Funding the Multi-Chain World

Weekly Recap

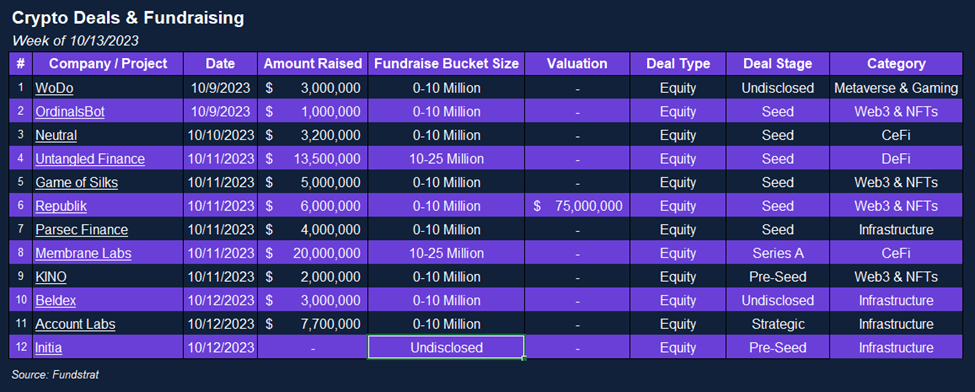

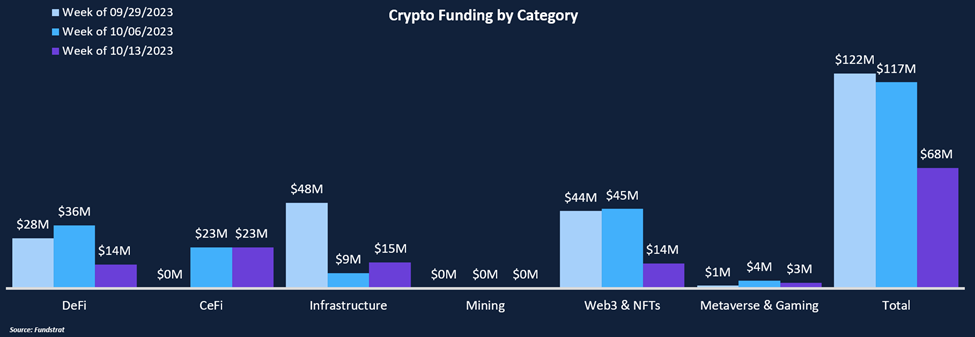

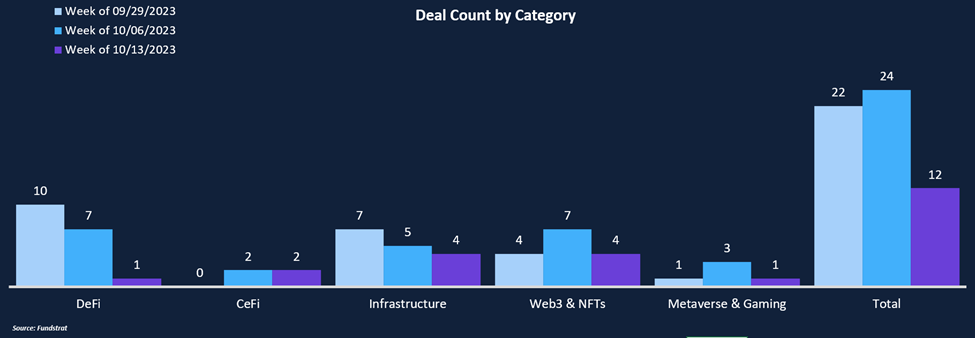

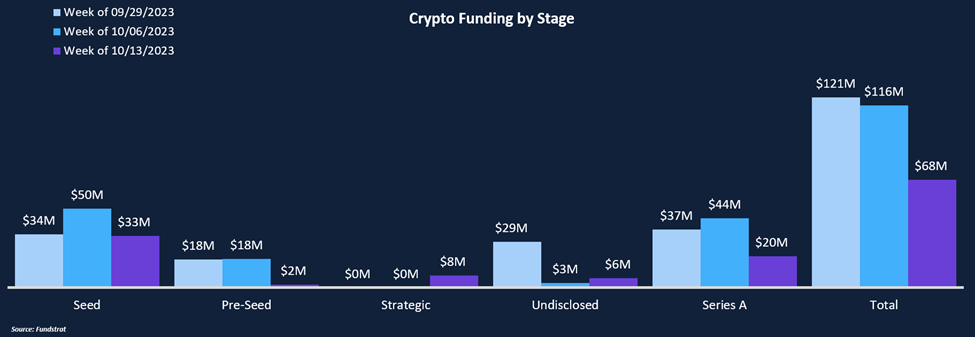

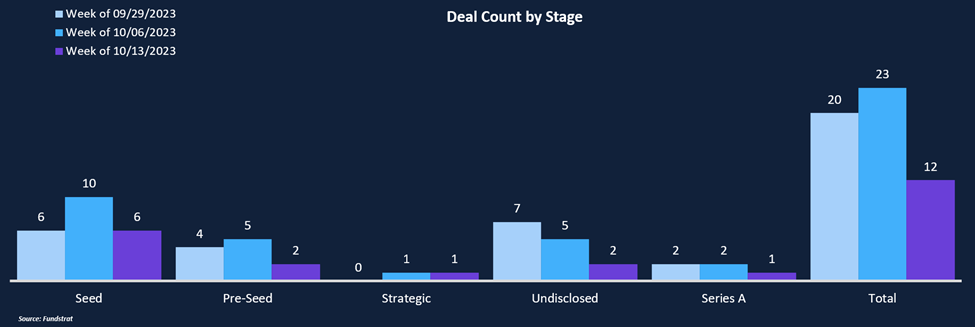

Funding has fallen to $68 million after a strong week of funding saw teams raise $117 million to start the quarter. The average deal size across both weeks was ~$6 million, and deal count fell from 15 to 12. The largest raise came from crypto prime broker Membrane Labs, which closed $20 million in their Series A round from several noteworthy investors, including Brevan Howard Digital, Point72 Ventures, and others like Jane Street and Two Sigma Ventures. Membrane is an institutional crypto trading and lending platform. Their infrastructure supports clearing, settlement, and workflow management for loans, collateral management, OTC trades, and derivatives. The CeFi market remains an area of opportunity following the collapses of major players like FTX, Celsius, and Genesis. After CeFi, infrastructure saw the second-largest amount raised at $15m. Investors remain focused on interoperability, wallet account abstraction, and native crypto analytics. From a deal stage perspective, deals remain concentrated on Seed and Pre-Seed companies, with two-thirds of deals this week falling into these categories.

Funding by Category

Funding by Deal Stage

Deal of The Week

The developers behind a Layer 1 network, Initia, have moved out of stealth mode and secured an investment from Binance Labs, the VC branch of crypto exchange Binance. While the investment amount remains undisclosed, the funds will aid Initia in facilitating developers to construct interconnected Layer 2 scaling solutions. Operating within the Cosmos ecosystem, Initia will act as a Layer 1, hosting scalable application-specific Layer 2s using optimistic roll-up technology and enabling cross-chain communication.

Why Is This the Deal of the Week?

It’s clear that blockchains will evolve in a multi-chain world. Interoperability solutions are nascent and competitive, as protocols compete to create the standards that will win the market. Although still in its test net phase, Initia plans to announce collaborations with various crypto entities, including Binance Labs-related companies and game publishers, in the near future.

Designed to rectify fragmented experiences in traditional systems, Initia oversees the L1, L2s, and communication layers, ensuring consistency for both developers and users. The Initia Platform is introducing policies to synchronize interests and enhance value for the entire ecosystem. Their guiding standards apply to technological and economic structures, ensuring rapid scalability in the Omnitia ecosystem. Initia’s L2s, named “Minitia,” are robust CosmosSDK application blockchains fortified with Optimistic Rollups and feature rapid block confirmations, diverse contracting environments, decentralized sequencers, and superior security. Minitia offers features like native stablecoin access, customizable gas fees, instant bridging, wallet support, and more. Beyond infrastructure, Initia also offers user-friendly applications like their app, wallet, and explorer to ease multi-chain navigation.

Selected Deals

Cryptocurrency platform Membrane Labs secured $20 million in a Series A funding round. Investors included Brevan Howard Digital, Point72 Ventures, Jane Street, and Two Sigma Ventures. The funds will enhance the trading infrastructure in the crypto domain, ensuring safer operations. Initially, Membrane developed a system to streamline clearing, netting, and settlement, as described by their CEO, Carson Cook. “You can think of us as the glue, a settlement network that connects all of these things together,” Cook said in an interview. “On top of this core infrastructure, we built workflow management for collateral management, loans, OTC trades, and derivatives. The permeating theme is to increase transparency and risk management, especially in a post-FTX and post-3AC world.”

Singapore’s Account Labs secured $7.7 million in funding with contributions from Amber Group, MixMarvel DAO Ventures, and Qiming Ventures. This coincides with the release of their UniPass Wallet, a user-friendly, self-custody wallet emphasizing P2P stablecoin transactions. A standout feature of UniPass is its account abstraction, allowing newcomers to create wallets using their Google credentials and offering top-up options with Mastercard, Visa, or Apple Pay.

Game of Silks, an NFT-based platform focused on horse racing, secured $5 million in funding. Users owning these NFTs can earn rewards based on the actual performance of the corresponding horse. Since its June 2021 inception, it has collaborated with major entities like the New York Racing Association and FOX Sports’ Americas Best Racing. Over 7,000 “Silks Genesis Avatars” NFTs have been issued, with a current starting price of 0.08 ether (around $125) on OpenSea. Some horse racing enthusiasts believe NFTs might rejuvenate interest in this ancient sport.