Funding Activity Continues Gaining Steam

Weekly Recap

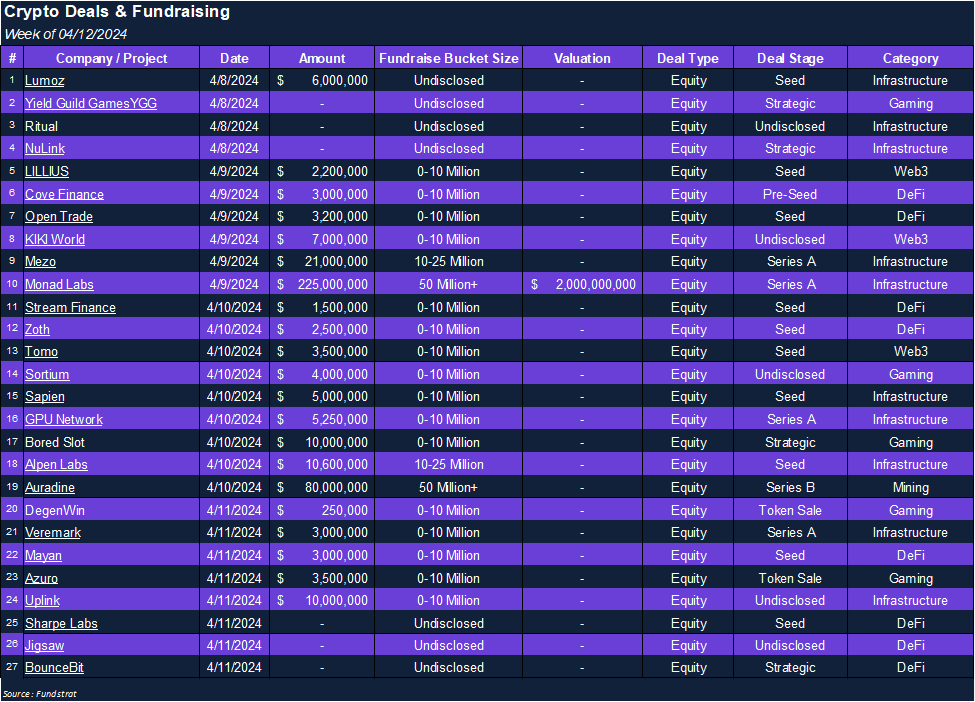

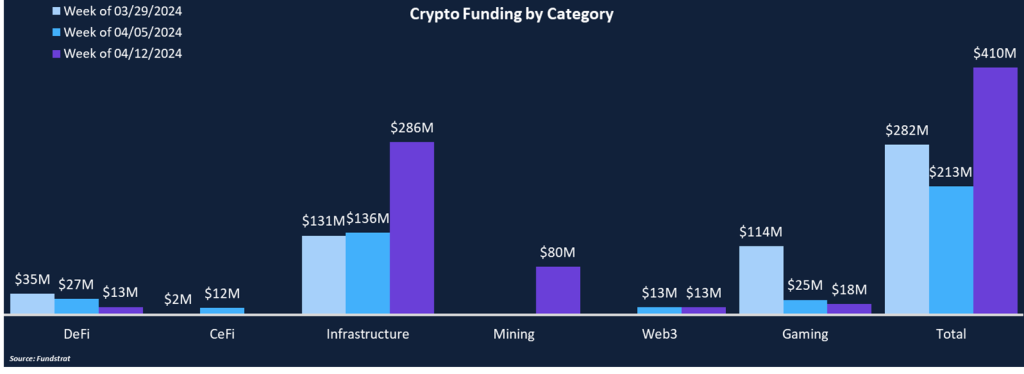

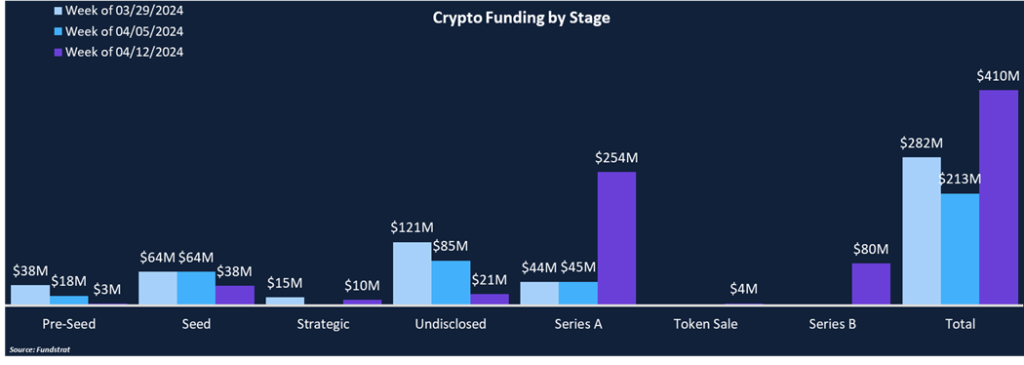

Crypto funding rose 92% from $213 million to $410 million, one of the highest weekly totals in months. The majority of funding came from two deals: Monad’s $225 million round (DotW) and Auradine’s $80 million Series B round, the first mining deal of 2024. Auradine’s Teraflux family of Bitcoin ASIC miners has set new performance and energy efficiency benchmarks and has shown robust field performance, which has helped them secure $80 million in bookings with another $200 million in the order pipeline. The funding will be used to scale its Teraflux revenues and enhance R&D for its portfolio of blockchain and AI security solutions.

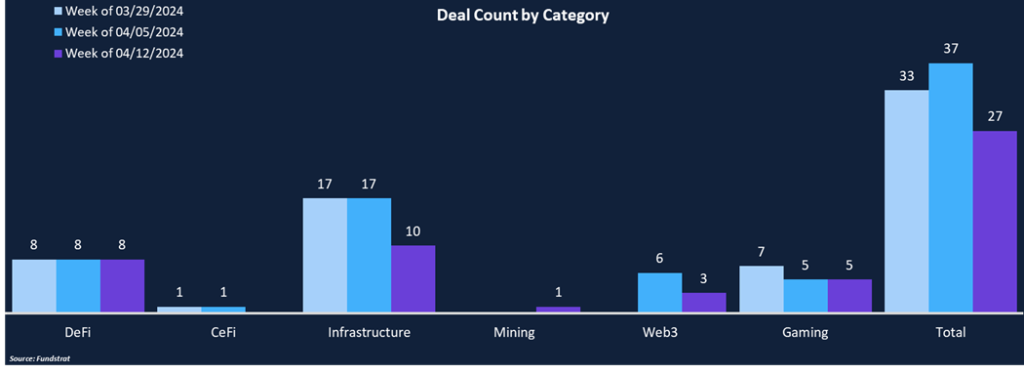

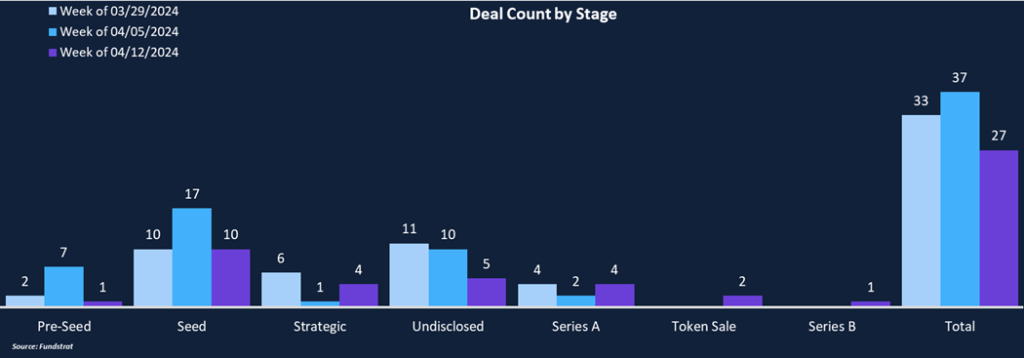

Deal count fell to 27 this week, the first week under 30 deals since February. Infrastructure was the leader in deal flow and total funding, comprising 37% of deals and 70% of funding. DeFi projects have been consistently attracting deals, with three consecutive weeks of 8 deals and the second highest category total over the last three weeks. CeFi continues to be a laggard category from both a deal flow and funding perspective, with just two deals totaling $14 million over the last three weeks.

Funding by Category

Funding by Stage

Deal of the Week

Monad Labs, the development company of Monad, a fully EVM-compatible L1 blockchain with the most performant parallel-EVM, raised $225 million in a series A round led by Paradigm. Other investors included Electric Capital, Coinbase Ventures, Greenoaks, Castle Island Ventures, Egirl Capital, and others. The funding round values Monad at $2 billion, marking another unicorn valuation and the largest deal of 2024.

Why is This Deal of the Week?

The vast majority of DeFi TVL lies on EVM chains, largely due to the interoperability between chains and familiarity for developers. Despite the large amounts of TVL, most EVM chains lack the throughput to properly scale with transaction demand. Ethereum operates at roughly 10-15 transactions per second and most Ethereum rollups are below 50 TPS. Monad is introducing parallel execution into the EVM to improve upon performance. To make that feasible, Monad has begun optimizing all levels of the tech stack including the database layer, virtual machine layer, consensus layer, and networking layer. Monad hopes to offer 10,000 TPS, 1-second block times, and single-slot finality to unlock the next generation of performance for the EVM ecosystem. Monad’s superscalar architecture combined with its EVM composability should allow it to vastly improve on current blockchain capabilities.

Selected Deals

Mezo, a Bitcoin economic layer, raised $21 million in a Series A round led by Pantera Capital. Other investor participation included Multicoin, Hack VC, ParaFi Capital, Nascent, Draper Associates, and others. The funding round occurred in two tranches, but no valuation was disclosed. Mezo uses a “proof-of-HODL” consensus mechanism, allowing users to deposit Bitcoin to secure the network and earn HODL points, which will be redeemable for its future token. Mezo allows users to deposit Bitcoin to earn yield from the Bitcoin economy. Mezo has already accumulated over 770 BTC (roughly $54 million) in two days since opening deposits.

Uplink, a dePIN network with the goal of democratizing access to the internet, raised $10 million in an undisclosed round led by Framework Ventures. Internet connectivity is dominated by large telecommunications companies like Verizon, AT&T, and T-Mobile. Uplink provides decentralized network connectivity to create better distributed and user-operated infrastructure. By contributing bandwidth or using the network, Uplink users will earn tokens. Uplink is expected to launch its token in the coming months.

Sharpe AI, an AI-powered crypto superapp, raised an undisclosed amount in a seed round with participation from Animoca Brands, Maven Capital, GBV, Morningstar Ventures, Contango, and more. Sharpe hopes to offer a comprehensive and effortless way to invest, track, manage, and automate DeFi positions using any wallet. It wants to tackle things like trading, data, research, portfolio management, and yield optimization all in one place. The ‘first season’ of Sharpe’s airdrop program is live and users can earn points for interacting with the platform, which will be redeemable for SAI tokens.