Anchor Protocol - A Look Into The Savings dApp On Its First Birthday

Fellow Yield Farmers,

I hope the previous issues of DeFi Digest have laid some foundation in this fast-moving space that is Decentralized Finance. We’ve covered concepts such as money markets, decentralized exchanges, and yield sources/flows, teeing up this week’s analysis of Anchor Protocol nicely. Today also coincides with Anchor’s one-year anniversary of launching on Terra on March 17th, 2021.

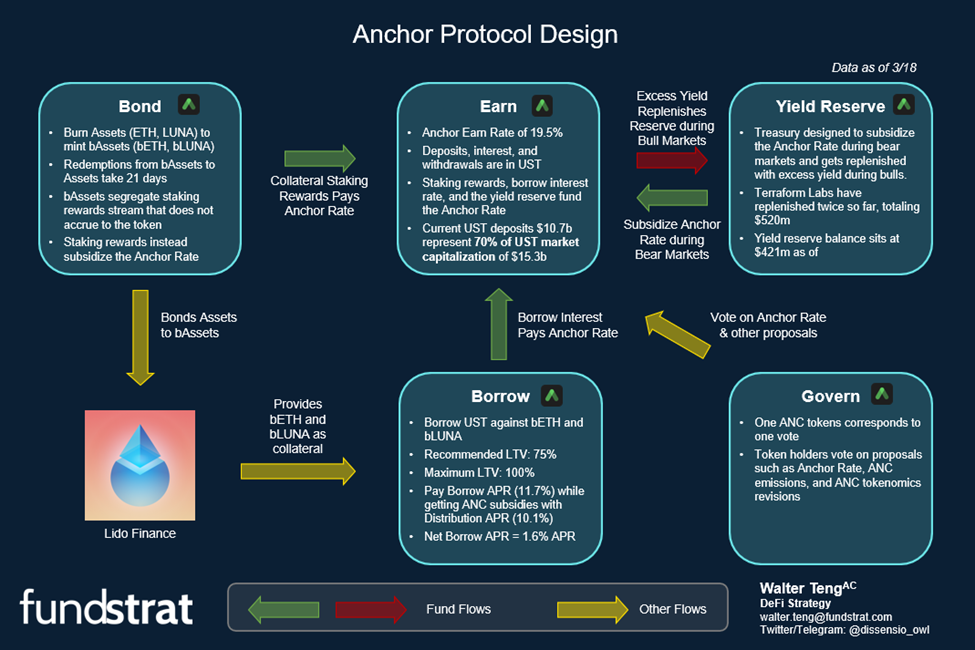

Anchor Protocol is a decentralized fixed income platform that features compelling savings yields powered by an integrated money market and diversified staking yields. It launched with Earn, Borrow, and Bonding product functions – we explore the functionality of each below:

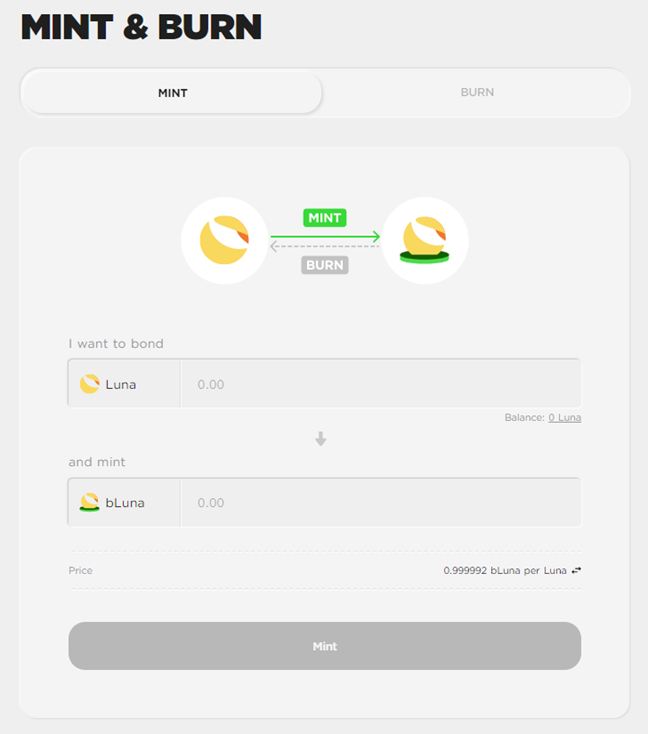

Bonding (bAsset)

Here, users can burn their Assets to mint bAssets, and vice versa. To reiterate, bLuna is the staked version of Luna, validating the network and earning staking rewards. Redemptions from bLuna to Luna, therefore, take 21 days to process and are still vulnerable to slashing risk.

bAssets segregate the staking rewards stream so that it does not directly accrue to the token similar to xSushi in previous issues. Essentially, users who collateralize bETH / bLuna and borrow UST against their position forfeit their staking rewards. These rewards, coupled with the borrowing interest described below, subsidize the Anchor ‘Earn’ rate.

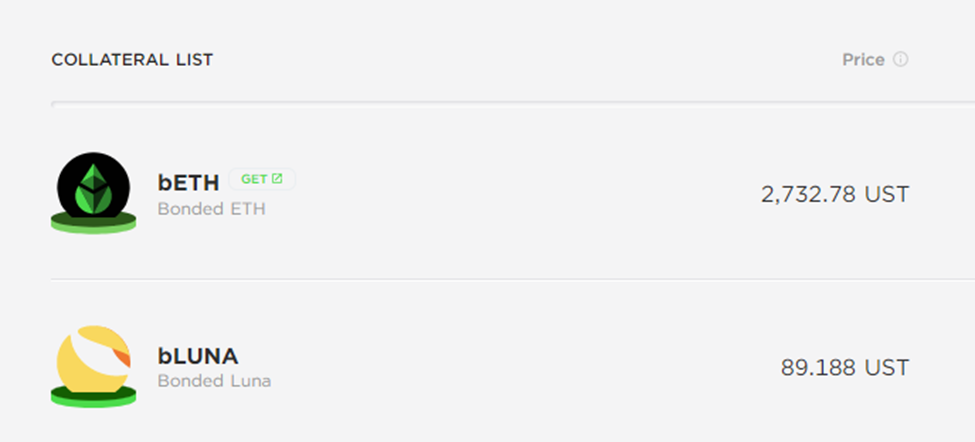

Borrow

In the ‘Borrow’ section, users can collateralize against their bETH or bLUNA positions to borrow UST tokens. These bonded versions of the tokens earn staking rewards for partaking in PoS, but forfeit this staking interest to subsidize the 19.5% UST deposit rate.

First pioneered by Lido Finance, this aspect of being able to borrow against your staked asset (within the PoS validator network) is dubbed ‘liquid staking’. Liquid staking serves several nuanced problems smaller validators face, including eliminating the need to maintain expensive infrastructure and optimized environment for the hardware, negating minimum staking requirements (e.g., 32 ETH for ETH 2.0), and minimizing slashing[1] and key risk[2].

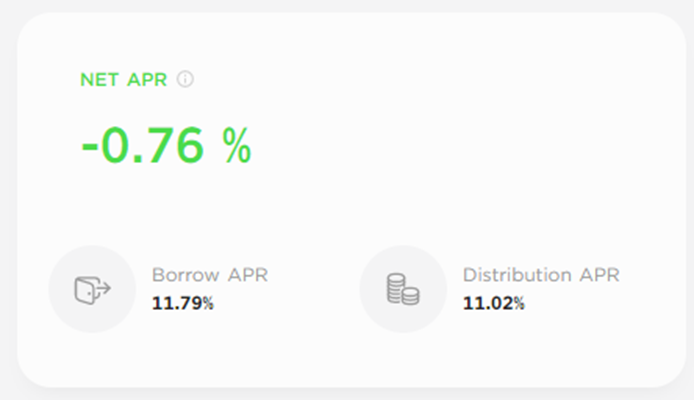

Currently, borrowers of UST on Anchor are paying 11.8% to borrow UST, whilst getting subsidized by Anchor emissions of 11.0%. This means on a net basis, they are paying -0.8% APY to borrow (assuming price of ANC stays constant or they sell periodically to realize gains).

In fact, degens will remember when Anchor Borrow’s Net APR was positive one year ago – they were getting paid (APY in the high teens) to borrow against their bETH and bLUNA.

In conjunction with Anchor’s 1st birthday, the project announced an implementation on the Avalanche network. Users can now deposit Wormhole-wrapped UST[3] in xAnchor on Avalanche network to enjoy the 19.5% Earn APY instead of having to bridge and deposit UST on Anchor on the Terra network.

There is also an active poll in progress to whitelist staked AVAX (sAVAX), where almost 100% of those voted (26.6% of quorum) have done so in favor of the proposal. Should this pass, holders of AVAX tokens can now stake AVAX on BENQI (Lido competitor/liquid staking service provider) for sAVAX, borrowing UST against it on xAnchor.

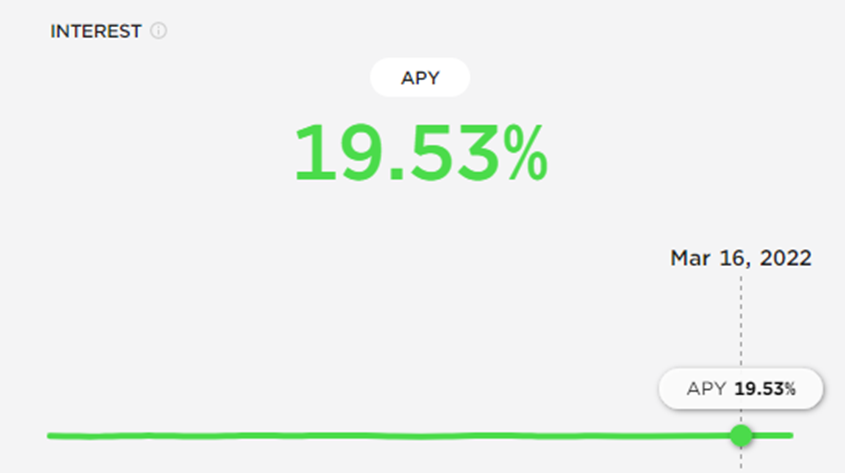

Earn

Anchor’s “Earn” function features the Anchor deposit rate that depositors have grown to love.

Users deposit their UST to the platform and are compensated with interest paid in the form of UST. This interest originates from three sources:

- Staking yields on collateral – staking yields are paid in ETH or LUNA from bETH and bLUNA that are used as collateral in the ‘Borrow’ functionality (discussed further below). The ETH and LUNA are then sold for UST on the open market and paid back to depositors in ‘Earn’.

- Borrowing demand for UST – the protocol collects interest from UST borrowed with the bETH and bLUNA collateral, which is redirected to depositors in ‘Earn.’

- The Anchor Yield Reserve – a ‘working capital’ treasury designed to subsidize the Anchor Rate during bear markets and gets replenished with excess yield during bull markets.

Staking yields from bETH[4] and bLUNA are paid in ETH or LUNA that are used as collateral in the ‘Borrow’ functionality. The ETH and LUNA are then sold for UST on the open market and paid back to depositors in ‘Earn.’ The UST borrowed with the bETH and bLUNA collateral also pay out interest in UST, which is redirected to depositors in ‘Earn.’

Depositors in the ‘Earn’ product receive a corresponding aUST token, representing their proportionate share of UST deposits in the pool. The interest accrues to aUST in the same mechanism xSushi accrues trading fees.

It is worth noting that Anchor’s 19.5% deposit rate is quoted in APY, not APR[5]. This means that should one withdraw the UST before the 1-year mark, the interest earned will not be proportional to the time deposited. Instead, it will be lower because of unearned compounding interest.

Govern

Governance is another product of the protocol, where ANC is the governance token corresponding to one vote. ANC token holders can vote on issues such as the “Anchor Rate,” the target APY (Currently 19.5%) Anchor seeks to pay out to Earn depositors.

How It Ties Together

The whole idea of Anchor is that it counts staking rewards from a diversified pool of Layer 1s (ETH, LUNA, AVAX) as the main source of yield, which is then stabilized around the “Anchor Rate” using money market demand and ANC token incentives.

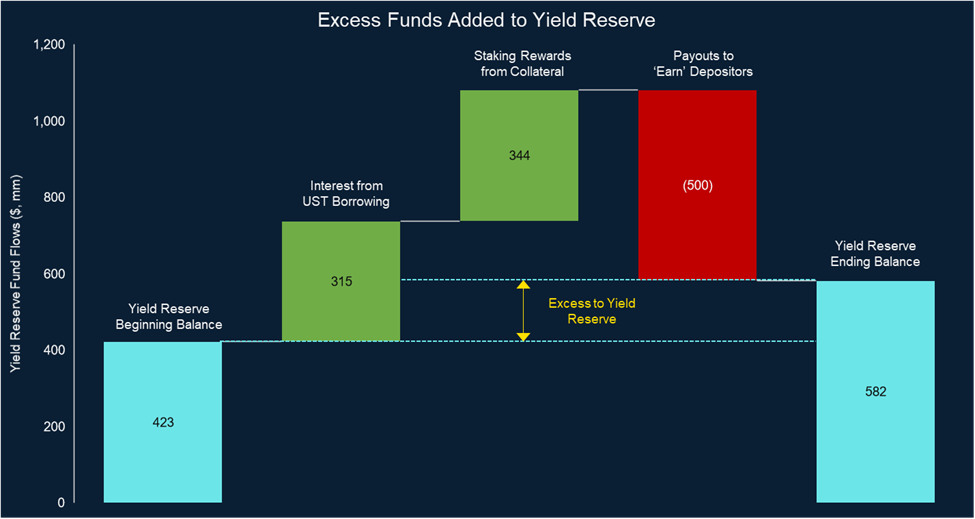

If the real yield is higher than the Anchor Rate, excess yield is stored in a UST denominated “Yield Reserve.” ANC incentives for ‘Borrow’ drop by 15% every week until the equilibrium is restored.

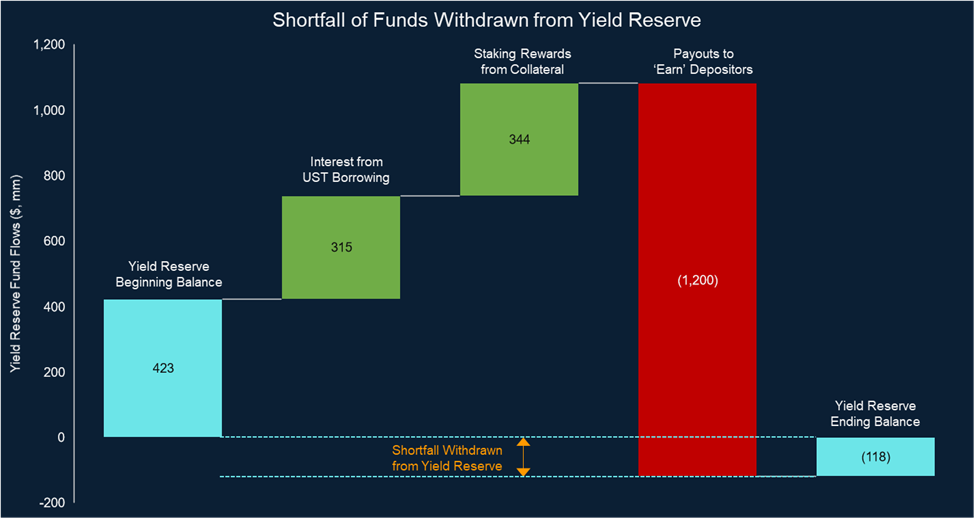

If real yield is lower than the Anchor Rate, however, the shortfall is made up from the yield reserve until it is replenished or the Anchor Rate decreases. ANC incentives to borrowers increase by 50% every week until real yield converges to Anchor Rate.

This seesaw mechanic hypothesizes that demand for leverage will be high during bull markets, subsidizing the 20% Anchor Borrow rate whilst having excess to be added to the yield reserve. Conversely, demand for stablecoin yields in ‘Earn’ will increase during bear markets, forcing the protocol to dip into its reserves to maintain the Anchor Rate.

The Elephant In the Room

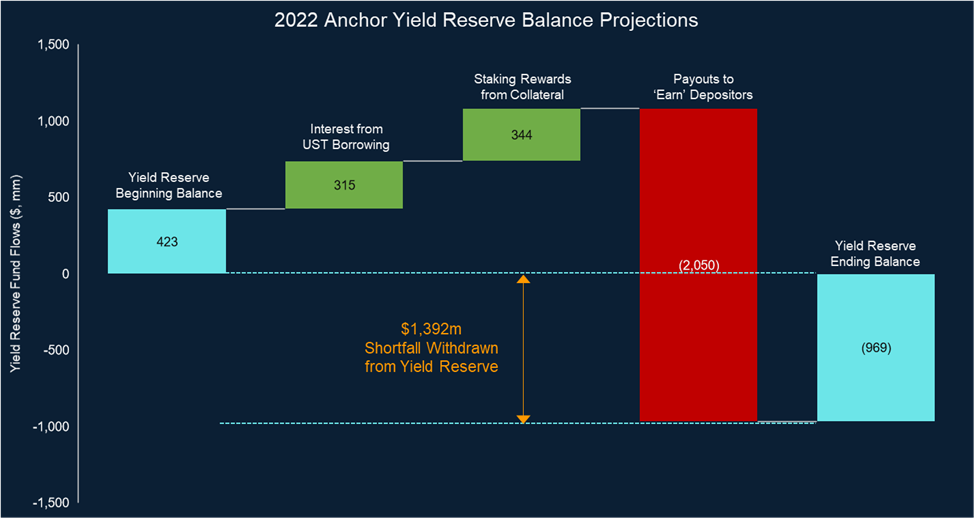

Currently, however, the yield figures I’ve scraped from Anchor suggest that we are in the latter camp. As of 3/17, the demand (11.9% interest on $2.7b UST borrowed) and collateral staking yield in ‘Borrow’ (weighted average 6.6% on $5.4b bLuna and bETH collateral) simply cannot sustain the payouts for ‘Earn’ (19.5% on $10.5b of deposits).

Anchor has a few choices as it crosses its 1st birthday with an increasingly morbid outlook ahead:

- Reduce the 19.5% ‘Earn’ APY in some form

- Increase ANC emissions to subsidize borrow demand, increasing borrow interest and forfeited collateral staking rewards

- Replenish the Yield Reserve as Terraform Labs have done so twice in the past, once for $70m in July 2021 and again for $450m in Feb 2022

Beyond that, I don’t see many other options Anchor has given the market conditions and inner mechanics of the protocol.

In his announcement of the most recent replenishment, Do Kwon may have temporarily reassured Anchor depositors and Luna token holders of the longevity of Anchor’s Earn yields, but the reality remains:

Sources simply do not cover uses of funds

Understanding this, as the CEO of Terraform Labs, Do Kwon has the delicate task of balancing between:

- Generating enough demand for UST apart from Anchor via other Terra ecosystem dApps such as Mirror, Astroport, or Stader Labs

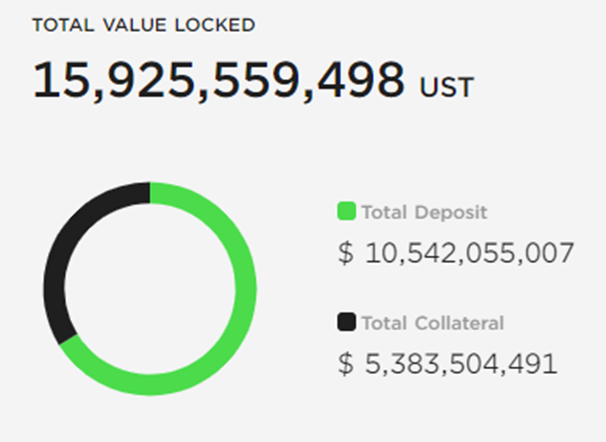

- While many supporters of the Luna ecosystem (‘Lunatics’) sing praises for the burning of Luna supply, few acknowledge the formidable task of creating extra venues of demand for UST. As of 3/17, UST has a market capitalization of $15,135m[6], of which $10,542m (69.7%) is deposited on Anchor as illustrated below

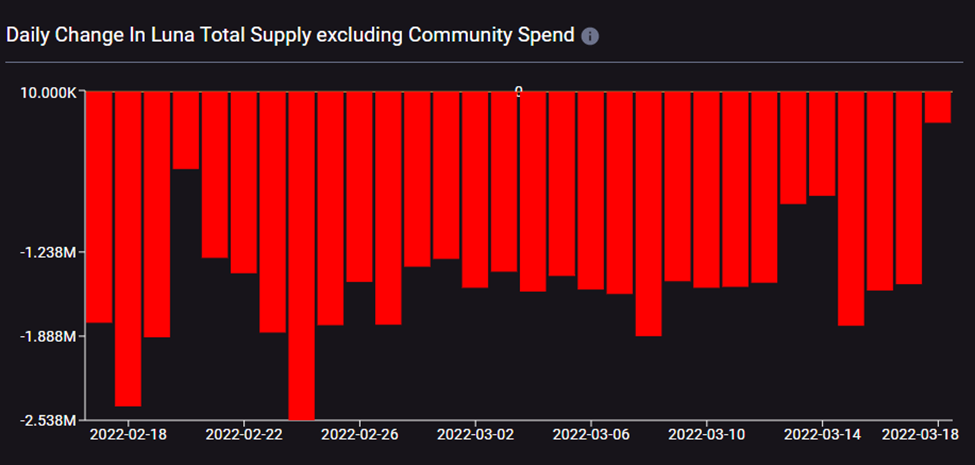

- The demand for the Anchor Rate restricts LUNA’s supply to increase LUNA’s price (see chart below for Daily Burn of Luna Supply corresponding to UST market capitalization increase)

- Raising enough external capital to replenish the yield reserve, subsidizing the Anchor Rate

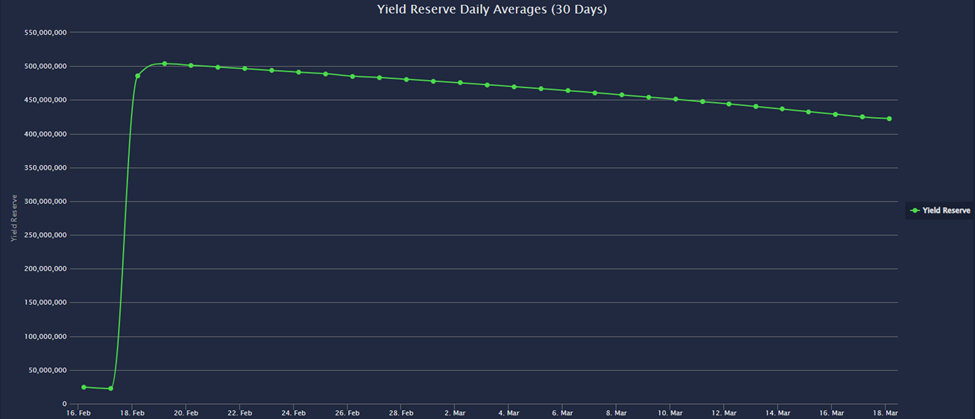

- Despite having just raised $450m in mid-February, the Yield reserve has since depleted from $500m to $420m

Figure: Total Value Locked (Total Deposit + Total Collateral) on Anchor Protocol

Figure: 30-Day Anchor Yield Reserve Balance

Sounds unsustainable given current market conditions? We tend to agree.

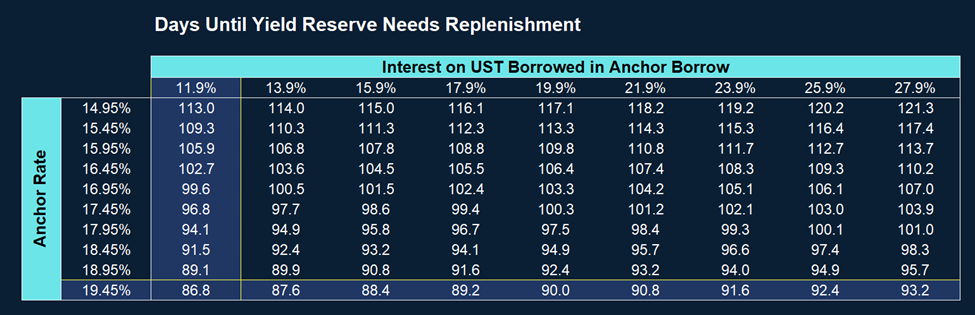

To quantify this, I sensitized the days until Anchor’s Yield Reserve needed replenishment against the Anchor Borrow Rate and Interest on UST Borrowed in Anchor Borrow, results below:

Figure: Days Until Yield Reserve Needs Replenishment Sensitized Against Anchor Rate and Interest on UST Borrowed in Anchor Borrow

This approach coincides with (2) from Anchor’s list of options above. Anchor Borrow Interest Rates will be subsidized by ANC token emissions, inadvertently increasing Interest from Borrowing to subsidize Anchor Rate.

This way proves costly, as a 27.9% borrow rate (representing a 2.3x increase) will merely lead to 10 extra days (7%) of run rate. Those Anchor emissions are simply not worth paying for the runway.

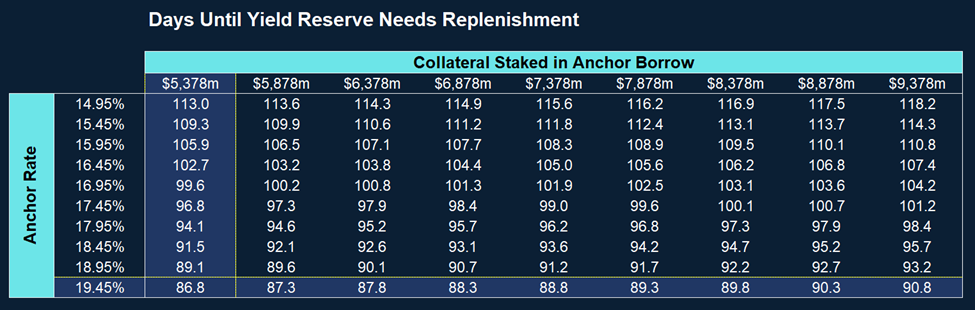

I then attempted the same but with increased collateral but encountered the same results. The takeaway rings clear: the Yield Reserve runway is most sensitive to the Anchor Rate. TerraForm Labs need to reduce the Anchor Rate or find external capital to fund the Yield Reserve.

Figure: Days Until Yield Reserve Needs Replenishment Sensitized Against Anchor Rate and Collateral Staked in Anchor Borrow

Note that the above analysis is illustrative and assumes all else equal apart from factors sensitized.

Anchor Yield and Tokenomics Revision Proposal

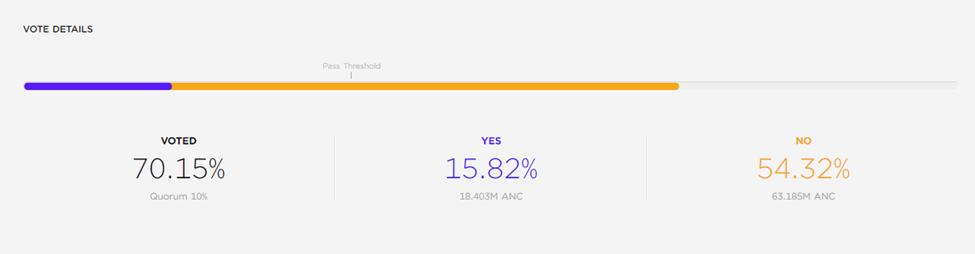

Our friends Matt Hepler from Arca and Josh Rosenthal from Polychain Capital are equally concerned. They submitted a notable proposal about 3 weeks ago. Within, they merge submissions from Retrograde and Arca to suggest:

- A payout of the Anchor Rate in a mixture of UST and ANC

- Absolute yield level is determined by how long depositors decide to vote-escrow ANC (veANC) portion of said paid yield

- This vote-escrow tokenomic design is inspired by Curve, where holders lock their tokens for higher yields and the ability to vote on various governance proposals including yield redirection

- Borrowers can earn boosted ANC rebates, proportional to their amount of ve-ANC

- Reducing overall yield paid by Anchor earn to relieve pressure from the Yield Reserve by introducing tiered yields according to deposit amounts (larger deposits have lower yield)

All these suggestions attempt to assign utility to the ANC token, inadvertently increasing demand for it. They also recognize the stress current protocol dynamics is exerting on the Yield

Reserve, attempting to abate it. Unfortunately, the proposal couldn’t gather enough support from ANC holders.

On the degen side of the pond, a few prominent figures on Crypto Twitter have put some skin in the game.

Algod ($1m) and GCR ($10m) have both entered wagers with Do Kwon, utilizing Cobie’s account as an escrow. Algod and GCR win if LUNA price dips lower in one year from when the bet was made, while Do Kwon profits if the price stays above. Fueled with conviction, GCR even offered to double the bet size but has yet to hear back.

As a DeFi Degen, this wager provides some excitement in my day as markets have looked weak over the past few weeks. However, the irony isn’t lost on me that a bet on the future of a smart contract platform is made on another chain (ETH) and uses a centralized entity such as another person’s account as escrow ¯\_(ツ)_/¯.

Bottom Line

The algorithmic stablecoin that is UST and its counterpart LUNA form the bedrock of the Terra ecosystem, proving to be the most successful implementation of an algorithmic stablecoin to date. Encapsulating a money market and a savings platform, Anchor Protocol represents the first breakthrough use case for UST. For the first time this past year, stakers of ETH and LUNA are able to borrow against their holdings and earn 20% by putting their staking rewards to work.

Although the Terra ecosystem represents $25b in TVL, much of it still depends on the Anchor protocol, whose long-term sustainability remains fairly uncertain. All while the Terra ecosystem leverages other dApps to bolster demand for the algorithmic stablecoin, the clock is ticking for them as the Anchor Yield Reserve gets drained.

[1] Slashing risk is a reduction in rewards when a validator node goes offline for extended periods of time.

[2] Key risk is the risk of losing one’s private keys or having them stolen by malicious actors.

[3] Wormhole wrapped UST is the mirrored version of UST on Avalanche issued by Wormhole bridge.

[4] bETH and bLUNA are tokens that represent staked ETH and LUNA in Lido. bETH and bLUNA rewards don’t accrue to the token, instead, they need to be claimed on Anchor.

[5] APY = (1+ APR/n)^n – 1. APR = Annual Percentage Rate, proportionate interest rate exclusive of compounding. APY = Annual Percentage Yield, interest rate that takes into account compounding interest, becoming a single-point comparison of different offerings with varying compounding schedules.

[6] Source: Coingecko