Level Finance

Key Takeaways

- While Level initially gained prominence by becoming the first GMX fork on BNB Chain, it has since grown to differentiate itself from other perpetual decentralized exchanges.

- The first improvement implemented by Level Finance is tranched risk management for liquidity providers that draws inspiration from Mortgaged-Backed Securities in TradFi. Moreover, Level Finance implements a dynamic emissions structure whereby emissions are based on the total trading fees paid on the platform, ensuring positive net earnings for the platform.

- The protocol ranks 3rd in revenue of its perp DEX comp set, garnering almost $10m in revenue in the past 90 days. On a FDV / 90D Rev basis and Circ. Market Cap / 90 D Rev basis, Level Finance is undervalued relative to its comp set.

- Level is launching a series of utility-based NFTs, although details remain sparse. We speculate that these NFTs will have varying utility.

- Because of thin liquidity, our recommendation is for buyers to accumulate as price enters our recommended buy zone ($2.00 - $3.00 / LVL).

- Level Finance employs a two-token model to delineate functions on the platform. LVL is the utility token of the protocol, while LGO 3.47% is the corresponding governance token that also entitles holders to the DAO's treasury assets.

- Level Finance has completed four strategic sales, including one to Arthur Hayes. The protocol is also not immune to a range of risks, including smart contract risk, price oracle maniplation risk, counterparty risk, and tranche liquidity risk.

Investment Thesis

While Level initially gained prominence by becoming the first GMX fork on BNB Smart Chain, it has since grown to differentiate itself from other perpetual decentralized exchanges, or ‘perp DEXes,’ via multiple proprietary improvements from TradFi and DeFi. For a recap on, perp DEXes, check out our piece here.

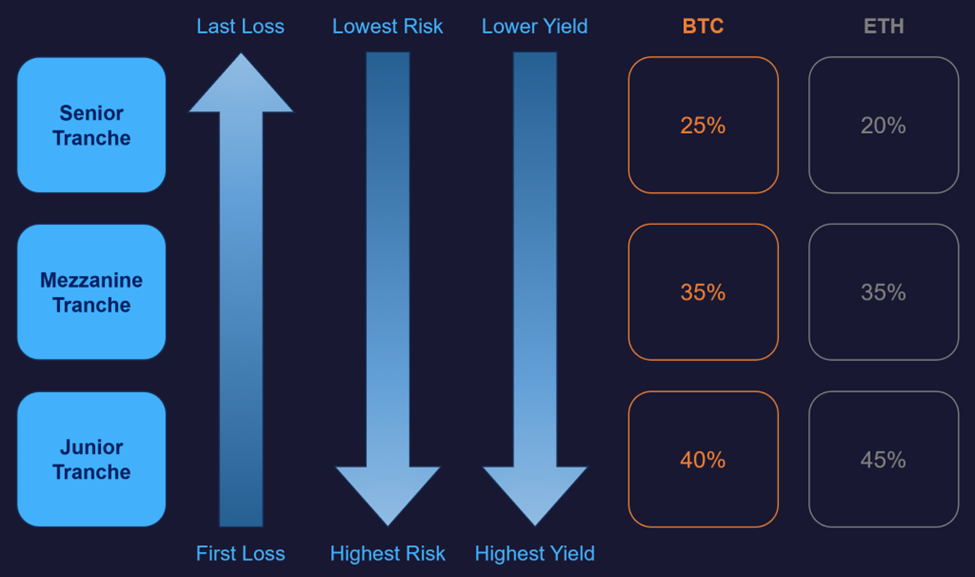

The first improvement implemented by Level Finance is tranched risk management for liquidity providers. Drawing inspiration from Mortgaged-Backed Securities in TradFi, the protocol achieves this by introducing tranches of LP positions into programmatically-defined risk exposures.

Figure: Level Finance Liquidity Tranche Mechanism

Each tranche represents a specific pool of assets from those available on the platform, currently BTC, ETH, BNB, and stablecoins. All tranches earn fees from traders on the platform according to the breakdowns above. Concurrently, each tranche is exposed proportionately to the gains and losses of traders.

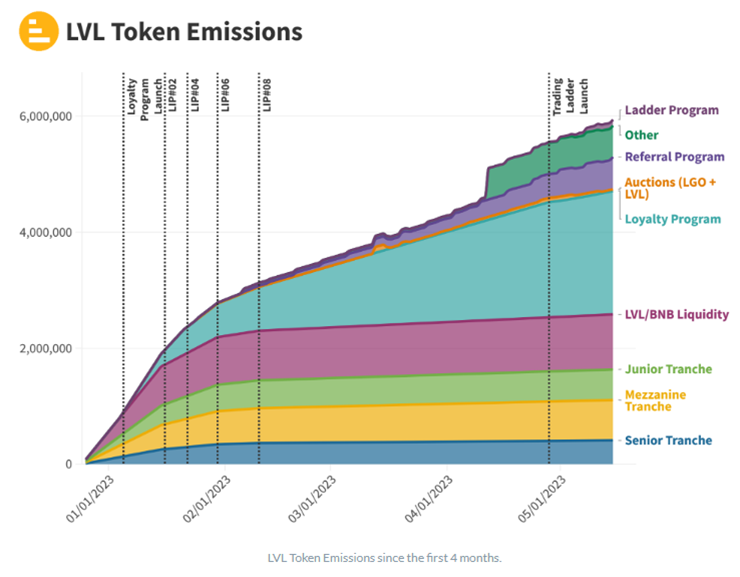

Moreover, Level Finance implements a dynamic emissions structure whereby emissions are based on the total trading fees paid on the platform. $20k in LVL incentives are distributed for the first $100k in trading fees and every $50k thereafter. Importantly, this creates a mechanism whereby incentives distributed will always be lower than trading fees earned, ensuring positive net earnings for the platform.

Similar to GMX and other perp DEXes, Level Finance generates revenue through fees charged for its usage, taking the forms of:

- Fee for opening and closing posiitons

- Liquidation fee

- Dynamic borrowing fee

- Swap fee

- Tranche LP minting and burning fee

These fees are distributed according the breakdown below:

- Level Liquidity Providers (LLP): 45%

- LVL Stakers: 10%

- DAO Treasury: 30%

- LGO Stakers: 10%

- Reserved for Development: 5%

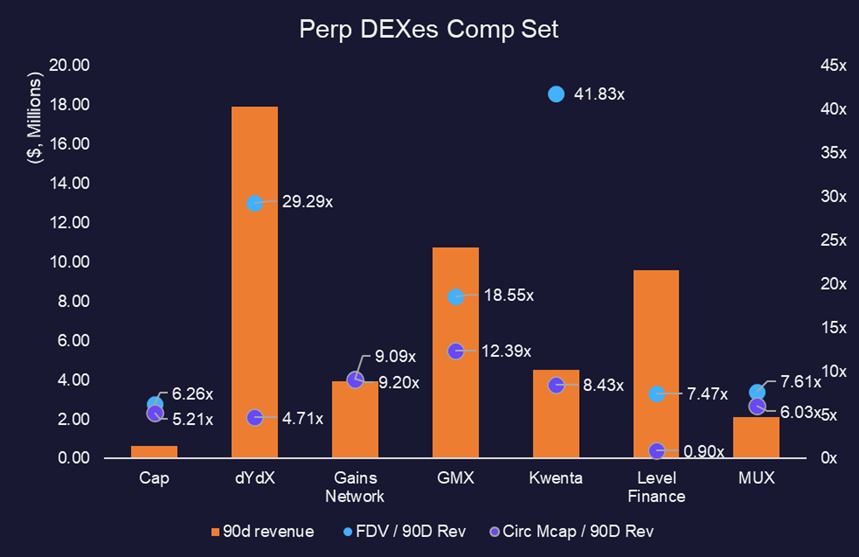

The protocol launched on Arbitrum on June 20, attracting $12m in TVL on top of the $17m it has on BNB Smart Chain. More importantly, the protocol ranks 3rd in revenue of its perp DEX comp set, garnering almost $10m in revenue in the past 90 days. On a FDV / 90D Rev basis and Circ. Market Cap / 90 D Rev basis, Level Finance is clearly undervalued[1].

Figure: Perp DEXes Comp Set

Upcoming Catalysts

Level is launching a series of utility-based NFTs, namely Stock Broker’s Vest for traders, Auctioneer’s Hammer for auction participants, and Tattered Farmer’s Hat for liquidity providers. Although distribution is at random, users can maximize their chances of earning each of the NFTs can be earned through active participation on the protocol.

While details remain sparse, users can expect to be airdropped the NFTs with use of the protocol. We speculate that these NFTs will have varying utility, including reduced trading fees, prioritized auctions, and extra yield for the corresponding participants.

Entry Suggestions, Liquidity, and Strategy

For a $100k (~414 BNB) purchase of LVL tokens at time of writing, buyers will incur a ~7.8% slippage. This is because liquidity is relatively thin for the token, with $2m of liquidity for ~$26m circulating market cap. Hence, our recommendation is for buyers to accumulate as price enters our recommended buy zone ($2.00 – $3.00 / LVL).

Figure: LVL Finance Price

As is the case for most tokens in DeFi, we believe investors are better off participating in the underlying protocol if not to learn, but to maximize returns. This point is more pertinent in the case of Level Finance, where apart from periodic auctions, staking level is the only way to acquire more LGO (expanded on below).

Tokenomics and Funding Rounds

Tokenomics

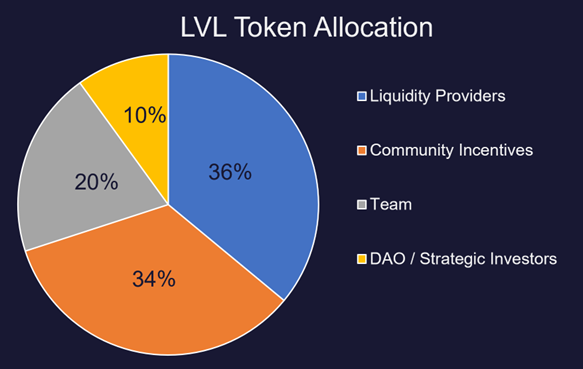

As alluded to above, Level Finance employs a two-token model to delineate functions on the platform. LVL is the utility token of the protocol, allowing users to earn platform revenue and accrue LGO tokens by staking their LVL tokens. LVL tokens are also distributed as incentives for platform participants through liquidity provider rewards and other programs. Finally, LVL can be used to acquire LGO at set intervals through auctions.

While LVL’s maximum supply starts at 50m, its total supply is continually reduced via LGO Dutch Auction. The emissions schedule of LVL is dynamic and can also be change[4] d via DAO governance, hence modeling it out is a futile effort.

Figure: LVL Token Allocation

Figure: LVL Token Emissions

On the other hand, LGO 3.47% is the corresponding governance token that provides decision-making power within the Level DAO. LGO tokens can only be acquired by staking LVL or via auctions held periodically. This is why 87% of LVL in circulation is staked as it is the only way to accumulate LGO 3.47% , while 90% of all circulating LGO is currently staked.

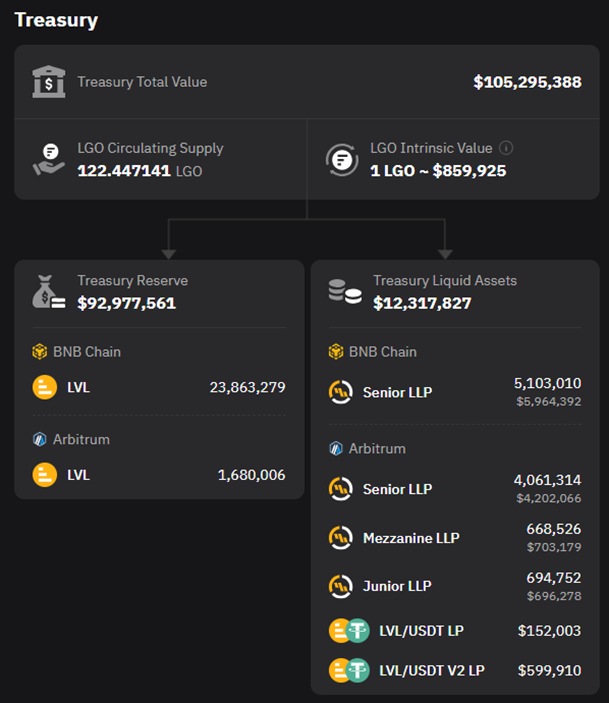

Furthermore, LGO holders can redeem their LGO tokens for the DAO’s treasury assets. Every two weeks, there is a 2-day redemption window for LGO holders to redeem their tokens in the treasury.

Figure: Level DAO Treasury Breakdown

The protocol recently passed a DAO proposal to regulate LVL Balance by (i) burning 180k (~$740k) LVL on their protocol-owned liquidity on TraderJoe and (ii) implement a continuous weekly burning of LVL tokens. For every $1 of trading fees the DAO accumulates via its protocol-owned liquidity, $1 of LVL tokens will be burned.

Funding Rounds

As a testament to the team’s building capabilities, Level Finance has completed four strategic sales to anonymous parties, including one to Arthur Hayes. These sales have amounted to ~1.37m LVL for ~$1.22m, implying an average price of $1.12/LVL. Apart from the first round which has a 12-month lockup, these sold LVL tokens are locked for 6 months and vested for another 6 months.

Most recently, it has attracted a $20m commitment from a ‘9-figure AUM firm’, subject to future protocol growth and underlying liquidity. The first $2m tranche was completed and is subject to the same terms as previous round investors.

Risks

Like other nascent DeFi protocols in crypto, Level Finance is not immune to a range of risks. First and foremost is smart contract risk, where hackers exploit drain funds from smart contracts in ways outside of the design scope.

Similar to other perp DEXes, LLPs are also exposed to the price movements in the underlying assets in each tranche and price oracle manipulation. They also take on the other side of each trade on the platform, so are exposed to counterparty risk.

Owing to its design, Level Finance users are also exposed to tranche liquidity risk, where tranche liquidity is insufficient to service trades.

Bottom Line

For those underexposed to the perp DEX space, we believe Level Finance poses an undervalued bet with improved risk management and token design mechanics. The team’s ability to ship across chains has also been corroborated by their recent raises, including from noteworthy investors in the crypto space.

[1] We use 90D Rev for valuation comparison because TokenTerminal does not include protocol-owned liquidity as protocol revenue, which undercounts since fees from protocol-owned liquidity flows to the treasury as mentioned below.