Off The Chain Capital

Executive Summary

Click Here for full report.

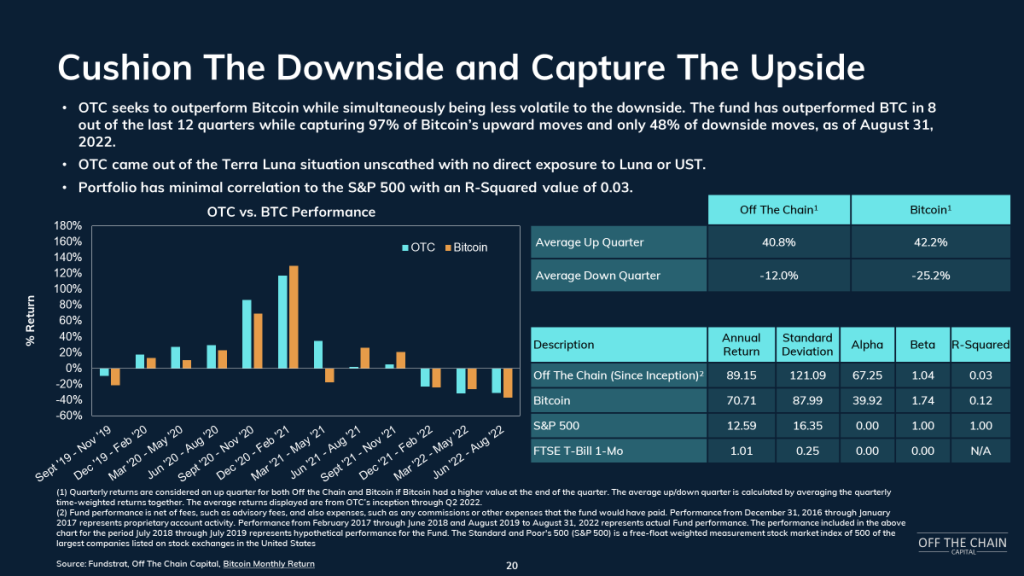

Next week, we will host Off The Chain Capital (OTC) for an introductory webinar discussing their value-oriented fund which is well suited to capitalize on current market conditions. Off The Chain Capital is focused on outperforming Bitcoin while simultaneously cushioning downside risks. OTC has outperformed BTC in 8 of the last 12 quarters, capturing 97% of Bitcoin’s upward moves and only 48% of downside moves as of August 31, 2022. We invite those interested in learning more about OTC’s offerings to review our presentation and sign up for our webinar on Tuesday, October 11th, at 3 pm ET.

Key Slides From This Report…

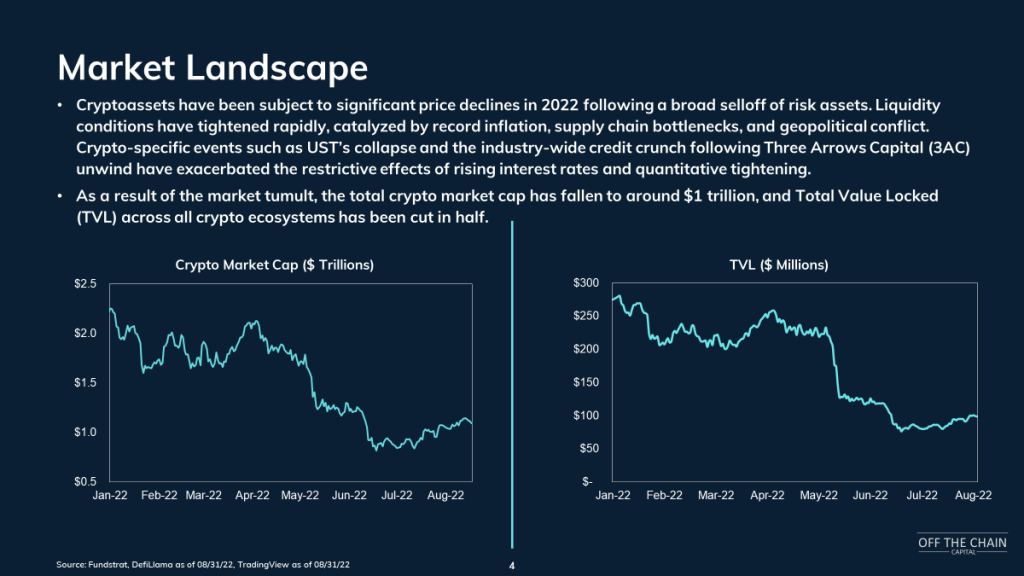

Market Landscape (Slide 4)

Deep Value Opportunities Abound (Slide 8)

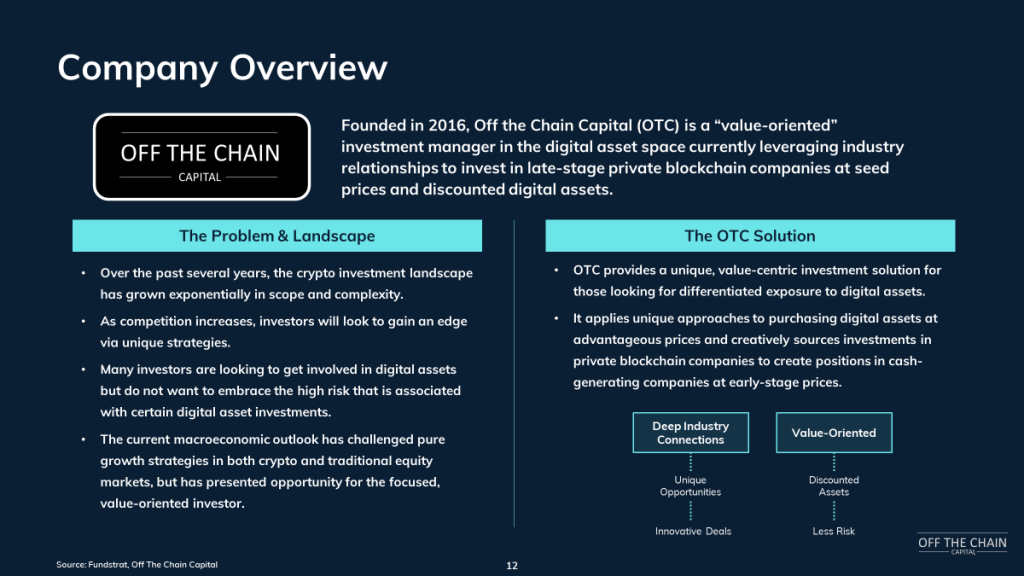

Company Overview (Slide 12)

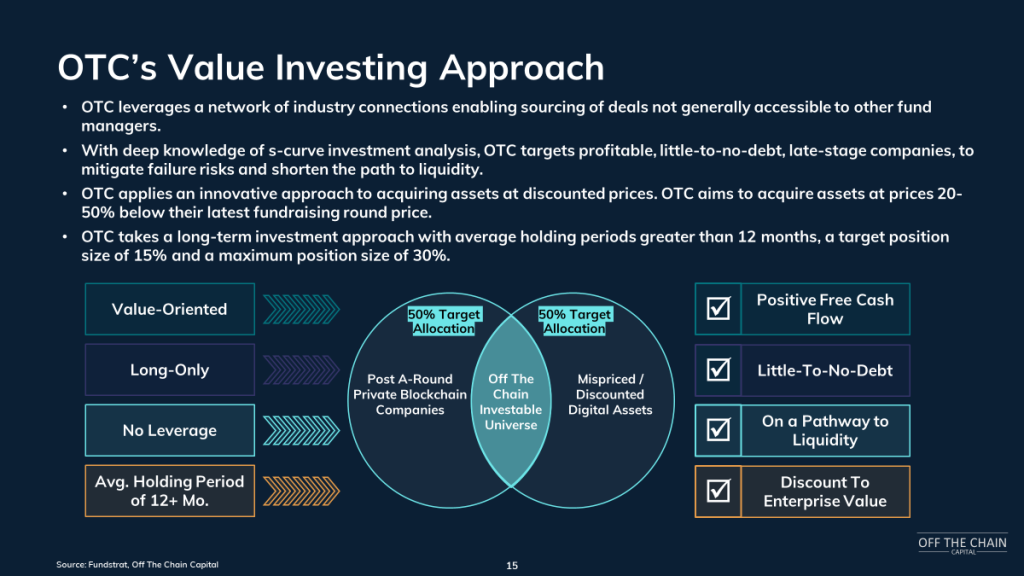

OTC’s Value Investing Approach (Slide 15)

Cushion The Downside and Capture The Upside (Slide 20)