Crypto Market Takes A Breather

Key Takeaways

- The crypto market faced nearly $1 billion in long liquidations on Wednesday morning, stymieing Bitcoin and Ethereum’s momentum and punishing altcoins. We viewed this as generally healthy market behavior and conducive for the next leg up.

- Long-term holders took profits off of the table following Bitcoin’s recent ATH – selling 39.6k BTC while short-term holders bought 51.3k BTC. The reentrance of short-term holders into the market is generally a good sign for price.

- Metrics such as new address growth and DEX user growth point toward potential outperformance for altcoins but we remain skeptical about a full rotation from BTC.

- Robinhood’s earnings provide key insights into retail’s limited role in the recent bull run and the value of memes.

- Monthly options expiry is on Friday – key level to watch is $55,000. Current volumes lean bullish.

- Bottom Line: We expect macro tailwinds and bullish on-chain fundamentals, among other factors, to continue to push Bitcoin and Ethereum towards their respective price targets of $100,000 and $10,500 by year-end.

Wash-Out Wednesday

On Wednesday morning, US investors awoke to a crypto market reeling from overnight liquidations across Asian markets. Over $100 million in Bitcoin long positions and $250 million in ETH long positions were washed out, driving Bitcoin below $59,000 for the first time in two weeks and rejecting Ethereum’s attempt at all-time highs, sending it below $4,000. Altcoins were disproportionately affected by the deleveraging event as Bitcoin dominance perked by 1% at the onset of the volatility and many of the leading layer 1 “ETH killers” saw hourly declines of 8-12%. At the time of writing, 24-hour long liquidation figures are approaching $1 billion across all cryptoassets, but the market is showing strong support at current levels.

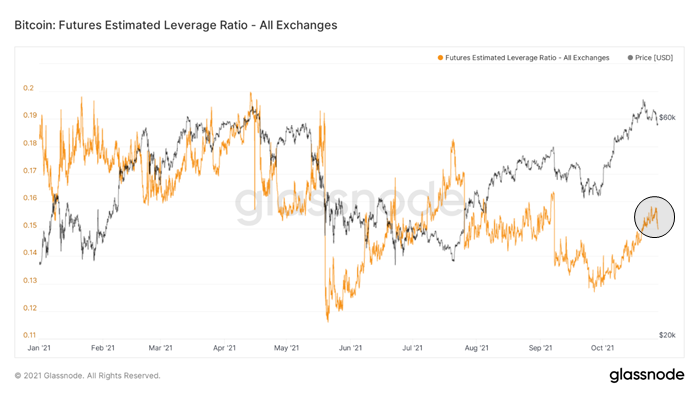

We can see in the chart below that BTC leverage across exchanges increased steadily up until this morning’s pullback. We can see a slight leveling of this metric, indicating investors are partially reigning in their leverage.

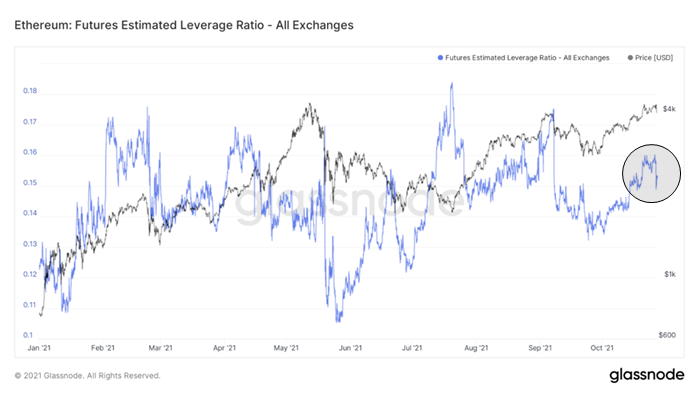

Similarly, we can see that Ethereum’s leverage ratio dropped at an even steeper angle.

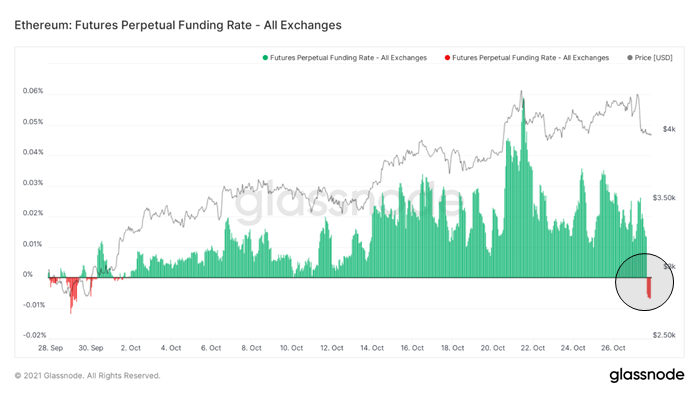

Funding rates on perpetual swaps also self-corrected as the cost to fund a long position on Ethereum turned net negative for some time on Wednesday afternoon.

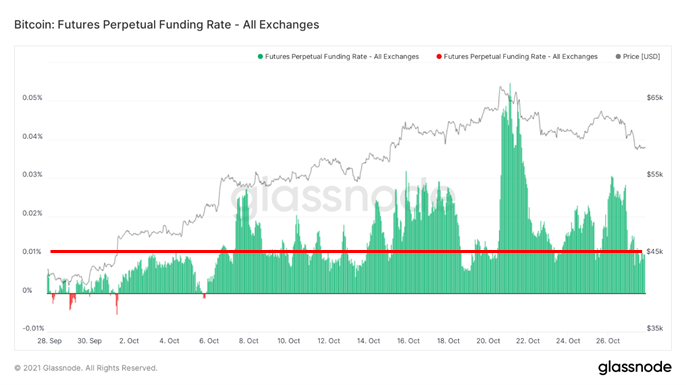

Bitcoin’s funding rates are also back down to levels maintained earlier this month, during the first couple weeks of “Uptober.”

Overall, we do not think the market is teeming with froth. Open interest is high, but as we mentioned in a prior note, over 50% of current OI is margined with fiat or stablecoins, which leads to a much more stable trading environment. Also, a large portion of the current open interest is a function of retail demand for the newly available futures ETFs – a qualitatively less speculative of a source than OI on a crypto exchange. Perp funding rates have also ticked up in recent weeks, but we think that they are still at levels that could be sustained during a proper bull market.

This is all to say, that while we are amid a 12% pullback from Bitcoin’s all-time highs, near-term shakeouts are healthy occurrences for sustained bull market runs, and we would advise our clients to position as such. We are still formalizing our thoughts on the drivers behind last night’s events, but we hypothesize that the cascading liquidations may have been the product of a few whales getting ahead of their skis in hopes of a run at new all-time highs.

Long-term holders sell the ATH

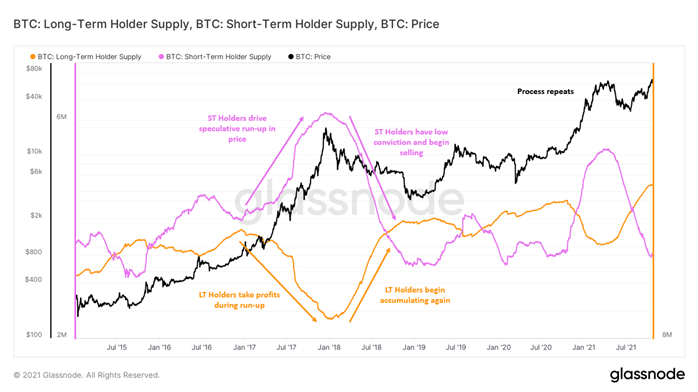

As we’ve noted in previous weekly newsletters the total supply held by long-term holders is an informative metric for gauging peaks and troughs within the halving cycle. This is because long-term holders generally accumulate bitcoins when fundamentals are strong and sell into speculative run-ups in price. We’ve also noted that short-term holders tend to do the opposite – buying on the way up / at the top while selling as valuations become more attractive. The chart below highlights this relationship between long-term and short-term holders during the late stages of the 2017 bull run as well as the mid-cycle bull run we experienced in 1H21.

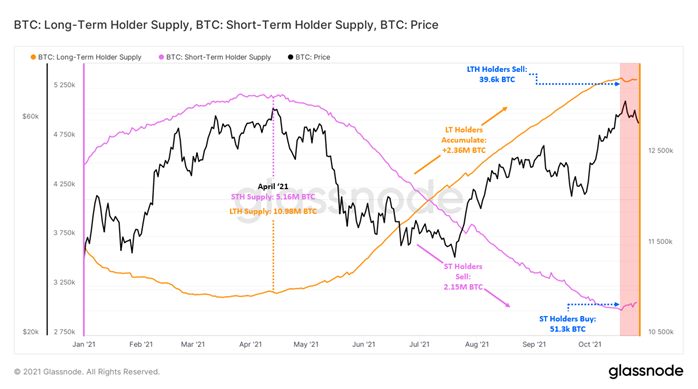

Zooming in on this year there are a few critical observations. Since the price peak in April, long-term holders have increased their stack by nearly 2.4M BTC (+21%) while short-term holders have essentially done the opposite – selling 2.15M BTC (-42%). This is the nature of Bitcoin. Over the long run, coins flow from weak hands to strong hands.

However, long-term holders took the recent ATH as an opportunity to take some profits – selling 39.6k BTC while short-term holders bought 51.3k BTC. This is significant for two reasons. (1) It highlights a deceleration in the parabolic long-term holder accumulation we’ve observed since April. (2) Short-term holders and retail investors may be re-entering the market. Previously, these two occurrences have preceded significant run-ups in price. For instance, long-term holder supply last peaked on October 21, 2020, when BTC traded at $11,916 and short-term holders owned 3.1M BTC. In the subsequent six months, BTC rallied over 430% as short-term holders became more active and increased their supply by nearly 2M BTC.

Is it time to rotate to alts?

Lately, there has been an increasing number of conversations amongst investors around shifting portfolio allocations from Bitcoin to alts to capture the higher returns alts have provided during more speculative risk-on periods. We discussed this topic and ‘Bitcoin Dominance’ in our Weekly published 10/13/21. To contribute to the conversations, here are a few positive on-chain trends for Ethereum that support the rotation, in addition to a few that give us pause. It is also important to note that we remain bullish on both Bitcoin (PT: $100,000) and Ethereum (PT: $10,500).

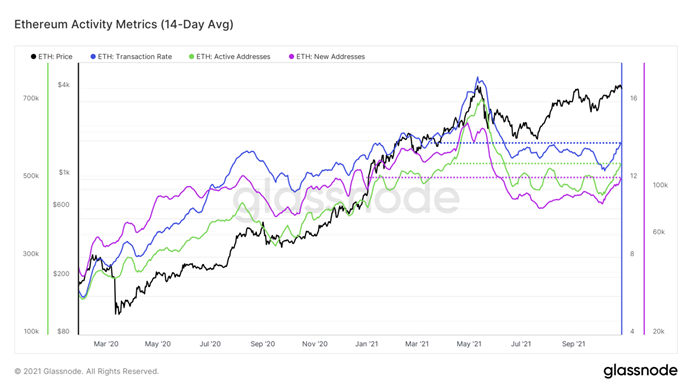

On-chain activity metrics for Ethereum appear to have found support and are reaching multi-month highs. Previously, transaction rate, active addresses, and new addresses had been in decline since peaking alongside price in May. Notably, they remained range-bound as ETH rallied from July to September but have since shown strong growth.

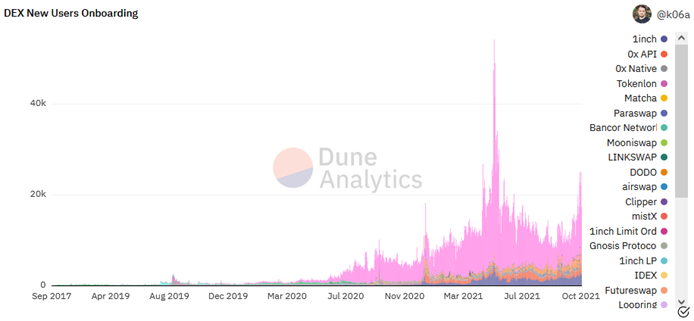

New address growth is also appearing in real-world use cases like DeFi. New DEX users have more than doubled since September and are increasing at a similar pace to April before peaking in May. This is especially notable given the recent attention paid to centralized exchanges like Coinbase, which reported 68 million verified users as of 2Q21, and Robinhood, whose crypto wallet waitlist topped 1 million signups.

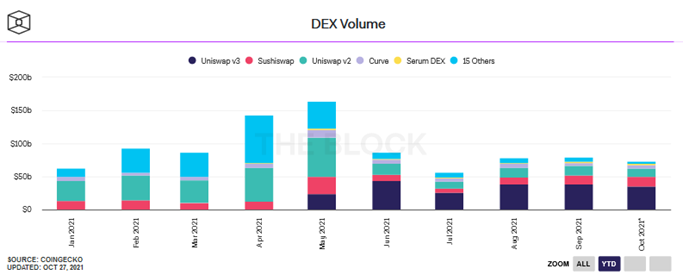

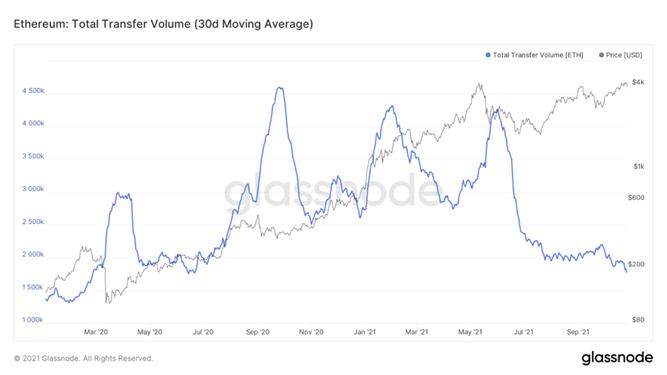

Despite promising user growth, new users have not yet translated to volumes on DEXs or Ethereum more broadly. DEX volumes remain in line with August/September levels, while total transfer volumes across Ethereum remain depressed at levels last seen in June 2020 and have been outpaced by volumes on Bitcoin. Increased volumes would go a long way to confirm the bullish signal put forth by user growth.

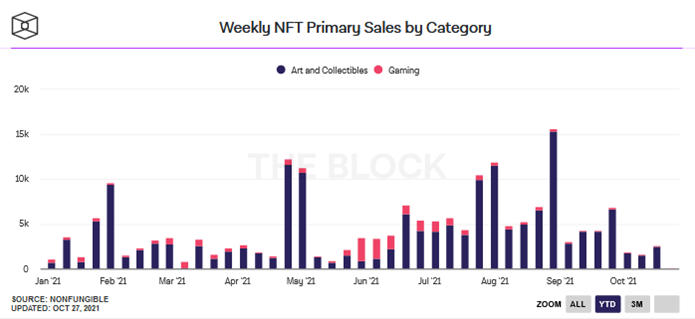

NFT activity has been trending lower as of late. Both primary and secondary NFT sales have been in decline since late August. NFTs have been one of Ethereum’s killer apps in 2021 and have given users more reasons to open an Ethereum wallet than just DeFi. They’ve also played an important role in supporting the price of ETH. NFT transactions like mints generally require more gas to complete which under EIP1559 is burned – reducing the total outstanding supply of ETH. A resurgence in NFT activity, as well as increased DEX volumes, would certainly support the notion of Ethereum and alt outperformance into year-end.

Robinhood, Retail, and the Rise of Shiba Inu

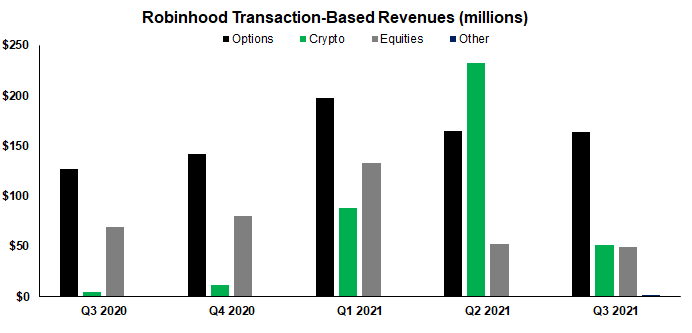

On Tuesday, Robinhood released its Q3 earnings and fell woefully short of the trading fee revenue expectations, thanks in large part to underwhelming crypto volume. We think that there are a couple of useful takeaways from the exchange’s most recent press release:

- Fewer transactions support the theory that traditional retail investors have not been as integral to the most recent bull run as they were to the bullish price action last winter and spring.

- Memes are valuable but difficult to inorganically capitalize on.

Retail is still MIA

We have discussed in recent letters that the current rally from Bitcoin and Ethereum’s July trough has been driven by “smart money.” In our view, this smart money has largely been comprised of institutional capital and high net worth, crypto-native retail investors. Casual retail investors, who often fuel the more speculative portion of any bull market, have yet to fully dive into this current run.

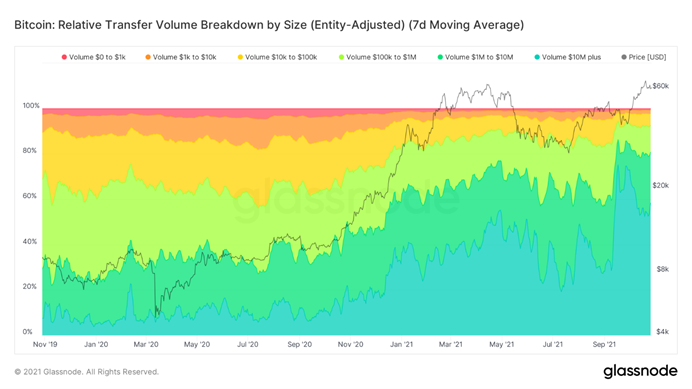

The chart below displays BTC volume transfers segmented by transaction size. We can see that starting a few months ago, there has been a disproportionately large percentage of transfers above $1 million, good evidence that entities with deep pockets have been the most active market participants.

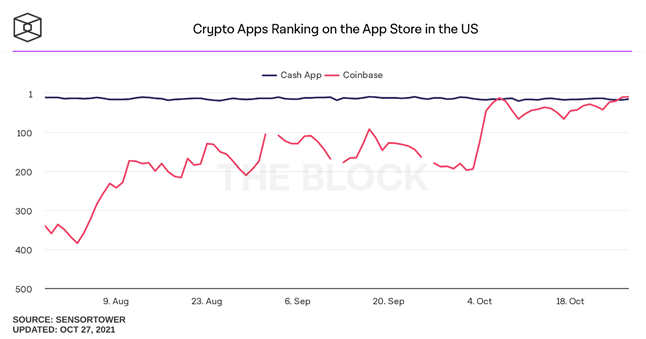

The good news (for BTC and ETH price) is that the tides appear to be shifting towards a more risk-on fall in traditional markets (as predicted) and traditional retail is starting to get more interested in digital assets. Using social signals, which admittedly serve as precarious leading indicators, we observe some preliminary signs of increasing investor interest in crypto. Below is a chart from the Block, that indicates that Coinbase’s app ranking has increased from nearly 200 to 10 over the past few weeks. We often see crypto apps storm to the top of the app download charts prior to retail-driven price increases.

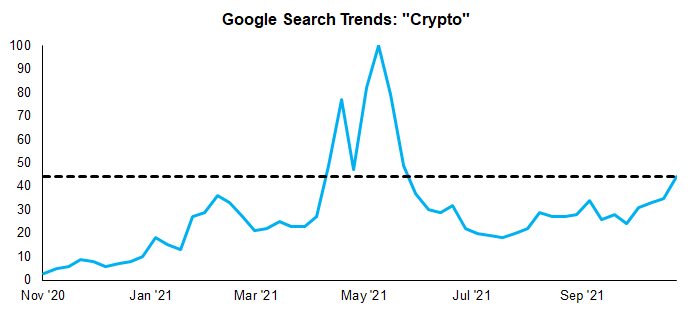

Additionally, Google searches for “crypto” have started to turn north once again as it appears that Bitcoin hitting all-time highs may have piqued retail investor interest.

What do you meme?

The second takeaway from Robinhood’s earnings is the power of memes. According to Wikipedia, a meme is “an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.”

In Q2 2021, over 60% of Robinhood’s crypto trading revenue was derived from transactions in Dogecoin (DOGE). For those who are unaware, DOGE is a fork of Bitcoin that was created in 2013 as a satirical response to much of the speculation in the crypto industry. It was principally designed to imbue internet culture as its logo donned the face of the popular “doge” meme. Additionally, its code dictates an infinitely expanding supply of tokens, which is a crude feature when juxtaposed with Bitcoin. Functionally, this was a very unserious digital asset, until it wasn’t.

Starting towards the end of the bull run last winter/spring, an army of DOGE-fanatics started to spread the idea that DOGE could have potential as the next big digital currency. This was largely retail-fueled but benefitted from the endorsement of Elon Musk, who to this day claims to own BTC, ETH, and DOGE.

The ensuing speculative craze caused DOGE to increase from $0.0080 to $0.70 in a matter of four months, as Dogecoin reached the top 10 coins by market cap and resulted in thousands of newly minted DOGE millionaires. We have witnessed meme stocks go mainstream, but this was the first instance of a meme coin gaining such traction.

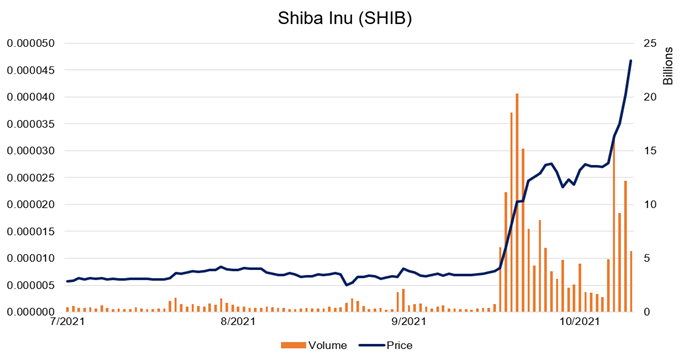

Starting just a few short weeks ago, we witnessed DOGE 2.0, however, this time with an unserious fork of Ethereum that was launched with the apparent intention of dethroning DOGE as the top meme coin. Below is a chart detailing the recent price action of Shiba Inu (SHIB), a meme coin created just over a year ago. Dubbed a “DOGE-killer,” the coin was created in jest and lacks any substantial ecosystem development. However, as demonstrated by the chart below, the internet took kindly to this emerging token and created enough demand to increase its price by 8x in a matter of weeks.

We are unable to recommend the Shiba Inu’s and the Dogecoin’s of the world due to their volatility, low liquidity, and lack of development (among other factors), but it is undeniable that memes have value and Robinhood’s earnings are tangible proof of this fact.

Options Lean Bullish With Expiry this Week

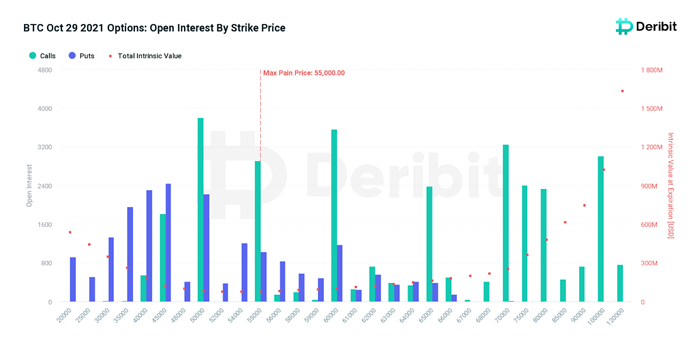

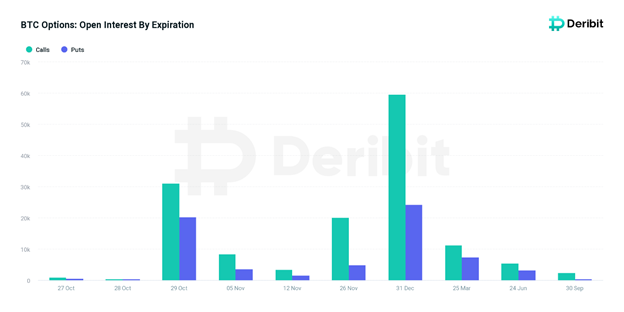

Now for a few parting thoughts on derivatives to keep in mind for the rest of this week. Friday is options expiry and based on current open interest, $55,000 will be a key level for Bitcoin to maintain. Any significant distance above this mark, and we may benefit from some positive price action from shorts needing to cover their positions, although we would probably need to have a substantial push higher to have this occur.

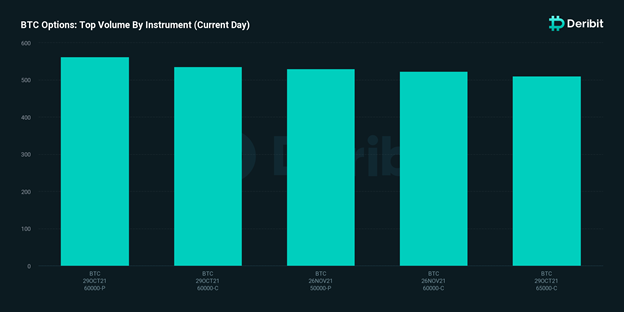

Interestingly, following the recent price action, we have witnessed some mixed options volume, as the leading instruments purchased on Wednesday were the $60,000 puts expiring this Friday, and the second most popular instrument were $60,000 calls also expiring on Friday.

That said, regardless of today’s volume, the put/call ratio for both short and long-term options on BTC demonstrates overwhelmingly bullish sentiment.

Conclusion

Some leveraged traders were shaken out on Wednesday, which can be troublesome for newcomers to crypto but is a healthy part of any bull market. We expect macro tailwinds and bullish on-chain fundamentals, among other factors, to continue to push Bitcoin and Ethereum towards their respective price targets of $100,000 and $10,500 by year-end.