Digital Assets Weekly: July 15th

Market Analysis

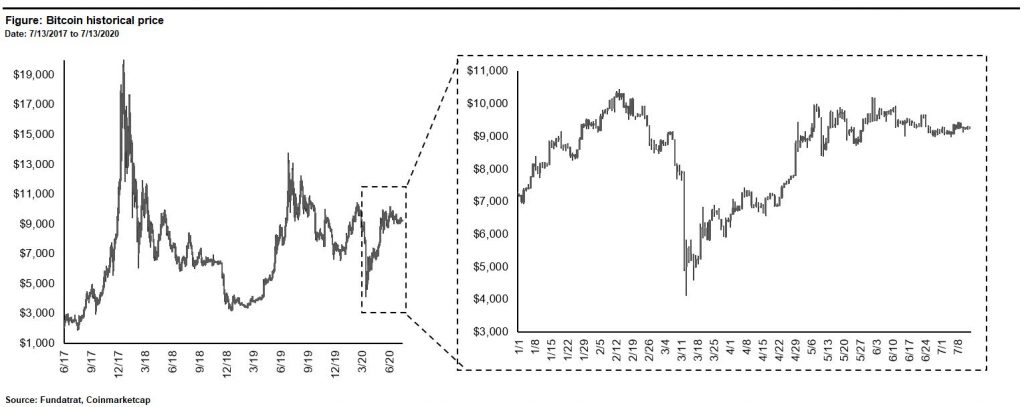

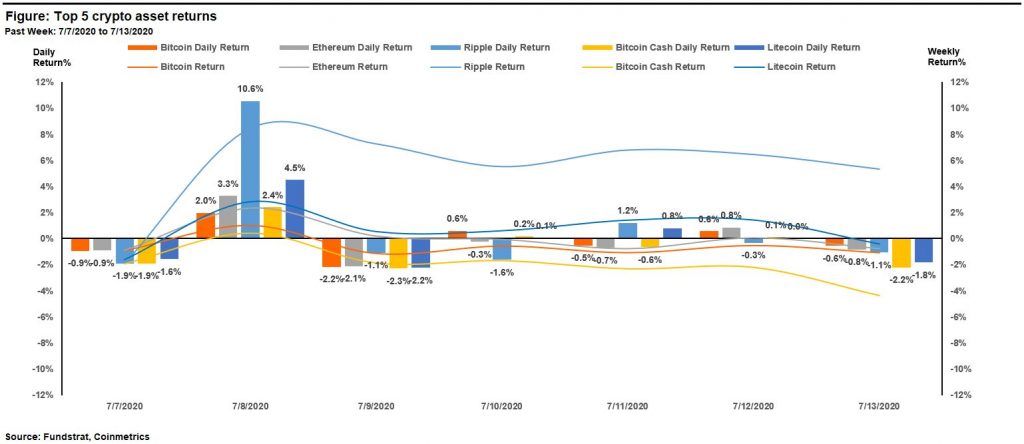

It was another quiet week with limited price action as BTC traded between a tight range of $9,118 and $9,450. The asset finished the 7 days ended 7/13 at $9,277; down 1.4% over the period.

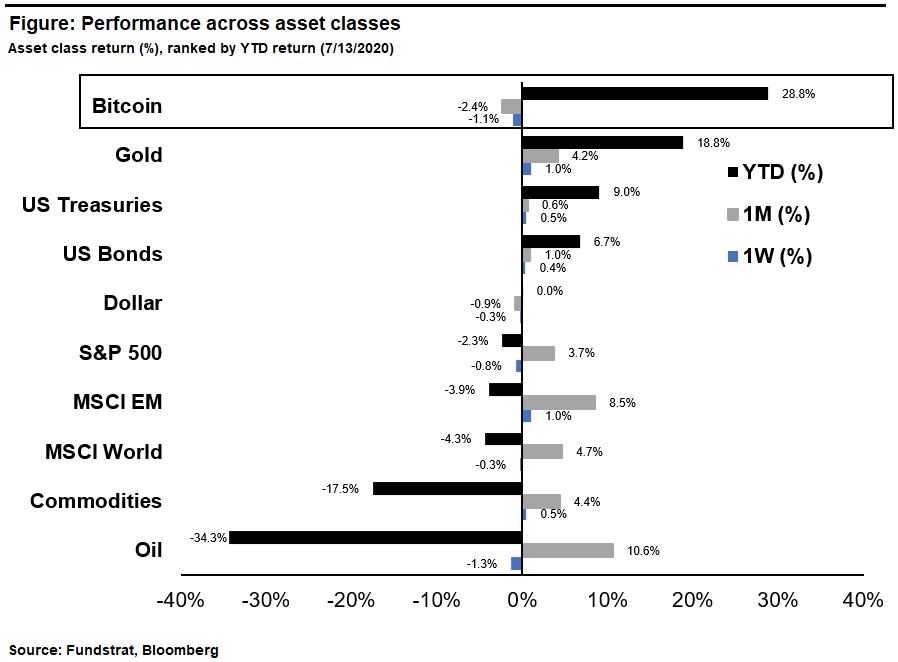

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

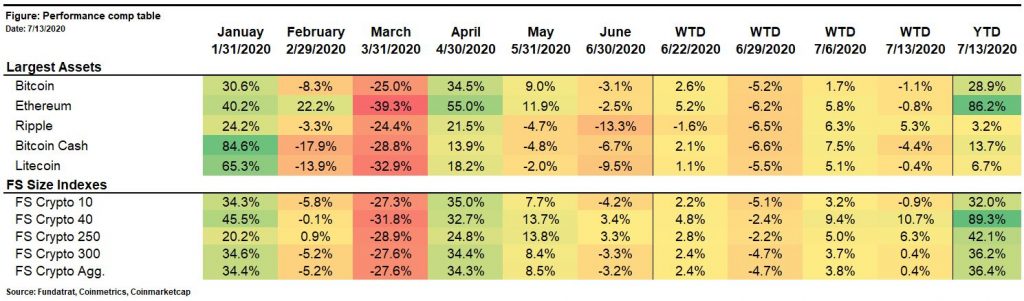

Ripple (XRP) led all other major crypto assets by 6% – 10% this week and was up 5.5% on the week.

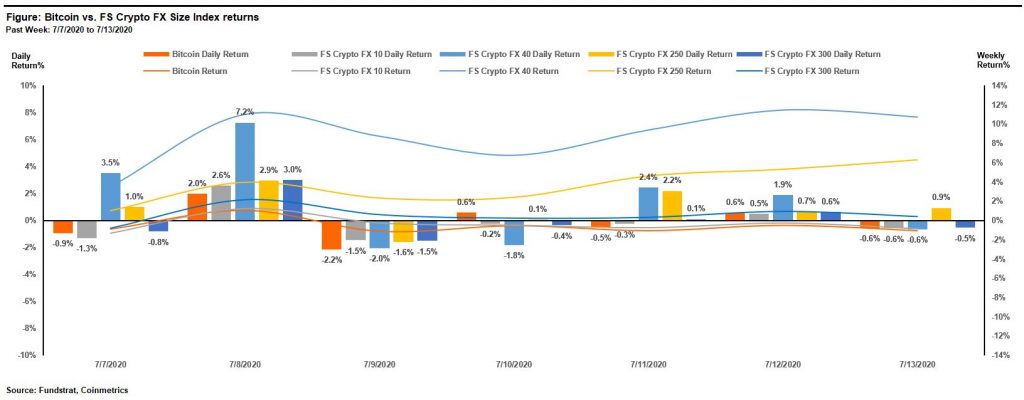

FS Crypto FX 40 was the best performing index last week and outperformed Bitcoin by 12%. Major contributors to the FS Crypto FX 40 index outperformance were Chainlink (+33%) and Cardano (+18%). FS Crypto FX 250 also posted a strong 6.3% gain this week with outperformance driven by Bytom (+46%), Holo (+26%) and Siacoin (+13%).

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

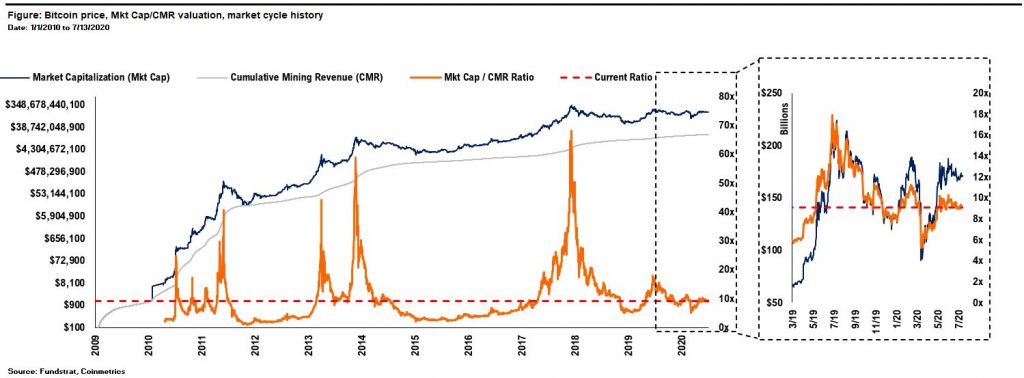

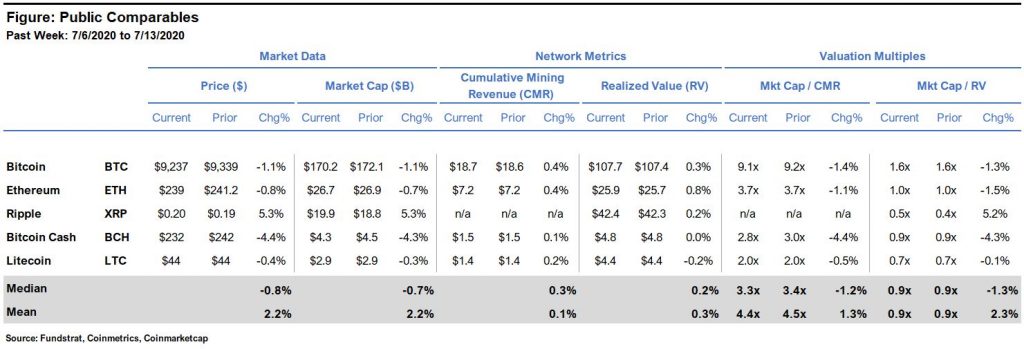

Bitcoin’s P/CMR valuation was unchanged week over week at 9.1x.

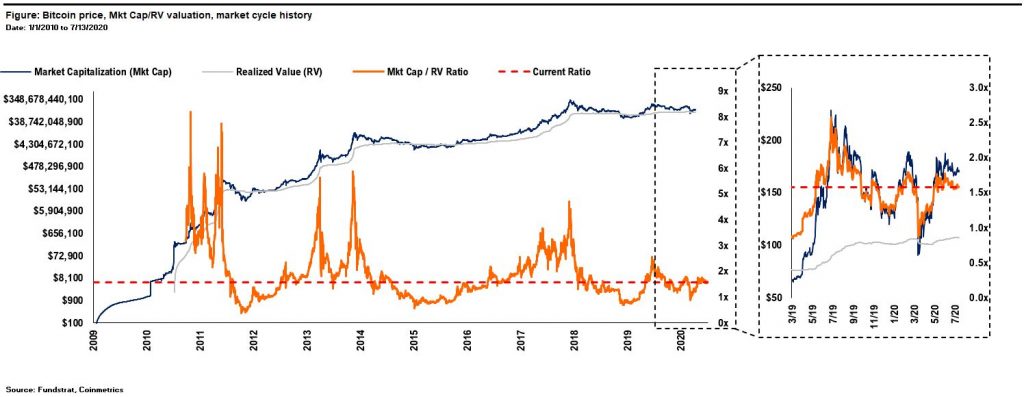

Bitcoin’s market cap to realized value (MV/RV) multiple was unchanged week over week at 1.6x.

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics give an approximate measure of unrealized profit, and therefore an investor’s incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

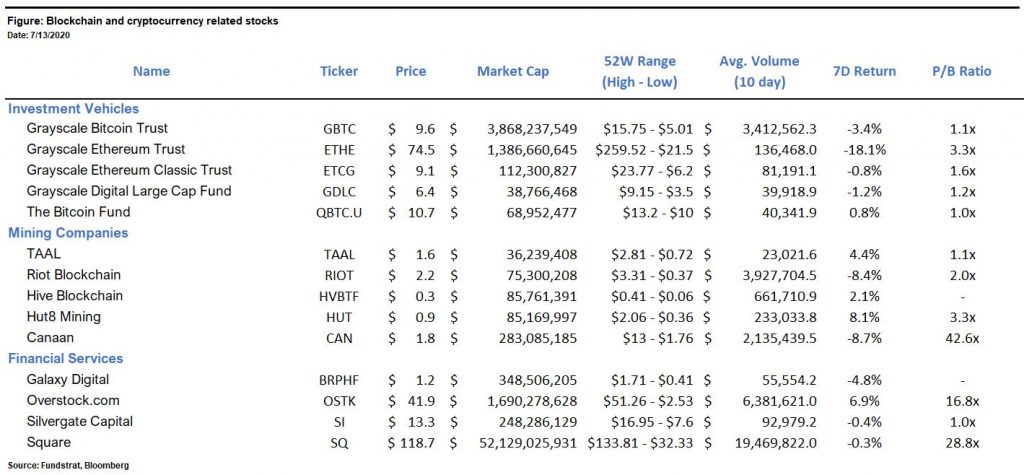

Blockchain & Crypto Stocks

The table above shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Grayscale Ethereum Trust (OTCQX: ETHE): – Shares of ETHE were down 18% on the week as the asset saw further compression of its premium. ETHE’s premium to NAV fell 27% on the week from 314% to as low as 213% on Friday; its lowest value since February 2020. Ethereum (ETH) was down 1% on the week.

TAAL Distributed Information Technologies Inc. (CSE: TAAL; OTCQX: TAALF) – TAAL qualified to trade on OTCQX Best Market on 7/13. The Company previously traded on the Pink Market in the United States and the listing will increase information available to U.S. investors

Galaxy Digital Holdings (TSX: GLXY.V) Upon its satisfaction of various requirements set out by the TSX Sandbox program, Galaxy Digital up listed from the Toronto Stock Exchange’s (TSX) Venture Exchange to the main TSX.

Hut 8 (TSX: HUT.TO) Global asset manager Fidelity announced it acquired 4.1 million units of Canadian traded crypto miner Hut 8 (TSX: HUT.TO). This brings Fidelity’s investment in the company to over 10% of outstanding shares.

Silvergate Capital Corporation (NYSE:SI) Silvergate announced that it will release its second quarter 2020 financial results before market open on Monday, July 27, 2020

Portfolio Strategy

Investment Themes

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

| Source: Fundstrat |

Winners & Losers

Winner: Chainlink (LINK) – LINK posted a 33% gain over the past 7 days, is trading at an all-time high, and recently moved into the top 10 cryptocurrencies by marketcap ($2.5B market cap as of 7/13). Last week the project also inked a new partnership with crypto lender, Nexo.

Loser: Bitfinex – A New York State appeals court ruled last Thursday that cryptocurrency exchange Bitfinex must face claims that it hid and lost client funds. Earlier this year, the court issued allegations that Bitfinex lost $850M in client funds and issued funds from its affiliated stablecoin, Tether, to cover the loss. The appeals court also affirmed that Tether resides in its jurisdiction by rejecting the argument that Tether was neither a commodity nor a security.

.

Financing & M&A Activity

Coinbase – According to a press release from Thomson Reuters, Coinbase has started plans for an IPO that could come as early as late this year or early next year. This would make it the first major U.S. cryptocurrency exchange to go public.

METACO – The Switzerland based crypto infrastructure provider raised $17M in a Series A led by Giesecke & Devrint with participation from SC Ventures, Zurcher Kantonalbank, Investiere, Swisscom, SICPA, Avaloq, and Swiss Post. With the fresh capital in place, METACO plans to serve central banks to support their digital currency initiatives.

Radix DLT Ltd. – The London-based decentralized finance protocol raised $4.1 million in new funding from London-based seed-stage VC LocalGlobe and TransferWise co-founder Taavet Hinrikus.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 5

- Robert Sluymer: Crypto Technical Analysis: Crypto sells off with risk assets but is holding above first key support

- David Grider: Digital Assets Weekly: July 8th