Boba Network: A Multichain Layer 2 Focused on Gaming

Oct 4, 2022

• 2

Min Read

Click HERE for the full copy of this report in PDF format.

Executive Summary

- Growing demand for Layer 1 block space. Through 2021, the demand for Ethereum block space has exploded on all metrics. Post-merge, Ethereum will attempt to scale via execution layers, while alternate Layer 1s might continue gaining market share on different use cases.

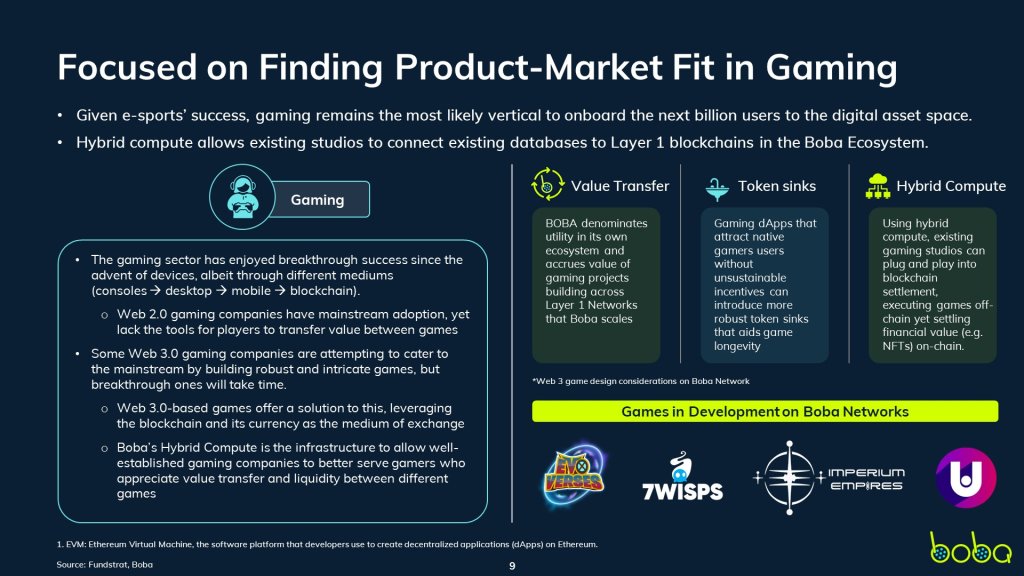

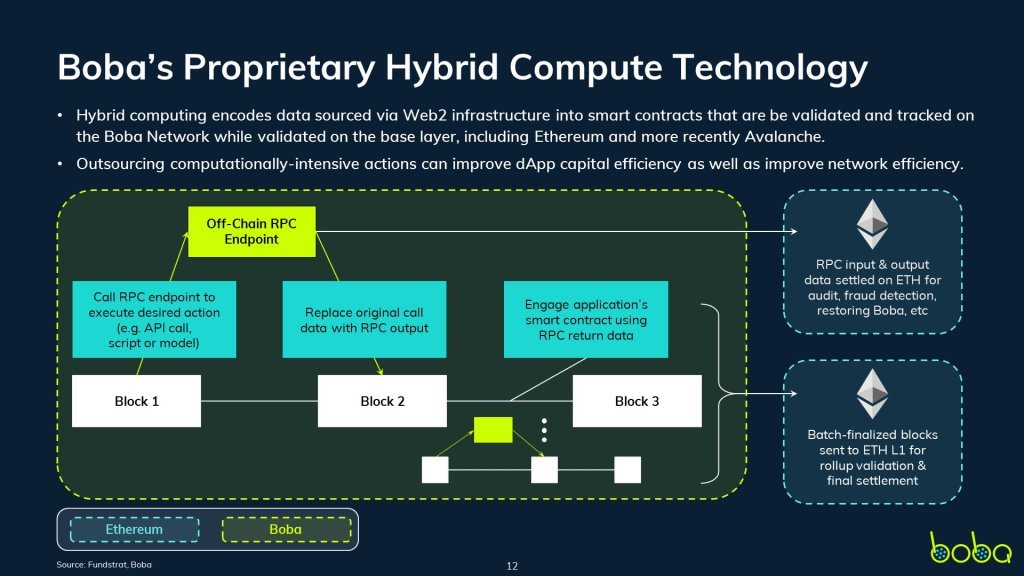

- Bridging Web 2 to Web 3 with Hybrid Compute. Boba’s hybrid compute technology brings the decentralization of Web 3 to the compute power of Web 2, while possessing distinct advantages over incumbent Layer 2 networks. Beyond latencies unlocked in gaming, hybrid compute can incorporate real-world data into other verticals such as NFTs and DeFi, leveraging blockchain technology to disrupt incumbents in traditional industries.

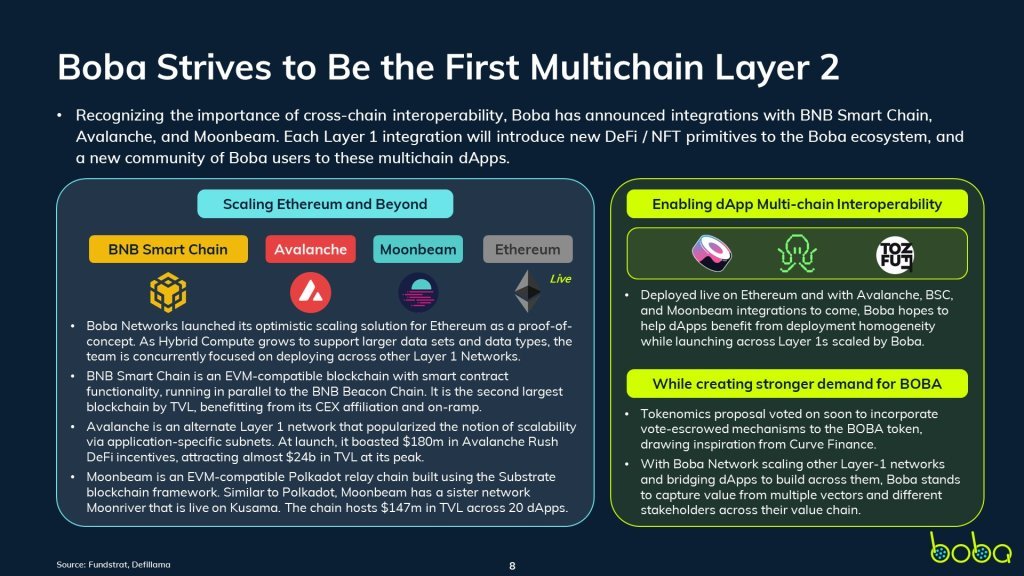

- Becoming the first multichain Layer 2 focused on gaming. Boba’s Hybrid Compute allows existing gaming studios to execute games off-chain while settling financial value on-chain. This positions BOBA well to accrue value from games built atop its network. So far, the Boba team has built infrastructure that connects Web 2 to Web 3 through the Turing Upgrade, with integrations with other Alternate Layer 1s to come.

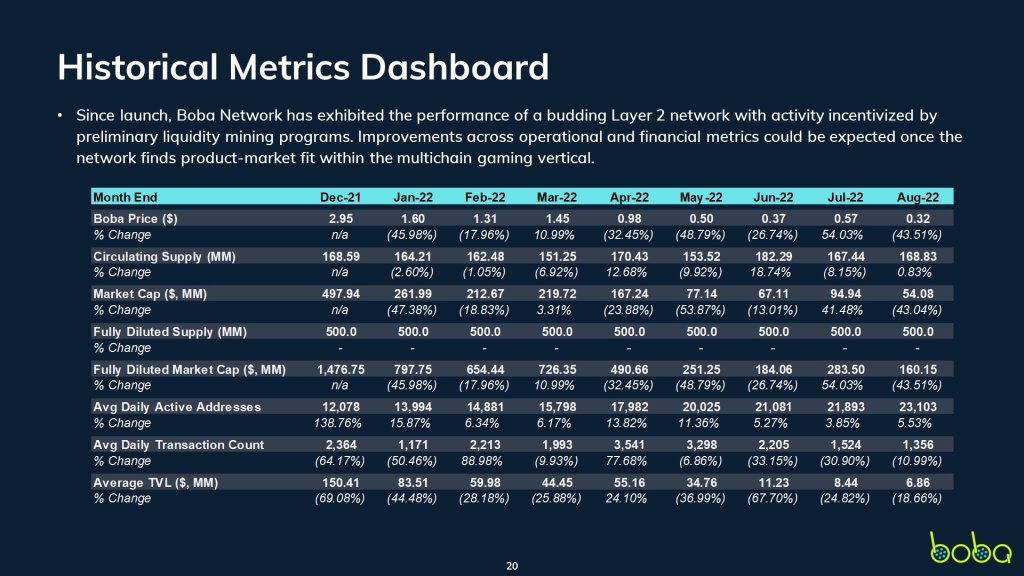

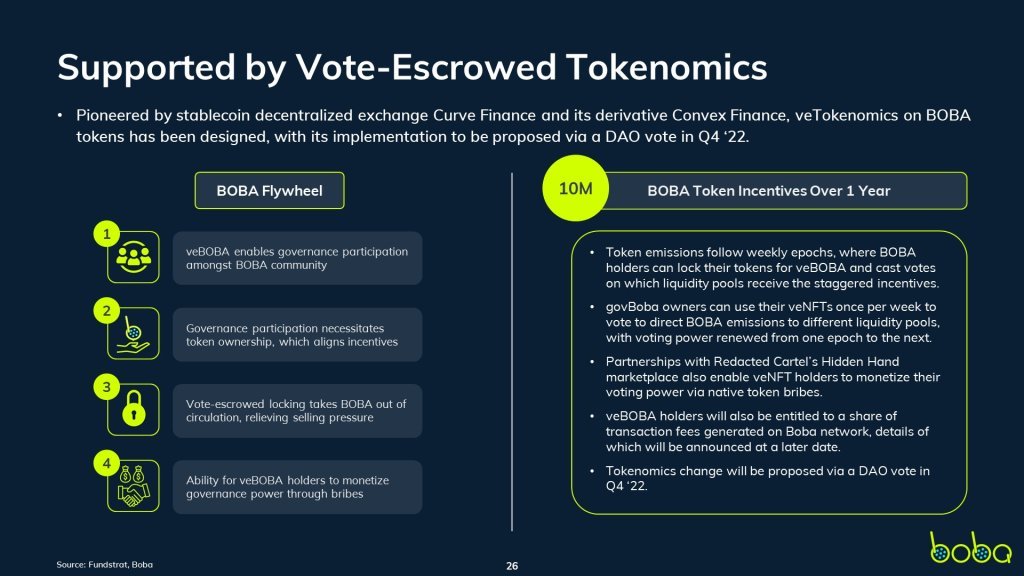

- Preliminary performance shows semblance of a budding network. After the airdrop to OMG holders, Boba has seen a surge of TVL to DEX infrastructure (OolongSwap) and cross-chain bridging (Connext Network), followed by a steep decline. Moving forward, they will look to capitalize on stickier network activity in multichain gaming by introducing vote-escrowed tokenomics to the BOBA token and bootstrapping value-driven governance with the unclaimed OMG airdrop and epoch-based BOBA incentives.

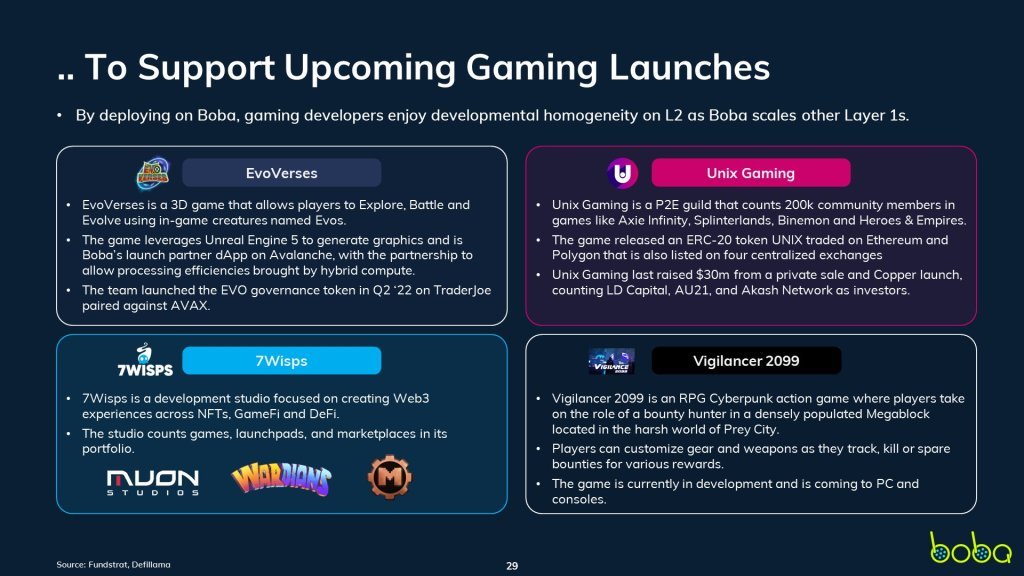

- Gaming to drive the next leg of network growth. Boba is actively forming partnerships with Web 3 gaming startups to scale adoption, counting EvoVerses, Unix Gaming, 7Wisps, and Vigilancer 2099 as new additions. To support the next phase of growth brought by gaming, the team relies on robust infrastructure in dApps (Sushiswap), tooling (Covalent), and bridging (Connext), with future plans to launch an ecosystem fund.

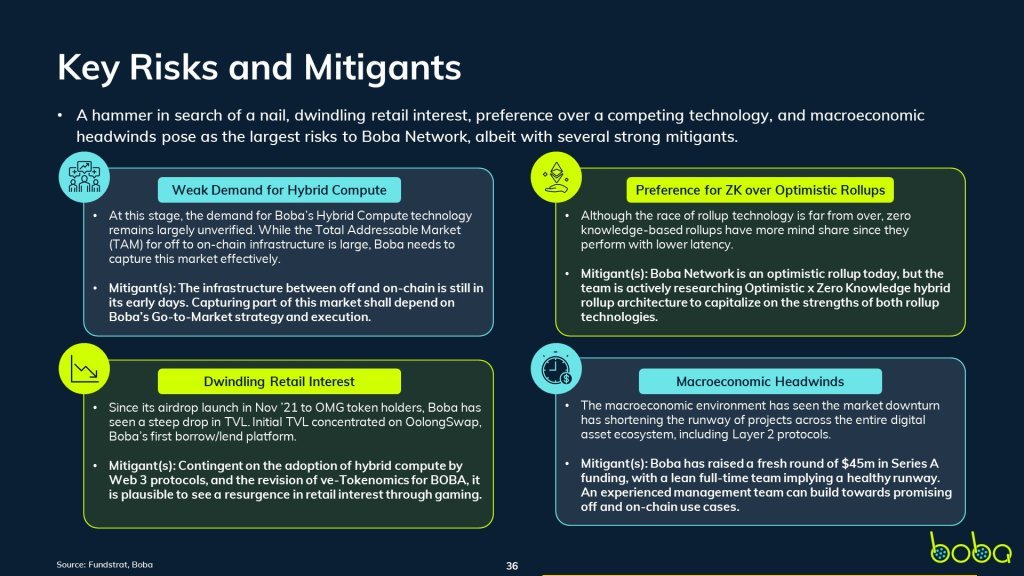

- Risks. Amidst a weak macroeconomic backdrop. Boba has raised a healthy $45m Series A round to explore multichain gaming enabled by Hybrid Compute. As such, the network’s success hinges on gaming to onboard the next wave of users, with Boba capturing enough market share. Given the prevalent narrative over Zero Knowledge technology, the team is also exploring ORxZK hybrid architecture to capitalize on the strengths of both rollup technologies.

- Bottom Line – Boba Networks is a nascent PoS network initially launched to scale Ethereum. Having built the infrastructure for a smart contract layer, Boba leverages Hybrid Compute technology to attempt to scale gaming dApps across alternate Layer 1 networks.