Digital Assets Weekly: April 3rd, 2020

Please see important disclosures at the bottom of this report

Portfolio Strategy

Howard Marks, the CIO of Oak Tree Capital said something this past week that caught my attention:

“There’s no argument for spending all your money now, but there’s also no argument for not spending any.”

In many respects, this statement summarizes my continued view on the crypto markets. We’ve been recommending investors have exposure to the crypto markets for the past few months. Following the recent sell off, we started recommending investors overweight crypto during the next 3-5 years by being allocated somewhere between 1% to 2% vs. its market weight of 0.01%. Our advice has been to adjust allocations more aggressively or defensively between these ranges as P/CMR valuations are more or less attractive.

Another statement from Howard during a recent interview:

“The outlook for the economy is weak. The outlook for the disease is bad. On the other hand, there’s good value in the markets. I liked them before they went up today more than I do now.”

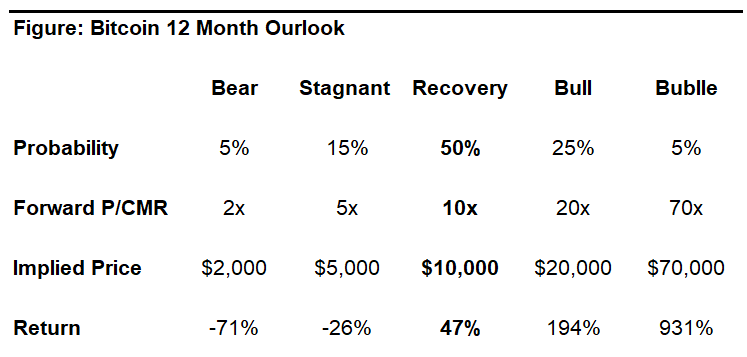

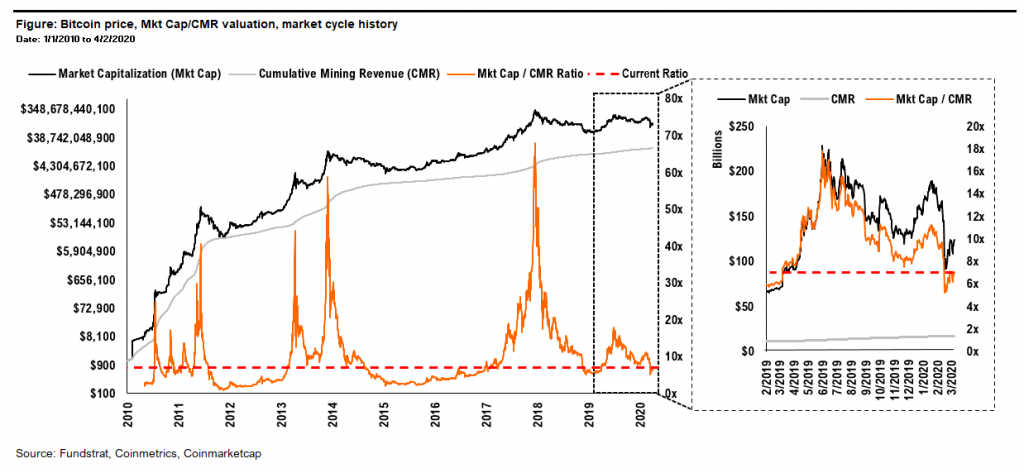

Similarly, Bitcoin’s March 13th price pull back took us to levels where we saw good value in markets. Prices have rebounded a bit. We still see some risks. We prefer getting most aggressive in the 4x to 5x P/CMR range if prices go there. But, there’s still good value in markets today at 7x if they don’t.

One final quote from Howard to offer perspective:

“You have to balance the risk of losing money against the risk of missing returns.”

Returning to crypto, these are not bad levels to have a core holding. Here, what you do next depends where you’re starting from, and how tactical you want and are able to be. My recommendation is:

- If you are completely out of crypto or under-allocated, start accumulating over the next few months to balance the risk of missing returns, but don’t FOMO into quick run ups.

- If you are reasonably but not overly allocated, accumulate lightly on pull backs like last weekend, or more heavily on ones like last months, as we’ve been advising.

- If you are already fully allocated, be patient.

The silver lining is, we see conditions in place that could produce tactical opportunities for each group over different time horizons. We’ve discussed many of these catalysts and risks in previous notes and will only focus here on a couple newly forming ones we’re keeping an eye on.

Starting with newly unfolding bullish dynamics:

- Rising stable coin dry powder vs. falling exchange supply: Prices are set by supply and demand – no secret. The supply on exchanges has been dropping rapidly over past weeks since the sell off. That means buyers have less immediate potential sellers waiting to transact. While Tether, the largest stable coin, has seen its market cap rise to near $6B from $5B a month ago. That’s a lot of “crypto-ready dry power” sitting in the markets, especially relative to liquidity and available supply. Putting this into context, there was $1.5B of margin longs liquidated on BitMex on March 12th and 13th. This was not the only driver, but as the largest crypto futures exchange, it was very material to causing the cascading 50% sell off we saw. What could happen if a material portion of that $6B Tether quickly went the other way?

Moving to newly unfolding bearish dynamics:

- Unprofitable miner capitulation vs. halving reduced supply: Saudi Araba and Russia for some reason found it timely to enter a price war, that caused oil to fall to $20 dollars a barrel, right in the middle of a global economic crisis. What does this have to do with crypto? They are both commodities and the competitive industry dynamics are similar. The price war is clearing competition by driving higher cost U.S. shale producers into bankruptcy. Lower Bitcoin prices are doing the same for many miners running legacy hardware. This is compounded once the Bitcoin halvening reduces supply. This is only negative for prices to the extent miners are forced to sell coins, not if they must only shut off machines. We’ve seen miner selling data increase lately. The question is, how much is left on unprofitable balance sheets and what happens if a larger, well capitalized mining competitor wants to temporarily suppress prices to drive out competition? This could weigh on prices into and following the halving. Either way, its long term bullish once existing seller pressure is worked out of the system right as the market is seeing a new supply reduction.

All of this is to say, our overall market view and recommended positioning has not changed since last week. This is meant to give more color on how we’d tactically execute on possible movements along the way. We still hold the following probabilities for Bitcoin’s price scenarios over the next 12 months:

Investment Themes

- Remain OW crypto assets vs. market portfolio

- Remain OW large cap vs. small cap crypto assets

- Remain OW defensive PoW vs. cyclical PoS crypto assets

- OW blue chip alts vs. Bitcoin once recovery confirms

Market Analysis

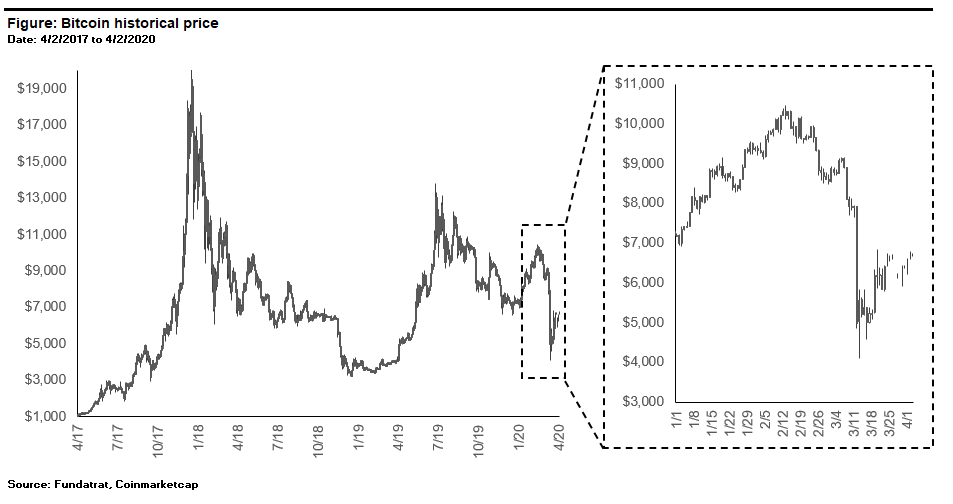

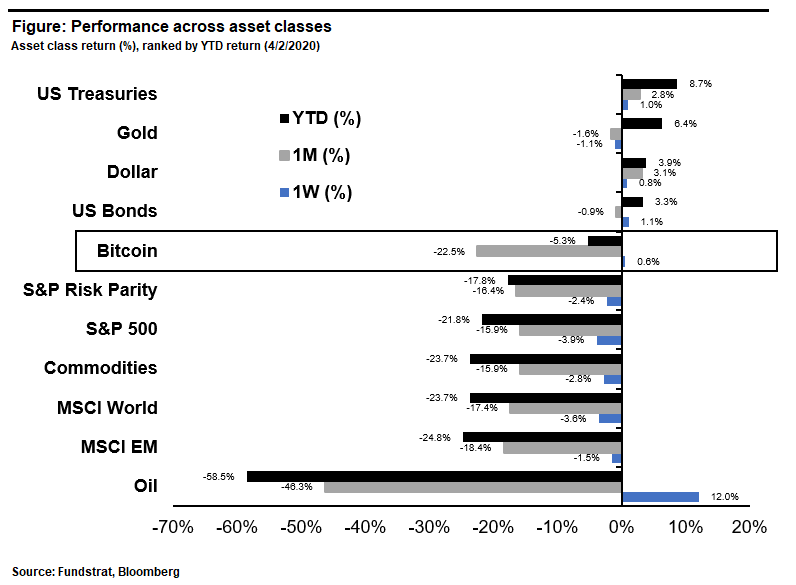

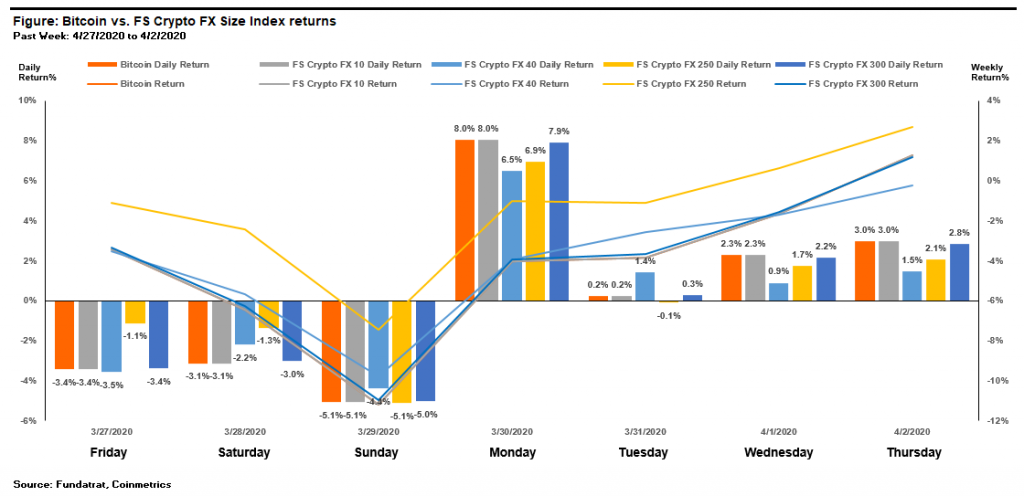

The price of Bitcoin finished the week ending Thursday around $6,700, leaving it mostly flat, up a modest 0.6% after dipping below $6,000 last weekend in to early this week and rebounding.

Bitcoin remains in the 5th best performing major asset class on the year, down a modest 5.3%.

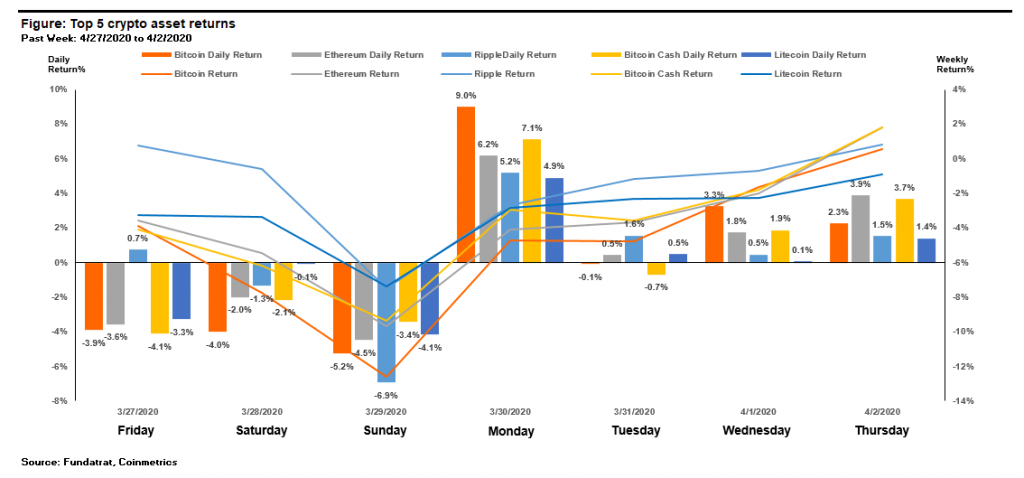

During the past week, crypto prices saw some noteworthy volatility. Markets fell late last week, then rebounded sharply by ~10% on Monday, and maintained momentum into the back half of the week to finish incrementally up.

Price movements among different size indexes have been consistent with small caps incrementally outperforming by 1% on the week.

Fundamental Valuations

Bitcoin’s P/CMR multiple is up slightly to 7.1x after briefly dipping back as low as 6.2x earlier this week (description in valuation methodology section below).

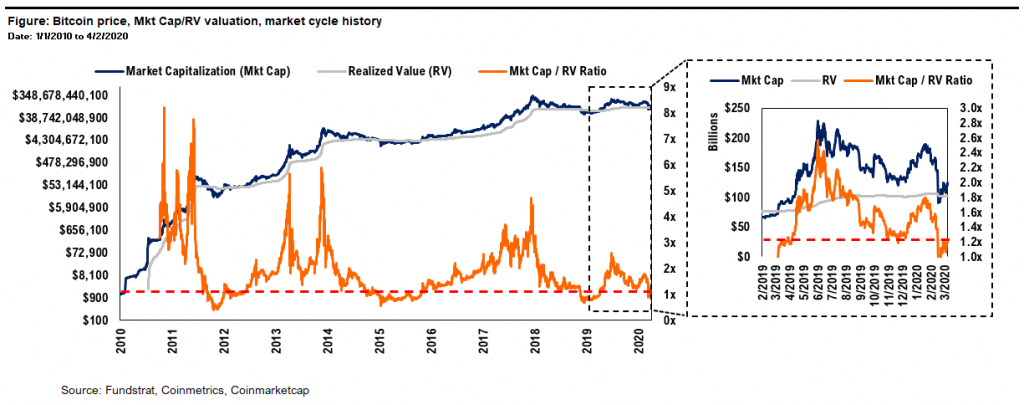

Bitcoin’s market cap to realized value (MV/RV) multiple remains mostly unchanged from the prior week sitting at 1.2x (description in valuation methodology section below).

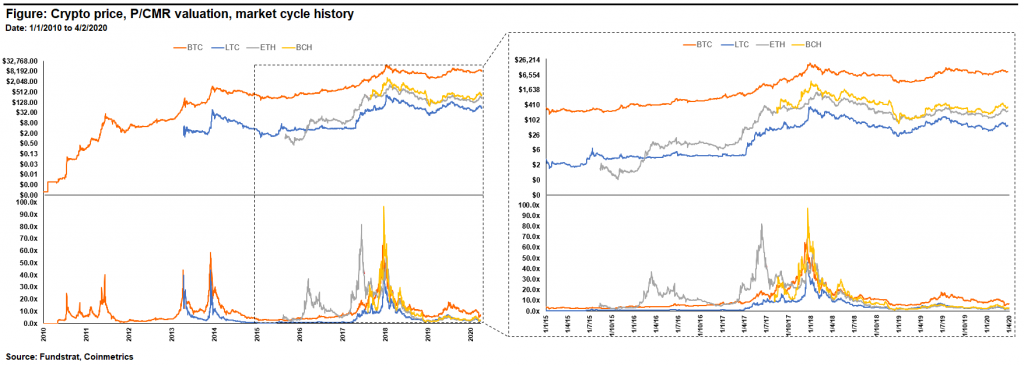

Valuations for the large PoW cryptocurrencies finished the week up ever so moderately but remain near their depressed prior cycle trough levels.

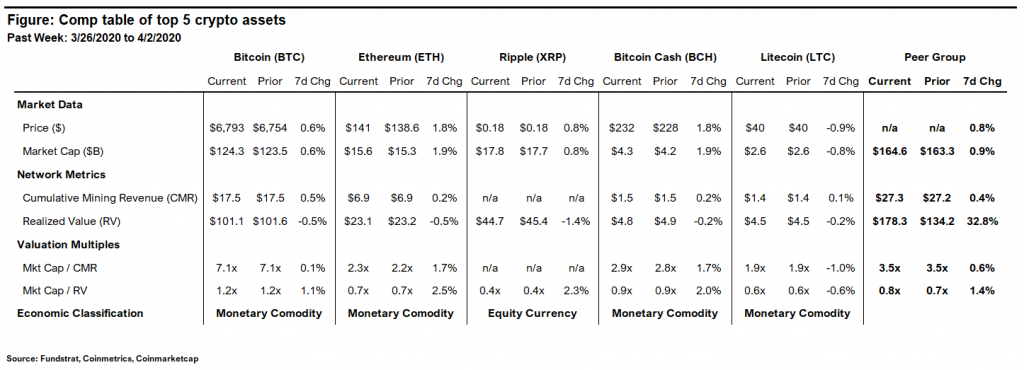

The fundamental valuation comp table for the top 5 large cap crypto assets are shown below.

Last week we provided some color on thinking about Bitcoin’s valuation relative to its peers. This week we will provide some color for thinking about valuations of the next two largest crypto assets.

- Bitcoin: Trades at a healthypremium to its peer group, but we believe this is more than justified and likely to continue due to its dominant size and other competitive advantages, as we mentioned last week. One new point we’ll add this week, as the oldest crypto asset, Bitcoin likely has the most lost coins. These coins are not subtracted in this analysis, but if they were, Bitcoin’s adjusted valuation would be lower than shown.

- Ethereum: Trades at a discount to the peer group, like all the others, due to Bitcoin upwardly skewing the average. Among Alt Coin peers, it’s currently cheaper than Bitcoin Cash but more expensive than Litecoin. We prefer to be value buyers of crypto in general, but that does not mean we believe valuation should be the only factor determining investment decisions. Its our view that Ethereum would be justified in trading at a consistent premium to Alt Coin peers, in a range near Bitcoin, given its strong and growing adoption and robust crypto economy activity.

- Ripple: Trades as the cheapest of the top 5 large cap crypto assets, but it’s important to note that XRP is not an exact economic asset type comp to the listed peers. The comp table now lists classifications for clarity. The others are more purely monetary commodities, like gold, silver or copper, due to their PoW mining requirement, which Ripple does not implement. Ripple more closely resembles equity that’s primarily used as a medium of exchange currency. This is because its economics implement a transaction fee that’s executed by permanently retiring XRP tokens from supply. In crypto speak, this is called burning tokens as a sybil protection mechanism. In traditional financial terms, this is economically equal to a share buyback. Its analogous to PayPal consumers sending transactions, then paying the service fee by purchasing and delivering PYPL shares that get retired as treasury stock. This saves the company from the process of receiving cash, flowing it through the P&L and buying shares back from net income. To be clear, we are only making a statement on XRP economics, not its legal classification, which will be determined by a range of other factors. But, it’s why the P/CMR model doesn’t apply. We’ll publish a more specific valuation analysis on Ripple in time.

Valuation Methodology

The P/CMR ratio is a fundamental valuation method I invented in December 2017 that has historically been a strong predictor of price movements. It functions like a Price/Book (Crypto P/B) ratio by telling investors if a crypto asset is relatively cheap or expensive. It’s calculated by comparing the Market Cap to Cumulative Mining Revenue (Mkt Cap/CMR). The ratio can be calculated on a per coin basis (P/CMR) by adjusting the Mkt Cap and CMR by outstanding supply. Read more.

The MV/RM ratio is another method later developed that takes a similar approach but adjusts the denominator value based on the last time coins were moved. Read more.

The P/CMR and MV/RV metrics gives an approximate measure of unrealized profit, and therefore an investors incentive to sell or hold. The P/CMR ratio gives a measure closer to the absolute floor value of sunk costs for all investors while the MV/RV ratio gives the highest end of the range. Its best to take multiple approaches when valuing any asset. These two have been the best for crypto assets in my experience, and the answer probably lies in the middle.

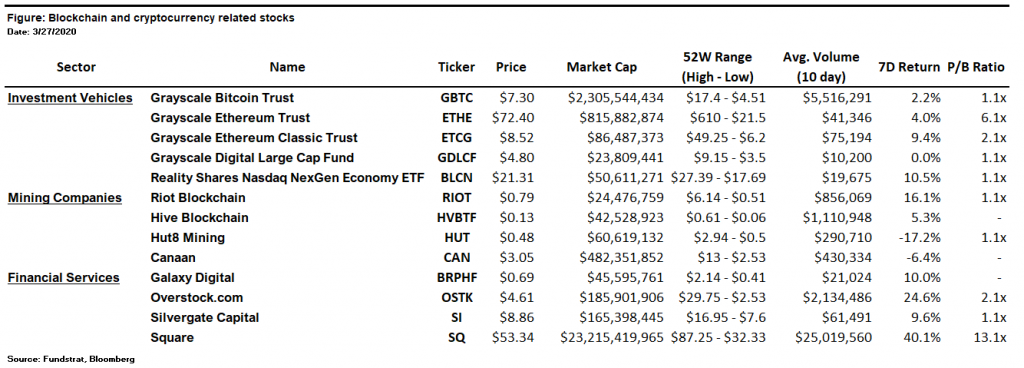

Blockchain & Crypto Stocks

The table shows publicly traded blockchain and crypto related stocks, which offer a vehicle for investors are constrained from owing underlying crypto assets themselves. Our advice to investors:

- Avoid ETHE due to its 600%+ NAV premium and favor the other investment vehicles. This type of Ethereum exposure is not justified by the spread contraction and liquidity risks. If ETHE performs well, the other vehicles are also likely to perform well, and they offer lower risks.

- Cautiously approach investments in the mining space for now, as we discussed last week.

Winners & Losers

Winner: IOTA is the winner this week after two positive news announcements. 1) The Crypto Ratings Council (CRC), an independent industry group, published a rating of 2.0 out of 5.0 for IOTA, indicating it has a lower chance of being a security, in their view. The CRC is not a regulatory body and the rating is not legal advice, but it is notable since many of the industry’s most influential organization are involved in the evaluation, and if they view IOTA as presenting less legal risks, it may open the door to new markets. 2) Bittrex U.S. announced that it will list IOTA on its exchange, which opens the door for greater market access.

Loser: Factom is the loser this week after it was announced the organization will filed for bankruptcy. It was one of the earliest ICO’s and it will be interesting to see how the market plays out with its network token, once the primary organization supporting it is gone. This serves as a reminder that many crypto networks are still start ups and the same risks apply.

Financing & M&A

MakerDAO – The decentralized saving, lending and payments network raised a $4.5M Secondary Token Offering led by Paradigm and Dragonfly Capital: Read more.

Keep Protocol – The Bitcoin focused decentralized finance protocol raised a $7.7M financing led by Paradigm Capital with participation from Fenbushi Capital and Collaborative Fund. Read more.

Sandbox – The blockchain-based game world company raised a $2M financing from Square Enix, B Cryptos, and True Global Ventures. Read more

Binance – The global crypto exchange is acquiring the crypto data service CoinMarketCap for as much as $400 million. Read more.

HIVE Blockchain – The Canadian crypto mining company is acquiring a Bitcoin mining facility in Canada for $4M. Read more.

Disclosures

This research is for the clients of FS Insight only. For additional information, please contact your sales representative or FS Insight at https://fsinsight.com.Conflicts of Interest

This research contains the views, opinions and recommendations of FS Insight. At the time of publication of this report, FS Insight does not know of, or have reason to know of any material conflicts of interest.

General Disclosures

FS Insight is an independent research company and is not a registered investment advisor and is not acting as a broker dealer under any federal or state securities laws.

FS Insight is a member of IRC Securities’ Research Prime Services Platform. IRC Securities is a FINRA registered broker-dealer that is focused on supporting the independent research industry. Certain personnel of FS Insight (i.e. Research Analysts) are registered representatives of IRC Securities, a FINRA member firm registered as a broker-dealer with the Securities and Exchange Commission and certain state securities regulators. As registered representatives and independent contractors of IRC Securities, such personnel may receive commissions paid to or shared with IRC Securities for transactions placed by FS Insight clients directly with IRC Securities or with securities firms that may share commissions with IRC Securities in accordance with applicable SEC and FINRA requirements. IRC Securities does not distribute the research of FS Insight, which is available to select institutional clients that have engaged FS Insight.

As registered representatives of IRC Securities our analysts must follow IRC Securities’ Written Supervisory Procedures. Notable compliance policies include (1) prohibition of insider trading or the facilitation thereof, (2) maintaining client confidentiality, (3) archival of electronic communications, and (4) appropriate use of electronic communications, amongst other compliance related policies.

FS Insight does not have the same conflicts that traditional sell-side research organizations have because FS Insight (1) does not conduct any investment banking activities, (2) does not manage any investment funds, and (3) our clients are only institutional investors.

This research is for the clients of FS Insight only. Additional information is available upon request. Information has been obtained from sources believed to be reliable, but FS Insight does not warrant its completeness or accuracy except with respect to any disclosures relative to FS Insight and the analyst’s involvement (if any) with any of the subject companies of the research. All pricing is as of the market close for the securities discussed, unless otherwise stated. Opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, risk tolerance, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies. The recipient of this report must make its own independent decision regarding any securities or financial instruments mentioned herein. Except in circumstances where FS Insight expressly agrees otherwise in writing, FS Insight is not acting as a municipal advisor and the opinions or views contained herein are not intended to be, and do not constitute, advice, including within the meaning of Section 15B of the Securities Exchange Act of 1934. All research reports are disseminated and available to all clients simultaneously through electronic publication to our internal client website, fsinsight.com. Not all research content is redistributed to our clients or made available to third-party aggregators or the media. Please contact your sales representative if you would like to receive any of our research publications.

Copyright © 2020 FS Insight LLC. All rights reserved. No part of this material may be reprinted, sold or redistributed without the prior written consent of FS Insight LLC.