Algorand: Designing a High-Performance Blockchain

Mar 22, 2023

• 2

Min Read

Click HERE for the full copy of this report in PDF format.

Executive Summary

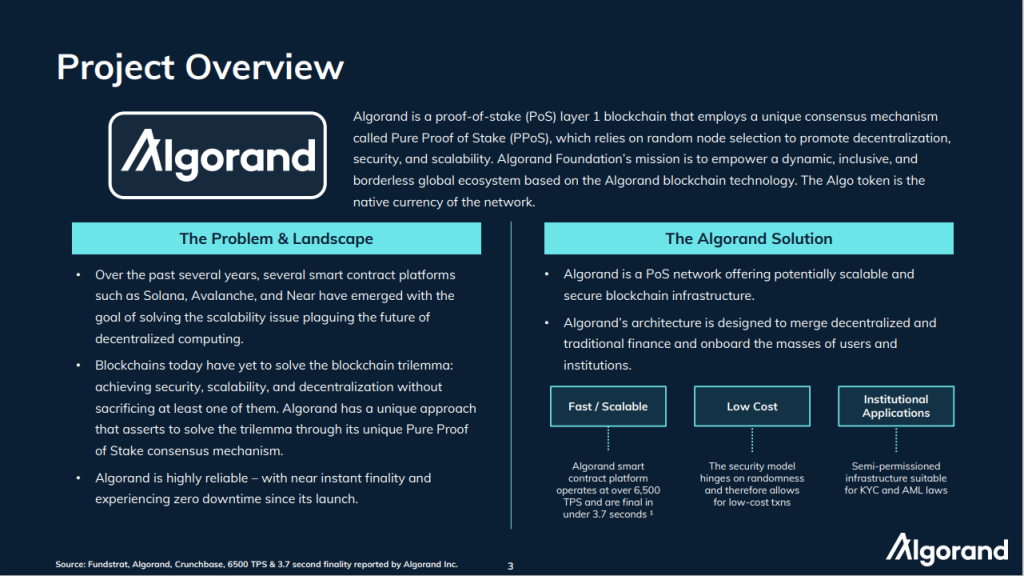

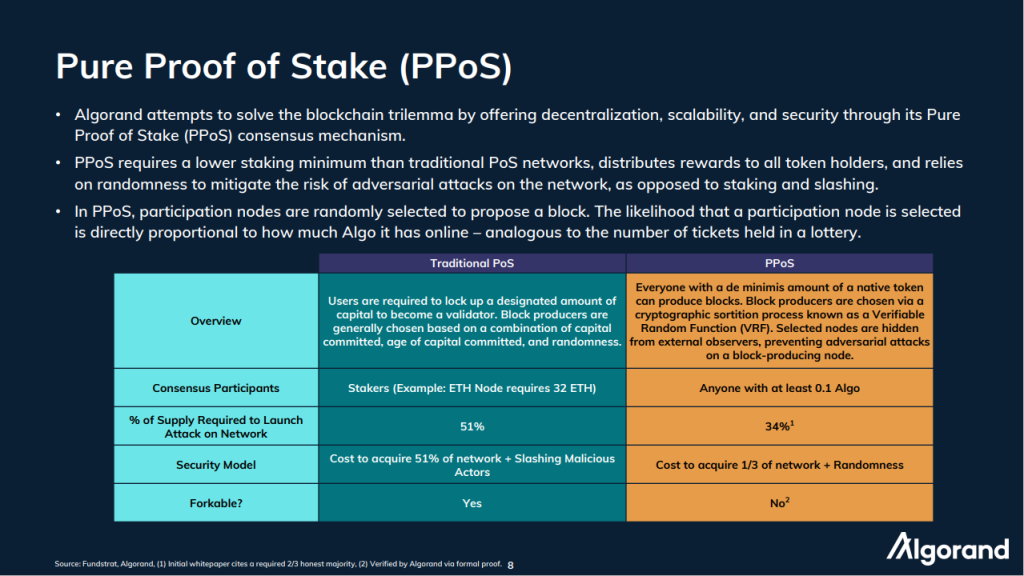

- Algorand (ALGO) is a layer 1 blockchain that employs a unique consensus mechanism called Pure Proof of Stake (PPoS), which relies on random node selection to promote decentralization, security, and scalability. Algorand Foundation’s mission is to empower a dynamic, inclusive, and borderless global ecosystem based on the Algorand blockchain technology.

- Algorand Layer 1’s Algorand Virtual Machine (AVM) powers Algorand’s smart contracts and is similar to Ethereum’s EVM. It can process over 6,500 transactions per second with finality under 3.7 seconds. Transactions on Algorand cost only ~0.001 ALGO. Algorand’s AVM also allows for Alogrand Standard Assets (ASAs). ASAs enable specific controls for the issuer of an asset, such as quarantining asset accounts for investigative purposes.

- Algorand’s distinct governance model incentivizes participation by rewarding “Governors” with Algo tokens. Algorand Governors can expect an annual reward rate of anywhere from 6%-24%, depending on the amount of Algo committed to governance accounts. Many Algorand DeFi protocols have enabled “Liquid Governance,” which allows users to participate in governance while using governance-locked ALGO in a capital-efficient manner.

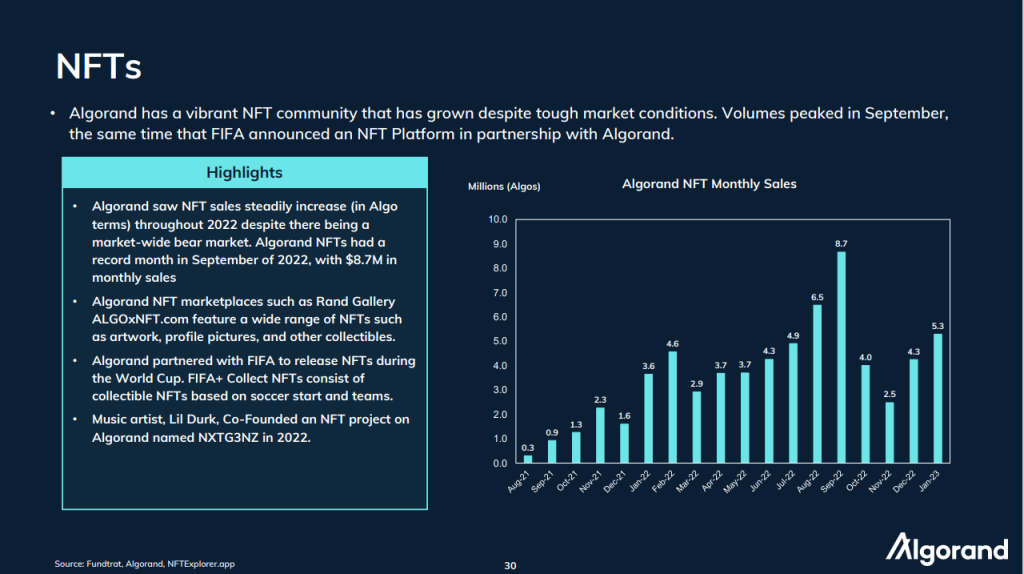

- Algorand has a burgeoning NFT community that has grown despite tough market conditions. Volumes peaked in September, the same time that FIFA announced an NFT Platform in partnership with Algorand.

- Explore our comprehensive research report on Algorand for further insights and analysis.

Key Slides From This Report…

Project Overview (Slide 3)

Pure Proof of Stake (PPoS) (Slide 8)

Growing Ecosystem (Slide 29)

NFTs (Slide 30)

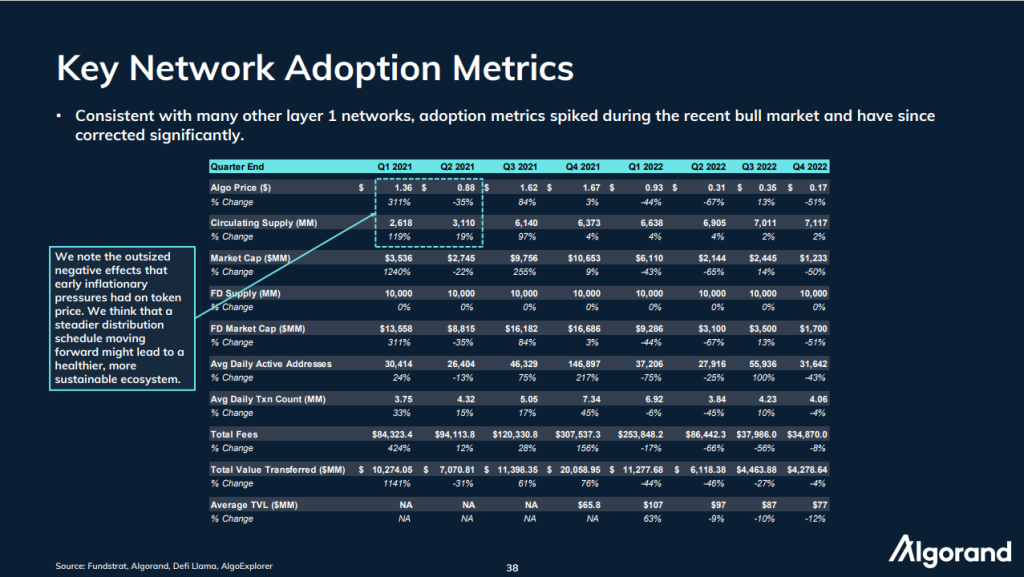

Key Network Adoption Metrics (Slide 38)