2022 Crypto Fundraising Report

Jan 13, 2023

• 2

Min Read

Executive Summary

Click Here for the full report.

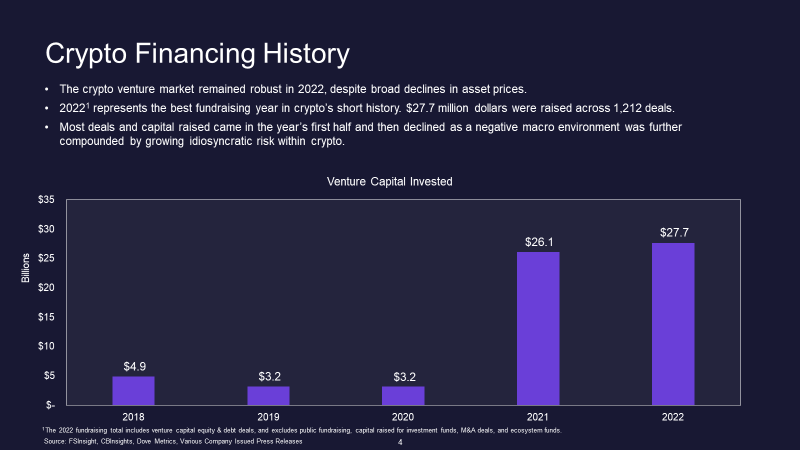

- Since late 2021, crypto markets have struggled in the face of a challenging macroeconomic background highlighted by rampant inflation and geopolitical conflict. Asset price drawdowns were exacerbated by a violent unwind of unhealthy leverage in the space, which revealed outright fraudulent behavior among some of the industry’s most prominent figures. Despite these headwinds, crypto VC funding remained strong in 2022 and set a new high in yearly cumulative fundraising.

- CeFi and Infrastructure were the two verticals that garnered the most investment, whereas Web3 & NFT projects and companies had the highest deal count, albeit at earlier stages of development. The collapse of centralized entities across the industry discouraged investment into most verticals, particularly CeFi, during the back half of 2022.

- Public mining companies have seen increased distress throughout the year, which has clearly manifested in the private market. Mining represented the vertical with the least number of deals and capital raised.

- The breadth of early-stage investors expanded, with 388 different funds/companies leading at least one investment deal. A16z, Binance Labs, Polychain Capital, and Animoca Brands were the most active lead investors throughout 2022.

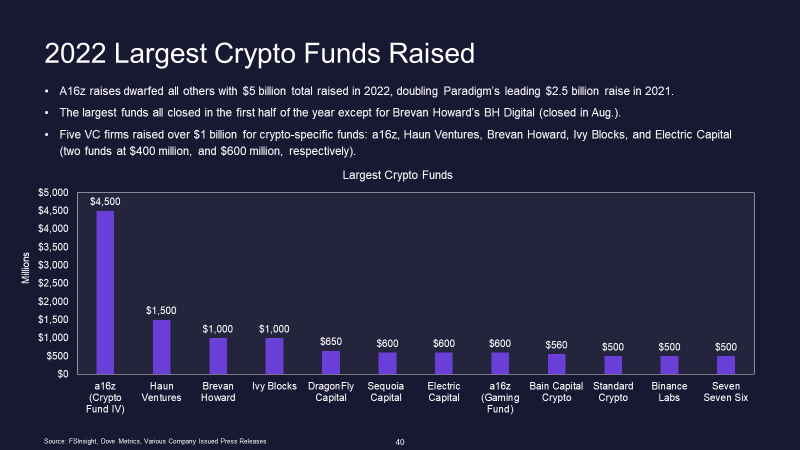

- Investment funds dedicated to the crypto industry thrived from a capital-raising perspective in 2022, raising over $23 billion. The largest was a16z’s $4.5 billion Crypto Fund IV.

- Bottom Line – The challenging macroeconomic backdrop and blowups by some of the industry’s most prominent names caused VC investment to wane in the second half of 2022. Despite this, private market investment remained resilient on an absolute basis. The $8.9 billion invested in 2H 2022 was greater than any year before 2021. We expect at least a portion of the seeds planted this past year to translate into world-changing products.

Key Slides From This Report…

Crypto Financing History (Slide 4)

2022 Fundraising Overview (Slide 5)

Verticals Summary (Slide 6)

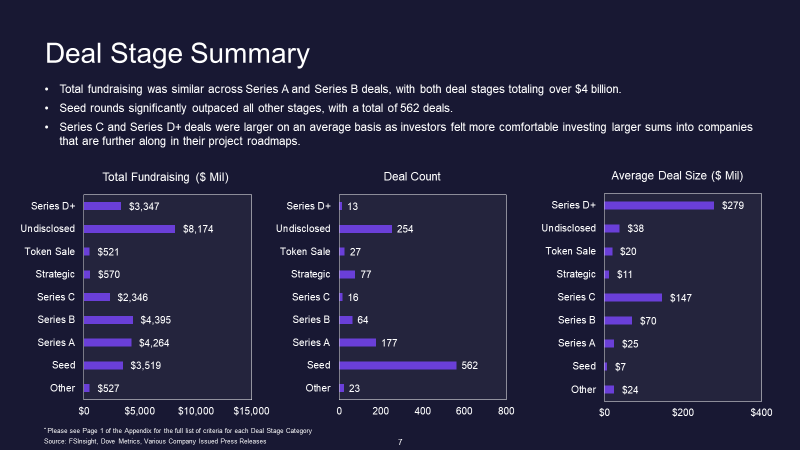

Deal Stage Summary (Slide 7)

2022 Largest Crypto Funds Raised (Slide 40)