Payments Shine as Funding Cools

May Recap

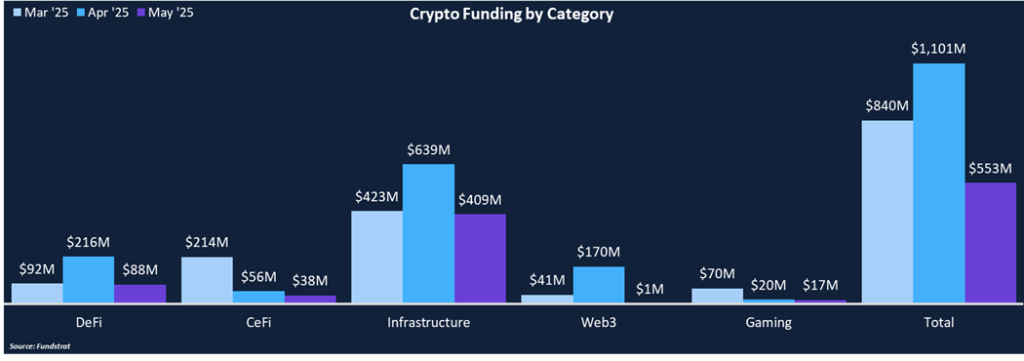

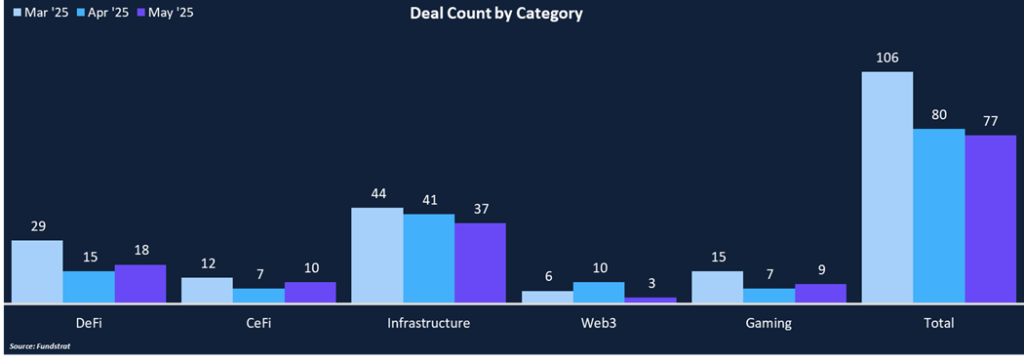

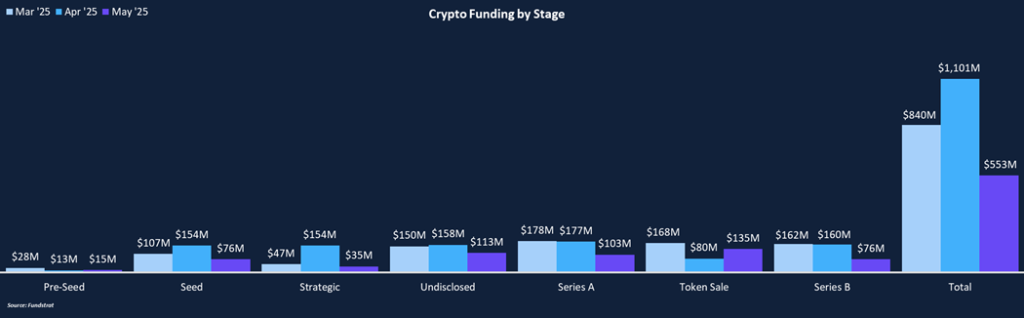

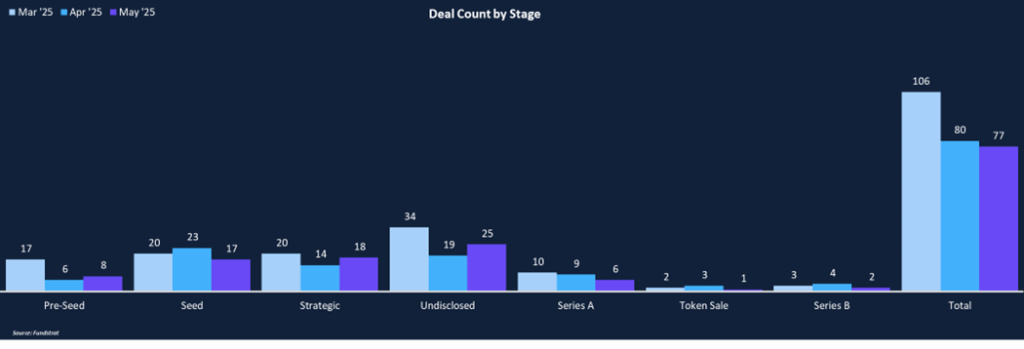

After April saw a multi-year high in monthly funding, May’s total funding cooled significantly to $553 million, while deal count held relatively steady at 77 deals. Despite lower funding, stablecoin/payments related companies were a bright spot in May, with companies such as Plasma (DotM), Conduit, and Beam all raising capital. Infrastructure accounted for nearly three-quarters of total funding and about half of all deals. DeFi was the second leading category, totaling $88 million across 18 deals. Funding was well dispersed across deal stages, with five stages having over $75 million in funding. Token Sale was the leading stage at $135 million due to Worldcoin’s (WLD) $135 million private sale to a16z and Bain Capital Crypto. The Sam Altman backed digital identity protocol went live in the U.S. this month and allows users to verify their identity via iris scans in return for WLD tokens. News of an Altman and Jony Ive (infamous Apple device designer) partnership has raised speculation about Worldcoin’s integration into an OpenAI-powered consumer device.

Funding by Category

Funding by Stage

Deal of the Month

Plasma, a purpose-built blockchain for stablecoins, raised an undisclosed amount from Peter Thiel’s Founders Fund at a valuation of $500 million. Founders Fund was one of Plasma’s earliest angel investors, and the fresh funding will likely strengthen Plasma’s relationship with experienced professionals in the payments sector. Thiel founded and was CEO of PayPal and has been an early investor in companies like Stripe, Nubank, Ramp, and Affirm – all teams that have redefined how money moves globally.

Why is This Deal of the Month?

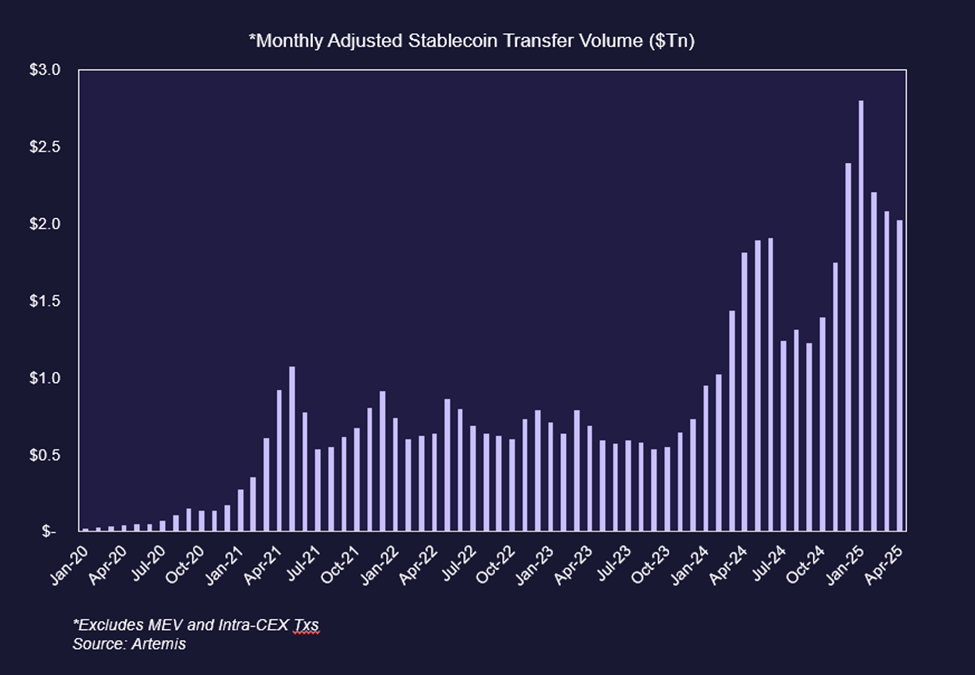

Stablecoins have proven to be one of (if not the most) killer use cases for blockchain technology. Total stablecoin supply has grown rapidly since 2020, now exceeding 240 billion as institutions and consumers alike have recognized the benefits of near-instant settlement, low costs, and composability. Adjusted monthly stablecoin transfer volume regularly exceeds multiple trillions of dollars, competing with more traditional payment networks, including ACH, Visa, and PayPal. It is likely that stablecoin legislation gets passed this year, which should fuel an acceleration in this trend as larger institutions including large banks enter the space.

While stablecoins have been a resounding success, much of the current infrastructure was not built with stablecoins as the primary focus. Plasma has recognized the shortfall and wants to bridge the gap by providing proper stablecoin infrastructure to facilitate the next generation of money movement. Plasma hopes to bring stablecoins past crypto-specific use cases and into the real world, powering efficient, low-cost, programmable payments on a global scale. Plasma is a high-throughput Bitcoin side-chain capable of handling thousands of transactions per second. It is designed with native stablecoin tools, deep liquidity, and a dedicated ecosystem, making Plasma the ultimate destination for stablecoins. Plasma is unique in that all transactions settle to Bitcoin, inheriting the security and decentralization of the largest blockchain in the world and providing credibly neutral rails for all payment transactions. Plasma is also EVM-compatible, allowing for seamless deployment of Ethereum smart contracts and applications, fostering a low-effort environment for developers to port applications to Plasma.

Plasma hopes to tackle multiple avenues of finance, including global remittances, merchant payments, trade finance, bitcoin yield, and high-yield savings, all facilitated via the Plasma network, making it a one-stop-shop for all consumer finance. The funding will be used to grow the Plasma team, expand the ecosystem, and accelerate adoption across key regions, including Latin America and the Middle East. Notably, Plasma is also conducting a public token sale in the coming weeks, offering 10% of its token supply at the same $500 million valuation that this private strategic round was done, emphasizing Plasma’s commitment to an equitable, inclusive, and open financial system.

Selected Deals

Doppel, an AI-powered social engineering defense platform, raised $35 million in a Series B round led by Bessemer Venture Partners. Other investors included a16z, 9Yards Capital, Sozo Ventures, Strategic Cyber Ventures, Script Capital, and others. The Series B round brings Doppel’s total funding to $54.4 million, valuing the firm at $205 million. Social engineering is extremely problematic across numerous industries as malicious actors are becoming more creative in their efforts to scam citizens. Doppel is an enterprise and consumer security platform built to neutralize social engineering threats that target executives, employees, and consumers before they have catastrophic effects. The Doppel Vision platform provides visibility across various avenues, including social media, emails, and apps, to prevent attacks before they happen. By combining advanced LLM technology with expert human analysis, Doppel eliminates blind spots, removes digital threats, and protects organizations at every level. While Doppel’s products apply to a wide variety of businesses, Doppel has recognized plenty of impersonation and social engineering scams riddled within the crypto industry. To address this, they have crypto-specific products to protect web3 users, including wallet drainer defense, malicious NFT detection, and active ransomware and phishing attack defense. Since its Series A funding round last year, Doppel has seen 400% growth in its enterprise customers, 90% growth in total customers, including 3x growth in annual recurring revenue, and 9x growth in expansion revenue with existing customers. Doppel has maintained a revenue CAGR of 230% since 2022, impressively displaying its effective use of AI tools to enhance cybersecurity. The funding will be used to support Doppel’s existing products and serve the rapidly growing demand from its enterprise customers to build a robust social engineering defense platform.

Hyperdrive, a money market protocol on HyperliquidEVM, raised $5 million in a Series A round led by Hack VC and Arrington Capital. Other investors included Delphi Ventures, CMS Holdings, Amber Group, and SIG. Beyond the native Hyperliquid application, TVL on the Hyperliquid EVM has increased as more applications launch and speculation surrounding another HYPE airdrop allocation circulates. Users on Hyperdrive can lend and borrow stablecoins, access liquid staking tokens for both HYPE and HLP, and deposit into one-click defi vaults. HLP has provided attractive returns for users willing to take on the risk of backing the trading pool. A liquid staking version of HLP will allow users to use their collateral across other defi applications to enhance their yields further. Hyperdrive plans to continually create new liquid staking and defi vaults as the Hyperliquid EVM ecosystem expands. Hyperdrive is striving to become Hyperliquid’s default yield infrastructure, with everything yield-related running through Hyperdrive in some form. As more users onboard to Hyperliquid, demand for stablecoin services and yield farming activity will likely increase. Hyperdrive is currently running its points program prior to its TGE, which is expected in the next few months.

Perpl, a decentralized perpetual futures exchange on Monad, raised $9.25 million in an undisclosed round led by Dragonfly Capital, with participation from Ergonia, Mirana, BHD, Hashkey, L1D, CMS, and Breed. Many perp exchanges make tradeoffs, either suffering with non-performant infrastructure or launching purpose-built layer ones to capitalize on higher throughput but potentially sacrificing liquidity and composability. Perpl does not need to compromise as their CLOB will offer minimal slippage, low gas, seamless UX, and be non-custodial and censorship resistant. By building on Monad’s highly performant infrastructure, we believe Perpl is well-positioned to eliminate the inefficiency of centralized financial systems and build a best-in-class pricing engine with no single point of failure, no off-chain matching, full verifiability, and maximal capital efficiency.