Funding Rebounds

Weekly Recap

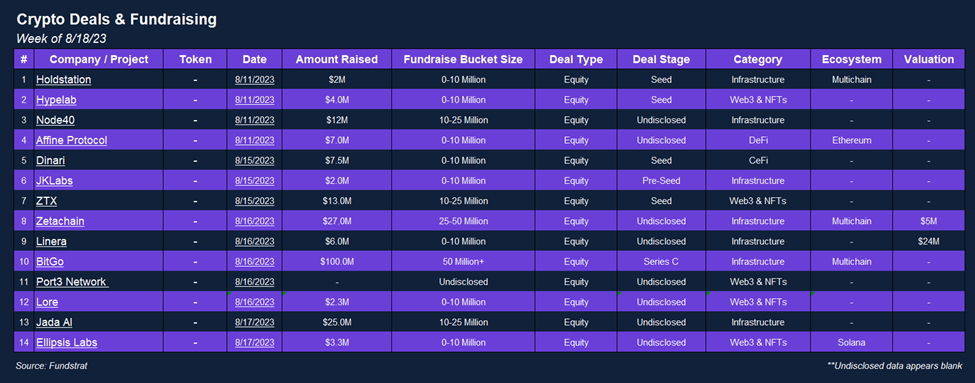

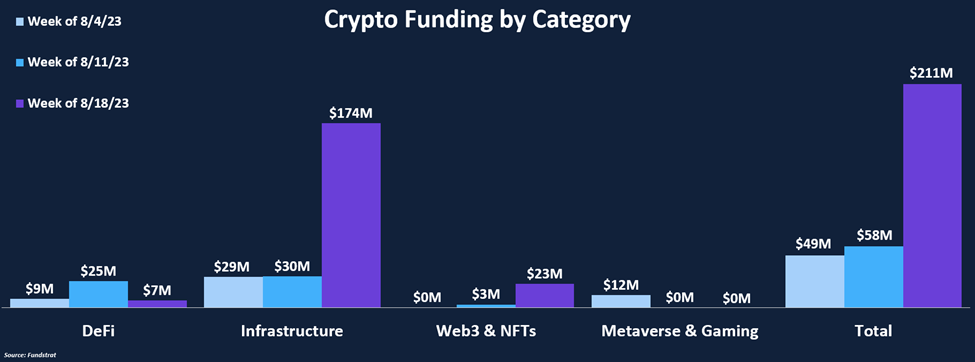

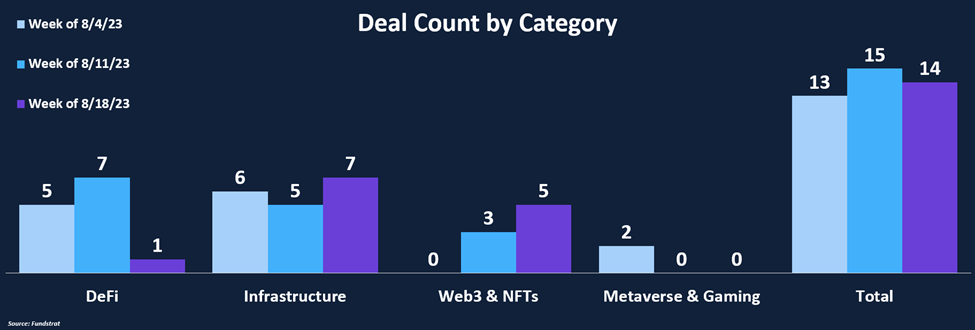

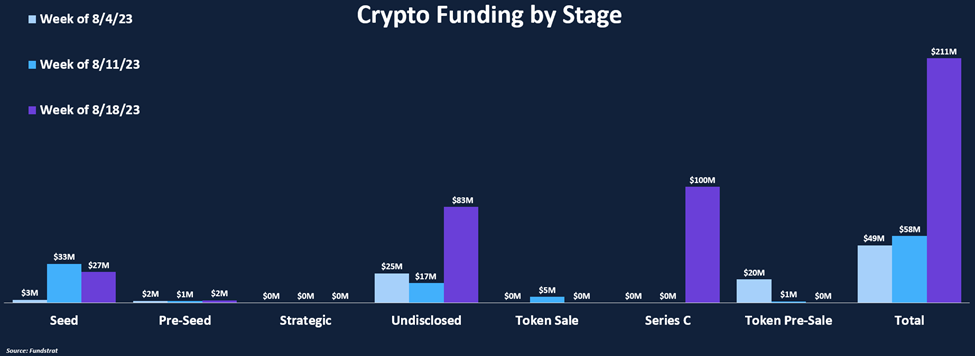

Funding levels have rebounded significantly, rising nearly 4x from last week to reach $211m this week. Half of the funds raised came from industry veteran BitGo’s $100m series C round, our deal of the week. Web 3 & NFTs saw a significant jump in funds raised, with companies like ZTX and Port.3 looking to utilize blockchain technology for novel use cases. Infrastructure continues to be the main focus of investors, contributing $174m of the total $211m raised. DeFi deals fell substantially, with only $7m raised in one deal, as investors favored infrastructure and software companies focused on data analytics and AI. While this was a strong funding rebound, most deals were likely closed before this week’s steep market drawdown. It will be interesting to see if investors continue funding amid broader market uncertainty or if spot prices have a noticeable impact on deals closed and funds raised going forward.

Funding by Category

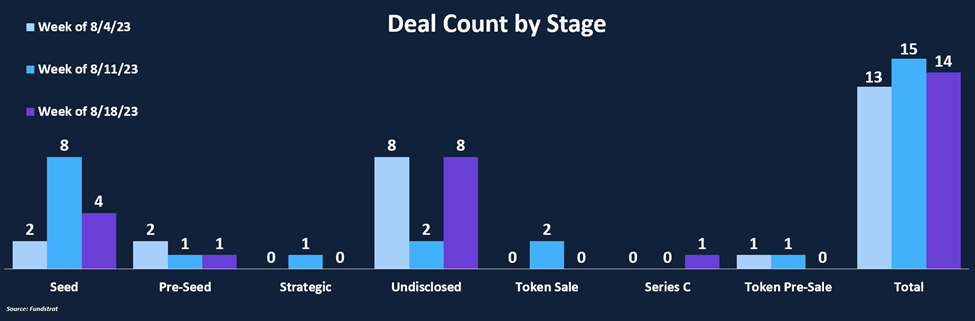

Funding by Deal Stage

Deal of The Week

This week’s Deal of the Week is BitGo, which raised $100 million in a series C round. The Palo Alto-based Crypto Custodian declined to disclose participating investors. The funds will be utilized to meet the growing demand for regulated crypto custody products and infrastructure solutions, in addition to making strategic acquisitions. Regarding the round BitGo CEO Mike Belshe said the company was seeing demand from both the U.S. and globally from “institutions, brands, coin foundations, and others” seeking “secure and seamless participation in the digital asset ecosystem.” The company has remarkably serviced the digital asset space since its nascency in 2013 when it pioneered multi-signature Bitcoin wallets.

Why is this the Deal of the Week?

This deal is significant for several reasons, notably the company’s history and staying power throughout several market cycles. Investors are willing to pay a premium for this staying power, as BitGo has achieved the 3rd highest disclosed valuation this year. Late-stage raises have also been few a far between, with investors favoring proven business models and track records.

BitGo is a crypto industry powerhouse, serving 1500+ institutional clients across 50+ countries and handling 20% of on-chain Bitcoin transactions by value. It pioneered secure storage with BitGo Trust in 2018 and expanded to services like BitGo Prime and BitGo New York Trust.

They lead in custody, with clients like Nike, Swan Bitcoin, and Mysten trusting them. BitGo’s pivotal role is seen in managing assets for distressed exchanges and as Mt. Gox’s distributor. Recent funding brought their total raised to $169 million, with a notable Series B round led by Goldman Sachs and Galaxy Digital in 2018. BitGo is a crypto industry linchpin, ensuring security, innovation, and credibility.

Selected Deals

Jada AI, a blockchain-powered artificial intelligence initiative, has secured $25 million in funding from LDA Capital, an alternative investment group. The project’s primary goal is to provide AI services that enhance decision-making and expand operational capacities for organizations. Jada operates within a blockchain-based ecosystem where AI computations occur across participating network nodes, ensuring secure, cross-verified processing. The funds raised will bolster the development team and onboard new organizations, solidifying Jada’s mission of efficient and reliable AI-driven decision support.

ZetaChain, a Layer 1 blockchain focused on interoperability, has secured $27 million in funding from prominent crypto and trading entities, including Blockchain.com and Jane Street Capital. Founded in 2021 and approaching its mainnet launch, ZetaChain aims to unite diverse blockchains like Ethereum, Polygon, BSC, Bitcoin, and Dogecoin onto one platform, setting a new standard for blockchain interoperability. The project’s EVM-compatible cross-chain smart contracts aim to simplify managing assets and data across blockchains, offering faster, more secure, and user-friendly services. With over 27,000 decentralized app contracts already deployed across sectors like DeFi, NFTs, and gaming, and more than 1.7 million users participating in its testnet, ZetaChain is poised to make a substantial impact on the web3 ecosystem.

Web3 advertising company HypeLab has secured $4 million in seed funding from a round led by venture capital firms Shima Capital and Makers Fund. Founded by former Google product manager Ed Weng, HypeLab utilizes on-chain data to personalize and deliver ads, catering to the increasing number of consumers embracing blockchain solutions. Shima Capital’s General Partner, Yida Gao, expressed enthusiasm for web3 and its potential role in the future ecosystem, underpinning the investment. HypeLab’s CEO, Joe Kim, emphasized the significance of ads monetization in attracting external capital and driving new user adoption in the web3 landscape. Despite a recent dip in new investment for blockchain startups, HypeLab’s infusion of capital coincides with its success in aiding over 50 companies in acquiring new web3 users.