CRYPTO SPECIAL REPORT: Avalanche: Building a Novel dApp Protocol for the Internet of Finance

CLICK HERE for the full copy of this report in PDF format.

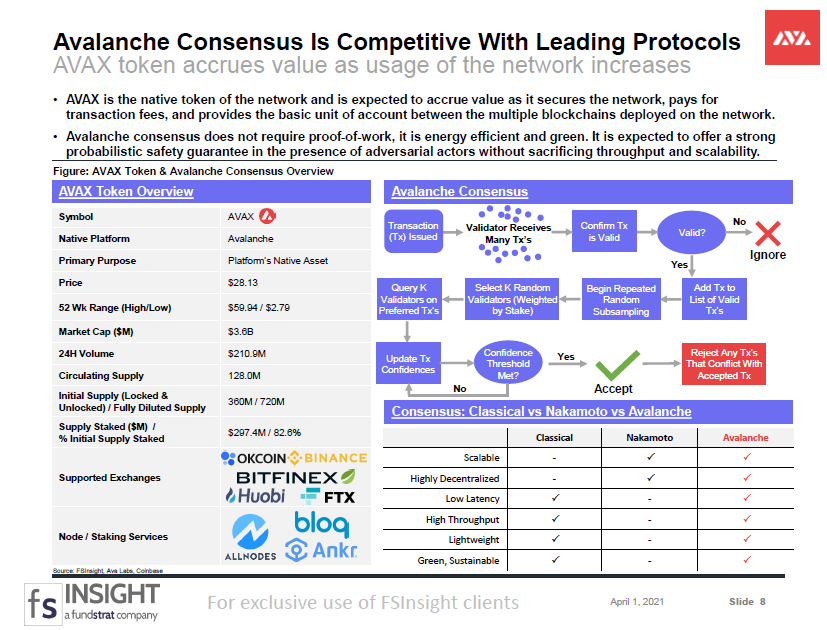

Ava Labs is building the Avalanche protocol which expects to deliver the highest performance, most secure, and most energy efficient general-purpose cryptonetwork for highly decentralized applications, novel financial primitives, and new interoperable blockchains. Using its innovative Avalanche consensus mechanism, the protocol hopes to create a new digital crypto-native economy for frictionless real-world and digital asset exchange, composable financial application primitives and derivatives, Web 3.0 privacy-focused data and social applications, and more. Avalanche expects to scale these use cases for global userbases.

- The Avalanche core team consists of seasoned professionals and distributed systems researchers. As the CEO and Founder of Ava Labs, Dr. Emin Gün Sirer is a former professor of computer science and networking systems at Cornell University. He developed Bitcoin-NG, a bitcoin scaling solution, and Bitcoin Covenants, a security solution. To develop the Avalanche protocol, he successfully built a team with experience in institutional finance, private markets, and technology (Slide 3).

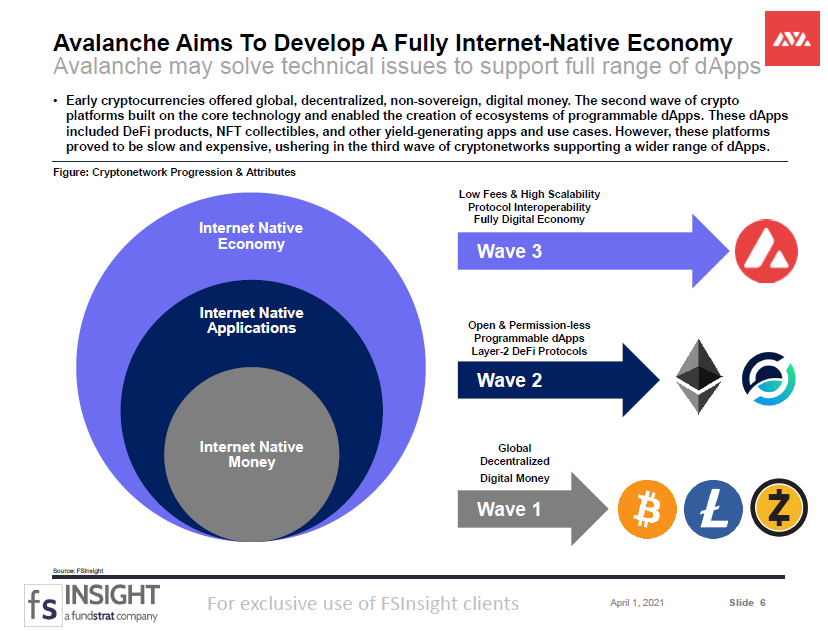

- Avalanche aims to build on earlier breakthroughs to develop a fully internet-native economy. Early cryptocurrencies offered global, decentralized, non-sovereign, digital money. The second wave of crypto platforms built on the core technology and enabled the creation of ecosystems of programmable dApps. These dApps included DeFi products, NFT collectibles, and other yield-generating apps and use cases. However, these platforms haven’t proven themselves to be designed for every use case. Now, a third wave of cryptonetworks are aiming to support a wider range of dApps on cheaper and faster blockchains. By offering a dApp platform with low fees, high scalability, and network interoperability, Avalanche believes it will enable the creation of a fully digital economy on a global scale (Slide 6).

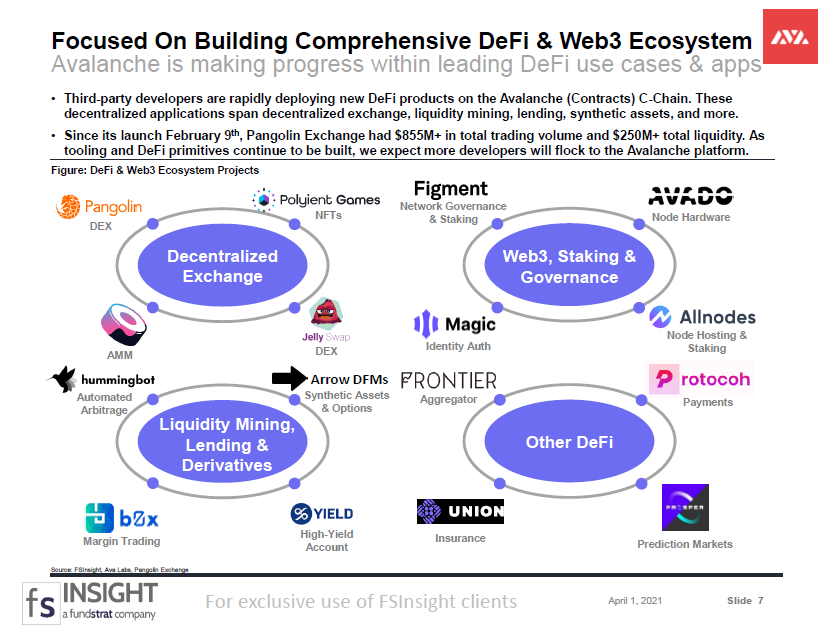

- Avalanche is organically growing a comprehensive DeFi & Web 3.0 ecosystem. Third-party developers are rapidly deploying new DeFi products on the Avalanche (Contracts) C-Chain. These decentralized applications span decentralized exchange, liquidity mining, lending, synthetic assets, and more (Slide 7). Avalanche’s unique, multi-chain framework enables core functions to interoperate seamlessly, without causing performance degradation as we see in networks that pile all activity into one chain. This is leading to rapid, precipitous growth of assets, applications, and custom implementations on subnets tailored to enterprises and institutions (Slide 9).

- Network metrics are competitive with top protocols in terms of scalability, security & speed. In order to host a wide range of decentralized applications and build a robust digital economy, the blockchain base-layer must offer decentralization, security, and scalability with low transaction fees. Avalanche’s mainnet already offers a transaction settlement layer with characteristics that are highly competitive with the leading staking networks and proof-of-work cryptocurrencies across these metrics (Slide 11). Additionally, AVAX’s proof-of-stake consensus incentivizes token lockups with high staking rewards (Slide 13).

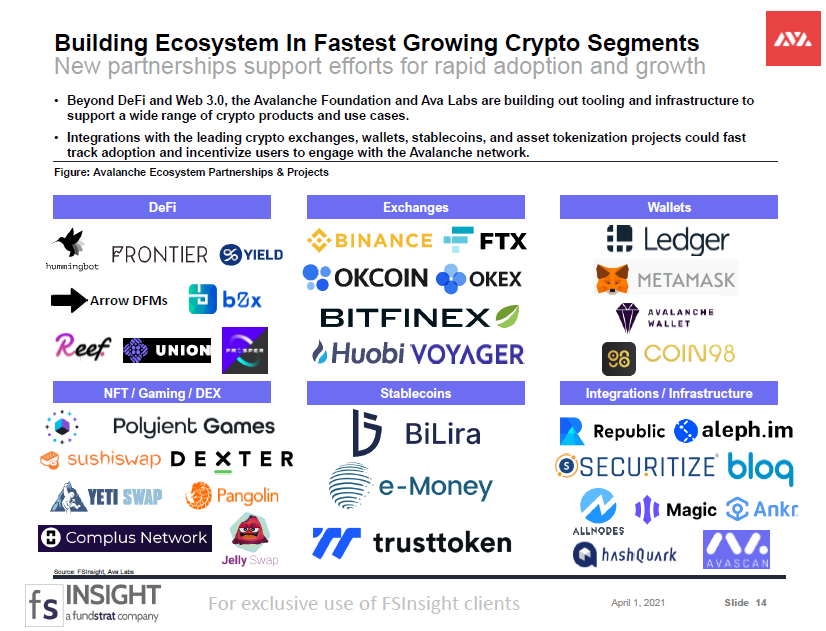

- Partnerships may help bootstrap network adoption and growth. The Avalanche protocol is a young network that initially launched its mainnet in September 2020, yet it already boasts an impressive ecosystem of partners, integrations, and third-party applications. Beyond DeFi and Web 3.0, the Avalanche Foundation and Ava Labs are building out tooling and infrastructure to support a wide range of crypto products and use cases. Integrations with the leading crypto exchanges, wallets, stablecoins, and asset tokenization projects could fast track adoption and incentivize users to engage with the Avalanche network (Slide 14).

- What could go wrong? Avalanche fails to execute on its roadmap, competing layer-one protocols or second-layer solutions iterate faster and deliver scalable cryptonetworks, Avalanche fails to attract significant developer mindshare and adoption.

Bottom line: Although the network is young in its growth and development, Avalanche implements an interesting consensus mechanism that may successfully deliver a scalable and interoperable cryptonetwork to enable a global and fully digital economy of decentralized financial applications and Web 3.0 personal data sovereignty.

Key slides from this report…

Cover Page (Slide 1)…

Avalanche Aims To Develop A Fully Internet-Native Economy (Slide 6)…

Focused On Building Comprehensive DeFi & Web3 Ecosystem (Slide 7)…

Avalanche Consensus Is Competitive With Leading Protocols (Slide 8)…

Building Ecosystem In Fastest Growing Crypto Segments (Slide 14)…