Sequencers Steal Spotlight

Weekly Recap

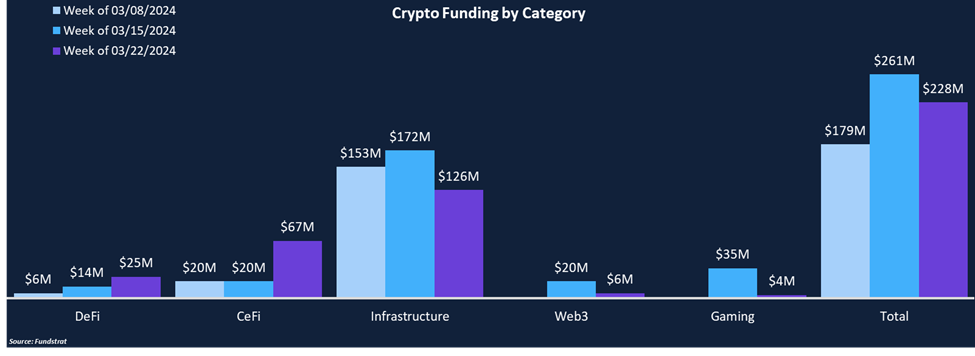

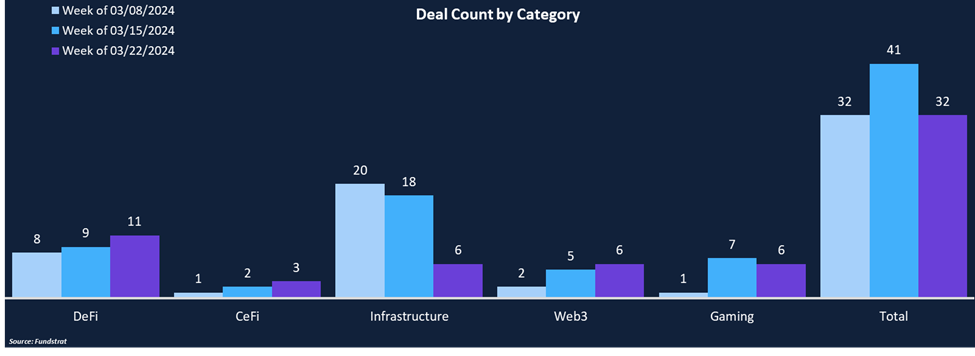

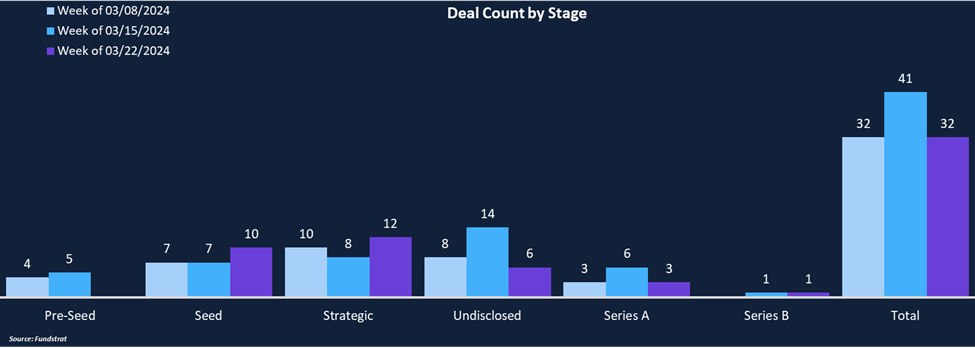

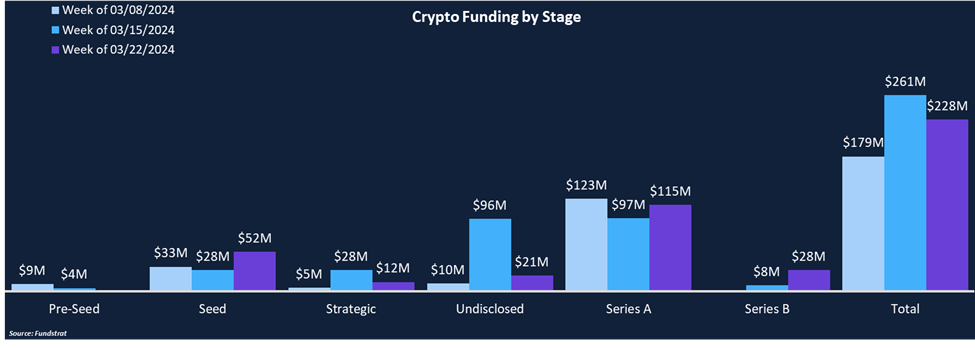

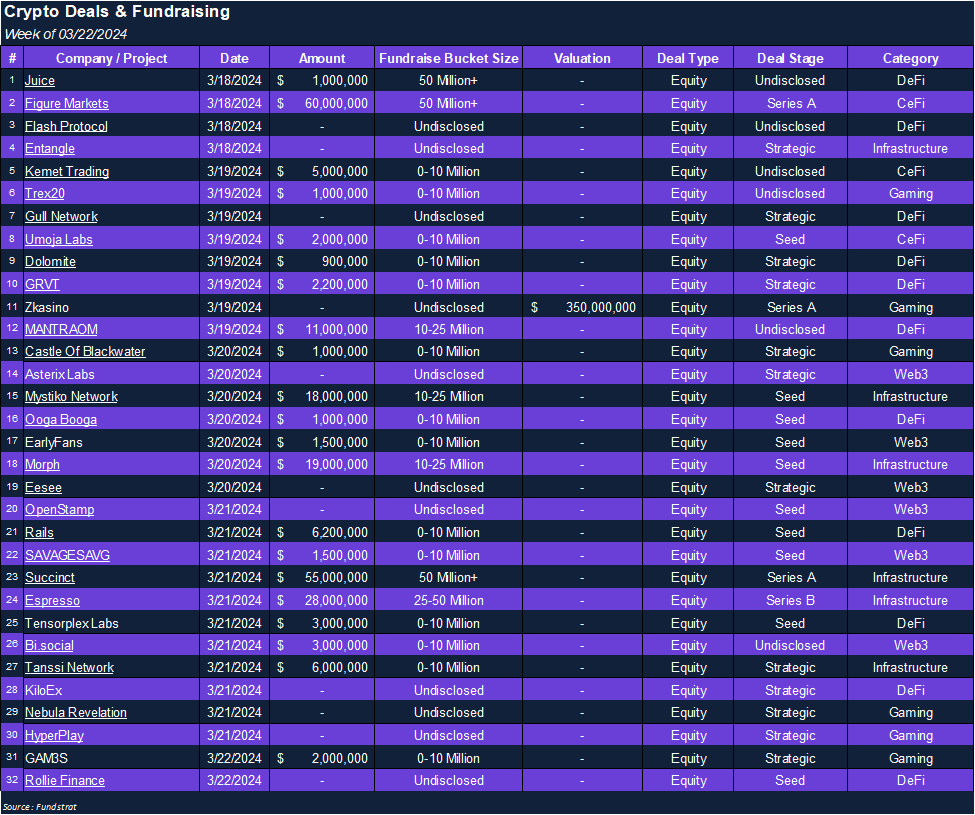

March continues to be an impressive month for the crypto private market. Total funding reached $228 million across 32 deals, marking the third consecutive week with over 30 deals. Average deal size has slowly been increasing. This week’s average deal amount was $10.9 million. For comparison, 2023’s average deal size was $9.2 million, representing an 18.4% increase. DeFi was the leading category from a deal count perspective, representing 34% of total deals but only 11% of total funding. In contrast, Infrastructure was the leader from a funding perspective, representing 55% of funding and only 19% of deals. Examining deal stages, Series A deals accounted for 50% of funding, totaling $115 million. There has been a recent uptick in Series A rounds. March has seen 13 Series A rounds while January and February both saw about half that amount.

Funding by Category

Funding by Deal Stage

Deal of the Week

Espresso Systems, a shared sequencing marketplace for rollups, raised $28 million via a Series B round led by a16z. Other investor participation included Polygon, Frax, Starkware, Rarible, Taiko, and Injective, among others. Espresso hopes to increase users’ utility through improved safety, liveness, and interoperability while being fully compensated for created value. The funding will be used to scale the Espresso team and bring production-ready implementation of Espresso to the industry.

Why is this Deal of the Week?

Rollup sequencers are responsible for ordering and validating transactions before posting data to Ethereum. The two main problems with sequencers are fragmentation and centralization. Many dApps lose composability due to the number of different rollups, and most sequencers are currently run by centralized entities, producing singular points of failure. Shared sequencers solve this problem by building blocks across rollups and maintaining chain sovereignty. Espresso is building a marketplace where rollups can sell sequencing time slots to their preferred block proposer. This should lead to atomic execution across chains and even app-level synchronous composability when combined with aggregation layers. Overall, shared sequencers are the future for rollups, as they should help with scaling, security, and interoperability across layer-2 networks.

Selected Deals

Zkasino, a hyperchain rollup for on-chain gaming, closed a Series A round from investors including MEXC, Big Brain Holdings, Pentoshi, and Sisyphus, valuing the company at $350 million. Zkasino is powered by zkSync and EigenDA to allow anyone to build on-chain gaming platforms within minutes with no coding skills. All gaming protocols built on ZKasino will share aggregated liquidity, reducing bootstrapping requirements, and creating a positive gaming experience from day one. ZKasino also announced a $40 million ecosystem grant program for protocols to take advantage of and build on the ZKasino network.

Succinct, an infrastructure company aiming to make zk-rollups available for everyone, raised $55 million via a Seed and Series A deal led by Paradigm. Other investors included Robot Ventures, Bankless Ventures, Geometry, and ZKV. Succinct’s SP1 is the first 100% open source zero-knowledge virtual machine performant enough to rival custom ZK circuits. With SP1, developers can integrate ZK proofs into their products using normal programming languages and leveraging existing data libraries. Succinct is also working on its prover network, which will serve as a hosted infrastructure layer for any application looking to outsource proof-generation.

Morph, a safer and more cost-effective rollup solution for consumer applications, raised $19 million in a seed round led by DragonFly Capital. Other investors included Pantera Capital, Foresight Ventures, The Spartan Group, MEXC, and others. Morph is aiming to create a seamless consumer blockchain with its decentralized sequencer, combination of optimistic and ZK rollup technology, and modular design. Developers building on Morph will have advanced tooling that will support projects through inception to potential token listings. The funding will be used for talent acquisition, increasing developer incentives, and expanding marketing efforts.

Reports you may have missed

WEEKLY RECAP Crypto funding was relatively unchanged week-over-week, with a 4% decrease to $138 million, while deal count saw a larger decrease, falling 29% to 25 deals. Infrastructure deals comprised 73% of total funding and Web3 and Gaming combined for 26%, with remaining categories making up the last 1%. As highlighted in our Q1 Funding Report, Series A funding has been a standout deal stage this year, and this week...

WEEKLY RECAP Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped...

WEEKLY RECAP Funding fell 27% from $282 million last week to $206 million this week across 34 deals. Triple-digit funding seems to be the new normal, as there has been a notable uptick in the private market in recent weeks. Despite the overall increase in activity, there has been a lack of CeFi-related projects in recent weeks, with just one deal in each of the last two weeks. Agora was the singular...