It's All Relative

Key Takeaways

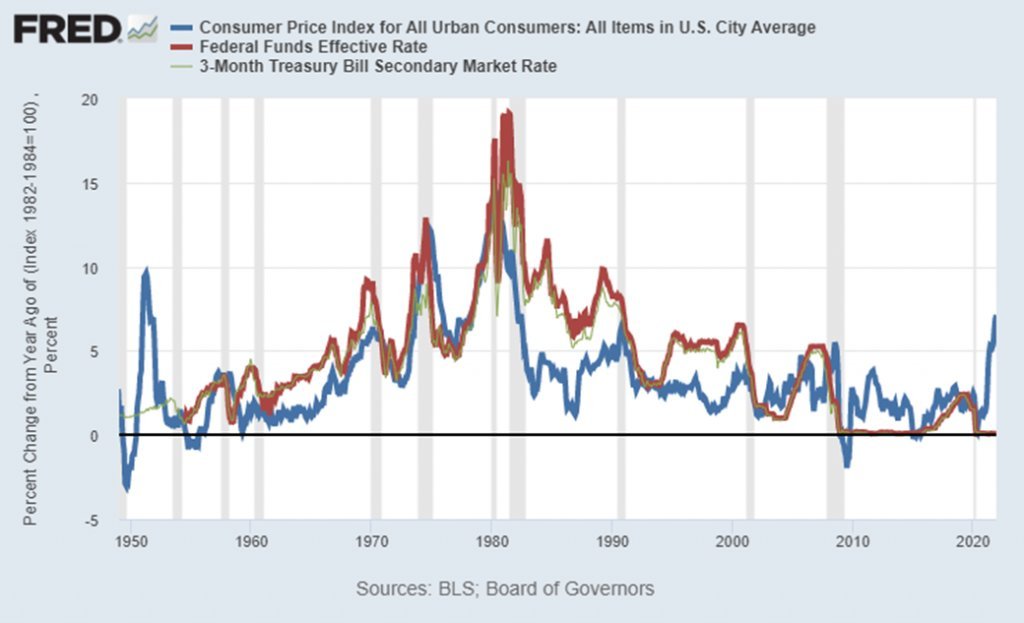

- On Wednesday, the global crypto market experienced some partial relief as the Labor Department released a December CPI figure that met analyst expectations. Consumer prices increased 7.0% over the prior 12 months, up 0.5% from last month.

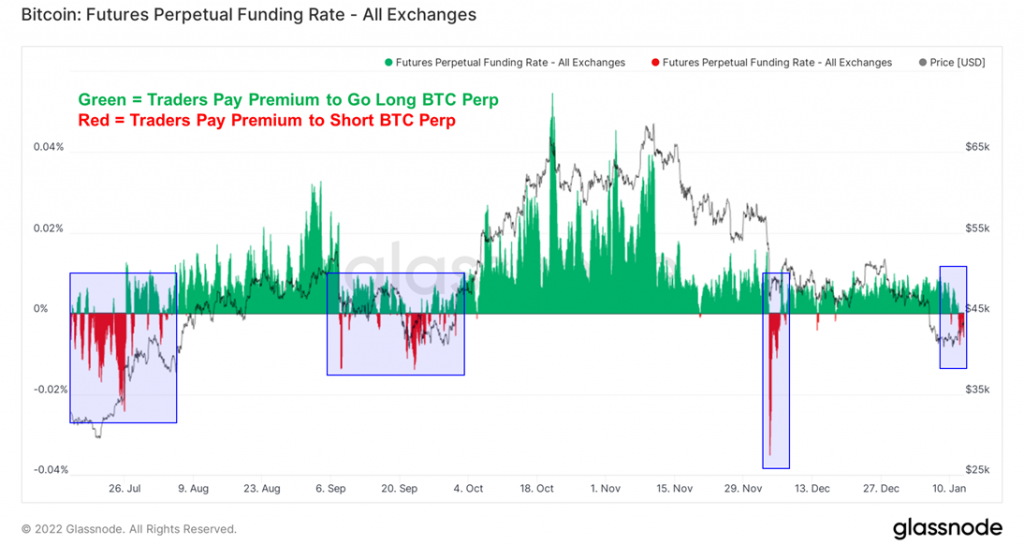

- Funding rates in the perpetual futures market turned negative leading up to the CPI print, reducing the near-term risk of a long squeeze.

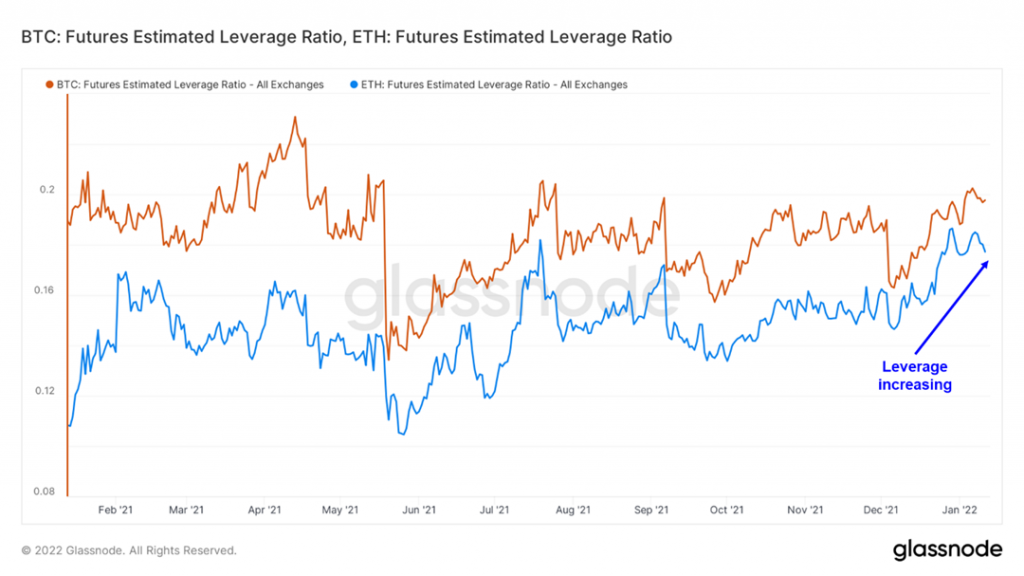

- Open interest continues to climb, as we are now well beyond the leverage ratio achieved in early December before the liquidation frenzy across the broad crypto market.

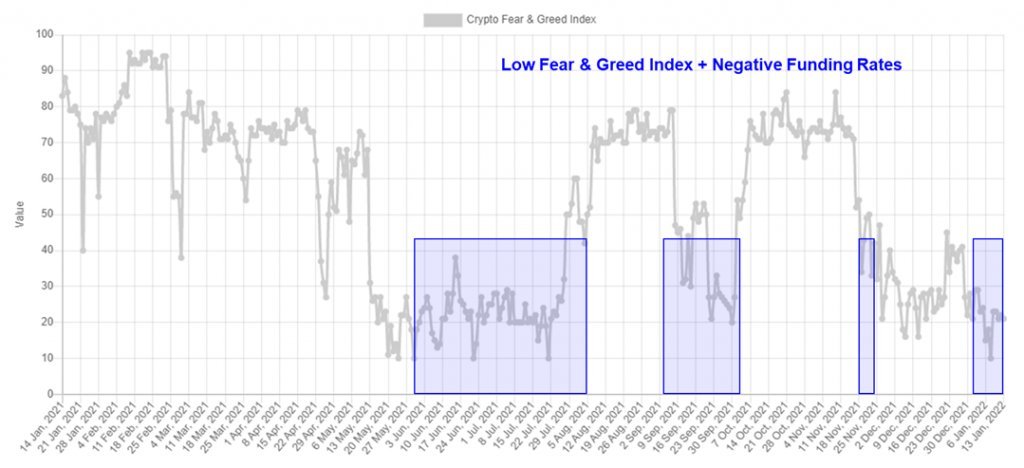

- The Crypto Fear & Greed Index indicates that market sentiment remains low. We discuss the implications.

- We revisit the concept of “TINA.”

- Bottom Line: As Bitcoin’s price rebounds and funding turns negative, the crypto market is in a better position for a rally in the latter half of January. Given the current leverage in the system, it is wise to stay positioned for volatility. We deliver our annual outlook in a couple of weeks, but as a spoiler, we think people are underestimating cryptoassets, specifically Bitcoin, in 2022.

It’s All Relative

After a tough start to the year for the global crypto market, investors experienced some partial relief on Wednesday as the Labor Department released a December CPI figure that met analyst expectations. Consumer prices increased 7.0% over the prior 12 months, up 0.5% from last month.

Despite registering the highest 12-month growth rate in nearly four decades, markets reacted favorably as it appears that the fires stoked by the Fed minutes last week anchored the market into a much more dire mindset. Based on funding rates in the futures market before the CPI release (discussed below), it is evident that the market was anticipating a figure much higher than the projected 7.0%.

BTC vs. US 10Y

The macro trend for crypto spelled out in last week’s note held true following the CPI print, as investors seemed more optimistic regarding inflationary risks and the subsequent effects of any hawkish Fed policy.

The 10-year pulled back slightly boosting risk-on assets, including Bitcoin, which bounced from $42k to nearly $44k at the time of writing.

Funding Rates Turn Negative

As previously mentioned, before the release of the December CPI figure, traders were piling into short positions, as evidenced by the perpetual futures funding rates.

As a reminder, perpetual futures are a special type of futures contract in which there is no expiry. When funding rates are positive (green) traders are paying a premium for a counterparty to take the short side of the trade. When funding rates are negative (red), traders are paying a counterparty a premium to take the long side of the trade.

This sudden movement of funding rates tells us a couple of things:

- Traders were likely anticipating a CPI print that would exceed analyst expectations and thus cause a sell-off in risk assets (I merely speak for myself here, but I know many who were anticipating a double-digit CPI figure).

- The risk of cascading liquidations to the downside is lessened given that there is demand from traders to short Bitcoin. If price continues to rise, and the demand to short BTC in the futures market remains constant, we could end up with cascading short liquidations (the good kind of liquidation).

Overall, we would categorize the recent funding rate levels as “mixed.” We will continue to monitor the “perps” market to see if the traders start to build conviction in either direction.

It is worth noting that the last several times that we have achieved “local bottoms,” most recently in July and September, funding rates were persistently negative for a few days before marginal sellers became exhausted and the market moved higher on a series of short liquidations.

Leverage Continues to Build

Recently, we have highlighted the excessive leverage mounting on derivatives exchanges and the risk of liquidations that this poses to the BTC and ETH markets. The chart below demonstrates that futures open interest continues to climb, as we are now well beyond the leverage ratio achieved in early December before the liquidation frenzy across the broad crypto market.

At some point, these leveraged positions will need to be unwound. The direction of price over the next couple of weeks may be the determining factor in which way the dominoes fall. Either way, we think it’s appropriate to anticipate some volatility over the next couple of weeks.

Fear & Greed

Much of Bitcoin’s daily and weekly price action is attributed to macro expectations and how reality is relative to those expectations. Below is the Crypto Fear & Greed Index, which is a widely used measure of crypto market sentiment – in other words, this can be considered a measure of “expectations.” Presently, this index is registering a value of 21 out of 100, meaning that despite a good day in the market, buyers are hesitant to get involved.

We think that this sentiment drawdown, coupled with negative funding rates, and a better near-term macro picture could put us in a good position for a bounce in the second half of January.

East vs West

A macro variable that we think might be currently overlooked is the ongoing softening of monetary policy in China. Due to recent tumult in the country’s real estate markets and lack of growth in its tech sector (largely self-imposed), China has hinted towards the potential expansion of credit over the coming year. This means that despite the near-certainty of monetary tightening here in the US, we could see a scenario in which liquidity increases in the east.

The degree to which this will affect crypto markets remains to be seen. Obviously, there have been a series of crackdowns on cryptoassets in Mainland China, but expansionary policy in China would certainly benefit adjacent markets and could lead to increased capital flows into the crypto ecosystem.

Below, we can see that large-cap Chinese stocks turned higher in concert with western risk assets, as this cohort of equities may be benefitting from China’s revised expansionary outlook. We are not sure that this is a “game-changer,” but it is something on our radar.

Looking Ahead

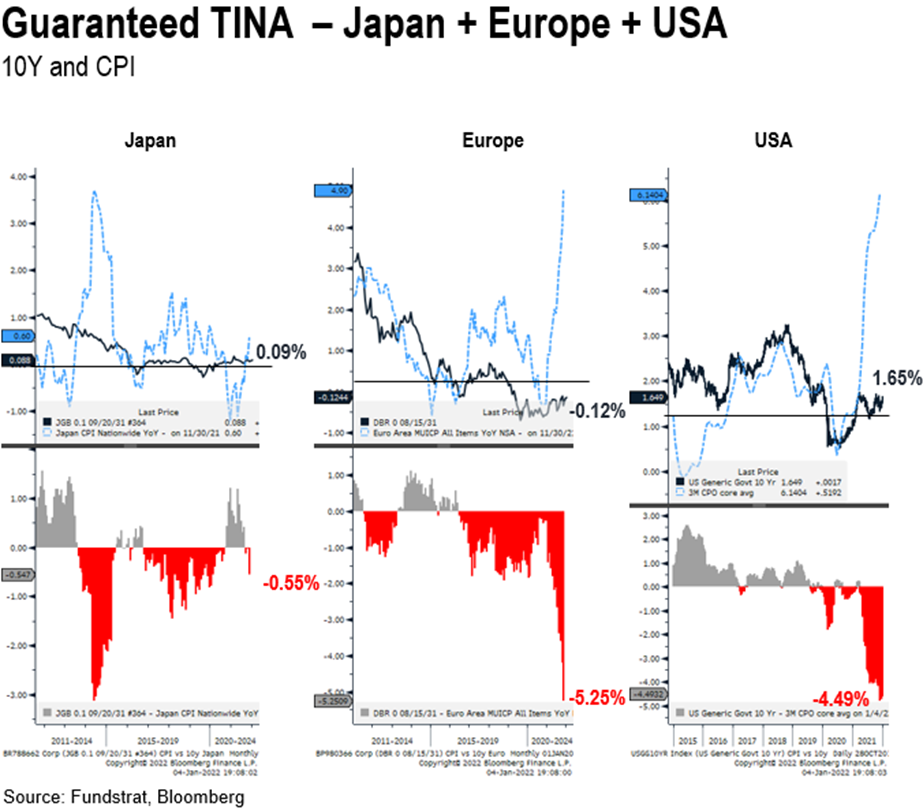

We deliver our annual outlook in a couple of weeks, but as a spoiler, we think people are underestimating cryptoassets, specifically Bitcoin, in 2022. While the current macro setup might make for a volatile first half of this year, we think the chart below, borrowed from our very own Tom Lee, speaks to an “inevitability” of crypto.

As investors adjust to rising rates, there is likely to be some uncertainty in equities. However, we are in a position where rates will be increasing, and real rates will remain negative for a few years. Making a positive return in bonds will be very difficult.

The economy is fundamentally healthy, earnings are strong, and there will be capital to work. Investors will look elsewhere if this capital is guaranteed to lose money in bonds. Therefore, despite any near-term market volatility, we think using the current pullback to position your portfolio for the rest of the year is wise, as There Is No Alternative (TINA) for funds looking to deploy capital.

Couple this dynamic with the fact that crypto funds are coming off a banner year, as the latest figures suggest the average crypto fund in 2021 returned 214%, and a scenario in which legacy investors FOMO into crypto is not impossible to imagine.

Bottom Line

As Bitcoin’s price rebounds and funding turns negative, the crypto market is in a better position for a rally in the latter half of January. Given the current amount of leverage in the system, it is smart to continue to be positioned for volatility. Looking beyond 1H 2022, we think investors may be discounting the potential for outperformance in digital assets.