Digital Assets Weekly: July 8th

Market Analysis

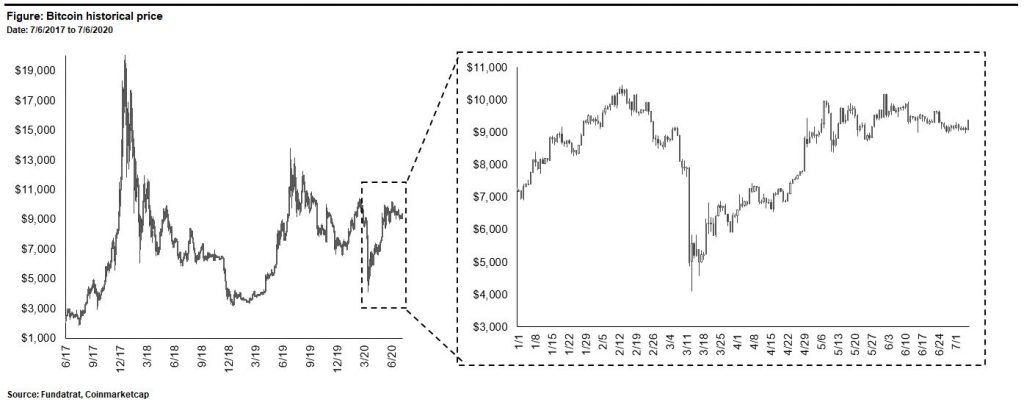

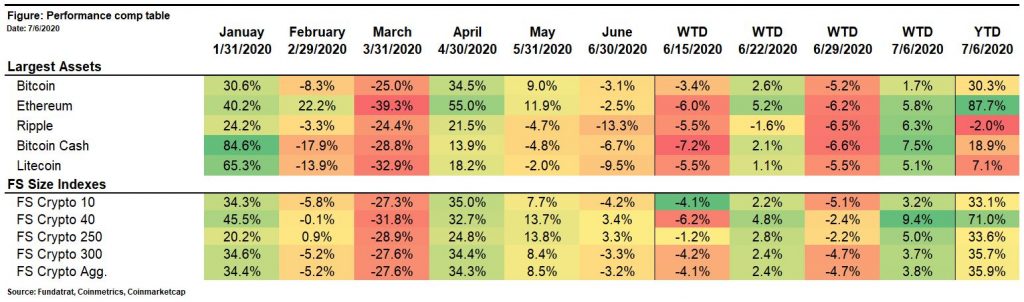

After briefly falling below its persistent $9,000 support level on Sunday, Bitcoin finished the 7 days ending 7/6 at $9,375; up 1.7% on the week. Volatility over the past 7 days has been exceptionally low with Bitcoin trading between a low of $8,977 and a high of $9,375.

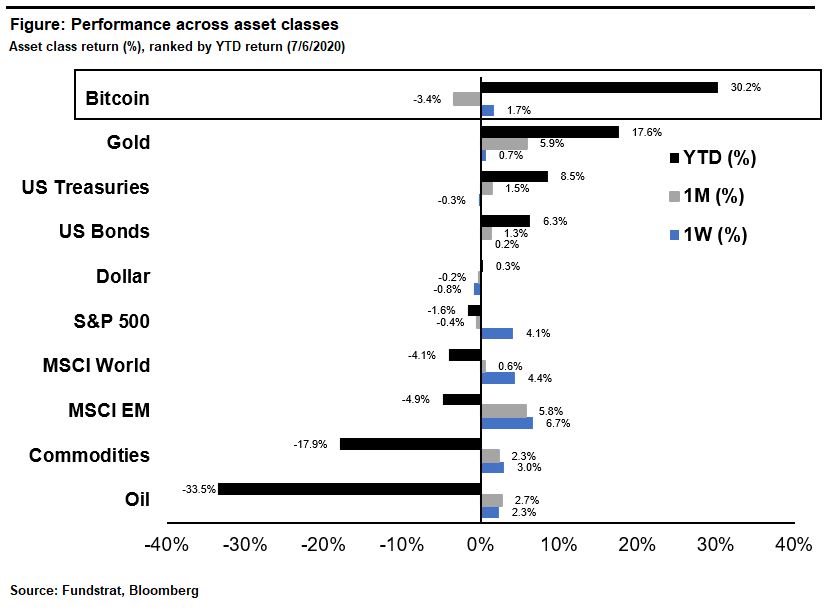

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

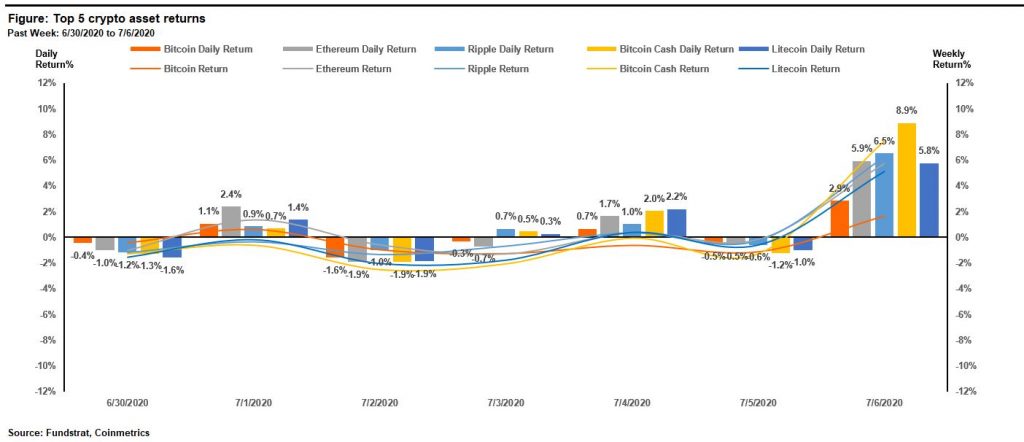

Bitcoin Cash led all other major crypto assets this week by 3% – 6% with a 7.5% return on the week.

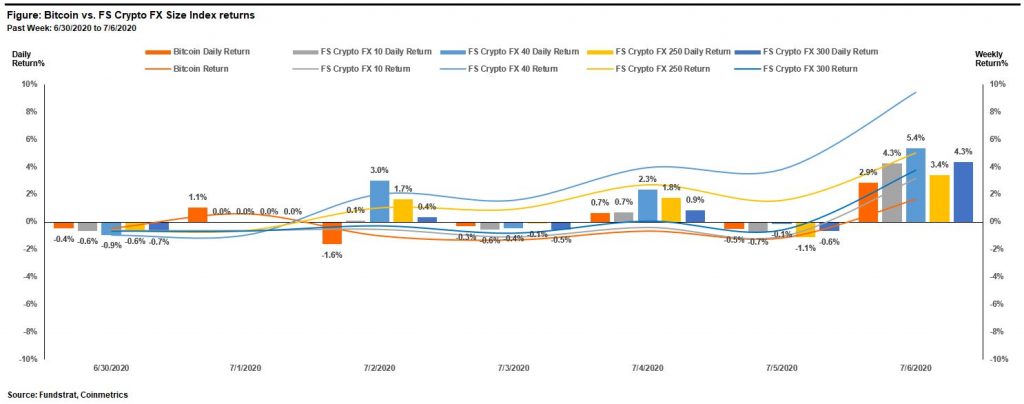

FS Crypto FX 40 was the best performing index last week gaining 9.4% and outperforming all other size-based indices by 4% – 6%. Major contributors to the FS Crypto FX 40 index outperformance were Cardano (+26%), Chainlink (+16%) and Iota (+15%)

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

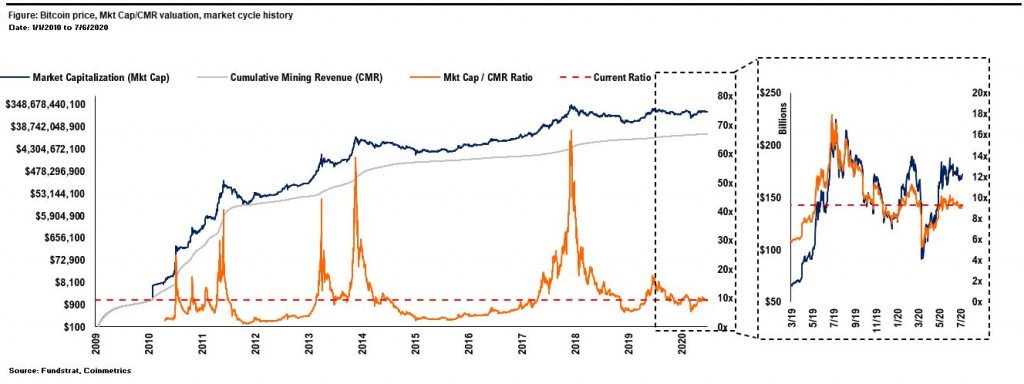

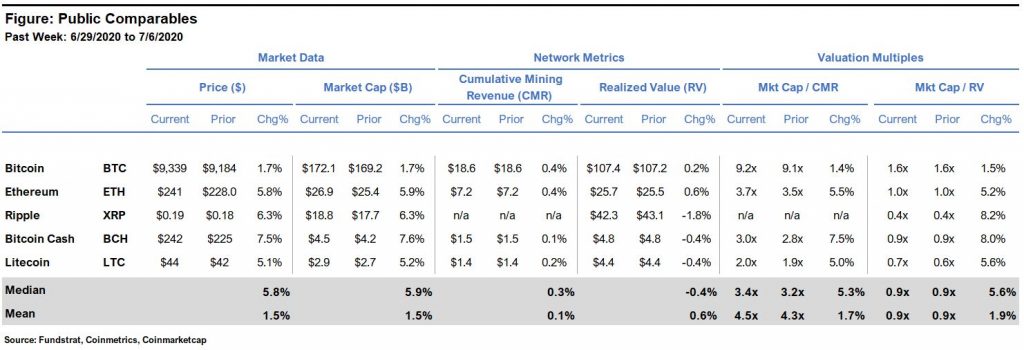

Bitcoin’s P/CMR valuation stood at 9.2x as of 7/6 vs 9.1x as of last week. This value remains slightly below the levels from Mar-19 through present.

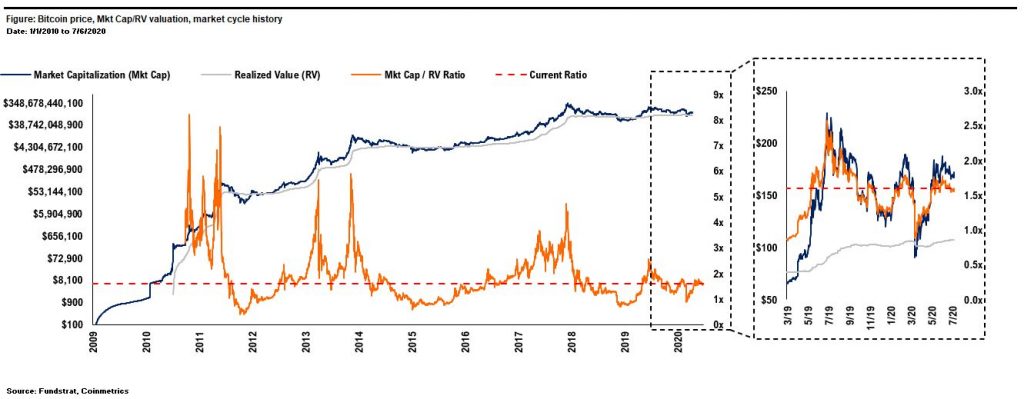

Bitcoin’s market cap to realized value (MV/RV) multiple was unchanged week over week at 1.6x.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investor’s incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

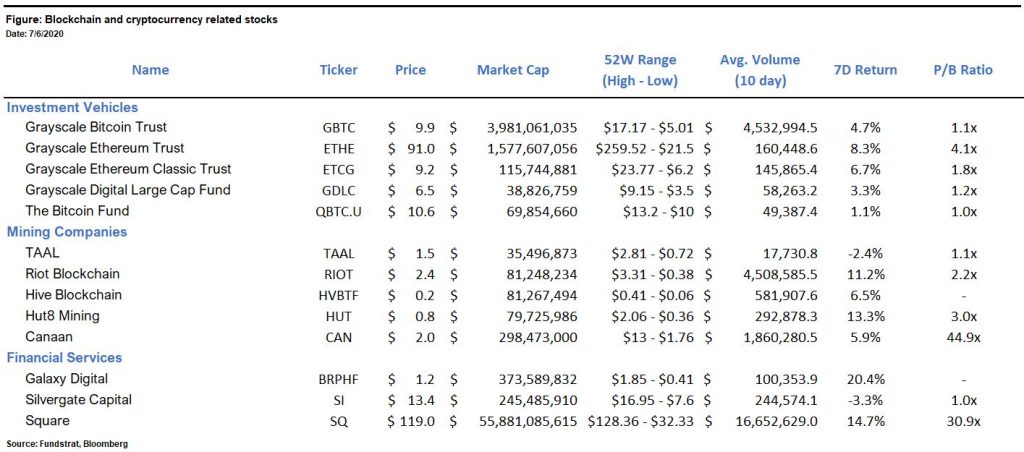

Blockchain & Crypto Stocks

The table above shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Portfolio Strategy

Investment Themes

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

| Source: Fundstrat |

Winners & Losers

Winner: Cardano (ADA) – Input-Output (IOHK), the blockchain engineering company behind Cardano, announced that deployment of the first “Shelley” upgraded node was completed on June 30th. As soon as August this year, delegation and staking are expected to be live on the platform’s mainnet. ADA is up 25% on the week.

Loser: PPP Bailout Loan Recipients – An estimated 75 companies in the blockchain and cryptocurrency industry collected $30M in PPP loans from the US government. Some of the money could have been put to good work and stemmed layoffs. But, there is an undeniable irony given the industry’s roots in the libertarian-leaning cypherpunk movement and many participant’s disdain for money printing (money printer go brrr” meme).

Financing & M&A Activity

NYDIG – New York Digital Investment Group, the New York-based crypto asset management firm, recently announced that is has raised $190M from 23 investors for a Bitcoin fund. The close makes the fund manager one of the largest institutional players in the market.

B2C2 – The London-based institutional trading firm announced that SBI Financial Services has agreed to acquire a $30 million minority stake in the firm. B2C2 will become SBI’s main liquidity provider as SBI expands its crypto offering to its millions of existing customers.

Curve – The New York-based crypto custody infrastructure provider raised $23 million in a Series A led by CommerzVentures with participation from Coinbase Ventures, Digital Currency Group, Team8, and Digital Garage Lab Fund. In February 2019, the Company raised $6.5 million in a seed round and with the latest fundraise, has raised about $30 million total.

Chainalysis – The New York based blockchain analytics firm has raised $13M in an extended Series B funding round with participation from Ribbit Capital and Sound Ventures. The fresh capital comes on top of a $36M Series B round in 2019 which saw participation from Mitsubishi Financial Group Innovation Partners, Sozo Ventures, Accel and others. To date, the Company has raised $66M and is valued at $266M according to estimates from Pitchbook.

Wintermute – The London-based crypto market maker raised $2.8M in a Series A led by Lightspeed Venture Partners. The funding comes on top of a “seven-figure” seed round in early 2020 led by Blockchain.com Ventures with participation from FBG Capital.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 5

- Robert Sluymer: Crypto Technical Analysis: Crypto sells off with risk assets but is holding above first key support

- David Grider: Digital Assets Weekly: June 30th