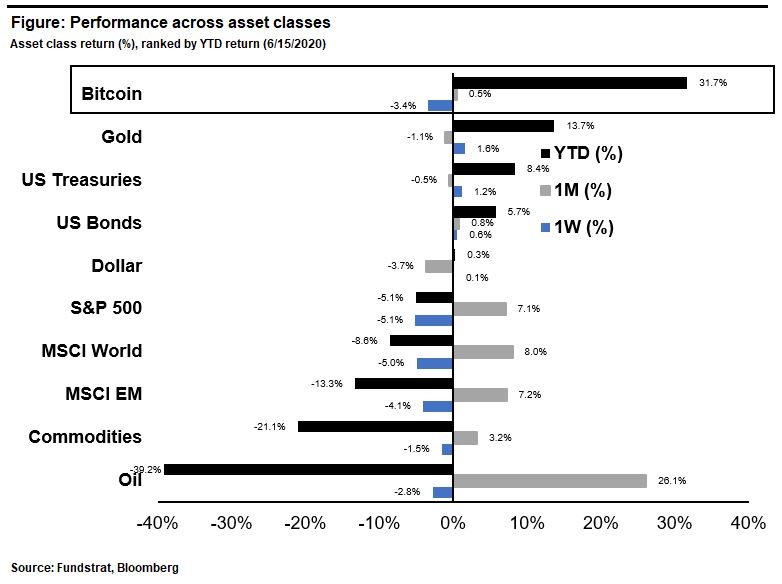

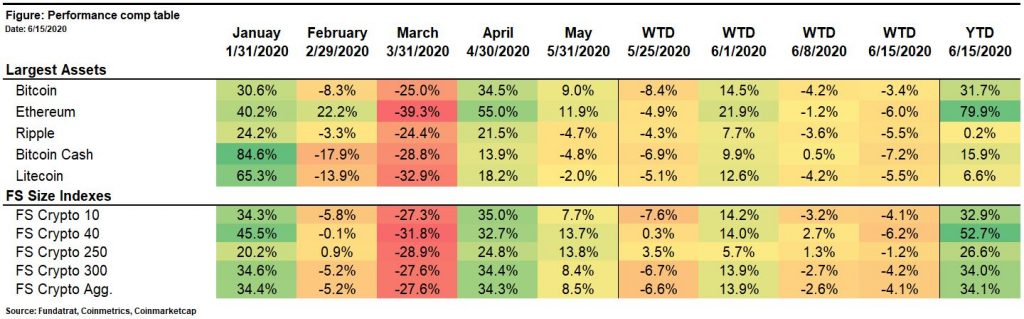

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

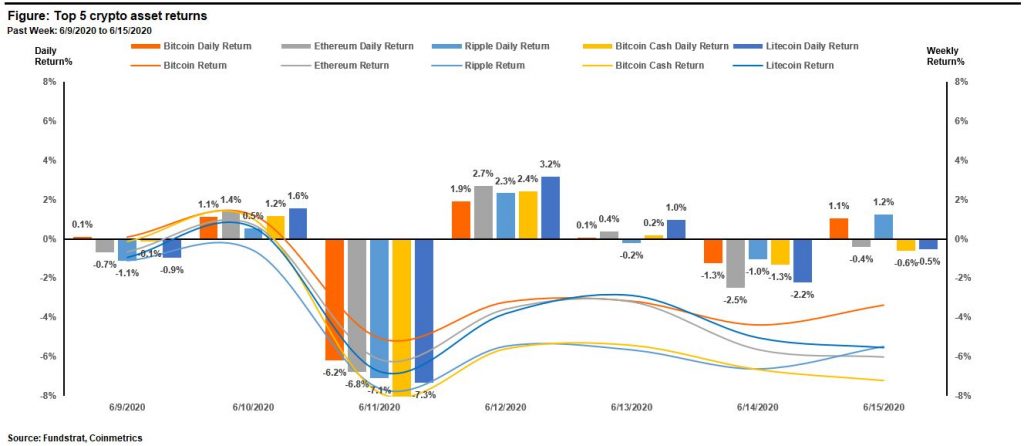

Bitcoin led all other major crypto assets over the past week by 2% – 3%.

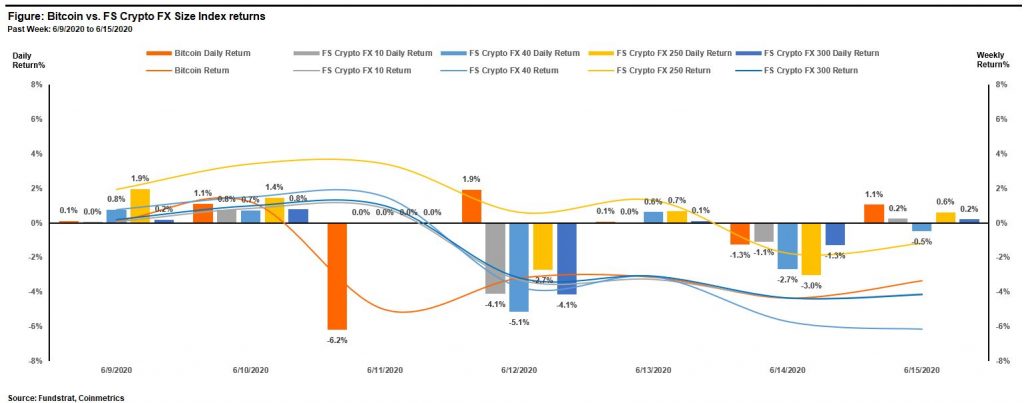

FS Crypto FX 250 was the best performing index last week, finishing the week down 1.2%. All other size-based indices lagged Bitcoin.

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

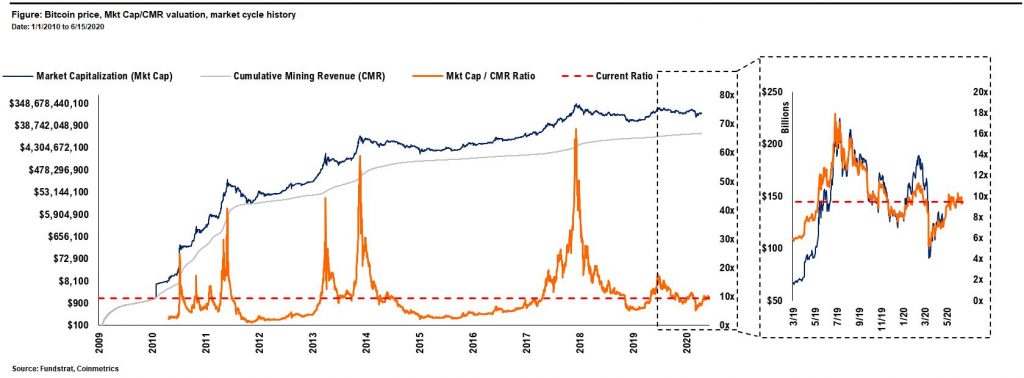

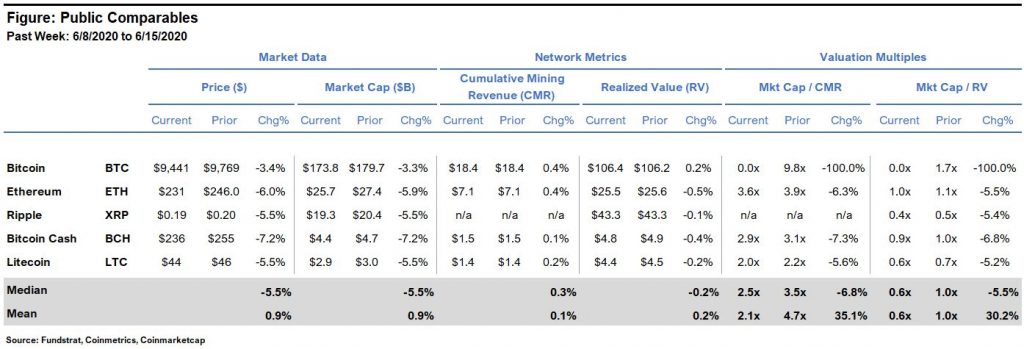

Bitcoin’s P/CMR valuation stood at 9.4x as of 6/15 vs 9.8x as of last week. This value remains slightly below the levels from Mar-19 through present.

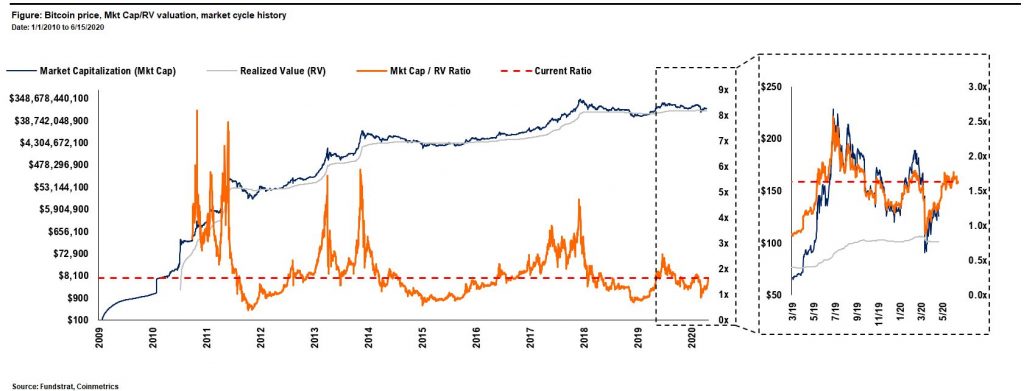

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.6x as of 6/2 vs 1.7x last week.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

Blockchain & Crypto Stocks

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Canaan (NASDAQ: CAN): Shares of Canaan plummeted below $2 on Monday 6/15, marking the all-time low since the Company went public in November. Since Bitcoin’s halving on 5/11 shares are down 63.2% as the company has seen soft demand for new equipment and COVID-19 related logistics disruptions in Q1 ’20.

Overstock (NASDAQ: OSTK): Shares of Overstock.com were flat on the on the week. Company management reported that the tZero security platform achieved record trading volume in May. Approximately 400K digital securities (+400% YoY) were transacted on the platform during the month.

Riot (NASDAQ: RIOT): Riot Blockchain announced that it produced 71 newly mined bitcoins in May compared with 108 BTCs in April primarily attributable to Bitcoin’s block reward halving. Shares fell about 4% in pre-market trading on Thursday on the news.

Portfolio Strategy

Investment Themes

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

| Source: Fundstrat |

Winners & Losers

Winner: JP Morgan Analysts – In a note obtained by CoinDesk, a team of strategists from JP Morgan outlined a generally positive take on Bitcoin and other crypto currencies. The report highlighted resilient market structure, and sharp rebounds in liquidity in the face of March volatility as positive developments for the asset.

Loser: Quadriga Customers – The Ontario Securities Commission (OSC) released a report claiming that Gerald Cotten, the late founder of the now bankrupt crypto exchange Quadriga, was engaged in fraudulent trading. The OSC attributed about $115M of a total $169M of lost customer funds to Cotten’s trading. While the agency noted that it would likely have pursued an enforcement action against Cotton and Quadriga, the death of the founder and the bankruptcy of the exchange were cited as reasons to not pursue action.

Financing & M&A Activity

Celsius Network– The New York based crypto lending platform has raised $10.5M of a planned $15M raise in a token sale at a $120M valuation. The sale is being conducted through the BnkToTheFuture platform which aims to allow smaller investors and CEL token holders to participate in the offering with investments as small as $1,000.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 5

- Robert Sluymer: Crypto Technical Analysis: Crypto break-outs pending? Tight consolidations look bullish

- Ken Xuan: Crypto Quant: Benchmark Crypto Indices Weekly Performance Review

- David Grider: Digital Assets Weekly: June 9th, 2020