Digital Assets Weekly: June 30th

Market Analysis

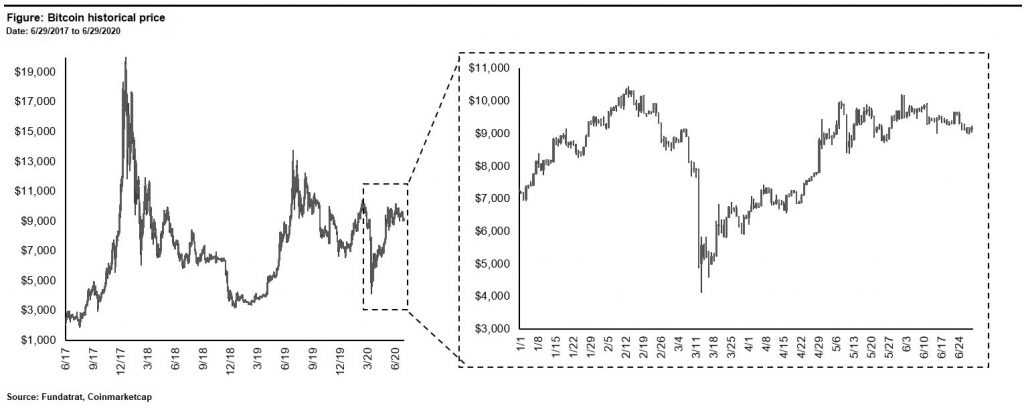

After Bitcoin’s price briefly dipped below $9,000 on Saturday, gains on Sunday pushed it back above $9,000 into the lower band of its $9,000-$10,000 trading range that has persisted since the halvening. This ended its longest streak of daily losses (5 days) in over half a year. Prices last declined for 5 consecutive days in early December 2019.

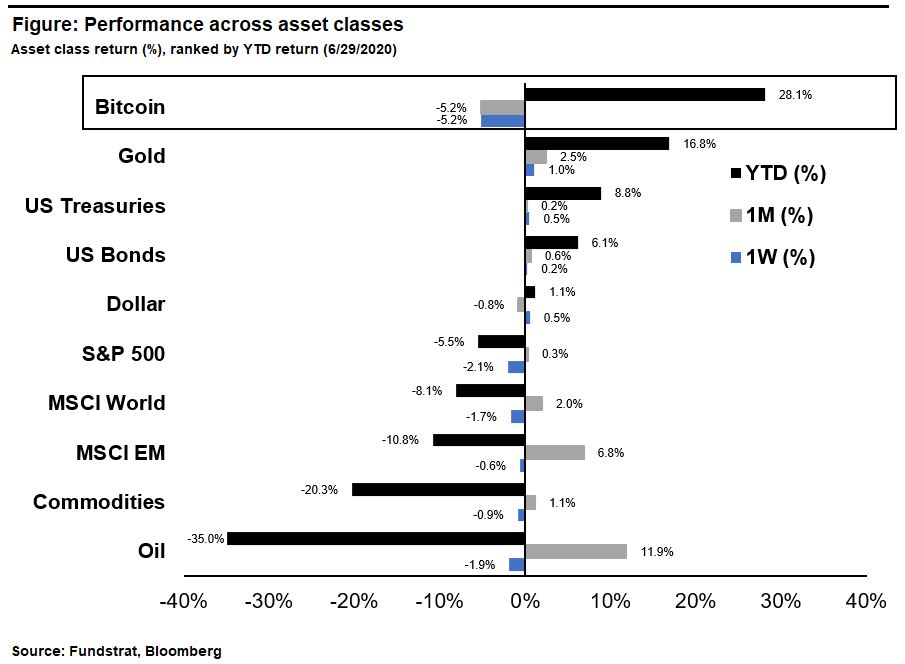

Bitcoin remains firmly ahead of gold as the best performing asset class on a YTD basis.

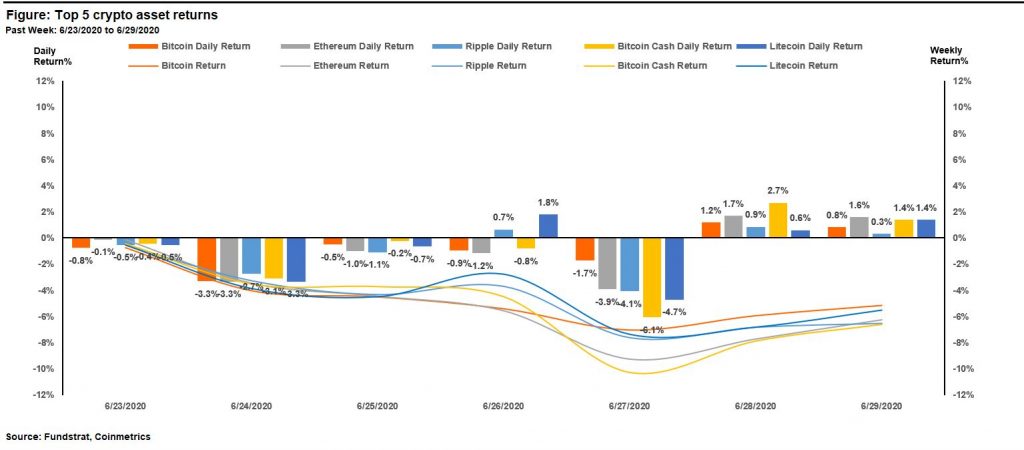

All major crypto assets were down 5% to 7% on the week.

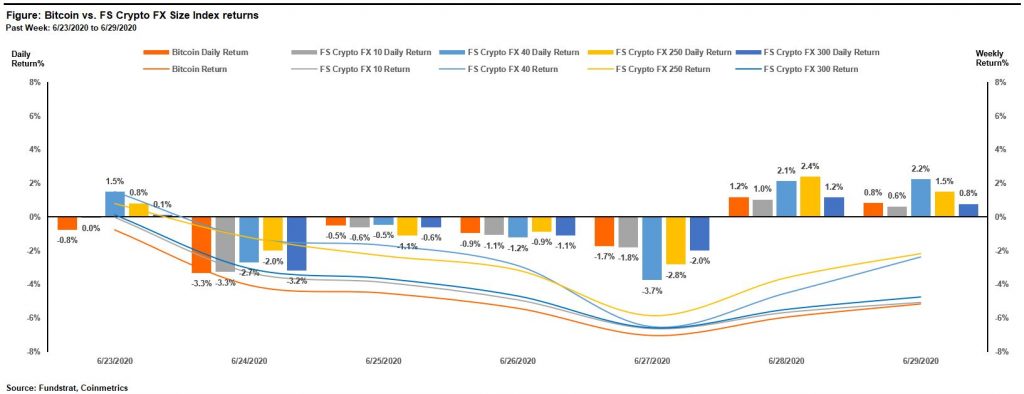

FS Crypto FX 250 was the best performing index last week, finishing the week down 2.2% and outperforming Bitcoin by 3%.

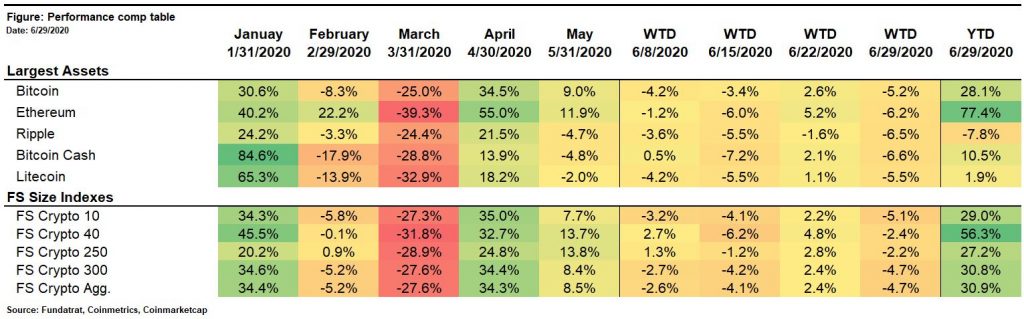

The table below shows the returns of the largest assets and the FS Size Indexes over the year.

Fundamental Valuations

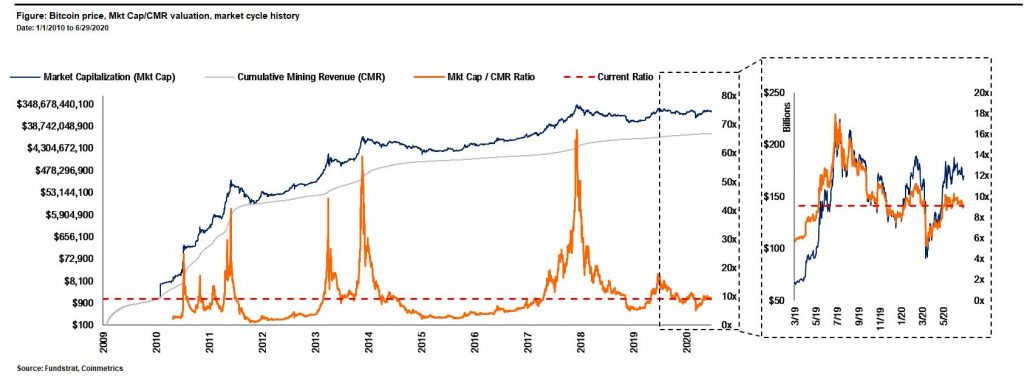

Bitcoin’s P/CMR valuation stood at 9.1x as of 6/29 vs 9.6x as of last week. This value remains slightly below the levels from Mar-19 through present.

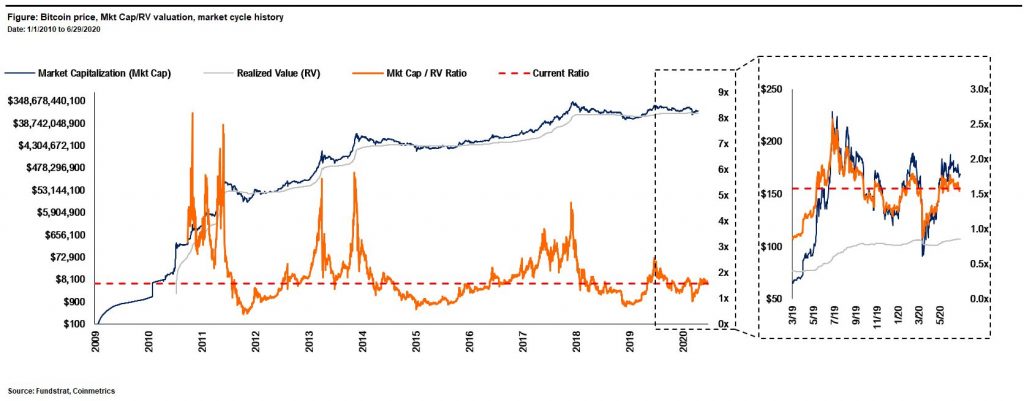

Bitcoin’s market cap to realized value (MV/RV) multiple was 1.6x as of 6/29 vs 1.7x last week.

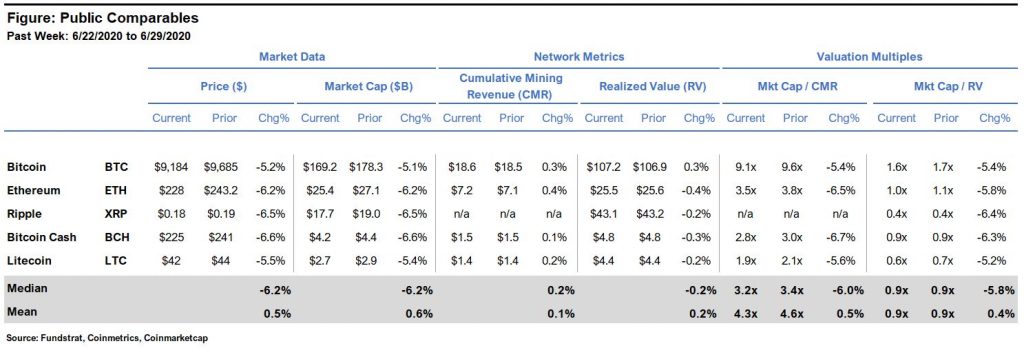

The comp table for major crypto asset prices and fundamental valuations is shown below.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RV ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

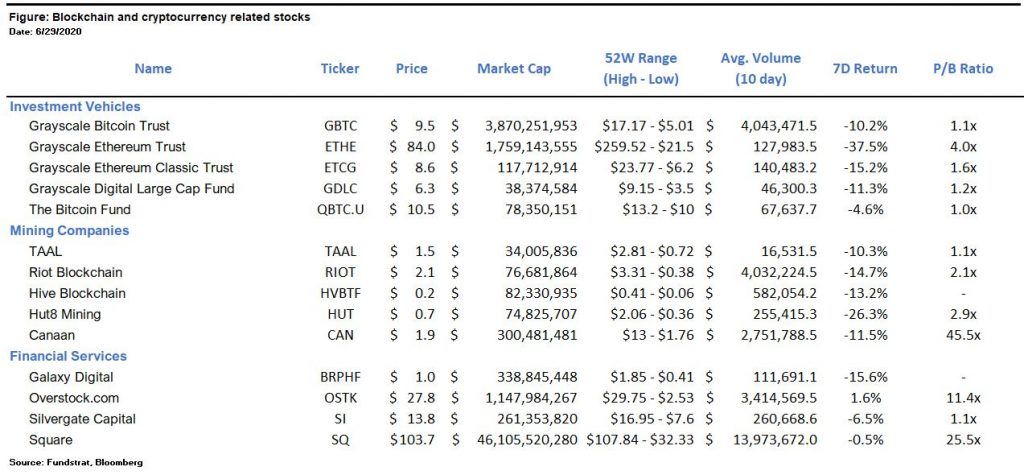

Blockchain & Crypto Stocks

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors who are constrained from owing underlying crypto assets themselves.

Noteworthy this week:

Grayscale Bitcoin and Ethereum Trusts (OTCX: GBTC, OTCX: ETHE): Shares of Grayscale’s Bitcoin Trust (GBTC) and Ethereum Trust (ETHE) were down 10% and 38%, respectively over the past 7 days as both assets saw large compressions on their premium to NAV. GBTC’s premium was down 46% over the period (from 16% to 9%) while ETHE’s premium declined 40% (from 500% to 300%). Bitcoin and Ethereum were down 5% and 6% on the week, respectively.

Portfolio Strategy

Investment Themes

| Bitcoin Outlook | Date |

| Buy Bitcoin ($16,500) | 5/12/2020 |

| Buy Bitcoin ($14,350) | 3/26/2020 |

| Buy Bitcoin ($13,500) | 3/17/2020 |

| Portfolio Allocation | |

| OW “crypto assets” vs. “market portfolio” (1%-2% vs. 0.1%) | 3/26/2020 |

| Market Positioning | |

| OW “blue chip alts” vs. “Bitcoin” | 3/27/2020 |

| OW “large cap” vs. “small cap” crypto assets | 3/26/2020 |

| OW “defensive PoW” vs. “cyclical PoS” crypto assets | 3/26/2020 |

| Asset Selection | |

| UW “Ripple” vs. “market crypto portfolio” | 4/14/2020 |

| OW “Ethereum” vs. “market crypto portfolio” | 4/3/2020 |

| MW Ethereum vs. “market crypto portfolio” | 3/26/2020 |

| Blockchain & Crypto Stocks | |

| Avoid ETHE | 4/3/2020 |

| Source: Fundstrat |

Winners & Losers

Winner: Iota – Iota took the next step towards releasing its Coordicide network upgrade today with the launch of its official testnet, Pollen. Coordicide promises to deliver an IOTA 2.0 network that is fully coordinator-less, decentralized, production ready. The release introduces a new architecture that will enable for future features such as Tokenization, Smart Contracts, Feeless dApps and Sharding that were not previously possible on IOTA. These added features could offer new sources of potential demand, should they become adopted.

Loser: Wirecard – Following a slew of accounting fraud allegations, Wirecard, a German based crypto debit card provider confirmed that ~$2.1B of its reported cash balances are missing. The Company began proceedings with the Munich district court to being preparing insolvency resolution proceedings. The Company’s stock is now down 93% since mid-June.

Financing & M&A Activity

Ava Labs – AVA Labs, the New York Based development arm behind the Avalanche DeFi platform closed a $12M private sale of its AVAX token. The funding round was co-led by Galaxy Digital, Bitmain, Initialized Capital, NGC Ventures and Dragonfly Capital, among others. The sale precedes a planned public offering of the AVAX token to U.S. accredited investors and non-U.S. citizens, according to a release from AVA Labs.

ECXX Global – Property developer Hatten Land has entered into an agreement to acquire a 20% stake in ECXX Global, a Singapore based digital asset exchange. The $6MM investment values the exchange at ~$30M.

CrossTower – The New Jersey based digital asset exchange raised $6M in a seed round led by Gerard Lopez.

Recent Research

Access Fundstrat’s recent crypto insights if you missed them by clicking below or visiting FS Insight.

- Tom Lee: Tom’s Take on Crypto: The Ten Rules of Bitcoin Investing: Rule No. 5

- Robert Sluymer: Crypto Technical Analysis: Crypto sells off with risk assets but is holding above first key support

- David Grider: Digital Assets Weekly: June 23rd