Digital Assets Weekly: August 11th

For a full copy of this report in PDF format please click here

Market Analysis

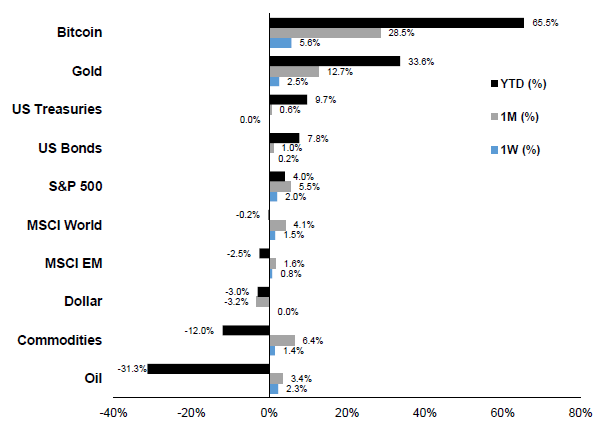

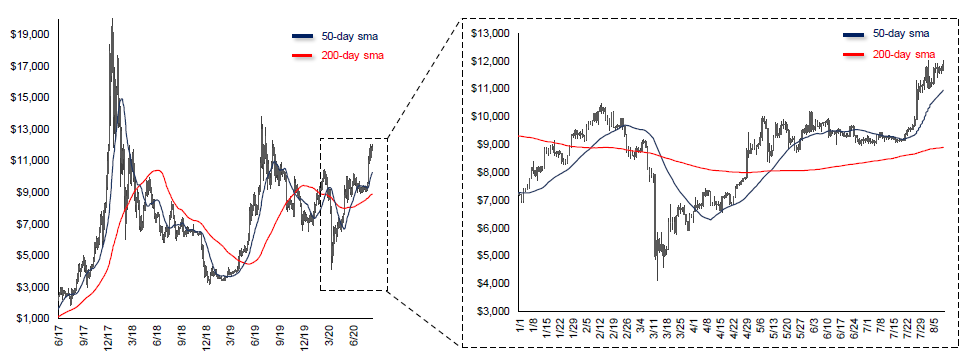

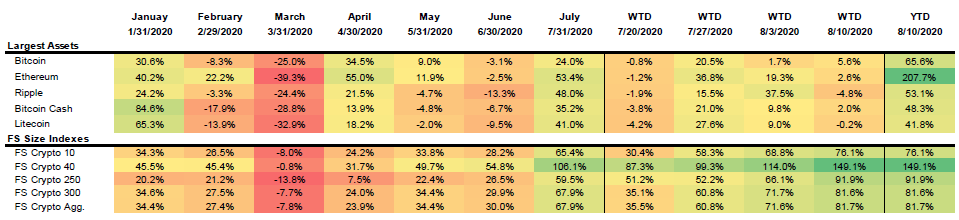

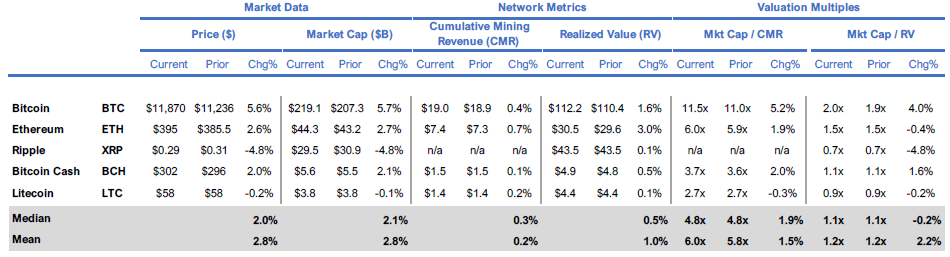

For the second time in two weeks, Bitcoin climbed above $12,000. Overall, it finished the week ended 8/11 up 5.6% at $11,878. Notably, it traded above $11,000 for the entire week for this first time since August 2019.

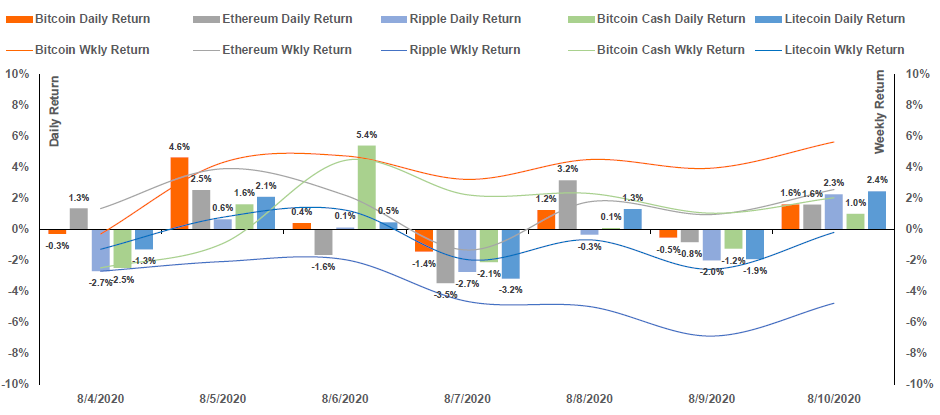

Bitcoin led all other major crypto assets by 3% – 9% this week. Ripple (XRP) was the worst performing asset and declined 4.8% on the week.

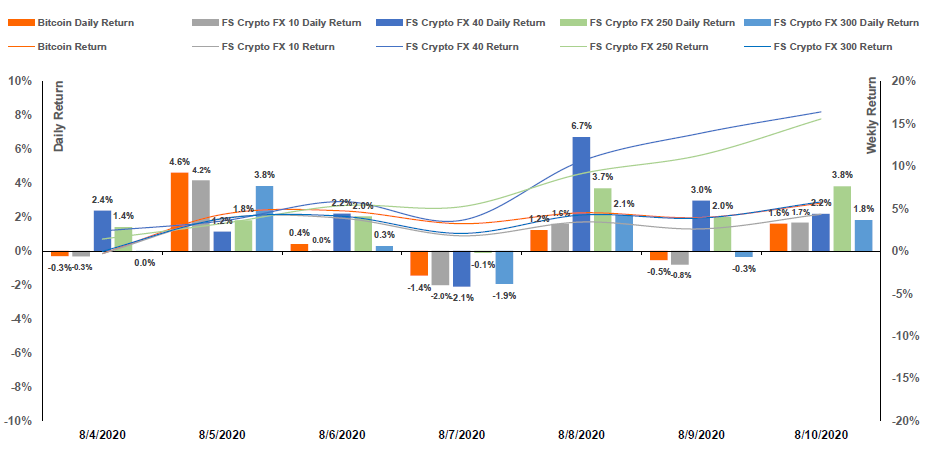

FS Crypto FX 40 and FS Crypto FX 250 led all other size-based indices by ~10% this week. FS Crypto FX 40 outperformance was driven by Tezos (+39.7%), Chainlink (+46.7%), and IOTA (+21.2%) while outperformance of the FX Crypto FX 250 was driven by MINDOL (+ 69.3%) and Lisk (+21.6%).

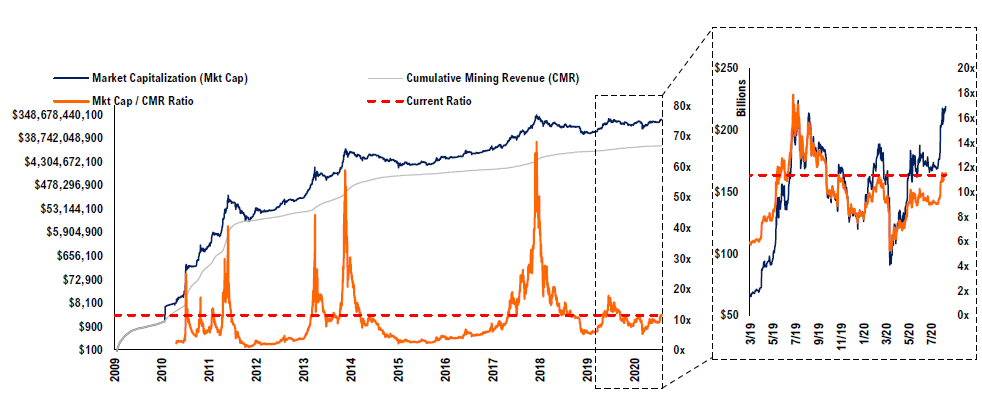

Bitcoin’s Mkt Cap/CMR ratio increased 5.2% week over week from 11.0x to 11.5x.

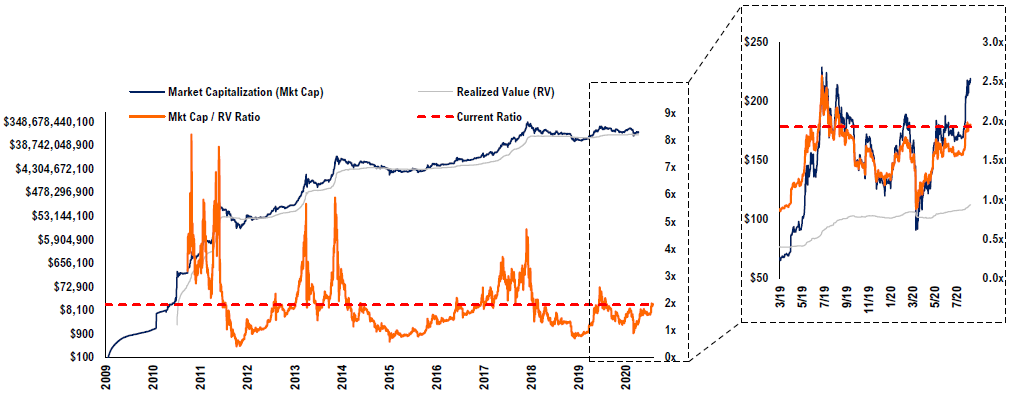

Bitcoin’s Mkt Cap/RV ratio increased 4.0% week over week from 11.0x to 11.5x.

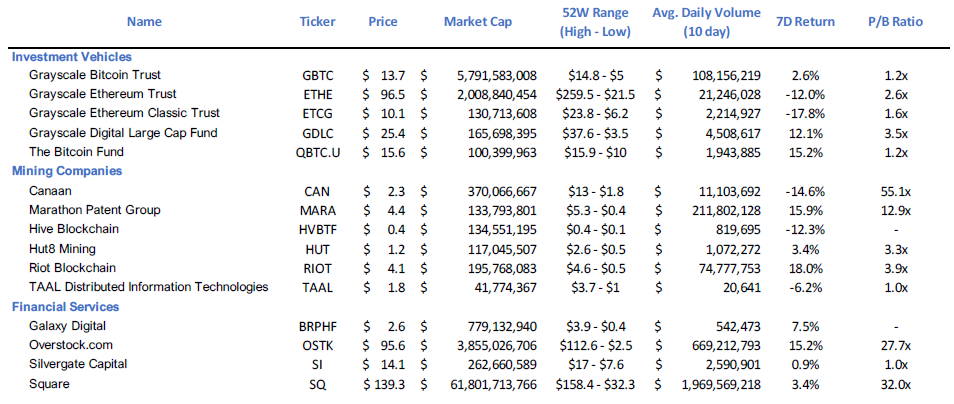

Digital Asset Investment Vehicles and Stocks

Noteworthy this week:

TAAL Distributed Information Technologies (OTCQX:TAALF; CSE:TAAL): TAAL announced that one of its operating subsidiaries has filed a second patent application with the United Kingdom patent office for its newly acquired Layer 1 token blockchain technology. Layer 1 tokens are validated by computers operating on the blockchain directly, unlike more common Layer 2 token systems which require separate Layer 2 protocol servers. The filing furthers TAAL’s goal of working with our enterprise clients and development partners to expand BSV’s smart contracting ecosystem.

Grayscale Ethereum Trust (OTCQX: ETHE): Despite Ethereum’s positive market performance in recent weeks, the OTC traded ETHE product has seen a reduction in its premium to NAV, which currently hovers at ~130%; its lowest value since late January 2020 and well below its highs around 900% in June.

Square (NYSE: SQ): Square reported earnings on 8/8. Outperformance to estimates was primarily driven by Cash App which saw its revenue increase 140% YoY (excluding Bitcoin sales). Bitcoin revenue/gross profit were up 7x/8x respectively year over year. SQ ended the quarter with more than 30M monthly transacting Cash App users and 7M active Cash Card holders; double the level from the prior year period. Shares rallied following the earnings beat and made a new all-time high around $158.4 on Wednesday.

Galaxy Digital Holdings Ltd. (TSX: GLXY): Galaxy announced that it will report 2Q earning on Friday, August 14th.

Marathon Patent Group (NASDAQ: MARA): Was added to our tracking list this week

Winners & Losers

Loser

Ethereum Classic (ETC) – Last Thursday, Ethereum Classic (ETC) suffered its second 51% attack in just five days. The first attack occurred on August 1 and resulted in a misappropriation of 807,260 ETC (worth about $5.6 million). Bitquery estimates that the attacker paid about $204,000 to acquire the hash power for the attack. The second, most recent attack resulted in $1.7MM worth of ETC being misappropriated and the reorganization of 4,236 blocks, or about 15 hours worth of blockchain history.

Winner

MicroStrategy Incorporated (Nasdaq: MSTR) – The largest independent publicly-traded business intelligence company, announced that it has purchased 21,454 bitcoins worth approximately $250 million. The purchase of Bitcoin was made in conjunction with a broader capital allocation strategy announced in July which aimed to return excess cash to shareholders via share buybacks and invest up to $250M in one or more alternative investments.

Michael J. Saylor, CEO, MicroStrategy commented: “This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Financing & M&A Activity

| Announced Date (Link) | Company Name | Financing Round | Financing Amount | Investors (Lead) |

| 8/11/20 | 1inch.exchange | Seed | $2,800,000 | Binance Labs, FTX, Galaxy Digital, Dragonfly Capital, and several others |

| 8/7/20 | Uniswap | Series A | $11,000,000 | Andreesen Horowitz, Version one Ventures, Varitant Alternative Income Fund, Union Square Ventures, Others |

| 8/6/20 | Dapper Labs | Series A | $12,000,000 | Andreessen Horowitz, BlockTower Capital, Coinbase Ventures, Several NBA players and several others |

| 8/6/20 | Alpha5 | Seed | $1,500,000 | FBG Capital, CMT Digital, Altonomy, SNZ Holding, Bollinger Investment Group, Nima Capital, Polychain Capital (existing investor). |

| 8/6/20 | IDEX | Seed | $2,500,000 | G1 Ventures, Borderless Capital, Collider Ventures, Gnosis. |

| 8/5/20 | Reflexer Labs | Seed | $1,700,000 | Paradigm, a16z crypto, Standard Crypto |

Noteworthy this week:

Uniswap – The Brooklyn based decentralized exchange protocol raised $11M in a Series A. According to Uniswap, this investment round will help them build Uniswap V3, which aims to dramatically increase the flexibility and capital efficiency of the protocol.

Dapper Labs – The Vancouver based development studio behind CryptoKitties raised $12M for further development of its Flow Blockchain which aims to address scalability challenges the company faced on Ethereum. The most recent round brings the Company’s total funding amount to $51MM and new investors in this round include Coinbase Ventures, BlockTower Capital and several NBA players.

Recent Research

Tom Lee: Fundstrat’s Tom Lee on why boomers are buying gold while Millennials are trading bitcoin

David Grider: Digital Assets Weekly: July 29th