Tokenization of Real-World Assets

Key Takeaways

- Blockchain networks and the real world are becoming increasingly intertwined. Real-world assets (RWAs) such as U.S. dollars and Treasuries are being tokenized and moved onto blockchain rails. Tokenization is the minting or creation of a digital “token” on a blockchain that represents a claim on an underlying asset.

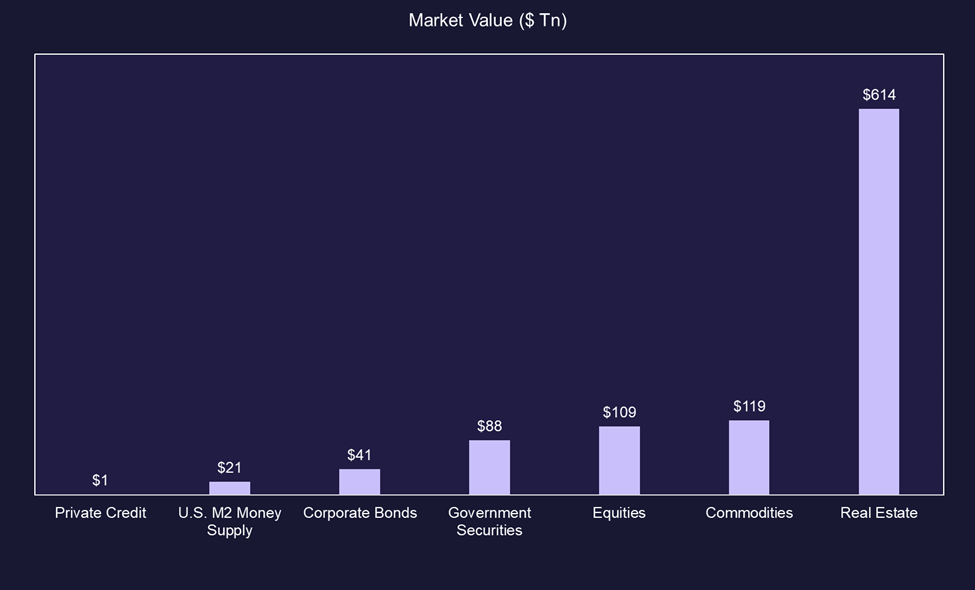

- RWAs have a current value of over $992 trillion across assets such as real estate, commodities, government securities, and others. Tokenization offers a multitude of benefits such as asset fractionalization, lower costs, transaction efficiency, composability, and interoperability.

- Considering the benefits tokenization brings to the table, both crypto protocols and traditional financial institutions are exploring the technology to enhance protocol profitability or improve traditional business activities.

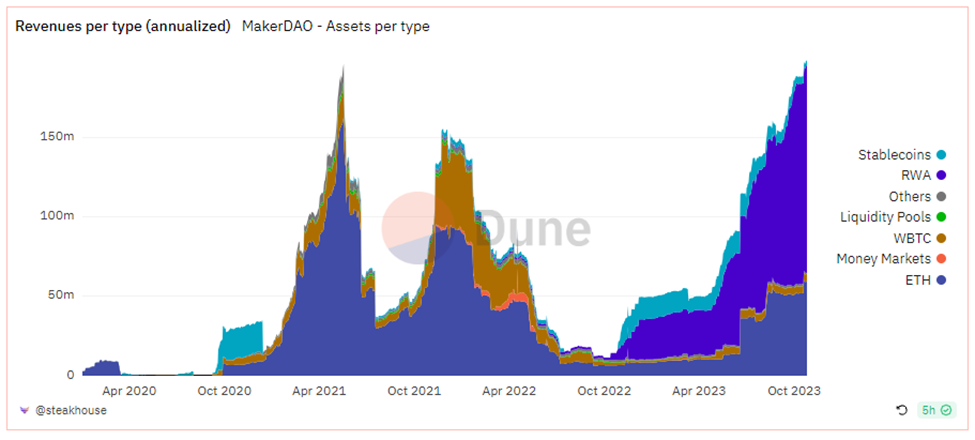

- Protocols like MakerDAO are investing excess reserves into U.S. Treasuries and using the yields to buy and burn MKR tokens. RWA income is now the largest contributor to Maker’s total revenue. Additionally, traditional finance companies like JP Morgan and Blackrock are experimenting with tokenized collateral networks to improve intraday liquidity and reduce transaction settlement times.

- Tokenization is still a nascent sector, with total on-chain RWA value sitting at $118.6 billion. Approximately 97% of that value is comprised of fiat-backed stablecoins, with commodities and government securities being the next largest two asset classes.

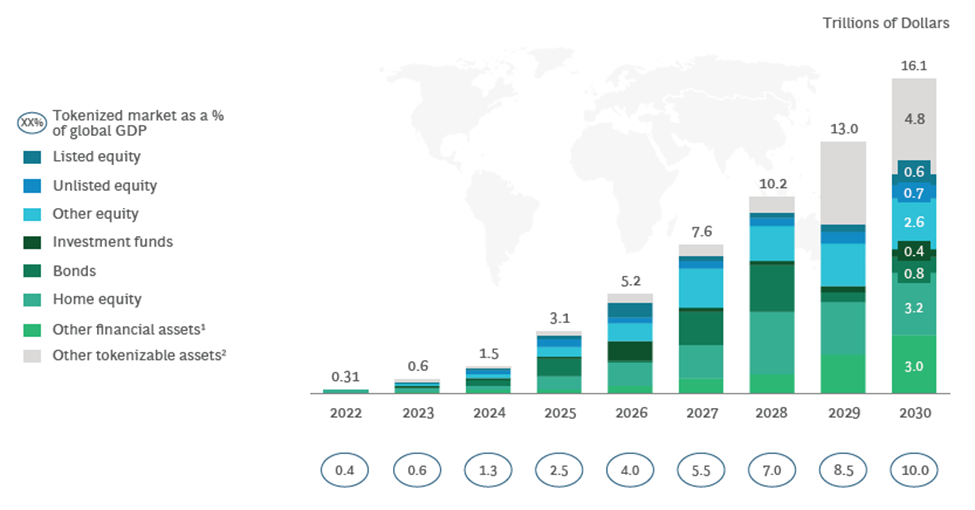

- Despite being in its early stages, tokenization represents a significant opportunity to enhance global finance. In an optimistic scenario, BCG estimates that the total tokenization market could reach a value of $68 trillion by 2030.

Introduction

Blockchain networks initially were more like closed-loop systems, meaning the value created and traded on-chain was confined to crypto native assets. As technology has developed, blockchains and the real world are becoming more intertwined. Crypto protocols and TradFi institutions alike are looking to tokenize real-world assets and benefit from transaction efficiencies, cost savings, interoperability, composability, and transparency. Protocols have already begun bringing assets like dollars and treasuries on-chain while some of the largest financial institutions in the world have started experimenting with tokenization and in-house blockchains. The line between the two will likely continue fading as technology and adoption grows, but it’s becoming increasingly likely the future of finance will move onto blockchain rails.

What are RWAs?

Real-world assets or RWAs include all tangible and intangible assets that are not native to a crypto network, from real estate and commodities to government securities and M2 money supply. The total market value across RWAs exceeds $992 trillion[1]. These asset classes are all extremely mature and have been developed on traditional finance rails over multiple decades. For context, the total market capitalization of all crypto projects is $1.21 trillion[2].

The majority of the world’s wealth is tied up in RWAs, and all these asset classes have unique properties relating to how they are traded, issued, and settled. Due to the uniqueness of each asset, there are many pain points that come with trading RWAs including:

- High Ticket Cost – Median home value in the USA is ~$400k.

- Storage Requirements – The average person can’t store commodities or natural resources in their basement.

- Accessibility / Awareness – Difficult to access fine art networks or gain valuable information into niche industries like livestock or private credit.

- Inability to Fractionalize Utility – Cannot infinitely divide living space between investors.

- Regulatory Hurdles – Accredited investor limitations or foreign investment restrictions.

Tokenizing these illiquid assets can alleviate a lot of these issues and reduce the pain points for investors and issuers.

What is Tokenization?

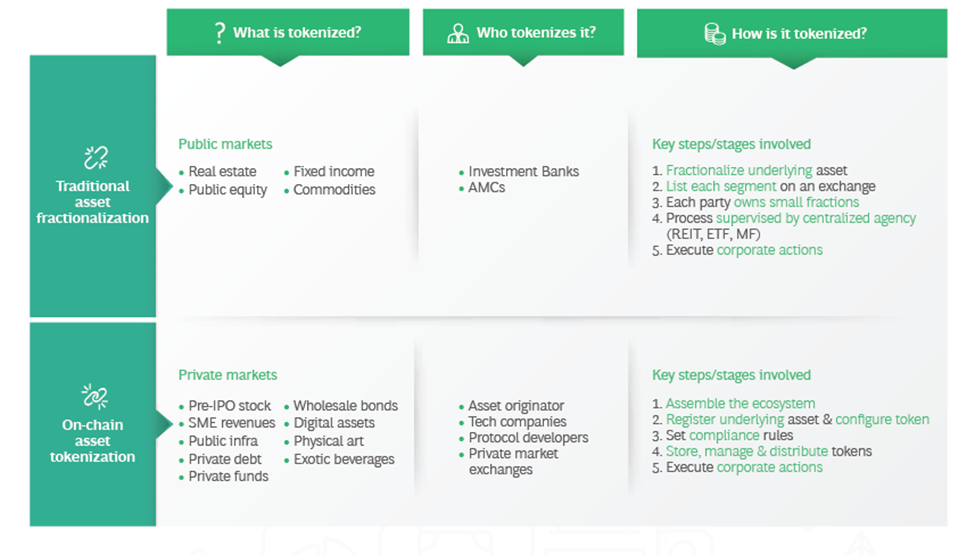

Tokenization is the minting or creation of a digital “token” on a blockchain that represents a claim on another corresponding asset. Tokenization is not a completely new concept as similar structures already exist in the traditional finance world. Examples include the securitization and fractionalization of Real Estate Investment Trusts (REIT) which are shares of a collection of investment properties and Exchange Traded Funds (ETF) that offer shares of an underlying pool of publicly traded assets.

Digitizing assets in traditional markets alleviates some of the mentioned pain points of illiquid assets which is evident in the popularity of REITs and ETFs. U.S. REITs own over $4 trillion in real estate and the ETF market has similarly grown to manage over $5 trillion in assets.

In the case of on-chain tokenization, real world asset issuers can mint digital tokens representing shares in an underlying asset on a distributed ledger. Issuers can either mint fungible or non-fungible tokens (NFT). If you are not familiar with the terminology, fungible tokens are interchangeable and divisible, meaning all versions of fungible tokens are equal in value and can be divided into infinite fractions. Non-fungible tokens are unique and non-interchangeable, meaning each has its own attributes and value. Fungible tokens are the typical crypto tokens such as Bitcoin and Ether whereas an example of non-fungible tokens would be CryptoPunks.

On-Chain Tokenization Benefits:

Blockchain technology has the potential to improve on the current tokenization market and enhance the trading experience of RWAs with a multitude of benefits such as:

- Improved Investor Affordability – Tokenization creates divisible shares of high-ticket investments such as real estate or alternative investments.

- Cross-Border Transactions – Decentralized blockchains are accessible globally allowing seamless foreign investment (assuming local regulations are met).

- 24-Hour Secondary Market Trading – Assets on blockchains will trade 24 hours a day and on weekends, improving liquidity and price discovery. Assets can also be traded prior to maturity dates.

- Transparency & Accountability – Distributed ledgers offer full transparency with immutable transactions, providing tamper-proof transaction history and clear record of ownership.

- Transaction Efficiency – Higher transaction speeds, lower fees, reduced settlement times, removal of intermediaries.

- Composability and Interoperability – Seamless transfer of assets and data across different blockchains or wallets. Easily leverage one’s assets and enable cross-asset collateral.

Due to the forementioned benefits tokenization brings to the table, it’s becoming increasingly likely that blockchains can become the back-end infrastructure for almost every asset class. The combination of some of the different technologies we’ve discussed in Crypto Concepts such as Oracles, Zero-Knowledge Proofs, and Appchains can potentially all come together to create a tokenized settlement layer for global finance.

As such, it is expected that the tokenization market has huge potential to grow. According to Boston Consulting Group (BCG), a highly conservative estimate of the tokenization market by 2030 would be $16 trillion. In BCG’s best-case scenario, they forecasted that the global tokenization market could reach as much as $68 trillion, representing over 40% of global GDP.

As mentioned earlier, the total value of RWAs is currently over $900 trillion, so even in a best-case scenario, the tokenization market would still have only captured less than 10% of total RWA value. Looking past 2030, it is likely that percentage continues to increase as infrastructure and adoption continues to scale.

Tokenization Use Cases

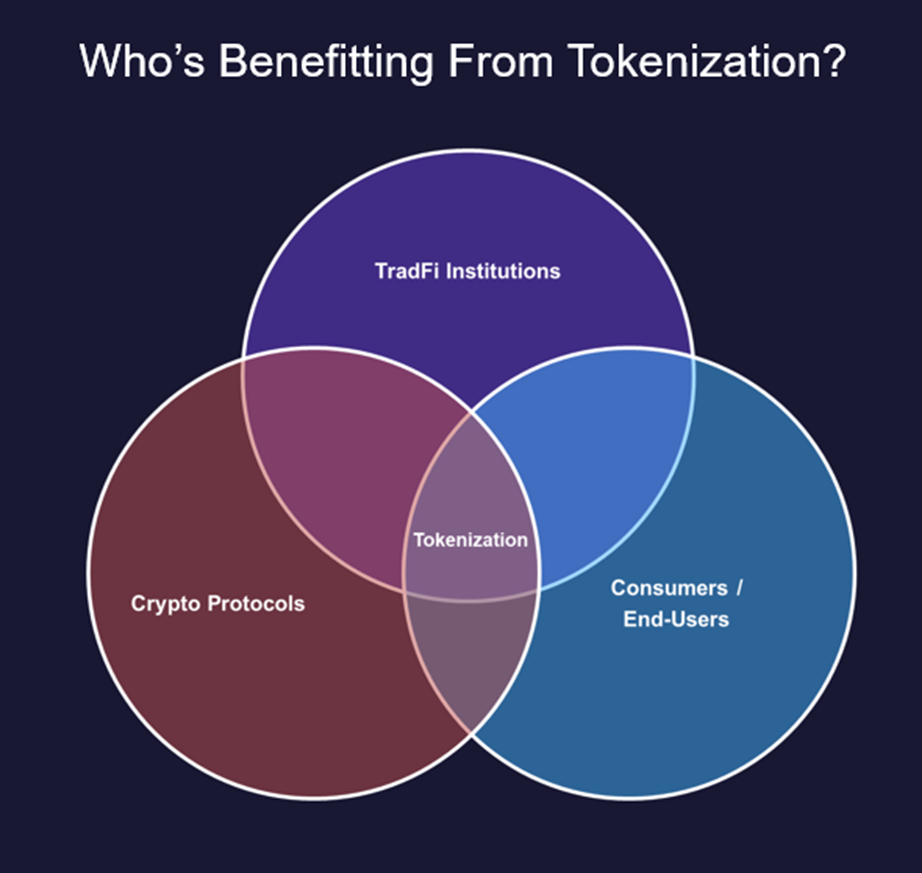

There are three main groups that are utilizing tokenized assets: traditional financial institutions, crypto protocols, and consumers/end-users.

Institutions

The potential of innovative financial infrastructure has caught the attention of many institutions, including banks, asset managers, brokerage firms, and mortgage companies, among others. The broad array of use cases is evident when examining the entities entering and exploring tokenization:

JP Morgan, Blackrock, and Barclays

JP Morgan has gone live with its Tokenized Collateral Network (TCN), an application enabling collateral transfers without moving underlying assets, built on JP Morgan’s in-house blockchain, Onyx. For its first transaction, Blackrock tokenized shares of one of its money market funds on TCN, which were then transferred to Barclays as collateral for an OTC derivatives trade. With Blackrock’s transfer agent connected to the TCN, the tokenization and transfer took place within minutes, significantly reducing the operational friction in which financial institutions typically transact. Traditional financial systems do not allow for the instant transfer of collateral, resulting in sudden liquidations in certain scenarios. JPM’s collateral network gives financial players access to intraday liquidity and allows them to nurse margin positions that come under pressure. TCN sources the liquidity from repurchase agreement transactions with tokenized collateral instead of using unsecured credit lines. Other benefits include transparency of collateral ownership throughout the asset’s lifecycle, automated reconciliations, reduced cost and settlement times, and the ability to leverage tokenized collateral across Onyx’s digital asset ecosystem.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT)

SWIFT and Chainlink are working to enable seamless interoperation of any blockchain network and apply it to the global financial system. The SWIFT network is integrated with over 200 countries and 11,000 institutions, and they process almost 38 million encrypted transactions daily. SWIFT is experimenting to solve fragmentation of the financial system by finding a single-entry point to move tokenized assets globally. Through their experiments they found that 97% of institutional investors believe that tokenization will revolutionize asset management, and 95% of capital markets firms believe that blockchain will play an important role in the settlement processes going forward[3]. The creation of an international settlement layer built on blockchain rails could end up being one of the most significant adoptions of blockchain technology.

The Hong Kong Monetary Authority (HKMA)

Hong Kong continues to embrace blockchain technology, as its central bank successfully issued $100 million of tokenized green bonds as part of Project Evergreen. The Hong Kong Monetary Authority found Project Evergreen to be very successful and showed that tokenization has the potential to improve efficiency, liquidity, and transparency in the bond market. Other benefits cited in the report included paperless creation for issuance, removal of multiple financial intermediaries, and reduced settlement delay and risk. The HKMA determined that to unlock the full potential of tokenization within capital markets, further use cases need to be developed along with addressing fragmentation and regulatory issues.

The common theme between the three examples listed above is that large global players clearly recognize the opportunity and efficiencies that tokenization can bring to global finance. There are obviously still pain points regarding interoperability, regulatory standards, and adoption, but those can be addressed over time.

Protocols

Similar to how TradFi institutions have recognized the benefits of tokenization, crypto protocols are leveraging RWAs to increase their profits or improve their business models:

Utilizing RWAs to Increase Profits

Fiat-stablecoin issuers such as Circle and Tether have secured enormous profits from backing their stablecoins with U.S. treasuries. Tether announced a Q2 profit of $850 million with a total of $72.5 billion worth of U.S. Treasuries backing USDT. Similarly, Coinbase reported over $200 million in interest income for Q2 2023, representing the second largest revenue stream on its income statement.

Maker DAO has been one of the major winners in the RWA space as they have been investing their excess reserves into U.S. Treasuries, with returns being used to buy and burn its native token MKR. The total amount of real-world assets on Maker’s balance sheet has surpassed $3.37 billion and RWA revenues have become the largest contributor to their total revenue.

Global Accessibility

Private credit marketplaces like Centrifuge (CFG -4.29% ) or Goldfinch (GFI 5.34% ) are building upon a traditional business model and expanding to the global market. Typically, private credit deals face a two-sided problem; they must source a creditworthy deal and raise capital. Many private credit deals are focused on emerging markets and require industry expertise or a trusted connection. Additionally, the average investor does not have access to private deals due to accredited investor restrictions or lack of awareness. With decentralized credit marketplaces, businesses from all over the world can apply for financing opening up a substantial market; globally, there is an MSME financing gap of over $5.2 trillion[4], and the private credit sector is expected to grow to $2.3 trillion in AUM by 2027[5]. Decentralized private credit protocols are bridging the gap between the two groups, facilitating financing to businesses in need, while offering investors diversified yield with average APRs around 10%[6].

Consumers / End-Users

As both traditional finance institutions and crypto protocols are benefiting from tokenization, many of the efficiencies are passed directly on to consumers/end-users. For example, we discussed how stablecoin issuers are profiting off holding yield-bearing assets, but similarly, the users of stablecoins realize multiple benefits.

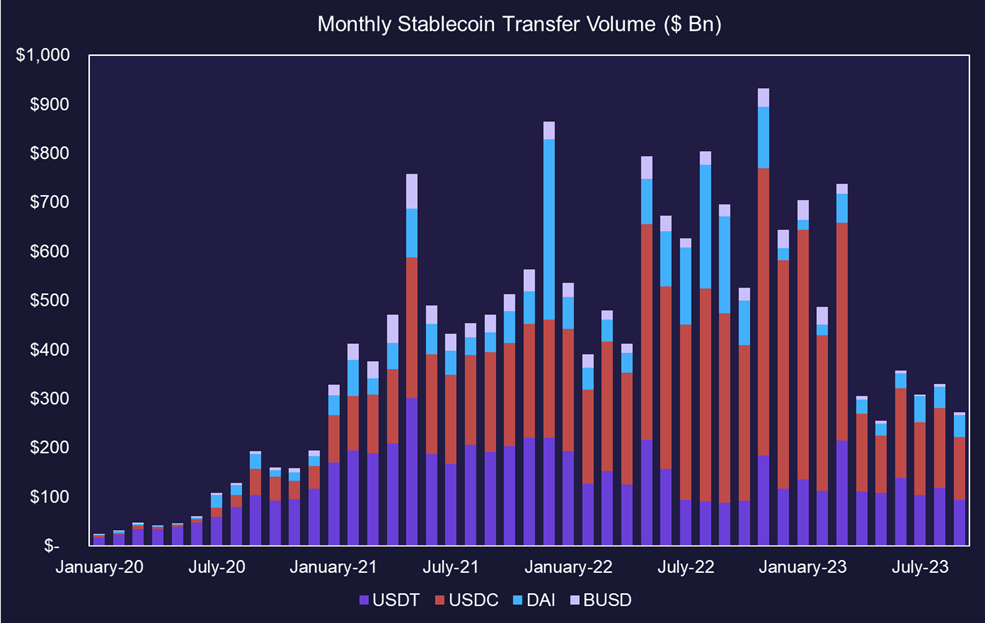

Stablecoins give blockchain users a way to store their wealth on-chain or send money quickly and efficiently. The top four stablecoins have been averaging over $300 billion in transfer volume in recent months, but at their peak, nearly reached $1 trillion in a single month.

The significant transfer volume can be attributed to the fact that many global economies rely on remittances as a source of cash to fuel spending. Coinbase published research determining that Americans alone spend over $12 billion a year in global remittance fees. The World Bank found that the average cost for sending $200 was 6.2%, and going through banks was even more expensive at 11.8%. In contrast, Coinbase found that using stablecoins or other cryptocurrencies would reduce remittance costs by 96.7%. In addition to cost savings, stablecoin users realize time-based efficiencies compared to sending money through traditional channels. Typical remittance takes anywhere from 1-10 days whereas sending crypto has an average wait time of 10 minutes.

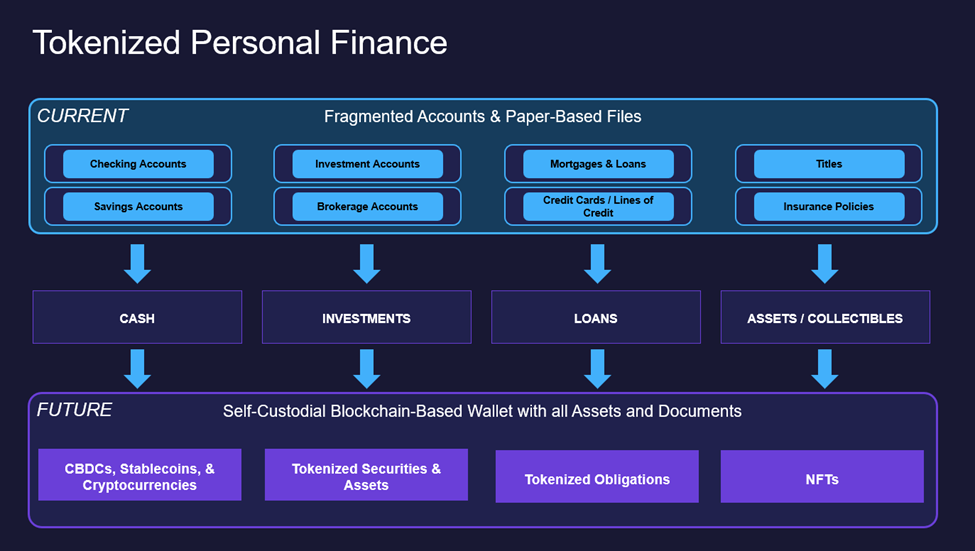

As more RWAs become tokenized, it can change the way in which consumers conduct personal finance. In the current state, wealth is fragmented across different accounts and institutions with many files still being paper-based.

In a tokenized future, consumers can have all their wealth stored in one wallet with full interoperability of assets and digital proof of ownership. Similar to how JP Morgan’s TCN network is enabling institutions to easily access liquidity and leverage assets, consumers will potentially be able to do the same thing, whether it’s through a decentralized crypto protocol or on an institutional blockchain.

By The Numbers

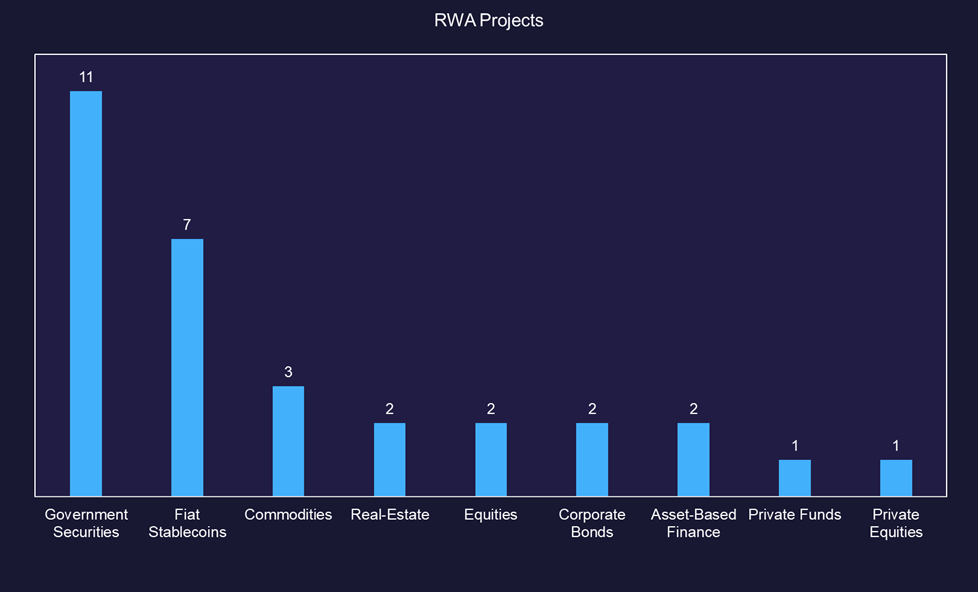

To date, there have been about 48 million holders of tokenized assets[7], most of which are attributed to users using stablecoins. Excluding stablecoin holders, there are roughly 116k tokenized asset holders, of which tokenized commodity holders make up 105k users[7]. The number of projects with RWA product offerings has begun to grow in recent months as developers and investors alike are taking notice of the large opportunity and it’s likely that the number of holders will continue to grow.

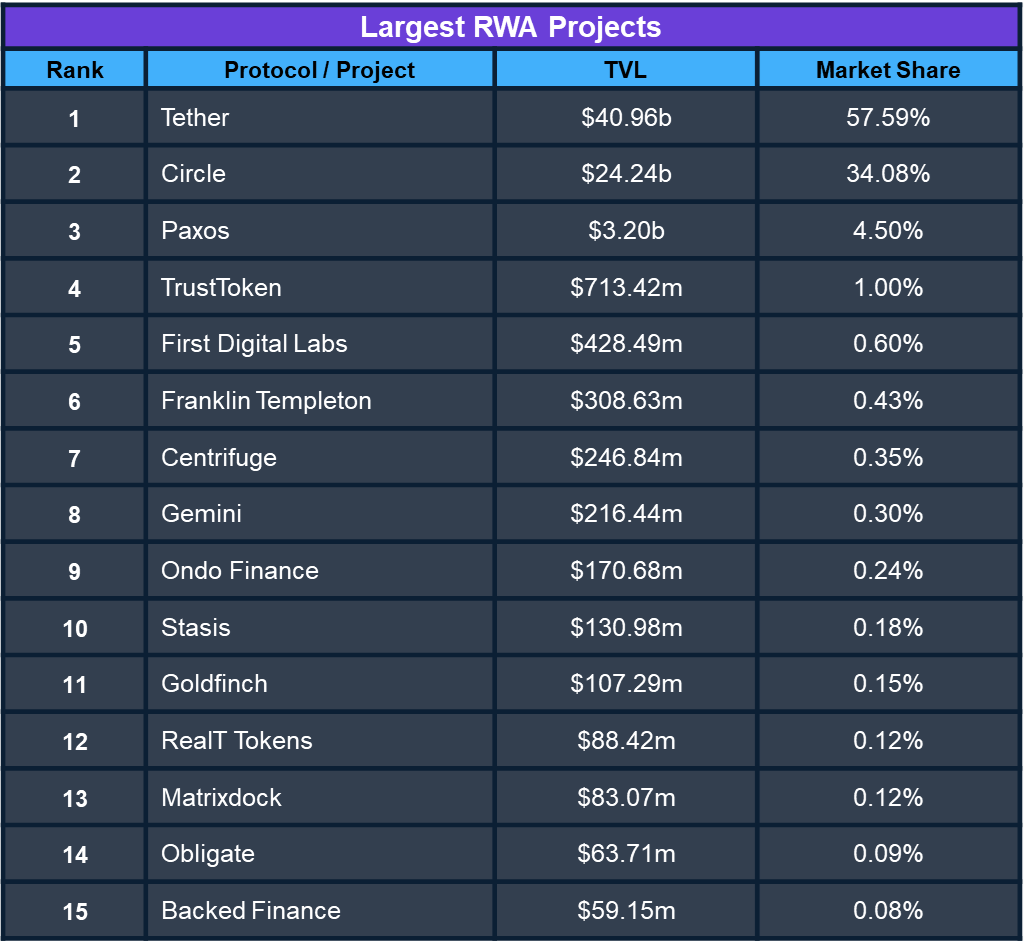

Total RWAs across all blockchains is $118.6 billion[7], the large majority which is made up from fiat-stablecoin issuers (Tether/Circle).

Excluding fiat-backed stablecoins and examining the RWA landscape by asset class, commodities are the largest RWA asset, followed by government securities. Tokenized commodities have almost surpassed the $1 billion mark while government securities have grown rapidly this year to $676 million.

Demand for USTs has moved on-chain as competitive bond yields have supplanted DeFi yields on a risk-adjusted basis. Many DeFi participants now prefer to get exposure to bond yields and protocols have pivoted to meet demand. It is important to note that the above figures do not include protocols which offer exposure to government securities but have not tokenized the product, namely MakerDAO and Frax Finance.

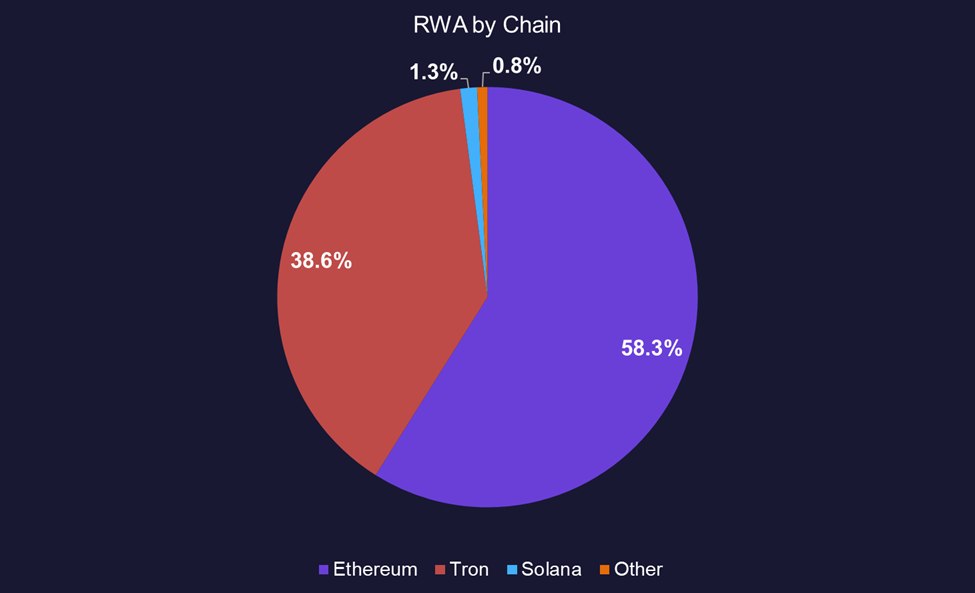

Most RWA activity has occurred on Ethereum, as it has established itself as the RWA hub. It accounts for 58% of total on-chain RWA value. Tron comes in second with 38.6%, and Solana is a far off third, representing just 1.3%.

The tokenization of real-world assets is still in the very early stages and adoption and awareness should continue growing as more protocols try to capture a piece of the huge $900 trillion pie.

Potential Roadblocks

The tokenization of RWAs is a massive opportunity and there are multiple potential roadblocks that could hinder the adoption and development of the sector:

Global Jurisdictions / Regulations

Users across the world can access open financial applications potentially side-stepping rules and regulations that pertain to specific countries. This will likely pose security concerns for governments, potentially leading to strict regulations to ensure all risks are properly monitored. For example, some investments are only available to “accredited investors” and decentralized marketplaces may open these opportunities to unqualified investors. This could lead to regulatory action against the protocol or laws against citizens accessing. The beginnings of this issue are already apparent as many protocols geo-block U.S. users IP addresses to reduce any change of regulatory scrutiny. Similarly, know-your-customer (KYC) and anti-money laundering (AML) rules are extremely important to U.S. regulators and adherence to necessary requirements will be a necessity if protocols want to be open to American customers.

Proper Infrastructure to Scale

As mentioned, RWAs represent a massive market at $992 trillion. The full tokenization of RWAs would be a huge endeavor requiring comprehensive infrastructure. Growing to the proper scale will take years and require significant resources and technological advancement to ensure the industry’s success.

Smart Contract Risks

Similar to almost anything we discuss in crypto, smart contract risk remains one of the most significant risks to any DeFi project, as any vulnerability in a contract’s code base could lead to immediate loss of funds. If RWAs are going to move on-chain, smart contract risk will need to be heavily reduced.

Conclusion

Most of the world’s wealth is tied up in assets outside of the crypto ecosystem (RWAs) including real estate and commodities. There are numerous problems with RWAs such as illiquidity, indivisibility, storage requirements, accessibility, and regulatory hurdles. Tokenizing RWAs presents a unique opportunity to revolutionize financial infrastructure while improving liquidity, transaction efficiency, and costs. Estimates value the total tokenization market at $68 trillion by 2030, presenting a huge opportunity. Both crypto protocols and traditional financial institutions recognize the benefits tokenization can bring to global finance and are racing to get a piece of the pie. The sector is still in its infancy as total on-chain RWA value sits at a little over $100 billion, but as technology and awareness grow, it’s likely most RWAs become tokenized and operate on blockchain rails.

[1] FRED, Statista, Bloomberg, Visual Capitalist, Morgan Stanley

[2] Coingecko

[3] SWIFT

[4] 2017 IFC MSME Finance Gap

[5] Blackrock 2023 Private Markets Outlook

[6] rwa.xyz

[7] Dune (21.co)