Delta Neutrality I

Key Takeaways

- Yield farmers need to acknowledge effect of looming macro headwinds on DeFi liquidity, and tailor their strategies accordingly.

- One class of strategies that might prove effective during periods of volatility is the delta-neutral strategy.

- Arbitrage is the simultaneous buying and selling of the same asset in different spot or derivative markets to profit from the price differential between them. While arbitrageurs are exposed to the price change risk from the time they open the trade to when they close it, this risk is mitigated through low-latency algorithms.

- Cash-and-carry trading yields traders the funding rate (comparable to cost of carry in commodities) through equally-sized but contrasting spot and futures positions. When funding rates oscillate around zero, cash-and-carry traders need to constantly adjust their positions (and incur trading fees) to collect low funding rates.

- By taking advantage of inefficiencies in the market, delta-neutral strategies are less sensitive to whether prices move up or down.

- Arbitrage and cash-and-carry are basic representations of this, each possessing their own set of risk and return profiles.

Figure: Farmer Pepe jaded from being overexposed to Terra whilst simultaneously rugged by Miladies, as he contemplates hurling in his last bag of seeds to one more farm

Fellow DeFi Enthusiasts,

We hope this week’s DeFi Digest finds you well. Evidently, these market (weather) conditions have shown to be inconducive to the strategies (crops) we’ve cultivated throughout the last 18 months.

Like farmers adapting to changing seasons, we humble (yield) farmers need to pay close attention to our crops, leaning into robust strategies (crop species) that can weather the ongoing storm (bear market).

Delta Δδ

One class of strategies that may prove effective in the current market climate is delta-neutral strategies. Delta is defined as the change in the price of a financial instrument relative to the change in price of its underlying asset.

Followingly, delta-neutrality is to be flat (zero or close to zero) on delta, causing negligible changes in P&L regardless of whether market moves up or down. This concept is not foreign to traditional finance, as illustrated in the strategies below:

I. Arbitrage

Arbitrage is the simultaneous buying and selling of the same asset in different spot or derivative markets to profit from the price differential between them.

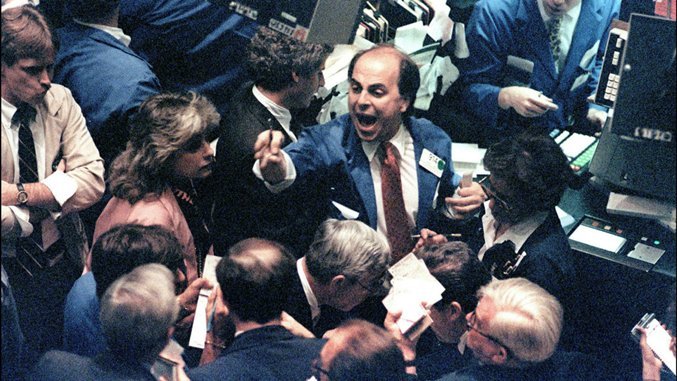

In 80’s TradFi, market makers would crowd around brokers on the trading floor hounding over incoming client orders, managing a loosely-constructed, delta-neutral book between other colleagues on the floor.

Figure: Anon NYSE Market Maker Shouting At His Floor Broker For Giving His 80bps Delta-Neutral Closing Trade Away

Today, this manifests in the form of algorithmic prop desks arbing[1] basis point spreads on FX markets electronically via different brokers and OTC desks. Floors like NYSE and CBOE are still operational, but suffice to say the glory days as pictured above are behind us.

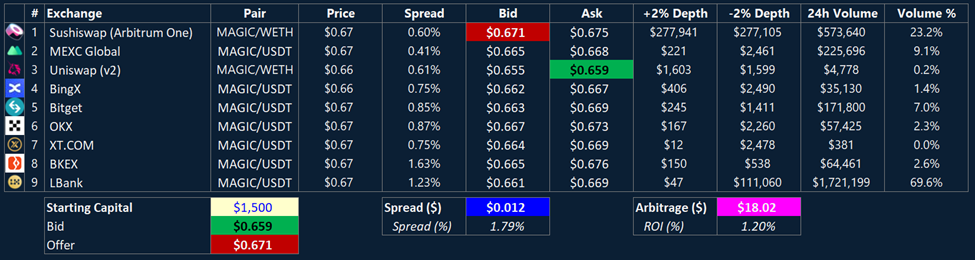

On the other hand, digital asset markets are far from efficient. To illustrate, TreasureDAO (MAGIC – $25m market cap, ranked #660 per Coingecko) is trading at $0.67 as of 5/19, with the top 9 markets offering differing levels of liquidity, spreads, and volume.

In this example, an algorithmic arbitrageur could deploy $1,500 into buying/longing MAGIC for $0.659 on Uniswapv2 while subsequently or simultaneously selling/shorting the same token on Sushiswap for $0.671, profiting from a $0.012 bid-ask spread. This near split-second trade would net them $18.02, representing a 1.2% return on their $1,500 investment.

Note that while arbitraging may seem like a lucrative business, it carries its own idiosyncratic risks. Specifically, when taking advantage of these price differentials across exchanges, traders are exposed to the price change risk (caused by changing liquidity depths or market volatility) from the time they open the trade to when they close it.

In the traditional world, this risk can be significantly mitigated with an emphasis on low latency infrastructure, popularized by Michael Lewis’ ‘Flash Boys.’ Because price change risk is negligible, the focus on speed has introduced a winner-take-all dynamic as traders become more confident in their ability to on and offload positions instantaneously.

For digital assets traded on-chain, traders compete with each other to get their trades included in the next block by bidding on gas fees. This is similar to the traditional world, except instead of bidding for infrastructure to win trades, users are bidding for block space to include their trades.

Gas Fees

Gas fees refer to the cost to users that are used to incentivize miners or validators to include the users’ trades in the next block. Gas fees are usually paid in the Layer-1 token (ETH for Ethereum), and they are driven by (i) gas limit (ii) gas price.

Often pre-determined by the protocol itself, gas limit is the block space needed to execute a smart contract transaction. It is also a proxy for the computational complexity of the smart contract interaction initiated by the user. The more complex the smart contract function, the higher the gas limit, and vice versa.

On the other hand, gas price represents the price users are willing to pay for a unit of block space. Gas price is denominated in ‘gwei’, where 1 gwei equates to 0.000000001 (or 10-9) ETH.

Gas price is analogous to the price per gallon drivers pay, while gas limit is the gallons of gas required to traverse to a destination. Followingly, users should tinker with gas price instead of gas limit to have their transactions prioritized.

II. Cash-and-carry Trading

We’ve covered cash-and-carry trading extensively in Sources of Yield:

“In centralized exchanges, this manifests in the form of funding rates for perpetual swaps (perps), where funding rates are positive: buyers pay sellers for the privilege to be leveraged long when markets are bullish…

… Harvesting this yield is similar to the cash-and-carry trade in commodity markets, where one would short perps (futures) and long spot when funding (carry) rates are positive, and long perps (futures) short spot to collect funding (carry) from shorters. The best part of this strategy is that it is delta-neutral, benefitting from market periods with clear trends and pronounced bullish/bearish market biases.”

As noted in the past issue, funding rates for perps are analogous to the cost of carry in commodities. Unlike traditional futures contracts, however, perpetual futures do not expire. Instead, they rely on the funding rate to balance open interest[2] and prevent lasting diverges in spot and futures prices.

Funding rates reflect demand for (bullish or bearish) leverage at a given point. Specifically, funding rates are payments to either long holders or short sellers based on the spread of perp and spot prices.

When perp prices are trading above that of spot, funding rate is positive (where long pay shorts). When perp prices are trading below that of spot, funding rate is negative (where shorts pay longs). This mechanic converges the price between spot and perpetual futures markets periodically (funding rates are usually refreshed every 8 hours).

Figure: 8H Funding Rates for BTC Perpetual Futures

Since the start of the year, funding rates have been flat to trending negative across the board for perpetual futures, in line with the predominantly bearish sentiment across the board.

Figure: Annualized Funding Rates for USDT/USD Margined Perpetual Futures Across Major Exchanges

Currently, cash-and-carry traders can earn 24.16% by longing BTC perps on CoinEx and simultaneously hedging elsewhere for a cost. They can also earn 10.95% by longing BTC spot and shorting perps on Gate. The difference in funding rates here are determined by the liquidity and pricing on these different order books, with the large spreads reflecting the nascency of the space.

The main risk cash-and-carry traders face is zero to near-zero funding rates. This occurs when there is a reduced demand for leverage in the market, typically when prices do not follow a clear trend. When markets are unbiased like this, funding rates oscillate around zero as cash-and-carry traders need to constantly adjust their positions (and incur trading fees) to collect low funding rates.

Bottom Line

Yield farmers need to acknowledge effect of looming macro headwinds on DeFi liquidity, and tailor their strategies accordingly. One class of strategies that might prove effective during periods of volatility is the delta-neutral strategy. By taking advantage of inefficiencies in the market, these strategies are less sensitive to whether prices move up or down. Arbitrage and cash-and-carry are basic representations of this, each possessing their own set of risk and return profiles.

[1] Arbing is slang for arbitraging.

[2] Open interest is the total dollar value of open futures contracts in the market.