Bitcoin Quickly Hits Target & Has Healthy Pull Back But Bull Market Remains Intact

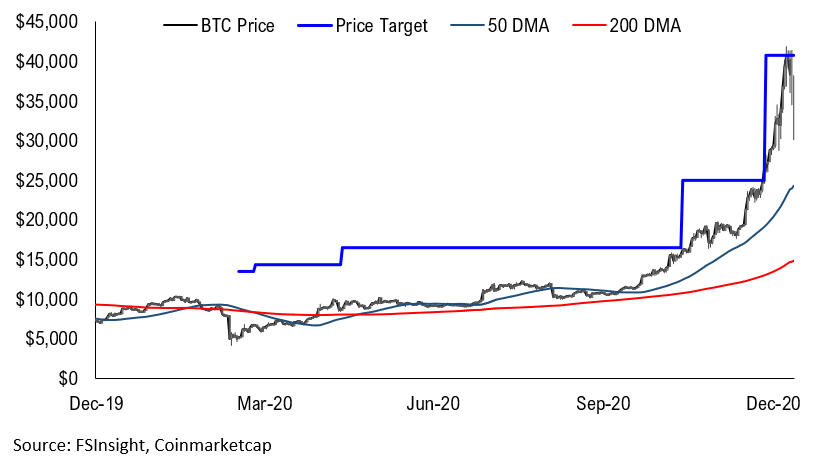

After raising our outlook 50% from $25,000 to $40,000 on December 30th, Bitcoin quickly rose to reach our target late last week. Prices then started to consolidate and slide over the weekend before retracing ~25% down to ~$30,000 and now rebounding to ~$33,800. Bitcoin and crypto are volatile assets, but the speed at which prices moved to hit our target was quite fast and we think a pull back is healthy.

We don’t think the retracement was indicative of a bull market top – to be clear we firmly believe the fourth crypto bull market remains intact. We think the sell-off was simply a combination of 1) traders taking profits after 50%+ gains in under two weeks, 2) an uptick in treasury yields and dollar strength, and 3) modestly negative news out of the U.K.

Nearly 70% of investors were in unrealized profit after the sharp move up and that means some selling is to be expected. But investors shouldn’t forget, last time Bitcoin reached these unrealized profit and loss levels during a bull market, Bitcoin still rose from ~$2k to ~$20k or ~10x over the course of the cycle. We think for Bitcoin to sustainably move higher to levels many expect, a similar pattern is necessary.

Macro conditions of a weaker dollar and low 10-year treasury yields, which have been trending in Bitcoin’s favor, saw what we see as a short-term bounce, which likely dampened the rally.

Finally, negative headlines out of the U.K. Financial Conduct Authority may have had a modestly negative impact on retail sentiments and prices.

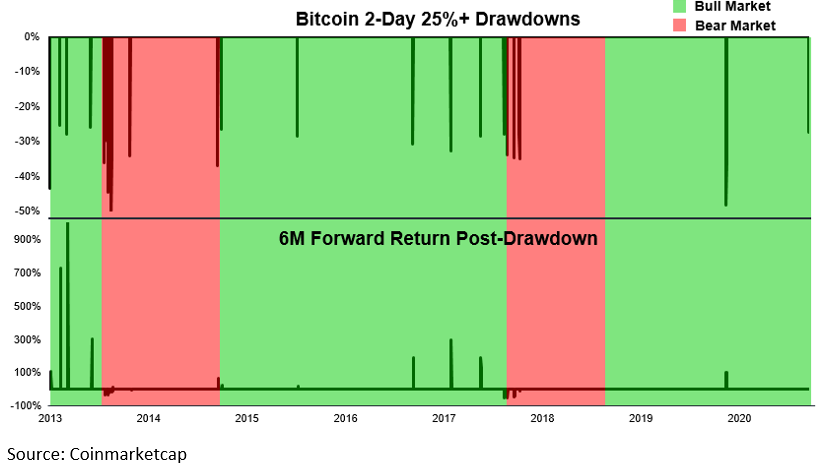

We have been in crypto long enough to know that these types of pull backs are common and represent opportunities during bull market cycles, even though 25% moves will seem extreme to traditional investors and the main stream media.

Excluding the current move, since 2013 has Bitcoin has had 35 drawdowns of 25%+ over two days, and the average 6-month forward return has been 93% with a win ratio of 57%. Among those drawdowns, 20 happened during bull markets and their average 6-month forward returns were 170% with an 80% win ratio.

Bottom line: We think the crypto bull market remains intact, but we expect to see waves of choppiness as prices move higher. Bitcoin sits ~20% under our $40,000 target, which we view as conservative. Our current target is under review with a bias to the upside.