All Eyes on Gaming and Web3

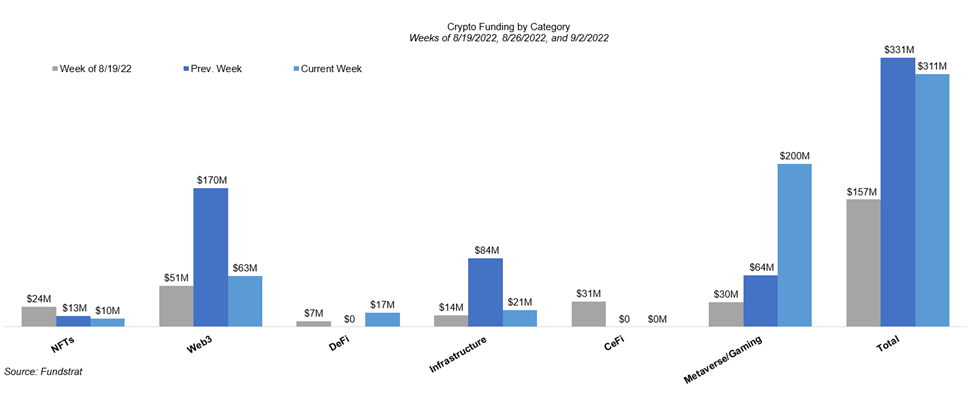

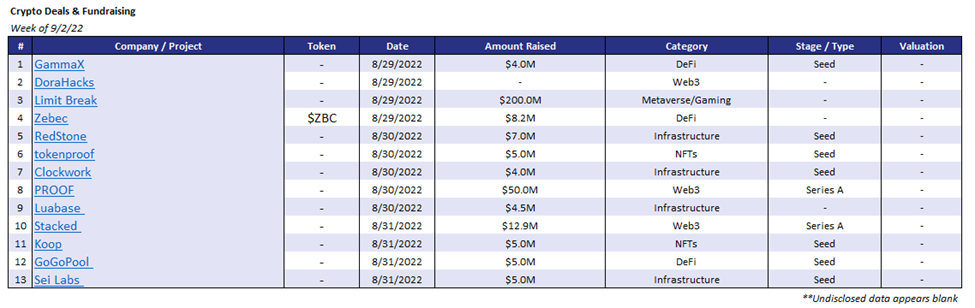

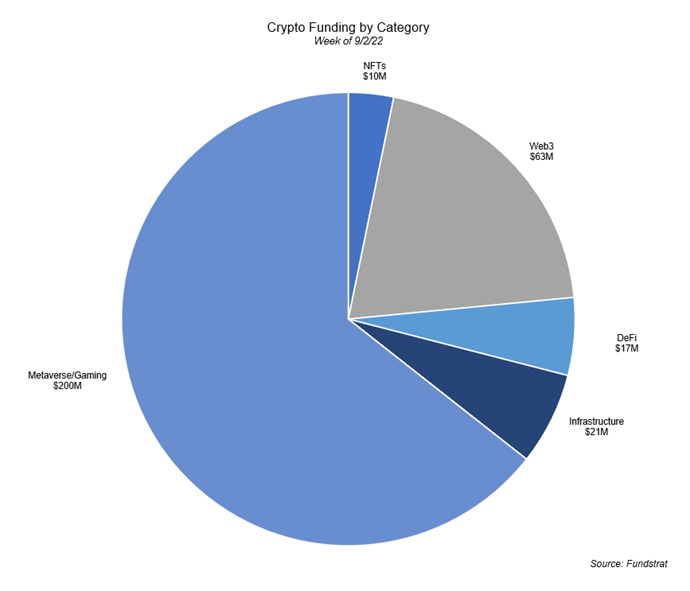

Funding dropping slightly this week from $331M to $311M. The largest deal of the week was Limit Break, in a gaming deal that raised $200M and accounted for nearly two-thirds of all funding. We dive deep into Limit Break in our Deal of the Week segment below. After Metaverse/Gaming, Web3 was the next highest funded sector with three deals totaling $63M. This is the third week in a row in which Web3 and Metaverse/Gaming projects attracted some of the most funding from investors. This starkly contrasts DeFi and CeFi, which have received next to no funding in the past three weeks. CeFi in particular has really seen funding dry up – with no funding for the second week in a row. This decline is most likely due to investors being hesitant with the segment after seeing the insolvency of Celsius and other CeFi platforms.

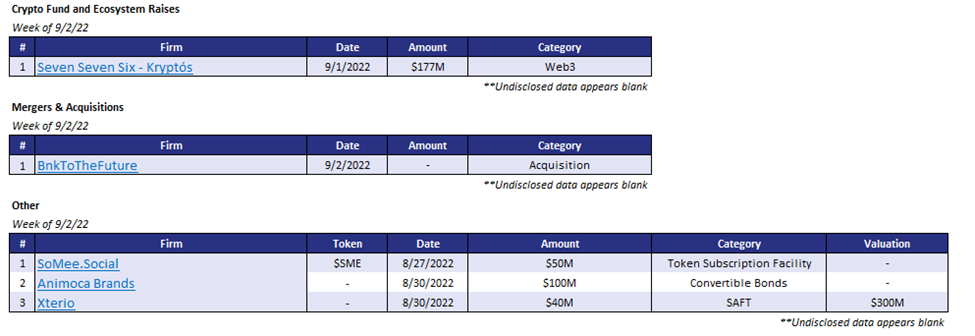

Adding to Web3 and gaming’s momentum, Reddit founder Alexis Ohanian announced an investment fund that plans to raise $177.6M to invest in the Web3 and gaming ecosystems. The fund, Kryptós, is the latest of Ohanian’s Seven Seven Six (776) venture capital firm.

Deal of The Week:

Limit Break, the company behind the NFT collection, DigiDaigaku, has raised $200 million across two deals to build Web3 MMO games. The investment was led by Buckley Ventures, Standard Crypto, and Paradigm Ventures. Other investors include FTX, Coinbase Ventures, Shervin Pishevar, and Anthos Capital. Limit Break founders Gabriel Leydon and Halbert Nakagawa have extensive developer experience in “free-to-play” gaming with successful games such as Game of War, Mobile Strike, and Final Fantasy XV: A New Empire.Leydon and Nakagawa plan to bring their successful track record to Web3 by creating free-to-play MMO games.

Why is this Deal of The Week?

Most Web3 games have followed the play-to-earn model where companies will launch a paid NFT mint and then offer prizes or tokens for playing. Often, these games go from play-to-earn to play-to-sell, with the dominant players eventually dumping any tokens and NFTs on the market until the game is left worthless. Additionally, a common problem is that players with the deepest pockets end up at the top of the leaderboards by paying for the best in-game advantages.

Limit Break wants to change the Web3 gaming industry for the better. Limit Break’s new “Free-to-Own” model centers around free genesis NFTs which lead to airdrops and other Web3 experiences (none of which involve quick fundraising schemes). Their first project was a free-to-mint NFT collection called DigiDaigaku, which will be used in their new games. By lowering the barrier of entry to their games and focusing on game development, Limit Break believes it will create a strong community and organic growth. Once the community is built, and games are delivered, Limit Break can worry about generating income. With savvy developers and high-powered investors, Limit Break has all the tools to disrupt Web3 gaming completely.

Selected Deals

Sei Labs is a layer 1 blockchain that is optimized for DeFi. The company has secured $5M in funding led by Multicion Capital. The funding round also included additional investor participation from Flow Traders, Hudson River Trading, Coinbase Ventures, and GSR. Sei Labs plans to use the capital raised to expedite the network’s growth. Ultimately, company leadership aims to grow the network to and become the most popular blockchain for DeFi applications.

Xterio is a gaming-based publishing and development platform aiming to onboard the Web2 gaming audience into Web3-based games. In addition, the platform plans to construct its ecosystem around user participation and transparency. The company has secured $40M in funding through a simple agreement for future tokens (SAFT) sale at a $300M valuation. The funding round was co-led by FunPlus, FTX Ventures, Makers Fund, and XPLA. The round of funding also included additional investor participation from Animoca Brands, Infinity Ventures Crypto, Hashkey, and others. Xterio plans to use the capital raised to expand its workforce and develop more games.

PROOF is a non-fungible token (NFT) collective aiming to become a leading Web3 company. The company recently disclosed details regarding its third NFT collection (Moonbird Mythics), which will release in Q1 2023. In addition, the company also plans to launch a social platform that will provide platform users with the ability to display their NFT collections. The company has secured $50M in funding through its Series A round led by a16z crypto. In addition, the funding round also included investor participation from Seven Seven Six, True Ventures, VaynerFund, and others.

Stacked is a Web3-based video and streaming platform aiming to provide an alternative to Youtube and Twitch. In addition, it plans to offer content creators partial ownership of the platform through a governance token. The company has secured $12.9M in funding through its Series A round led by Pantera Capital. The funding round also included additional investor participation from GFR Fund and Z Venture capital. Stacked plans to use the capital raised to expand its workforce in India, Latin America, and Southeast Asia, in addition to acquisitions and marketing.

Animoca Brands is a venture capital and game software firm. Its portfolio currently consists of 340 companies primarily involved in the blockchain gaming, infrastructure, and DeFi fields. Notable companies within Animoca’s portfolio include OpenSea, Metamask, and Ledger. The company has secured $100M in funding through convertible bonds. The funding round was led by Temasek, the government of Singapore’s holding company. This funding round adds to the $359M raised in January at a $5B valuation led by Liberty City Ventures and a $75M raise in July at a $6B valuation.