Funding Cools to Start November

Weekly Recap

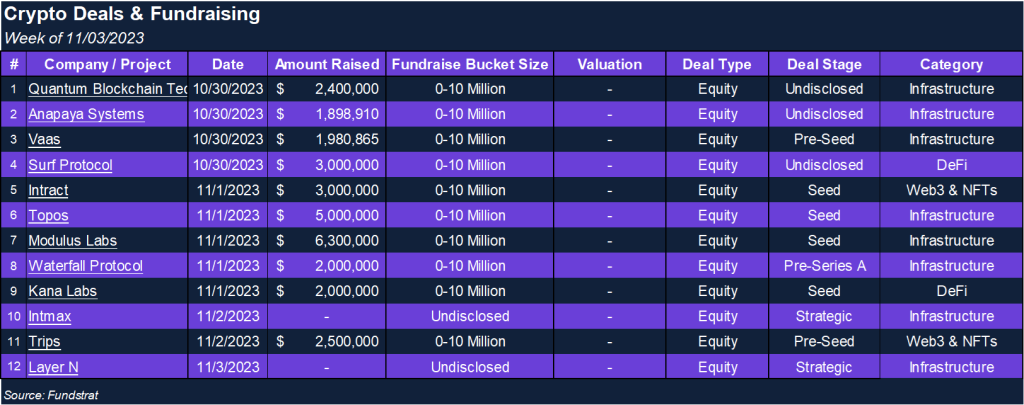

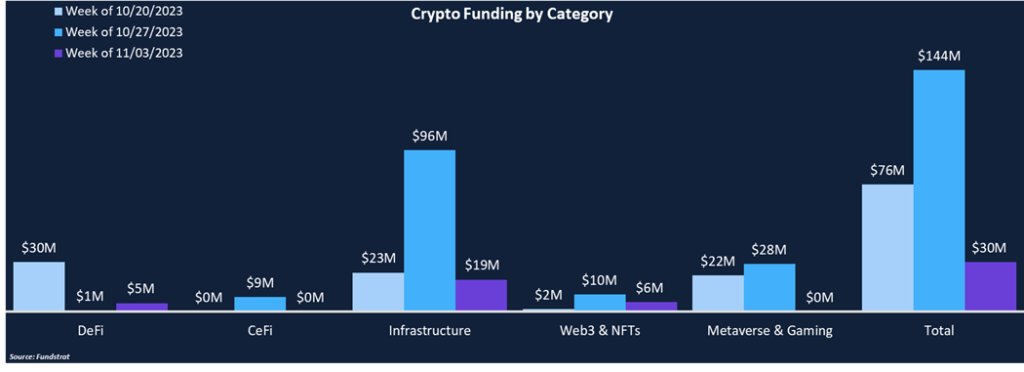

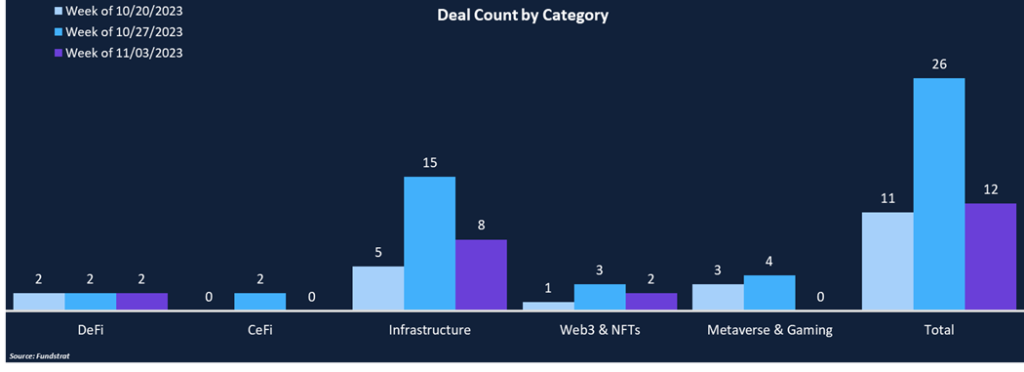

Crypto funding dropped significantly this week, falling from $144 million to $30 million, while deal count fell by more than 50%. Infrastructure was the most popular category, making up about two-thirds of total funding and total deal count. Within the Infrastructure category, two layer-2 networks (Layer N & Intmax) completed fundraises along with one layer-1 network (Waterfall Protocol). The average deal size was notably small this week at just $3 million compared to last week’s $7.2 million average.

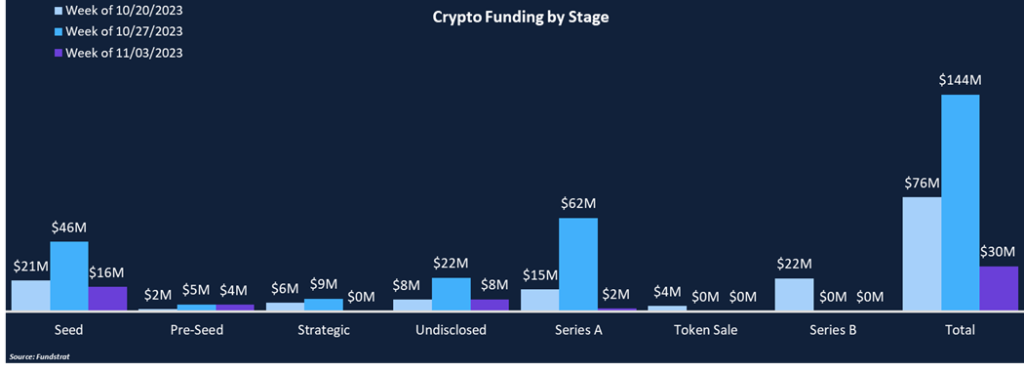

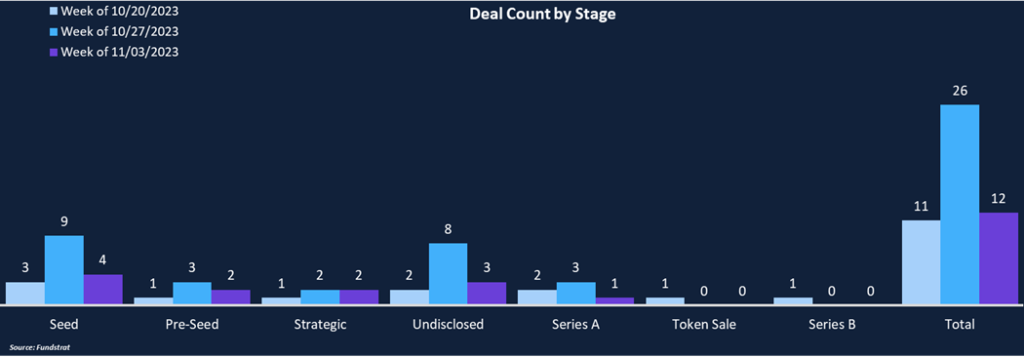

From a deal stage perspective, deals were relatively evenly dispersed with seed rounds tallying the most at four. Additionally, pre-seed rounds made up 17% of total deal count and 15% of total funding. There were no token sales or late-stage deals this week but there was one M&A transaction, with Web3 firm Treehouse acquiring NFT analytics platform Origin Analytics to bolster its NFT offerings.

Funding by Category

Funding by Stage

Deal of the Week

Modulus Labs, a company enabling accountable artificial intelligence for dApps, raised $6.3 million in a seed round led by 1kx and Variant. Other investors include Floodgate, Alliance, Bankless, GCR, Inflection, and Stanford Blockchain. Additionally, Modulus is backed by angel investors such as Polygon, Solana, The Ethereum Foundation, Consensys, and Microsoft. Modulus uses its Accountable AI product, a cryptographic solution to verify that AI results were not doctored, to allow smart contracts to leverage AI tools without concern for invalid results.

Why is this Deal of the Week?

Two of the most exciting technologies today are artificial intelligence and blockchain. A common concern with AI technology is verifying the legitimacy of AI-generated data. Many dApps have been slow to leverage AI because of the added security concerns. Modulus strives to solve this issue by leveraging zero-knowledge proofs to efficiently verify that AI providers don’t manipulate their algorithms. With Modulus’ specialized zk-proofs, they verify data outputs and preserve the privacy of the underlying AI model, resulting in the delivery of powerful AI tools to dApps at a fraction of traditional costs. With enhanced tamper-proof artificial intelligence, dApps can surpass competitors by offering users a more intuitive user experience and innovative features. As AI continues integrating itself into society, Modulus hopes its cryptographic accountability tools will safeguard the computational future.

Selected Deals

Trips, a Web3 platform focused on letting creators protect and monetize their content, raised $2.5 million in a pre-seed round led by Shima Capital. Other investor participation included Animal Capital, Blackwood Ventures, Serafund, Blizzard, and The Avalanche Ecosystem Fund. As the creator economy continues to grow, protecting intellectual property is becoming increasingly important. Influencers struggle to track where and how their content is being used and ensure they are properly compensated. Trips allows creators to verify their identities and mint copyrights on-chain, paving the way for users to buy and sell parts of intellectual property. Trips is built on Avalanche’s Evergreen Subnet, an out-of-the-box subnet built for institutional finance. Trips is only integrated with YouTube but plans to add more social media platforms as it grows.

Surf Protocol, a permissionless perpetual futures exchange, raised $3 million in an undisclosed round led by ABCDE Capital, with other investor participation from OP Crypto and C2 Ventures. One of the largest pain points across perp DEXs is the limited scope of tradable assets. Each asset needs sufficient liquidity to let traders efficiently open positions. In a market where liquidity is diminished and fragmented, it has become increasingly difficult for protocols to attract deposits. Surf hopes to alleviate this problem with its unique AMM model. Surf allows anyone to instantly deploy liquidity pools, enabling the trading of new assets. Each liquidity pool is independent, and liquidity providers (LP) have the option of choosing between five different fee structures. They must strike a balance between securing high fees or prioritizing their liquidity. The lowest fee pools get matched with orders first, whereas the highest fee pools get matched last, resulting in a constant state of competition between LPs to optimize profitability. By combining its unique AMM model with the ability to instantly deploy new trading pools, Surf hopes to attract a substantial and sticky user base. Surf is currently available on testnet but plans to launch on Base mainnet soon.