Funding Reaches its Highest Level in Months

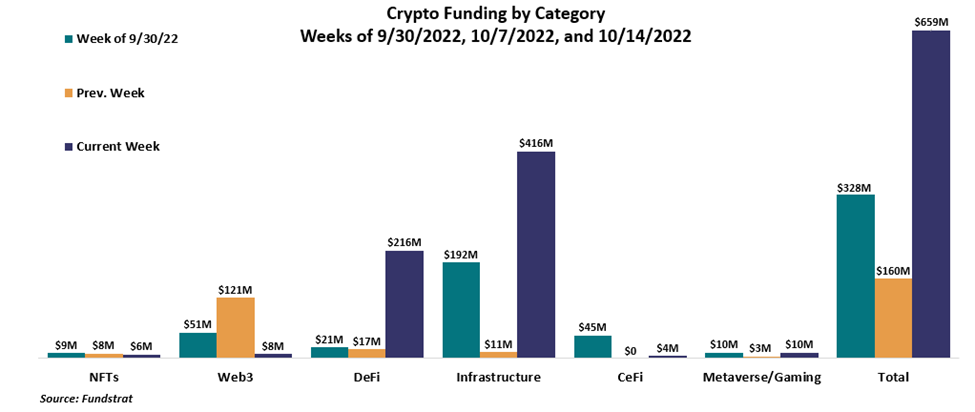

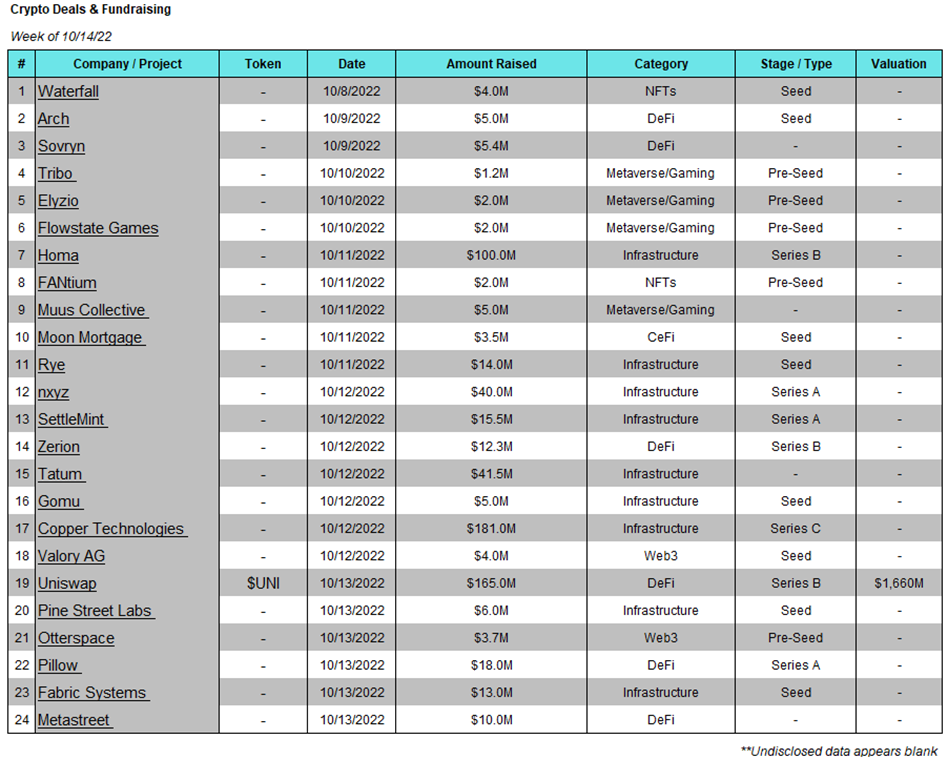

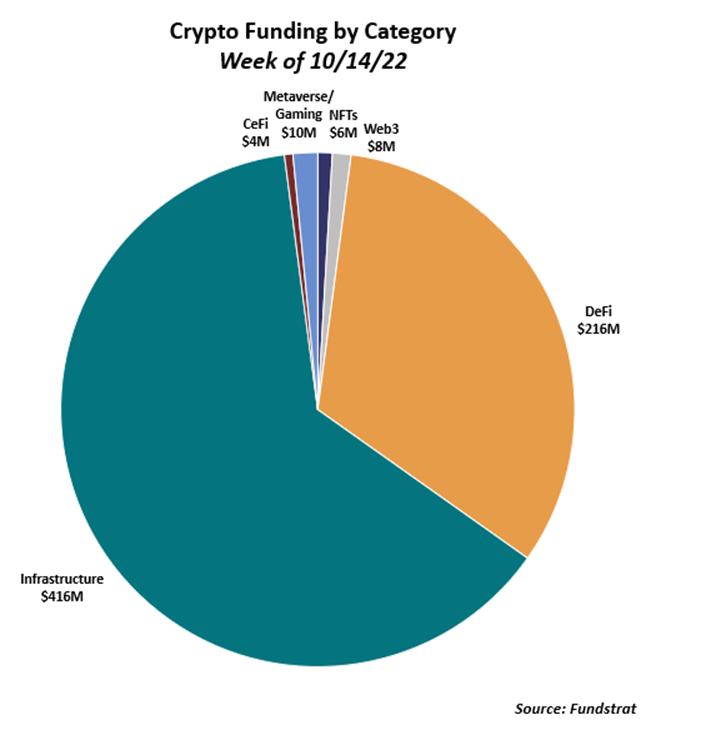

Funding was the highest it’s been in months, shooting up from $160M last week to $659M this week. Not surprisingly, the bulk of this funding ($416M) came from infrastructure, which has been the strongest segment for most of 2022. Nine of this week’s 24 deals were infrastructure, the two standouts being Homa and Copper Technologies, which raised $100M and $196M, respectively. Interestingly, DeFi accounted for $216M of funding this week, making it one of DeFi’s highest-funded weeks all year. There was a total of seven DeFi deals, the largest of which was a $165M raise for the decentralized crypto trading protocol, Uniswap, giving the protocol a $1.66B valuation. Other segments such as NFTs, Web3, and CeFi, had a slower week, each seeing a decline in funding. Metaverse/Gaming funding rose from last week but was still relatively low at $10M.

There were two acquisitions this week. Crusoe Energy Systemsacquired the operating assets of bitcoin miner Great American Miner and Offchain Labs (the developer of Ethereum Layer 2, Arbitrum) acquired Prysmic Labs, one of the core teams behind the development of the Ethereum Merge.

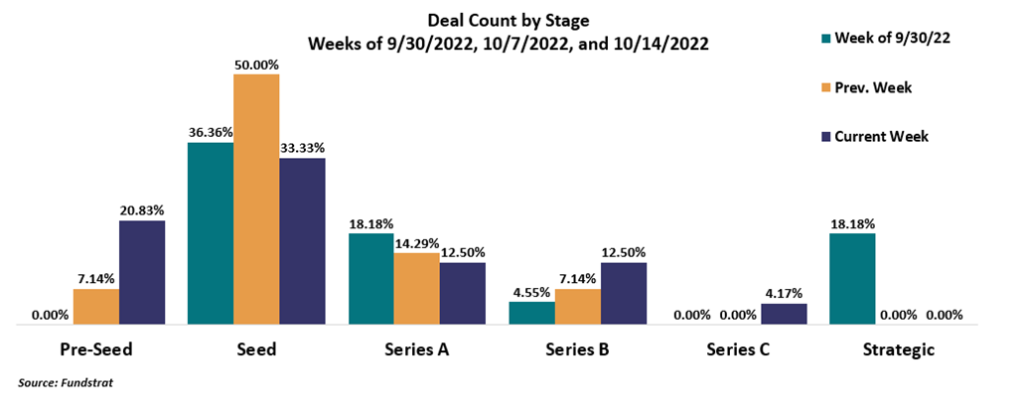

The majority of deals are still taking place in the early stages. Pre-Seed and Seed deals were 20.8% and 33.3% of deals, respectively.

Deal of The Week:

nxyz, the blockchain infrastructure company providing Web3 companies with fast, reliable Web3 indexing technology, has closed a $40 million Series-A fundraise led by Paradigm. Other investors include Coinbase Ventures, Greylock Partners, and Sequoia Capital. Valuation figures of nxyz were not released with the announcement. nxyz was started earlier this year by ex-Google engineers and is aiming to “empower a new generation of builders, creatives, and entrepreneurs to develop a better internet by providing fast, flexible, and reliable blockchain indexing and data infrastructure.” The fundraise will be used to expand nxyz’s team, expand use cases, and increase support across different blockchains.

Why is this Deal of The Week?

Data quality and sourcing are a massive part of any tech startup, whether it’s Web3 or traditional tech. nxyz will enable developers to focus more on product quality and worry less about infrastructure. nxyz ingests data directly from blockchains and provides the data via APIs to developers in under 200 milliseconds. The increased speed of data processing should unlock tons of blockchain potential. Since nxyz’s inception earlier this year, it has processed over 5 billion transactions across various blockchain networks. nyxz currently supports Ethereum, Polygon, Binance, Avalanche, Arbitrum, and Optimism, with support for Solana coming soon. As the adoption of blockchain technology increases, there will be significantly more data across different chains, and developers will need reliable and fast APIs to continue innovating. nxyz is well-positioned to take advantage of the growing market and should continue to see increased usage.

Selected Deals

Uniswap Labs($UNI) are the developers behind the popular decentralized exchange, Uniswap. The company has secured $165M in funding through its Series B round at a $1.66B valuation led by Polychain Capital. In addition, the funding round also included investor participation from Variant Investments, Paradigm, Andreessen Horowitz Crypto, and SV Angel. Uniswap Labs intends to allocate the capital raised towards increasing awareness and exposure of the platform globally.

Homa is an infrastructure-based platform aiming to create useful tools for mobile game developers. The platform can achieve this through its software development kit, which tracks various metrics through integrated analytics features. The company has secured $100M in funding through its Series B round, co-led by Headline and Quadrille. In addition, the funding round also included investor participation from Fabric Ventures, Northzone, BPI France, and others. Homa intends to allocate the capital raised for workforce expansion and investments in data products.

Moon Mortgage is a centralized finance (CeFi) based platform. The platform’s product CryptoMortgage aims to provide a service that allows individuals to use their digital asset holdings as collateral for financing real estate. In addition, the platform will provide users with the ability to get a loan based on the value of their portfolio. The company has secured $3.5M in funding through its seed round, co-led by CoinFund and Cadenza Ventures.

Rye is an infrastructure-based platform aiming to build APIs and tools that enhance e-commerce experiences. The company has secured $14M in funding through its seed round led by Andreessen Horowitz Crypto. In addition, the funding round also included investor participation from GOAT Capital, Electric Feel Ventures, Solana Ventures, and others. Rye intends to allocate the capital raised primarily toward workforce expansion.

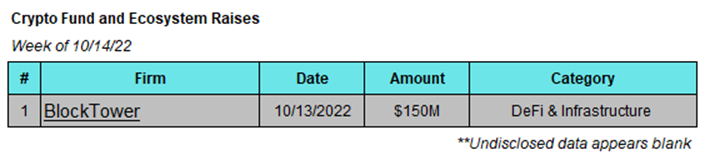

BlockTower Capital is an institutional crypto asset investment firm. The company has revealed a $150M venture fund backed by the Teachers Retirement System of Texas, MassMutual, BPI France, and others. The fund will primarily focus on investments in crypto-based infrastructure and decentralized finance (DeFi) platforms. BlockTower Capital intends to deploy the capital raised over the next three years.

Copper is a centralized finance (CeFi) based platform that provides a gateway for institutions to invest in digital assets. It accomplishes this by providing its users with brokerage, settlement, and custody services. The company has raised $196M in funding through its ongoing Series C round, with $15M coming from a convertible loan note.